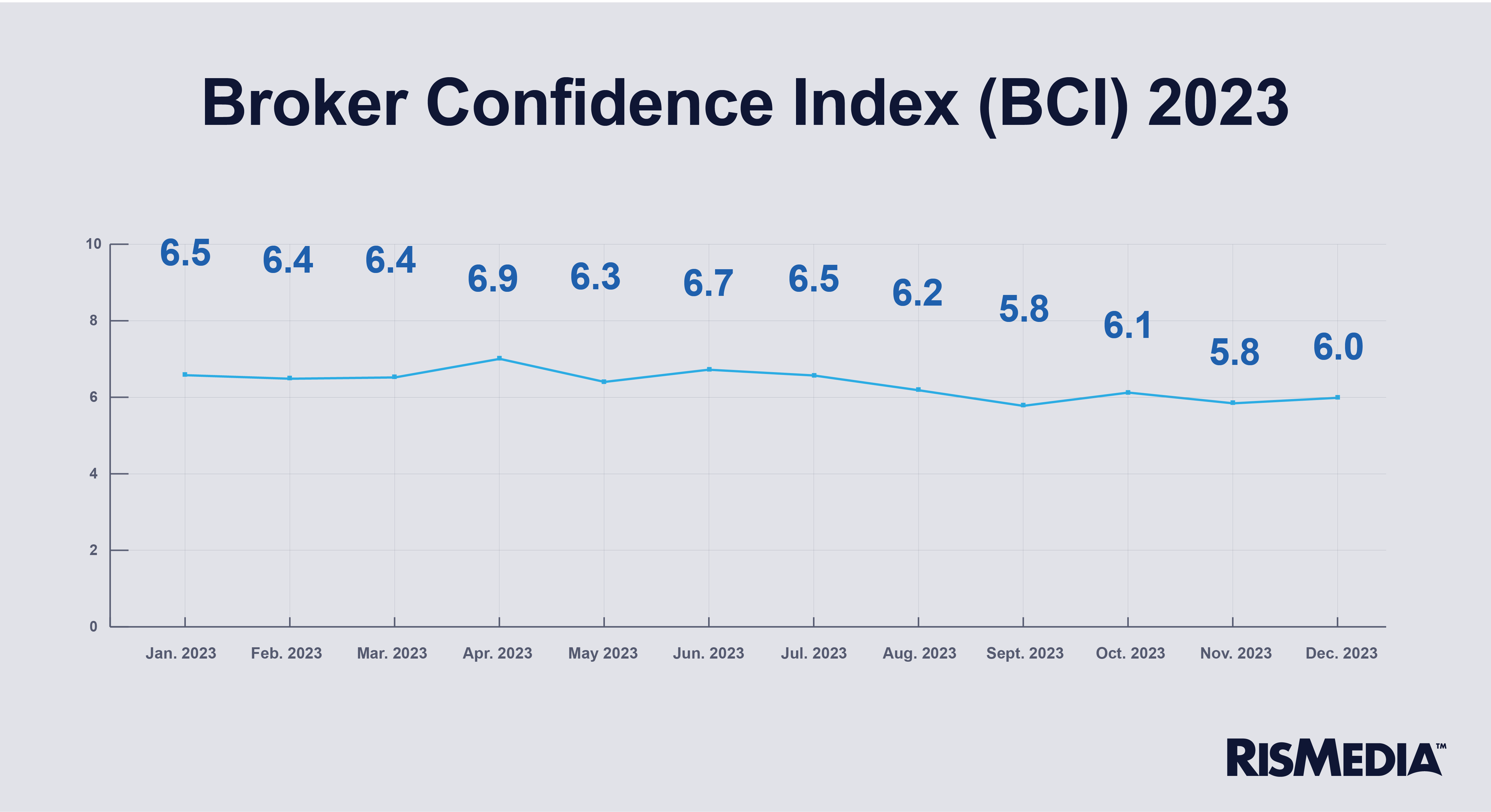

Brokers are more optimistic about the market now, and are less worried about some of the more high-profile challenges of 2023 going into the new year, according to RISMedia’s latest Broker Confidence Index (BCI), with an uptick in broker sentiment to mark the end of last year.

