The United States real estate market is actually the envy of the world. The U.S. boasts the world’s most orderly, efficient and equitable housing market—and many other countries are attempting to emulate it.

Our system’s efficiency is driven in large part by agents and brokers competing aggressively, while also sharing their listing information with each other—and with the public—on an impartial basis. The local companies offering multiple listing systems (MLSs) around the country facilitate that process, while also giving brokers and their clients the option to offer to pay a finder’s fee—sometimes called a commission split—for the buyer’s broker. In turn, the real estate finance system has created relatively efficient processes for buyers to obtain loans, and for the costs of their real estate agent representation to be paid by the seller out of the transaction.

Unfortunately for the United States real estate consumer, this system is under attack by misguided lawsuits that allege the equitable, efficient, and highly competitive real estate marketplace in this country actually was created to artificially inflate commissions.

The first one of these cases, in Missouri federal court, recently concluded trial with the Missouri jury handing down a verdict in favor of the plaintiffs, a verdict we feel risks adversely affecting the ability for minorities and people of color to participate in the housing market.

After the conclusion of that first trial, the lead attorney for the plaintiffs was interviewed on CNBC, touting that homeowners were victims of a “rigged system,” and that compensation in real estate is different from any other industry—statements we found misleading and disingenuous.

Neither is correct.

A ‘rigged system’?

The system is indeed rigged, but not in the way he asserts. This country has a long and sordid history as it relates to discrimination in housing, and this discrimination comes from years of federal, state, and local policy and legislation aimed at enabling upward mobility for White Americans while hindering the ability of others to achieve the same homeownership objectives.

There have been mountains of studies and research done in this area, consistently finding that homeownership is the most effective way to build generational wealth and upward mobility in society.

A recent study by the Federal Reserve in 2020 found that homeowners in the United States had a net worth 40X that of renters. 40X.

To put that into real dollars and cents:

- Median net worth of US Homeowners: $255,000

- Median net worth of US renters: $6,300

That’s a staggering gap.

