Above, Villa O’Calm, Saint Barthelemy, from LeadingRE memberSibarth Real Estate. Photo: Hugo Allard. Search MNPH on luxuryportfolio.com.

In a real estate industry that has been riddled with strife—from inflation and high interest rates to a scarcity of inventory—finding new ways to grow brokerage business has become more challenging than ever before.

For the members of Leading Real Estate Companies of the World® (LeadingRE), however, there is a unique opportunity to expand business by expanding their firms’ reach. Thanks to the ability to connect with some 550 fellow network firms around the globe, LeadingRE members are facilitating an increasing number of cross-border deals and maximizing transaction opportunities beyond their own countries.

Motivated for a variety of reasons, from financial to personal, homebuyers seeking properties outside of their country of residence are on the rise, according to LeadingRE, which placed business in 84 countries last year, including cross-border deals from Tokyo to Las Vegas, St. Thomas to San Antonio and Quebec to Sarasota, to name just a few. While referrals occur in all price ranges, high-end opportunities are on the rise, with 25 closings at more than $1M, topping out at an almost $4M referral from Ohio-based Sibcy Cline to Casaiberia in Portugal. According to LeadingRE, the increase in cross-border business is reflective of a broader, societal trend. “In an increasingly global world, we recognize that having global reach, awareness and influence is more important than ever,” says LeadingRE COO Kate Reisinger. “That is why as a network, we’ve placed a premium on growing our global footprint, opening up strategic doors of opportunity for our members all over the world. Over the last year and a half, we’ve brought on 48 new members in 22 countries—which includes the U.S. and abroad.”

Many of LeadingRE’s members bear witness to the rising occurrence of out-of-country transactions.

Thomas Zabel, managing director of Savills Residential Agency in Germany, for example, explains that cross-border transactions are being propelled by the desire to diversify investments and pursue better living standards. “Cross-border transactions are crucial, enabling us to cater to a wide array of client needs, diversify our portfolio and solidify our global presence, highlighting our adaptability and expertise in international markets,” he says.

At the center of the increase in cross-border business is the LeadingRE network. During the organization’s Conference Week in Las Vegas this past February, the global reach of the organization was on full display. “We had attendees from every inhabitable continent on the planet, many of whom traveled a long way to be there,” says LeadingRE President of Global Operations Chris Dietz. “The relationships formed lead to real business.”

Dietz explains that it is indeed rare to make such effective connections globally in a business that relies so heavily on the value of local. “Our members are confident about their global connections and the business opportunities this represents,” he says. “They are real, and they happen every day. It is an exciting experience to do business across borders, cultures and languages. You learn so much, and it is highly rewarding, not only financially, but also professionally and personally.”

From the pandemic to portfolios: What’s fueling the cross-border bonanza

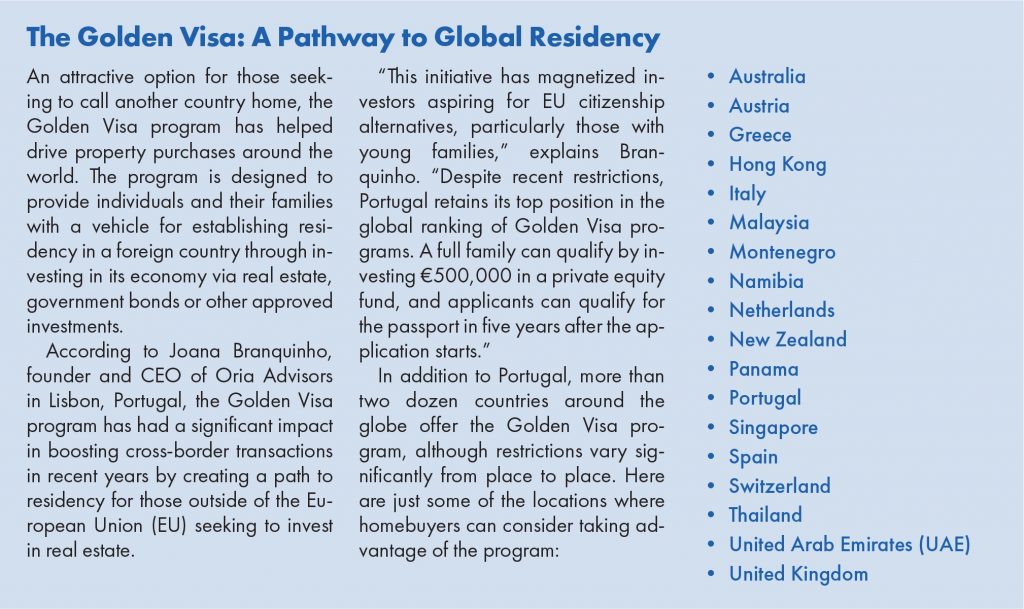

From pandemic-sparked remote work trends to luxury lifestyle goals, there are many factors driving the increase in global real estate purchases. The case studies reported by LeadingRE members are many and varied: a California resident purchasing an investment property in Mexico to later be used as their retirement home; a German couple in need of a villa within two hours of their yacht berthed on the Swiss border; a semi-pro surfer looking to take advantage of Portugal’s Golden Visa program; a family moving from Colorado to Italy because of a job transfer. The list goes on.

From pandemic-sparked remote work trends to luxury lifestyle goals, there are many factors driving the increase in global real estate purchases. The case studies reported by LeadingRE members are many and varied: a California resident purchasing an investment property in Mexico to later be used as their retirement home; a German couple in need of a villa within two hours of their yacht berthed on the Swiss border; a semi-pro surfer looking to take advantage of Portugal’s Golden Visa program; a family moving from Colorado to Italy because of a job transfer. The list goes on.