Similar to the pattern observed in 2022, the BCI hit its lowest point in November before a slight rebound in December. That was followed by a major surge in both home sales as well as the BCI early in 2023, as falling mortgage rates sparked a mid-winter rebound in markets across the country.

Whether 2024 will follow this same pattern is not yet known, but brokers described a similar environment as they kicked off the new year.

“Inventory is increasing gradually,” said Brian C. Schmitt, broker and president of Coldwell Banker Schmitt Real Estate in Florida. “Interest rates are decreasing and the Fed is loosening the screws on the federal funds rate.”

Mortgage rates also peaked around November last year, and have fallen even more precipitously than they did in late 2022 and early 2023. While sales are still depressed from pre-pandemic markets, economists and industry insiders expect this year to quickly shift, with a strong possibility of rate cuts by the Fed before year’s end.

“Consumers (are) waiting for lower interest rates,” said one broker, who asked to remain anonymous. “(But) the number of homeowners who will have a hard time giving up mortgages at 3.5% interest rates mean fewer overall moves!”

After a year that saw little relief from the longer-term issues plaguing the housing industry—namely, inventory and affordability—shorter-term shifts in rates and consumer optimism could bolster the market in 2024, assuming that macro fundamentals remain strong.

Other brokers pointed to positive inflation reports as more evidence of a rebounding market. But more brokers continued to point at inventory specifically as a bottleneck that will still put a cap on any rally in the near future.

“Low inventory and high mortgage interest rates are keeping both sellers and buyers on the sidelines,” said Patrick Shea, president and CEO of Windermere-owned Lyon Real Estate.

Fight the future

At the end of a year that started with an AI-generated tech scramble and finished with a historic jury verdict against the industry, brokers were asked last month to look forward rather than backward, and try to parse out what would continue to drive change in the new year, and what wouldn’t.