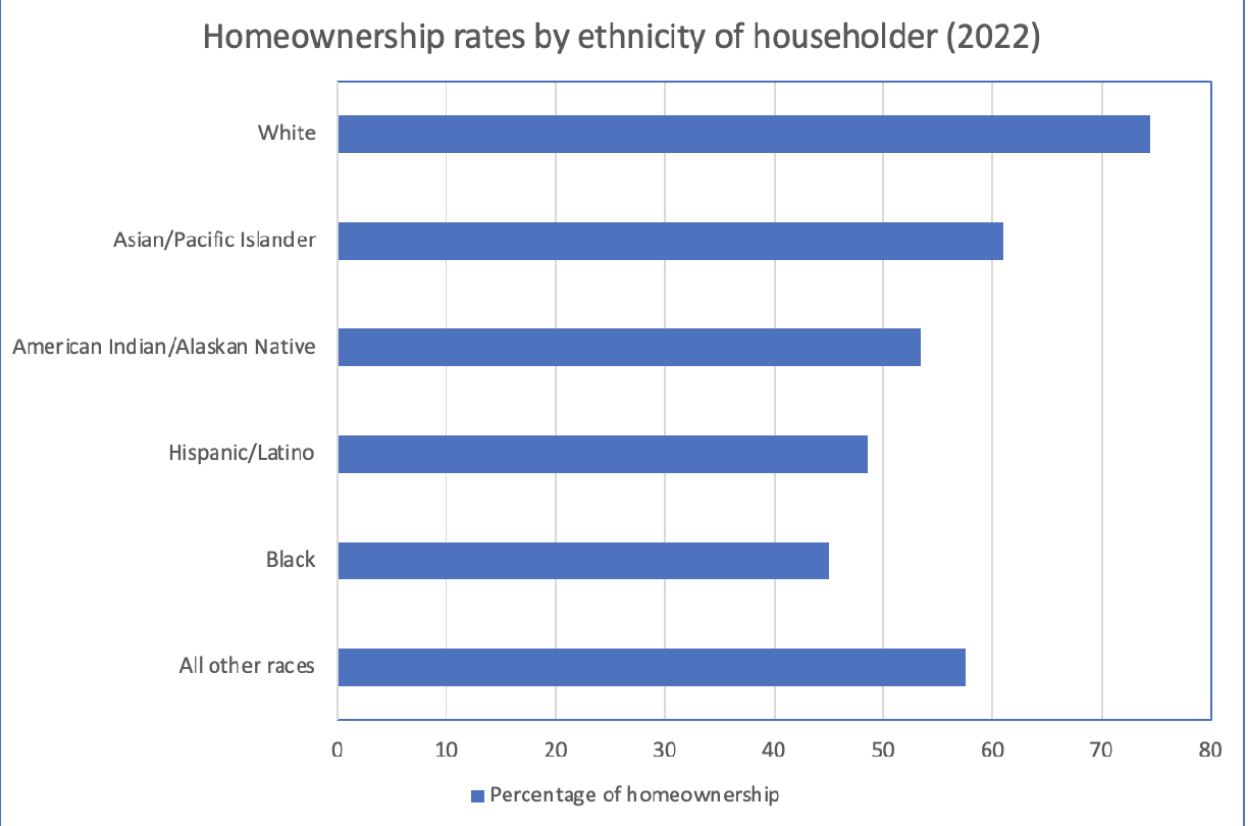

But it’s also a gap that favors white Americans, as rates of homeownership for whites far outpaces every other group:

Source: U.S. Census Bureau, 2022

And if the judge decides to prohibit sellers from paying a buyer’s broker fees, or if the DOJ tries to do the same, it will make it that much harder for folks in the “renters” category to move into the more lucrative “homeowner” category.

In a world where the current system of shared compensation was banned, buyers–especially first-time buyers–would be at a significant disadvantage in the property market.

The numbers are telling: Today’s median sales price hovers around $400,000, and in this scenario, prospective buyers need to bring between $14,000 – $80,000 to the table just as a down payment. This does not include all the other costs associated with a home purchase such as lender fees, appraisal fees, inspection fees, title and escrow fees—to name just a few.

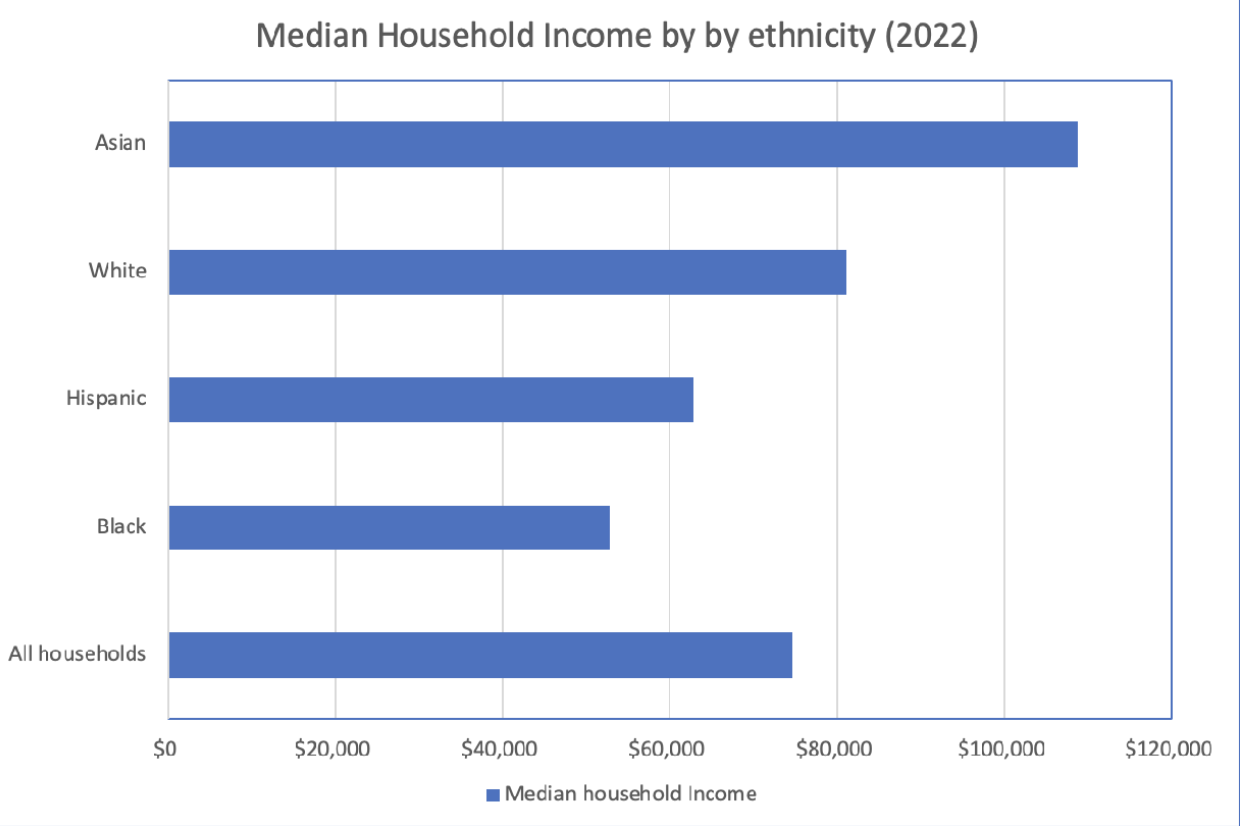

According to the U.S. Census Bureau, the median household income in the United States was $74,580 in 2022, so for the vast majority of Americans, a home purchase is already the most expensive and stressful transaction of their lives.

And it gets much harder if you are Black or Hispanic, as the median income for these cohorts are much lower than those of White Americans:

Source: U.S. Census Bureau, 2022

So, with a 20% down payment on a median priced home at $80,000, and the median household income at $74,580 (much less if you’re Black or Hispanic), the question remains: How is a buyer going to be able to pay for quality representation on the most expensive and stressful transaction of their lives, when the down payments required are potentially higher than their household’s annual income? They can’t be rolled into any loan products today, and it would take significant regulatory and financial institution policy changes to address that, any of which might be years away, if accomplished at all.

And if you happen to be Black or Hispanic, and if seller-paid compensation is no longer available, then the system seems even more rigged against you.

How are people–who have been discriminated against for decades in the United States–able to break into the property market when:

- The rates of homeownership for all minorities pales in comparison to the 75% of White Americans, and

- The median household income for Blacks and Hispanics is $20,000 – $30,000 less than Whites.

With those staggering disparities, how is it helpful to—or healthy for—a fair and equitable housing market to make an already expensive and stressful transaction even more expensive and stressful for the most disadvantaged?

Ultimately, if shared compensation were affected by this ruling, many buyers will be forced to forego representation altogether, or pay less for services that lack quality, ethical representation in the most complicated, expensive deal of their lives.

And this hurts people of color the most, as the more affluent, property-owning white population will be the least affected by this change—a change that will drive income and wealth disparity to staggering new heights.

Not to mention thrusting another shock into the housing system.

If the judge or the DOJ were to somehow stop seller-side commission sharing, it would not only inject risk into housing prices and buyer demand, but also have the potential to take this country back to the Dark Ages of real estate—when your ability to purchase a home was influenced so much more by what you look like, who you are, and who you know.

This is not hyperbole, it is happening right now.

Pocket listings and private networks of “exclusive” listings are on the rise.

“Exclusive” networks available to an “exclusive” set of buyers.

Brokerages and online real estate companies are already working to create closed systems of property information that are accessible based on… who you are, and who you know. Mostly to the detriment of the consumer, and the benefit of their bottom lines.

Are those “exclusive” services offered to clients, and then shared with prospective buyers, on an impartial basis? Nope.

One-sided compensation is unusual?

The lead attorney—who has now filed another case against more brokerage firms—made his closing argument on CNBC by asking, in what other industry do people pay for the other side’s services?

Well, Counselor, it’s actually YOUR industry.

In this case, the lawyer is not being paid by his clients, the plaintiffs he represents. Instead, the defendants will pay for both sides.

Sound familiar?

The plaintiffs’ lawyer is being paid in the same way buyers’ agents get paid today.

I guess that’s OK for the lawyer, but not the licensed real estate professional?

Of course, even without the MLS or a similar set of policies, other markets also work this way, such as employment recruiters (paid by the company looking for talent), as well as the commercial real estate market, where the seller also typically pays the buyer’s broker fees.

But without the efficiency of a centralized repository like the MLS, finding information about commercial properties is opaque, inefficient and expensive; and even without the MLS-facilitated offer of compensation, the commercial seller nearly always pays the buyer’s broker and nearly always at about the same split.

Do we want a less transparent, less efficient system for people’s homes, too?

Could brokerages and MLSs find ways to enhance their own transparency and efficiency?

Probably.

But that should not come at the price of putting up more barriers for any person—regardless of race, color, creed or sexual orientation—to access the housing market.

For more information, visit https://brightmls.com/open.

Incremental steps to, “you’ll own nothing and be happy”…

Amit Kulkurni, you are right on target. Your article should be on the front page of newspapers and every news outlet. I have been a licensed REALTOR and broker for nearly 40 years and have worked hard for my local MLS’s to make our real estate practice fair and equitable to all. Now a few so called Attorney’s see a major payday and are allowed to throw our system amuck. We need to get back to common sense!

Thank you for writing the article that really tells the REALTOR side.

Hi LuVerne, Hope you are doing well. I totally agree with you and the individual who wrote this article.

Dee Spraker

Won’t this hurt all low income potential home buyers regardless of skin color?