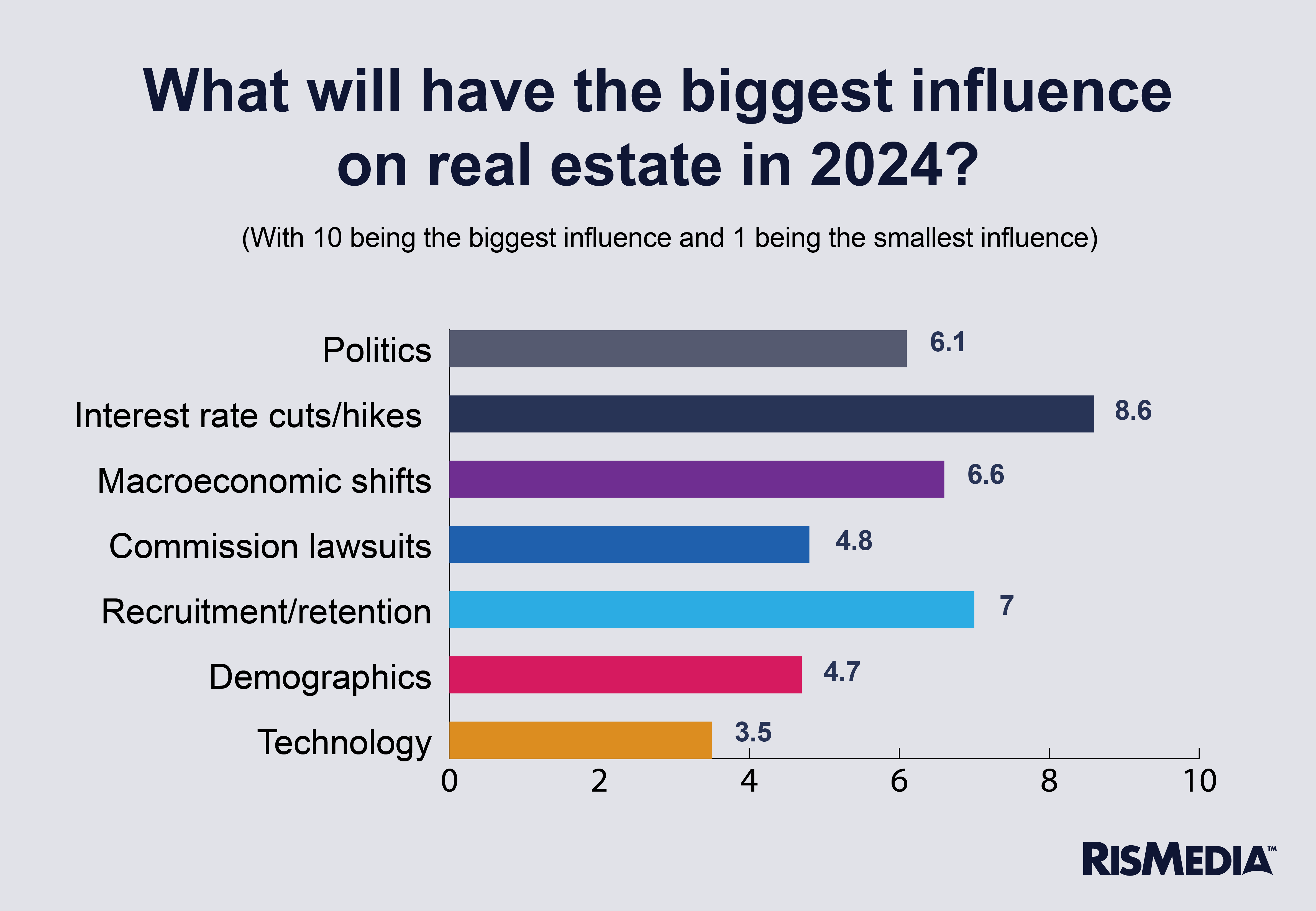

Presented with several potential factors that could broadly influence real estate, brokers surveyed in the BCI predicted that more tangible, practical and established challenges would dictate the path of 2024.

Far and away, the path of interest rates—whether that means cuts, hikes or holding steady—was the biggest focus for brokers. No broker rated the importance of these lower than a six out of 10, and over 60% of brokers rated it as either a nine or 10.

Politics ranked a somewhat distant second. With 2024 being a presidential election year, the potential disruptions to real estate are numerous—though hard to predict. Notably, a now-dormant Department of Justice investigation was initially concluded under former President Donald Trump, but restarted under President Joe Biden’s administration. Biden and Trump are both the frontrunners for their respective party’s nomination this year.

Biden and Trump also diverged in their overall approach to housing issues, with Trump’s “opportunity zones” offering some promising early results, and Biden’s push for down payment assistance and zoning reform mostly welcomed by the industry.

On the other hand, commission-focused lawsuits, which dominated the headlines and worried real estate executives in the near-term, ranked relatively low on the list of influences. Just over a third of brokers (34%) ranked the lawsuits as a three or lower, and only 12% ranked them as an eight or higher.

It is possible that this rating reflects broker’s confidence in the National Association of REALTORS®’ (NAR) ability to overcome these legal challenges in court, or more likely, that their effects won’t be felt immediately in 2024 as the slow-moving judicial process grinds on.

Another headline-grabbing topic, technology, was also viewed as a relative nonfactor. Brokers were previously polled on their attitudes toward AI, and the vast majority saw it as influential, though not transformative, which could explain this result.

Back to the more practical concerns, recruiting and retention ranked near the top of potential influences. NAR recently reported a small but not insignificant decrease in membership, and the challenge of attracting talented and motivated agents is clearly still at the forefront of broker concerns, despite all the other changes going on in the industry.