Michael, yes it will hurt every low-income person trying to break into the housing market, not just people of color. Unfortunately, as the data shows, it’s exactly those demographics that will be hurt the most.

Then why not simply make refernce to low-income folks?

Great perspective!

Thank you for being a voice of reason in a conversation riddled with misinformation!

First of all, the 20% down payment is not true. There’s plenty of programs to get in with zero down. So stop this 20% down stuff.

Actually, Lou and Byers are going to benefit from this because commissions are going to be reduced to the sale. Price is going to be reduced so therefore the monthly payment will be reduced so therefore the income to qualify will be reduced.

Fred, I disagree. The “you can get anything with zero down” works in theory. However, as we all know, in practice, an offer with a higher down payment is far more attractive to a seller than one that has less. I think for us to move forward we need to dispose of the hyperbole and talk about the facts, and talk about how the business actually works. It’s not perfect, and I’m not saying it is. But let’s have a real discussion about the real facts so we can make real progress.

I voiced some of your observations. I questioned if any of the jury had ever bought a home (within the last 5 years). Did either side show an average Buyer’s closing statement to actually see how much money a Buyer has to bring to the table? Add a Buyer’s Agent fee to that and there are not many Buyers who could or would afford that.

Did anyone mention that our fees are negotiable? Did anyone mention that real estate agents work for free many times? From the time a Buyer or Seller contacts us, we start working, researching etc. with no guarantee of payment. we only get paid if we preform. No attorney can state that. I question how many of the jurors would work for free.

A great perspective and it covers it all. May I add that when market starts to struggle because of higher Interest rates, the seller would wish not only to pay for buyer’ brokers’ commissions, they will also offer bonuses to selling agents. It is the stupidity of the court to interfere with a free process of real estate sales where buyers and sellers negotiate the terms.

This decision to prohibit the co-op system will choke the real estate market. When the buyer pipeline is cut off, sellers’ equity will not grow either.

Nice write up!!

to me the ending sections hit the nail right on the head “closing argument on CNBC by asking, in what other industry do people pay for the other side’s services? Well, Counselor, it’s actually YOUR industry.

In this case, the lawyer is not being paid by his clients…. Instead, the defendants will pay for both sides. … The plaintiffs’ lawyer is being paid in the same way buyers’ agents get paid today. “

Thank you for you helpful and informative article. These lawsuits are more examples of how our country and it’s legal system are out of control; and common sense isn’t so common any more! I’ve been a PA licensed Realtor for 31 years and can attest to the fact that our system and the manner in which we cooperate is fair; efficient; and actually benefits the consumer. The attempts to destroy the way we conduct business are pathetically sad.

May also further add the most important aspect of representation is a buyers agent works on defense and negotiating on their behalf. As a realtor, with 25 years experience, I’ve had deals come together because we balance out the negotiation. We all know that sometimes there is a difficult buyer or seller, and the agent is there to make sure it is a smooth transaction complete to closing. This lawsuit is absolutely ridiculous. Anything is negotiable in real estate. This lawsuit is making it more difficult for buyers to have representation. And it could become a one sided deal. My thoughts is there would be more lawsuits benefiting the lawyers if the buyers decide not to represented and do the deal on their own. The price of the home is always discussed first with the sellers and includes the conversation on their net sheet. They are fully aware of this and happy to pay because they want to close and sell the house. And why would agent work for free? This is really unfortunate this lawsuit happened, I certainly hope we can overcome this and dismiss the case.

I think you people are missing another important part of this discussion. If buyers know that buyer agent compensation is not being paid by the owner, then a rational buyer will factor that into their offer. Buyers in a normal, transparent market will want to keep the same money that the sellers are trying to keep. This will push prices down. In addition, buy making it harder for those with less down payment money, this will decrease overall demand for many properties, leading to lowered prices as well. In the end, these pressures will push down prices by the amount that the sellers think they are saving in buyer agent commissions. In addition to hurting individual buyers, the macro economics of this will be a wash for sellers. It is all pointless. Unless you are a victorious attorney…

I meant to say, “I think many people…”

Thank you!

Nowadays everyone is trying to change everything that has worked properly, efficiently and justly forever. Need to ask why? What is the motivation?

This economy is already in the tank and likely going to get worse. Folks are living paycheck to paycheck now.

How can your average hard working middle class buyers and low income buyers afford paying for buyer agent services? “He who has the gold makes the golden rule”. This was a terrible decision for the middle class and those below the middle class. This is about rich sellers that don’t want to pay the commissions for rich buyers who are buying their property. Again the middle class gets screwed!

All commissions are negotiable and always have been.

I agree with your article and how this would be a complete hardship for many buyers. Yet, aren’t we ignoring the obvious? While a seller may be paying their realtor as well as the buyer’s realtor out of the proceeds, wouldn’t it be more accurate to say that the buyers paid the commissions in the purchase price? And wouldn’t a better policy be the lenders allowing the buyers to include the cost of their agent on their side of the closing sheet? At least then, a buyer could claim that expense on their taxes. All these sellers suing for being required to pay, yet benefit from the tax write off. If they ever do receive compensation from this lawsuit, I hope they at least reward the buyers back the money they lost.

Respectfully disagree. Yes, in many countries around the world, the systems are far less efficient. I have dealt with a few. Generally, the Buyer/Lessee pays half the commission. I think that is the most equitable. After all, the buyers’ brokers are not working for the homeowners. The homeowners have already retained their representative. In fact, the buyers’ brokers are totally indifferent about any particular home their clients buy. They might even be discussing with their client some of the negative aspects of the Seller’s home that their client ends up disregarding. So, why should the Seller be paying for that! The buyers’ brokers are not a factor in their clients’ decision to buy a specific home.

Many low-income homeowners would also like not to pay both sides when they sell their homes and want to move up. They , too, could use that extra money, right?

The attorney situation is not at all comparable. If the defendant loses a case, they should pay attorney fees for causing the grievance to the plaintiff and forcing the litigation.

Dissenting opinion. Sellers should pay their agents. Buyers should pay theirs. If they can’t, they should ask for a subsidy to cover those costs the same way that they ask for a subsidy for loan or other costs.

What will this do? It allows buyers to negotiate the value of their buyer’s agent. And **THAT** my friends is a fair and free market.

REALTORS have their panties in such a wad that they can’t think straight. This lawsuit is valid.

That said, the really “problem” as I see it is brokers will have to enforce buyer agent agreements. As it is, since buyers don’t pay their agent, we know that the buyer will use **someone** and not try to circumvent the agent after the agent has put in significant work. Procuring cause is gone. Agents will no longer fight over who is owed “the” buyer’s agent commission being paid ***BY the LISTiNG BROKER***. Agents will have to fight for their clients. And that’s fair.

Amit, you should have been the defense attorney. They clearly walked in unprepared touting a level of confidence that got slapped to the ground after the verdict. Let’s just hope they presented enough material so that the appeal will be effective.

The Realtors need to plan a solid law suit against the current lawyer that is trying to destroy our profession. Realtors integrity and regulations place them far higher than that of the lawyers. We work very hard but paid very little. It is a case of a thieve trying to steal from the owner of a household. He will do everything possible to make the home owner believe that he is friendly. Some lawyers, use their knowledge to steal, sheat and destroy people. Some very good lawyers look at the law and help make the world a peaceful place for all to co-exist. If we fail to fight back, the US may return to those dark days where it was very difficult for the minorities to buy or own a house.

We must fight back, and make unscrupulous lawyers pay dearly for what they are trying to do to over One million hard working Realtors. Our Code of ethics and regulations place us above all the lawyers who out to milk the consumer and cause division in the market place. Thank you Amit Kulkarni for your great article. We must fight back.

Excellent article. You should submit it to the editorial pages of the New York Times and Wall Street Journal for all to read.

By far the best write up I’ve seen on this issue and we’ve been bombarded with them. This is the one I will share. Thank you Amit!

I have been in the Real Estate business for over 30 years after graduating from Howard University and at that time all agents worked for the seller. There was no buyer broker agency and the saying was,” Buyer beware”, however, when the buyer agency came about a lot of us older agents did not like that the seller still had to pay the commission but we were over ruled and now 30 years later here we are again with the same argument we had 30 years ago. I still feel the same way, buyers need to pay just like you pay your doctor, lawyer and accountant if the seller is paying you, you need to be working in the sellers best interests and also to be fair and reasonable to the buyer like we were taught so many years ago. The more things change the more they stay the same.

Amit, I agree with your comments and that your points should be made more public in every online and offline forum. More people need to know the consequences of those lawsuits and how it impacts all homebuyers and sellers. Thank you for a great article.

Wonderful perspective meshed with the data. Thank you!

Spot on Amit! I can as a full time Broker for 47+ years, your facts and perspective is accurate as any I’ve seen to date. This is a step backwards like none we’ve ever seen!

Commissions have been going down for many years. They have always been negotiable .If the seller and agent cannot agree on the fee charged, either party can walk away. We just had Fair Housing month, how is buyer agency going to help Fair hiusing, It is NOT!.