According to Kimberly Barkoff, executive director of referrals and relocation for New York City-based Brown Harris Stevens, the increase in cross-border moves is a reflection of modern times. “With the world seeming smaller with Zoom technology, and with the ability to communicate more personally, it revealed an untapped need for our agents and their clients,” she says. “Our global reach goes way beyond our coverage areas, and the agent’s sphere of influence includes clients interested in living and/or investing in other areas of the world. We have never had as many successful international transactions.”

The reasons behind more cross-border home purchases range from financial to personal, says Zabel. “Clients are increasingly drawn to overseas properties for lifestyle enhancements, retirement in serene locales and investment opportunities in emerging markets, driven by economic stability and quality of life,” he says.

LeadingRE member Manabu Suzuki, vice president of International Property Agent in Japan, established his firm in 2017 specifically to meet the needs of those interested in investing in cross-border properties. Clearly, he’s delivered on that intention, with 70% of his firm’s revenue coming from overseas transactions.

“We all see the post-pandemic increase in cross-border transactions, especially buying needs into Japan from overseas buyers,” says Suzuki. “This is mainly because the exchange rate is favorable for buyers, plus the number of tourists who are impressed by Japan. Many people want to diversify their asset portfolio across a couple of different countries.”

Dietz has witnessed the post-pandemic increase in cross-border home-buying that Suzuki describes throughout the LeadingRE network.

“One trend that remains from the Covid experience is that people feel more comfortable extending their portfolios to foreign markets,” explains Dietz. “People move where they see opportunity, and depending on the individual, that opportunity may be financially motivated, driven by lifestyle, prompted by geopolitical issues, or a combination of these and other factors. Generally speaking, we see interest in markets that are economically stable with affordable cost of living and a desirable lifestyle. Often, these markets also offer a favorable return on investment.”

This is the trend that has unfolded in the Czech Republic, where economic conditions at home have sparked an increased interest in purchasing property beyond borders, according to Filip Šejvl, managing partner of Philip & Frank in the Czech Republic. “The increase was driven by high inflation rates in our country, potential political instability in Europe due to the war in Ukraine, rising prices of real estate in the Czech Republic and easier access to investment opportunities around the globe,” he says. “We might expect that the number of cross-border purchases will even increase in the future since the purchasing power of the Czechs is increasing.”

Additionally, Šejvl explains, it is common practice for Czechs to purchase a second home away from the city environs. The desire to look beyond the Czech countryside to other countries was a natural progression.

“Czechs are used to owning second homes,” he explains. “Since the prices of these ‘recreational’ properties have significantly increased in the Czech Republic, as well as the fact that the country is land-locked, people started to look somewhere else, outside of the country. The most popular locations for second-home purchases abroad are locations that are easily accessible by plane and have nice coastlines: Spain, Portugal, Italy, France.”

Joana Branquinho, founder and CEO of Oria Advisors in Lisbon, Portugal, has witnessed the increase in overseas homebuyers. “There has been a noticeable upsurge in cross-border transactions in Portugal over the past couple of years,” she says. “This can be attributed to various factors, including the country’s reputation for safety, robust and affordable healthcare system, favorable exchange rates, appealing lifestyle, a stable and expanding real estate market, and English-speaking populace known for their hospitality, and exceptional education opportunities.”

Šejvl also points to return on investment as a compelling reason for cross-border home purchases, adding that many, in fact, purchase more than one property if the price point is right. “People are investing in countries with a high possibility of future growth of prices,” he explains. “These locations are very often in developing countries where you witness significant price growth—Thailand, Costa Rica, Vietnam, India, etc.”

Cross-border business is an important component for U.S.-based LeadingRE firms as well. “While some people may assume these opportunities are focused on the coastal markets or major cities, we have seen referrals from across the country and around the world,” says Reisinger. “Just a few examples include Montana to Pattaya, Thailand; Oklahoma City to Switzerland; and Aspen to Venice, Italy.”

Despite troubled times for its residential real estate market, Dietz explains that the U.S. remains a prime destination for cross-border referrals.

“A company with a referral for the U.S. may have questions when reading about the legal issues in the U.S., but the U.S. is still regarded as one of the world’s strongest markets,” says Dietz. “Having an active presence in 70 countries allows us to remain steady even in turbulent times.”

What it takes to succeed in the global arena

While market trends, lifestyle preferences and financial goals are fueling interest in cross-border purchases among consumers, success in the global real estate marketplace requires specific skills and strategies.

Reisinger advises brokers to focus on several key areas. “Encourage your agents to think globally when having referral conversations with those in their sphere,” she explains. “Just as they would engage in conversations about local real estate needs, when they open the dialogue to more far-reaching destinations, they may identify expanded opportunities. They may be surprised to find that a client who vacations regularly in the South of France is interested in purchasing a property there.”

A variety of skills are necessary for successfully facilitating cross-border transactions, says Branquinho, such as understanding local regulations, working with knowledgeable professionals familiar with both local and international markets, clear communication, transparency and ensuring legal compliance throughout the process. “For clients, security of investment is key,” she adds. “Potential property appreciation, ease of relocation and lifestyle factors are crucial considerations. There is a massive advantage to having an experienced local partner to guide you all steps of the way.”

A variety of skills are necessary for successfully facilitating cross-border transactions, says Branquinho, such as understanding local regulations, working with knowledgeable professionals familiar with both local and international markets, clear communication, transparency and ensuring legal compliance throughout the process. “For clients, security of investment is key,” she adds. “Potential property appreciation, ease of relocation and lifestyle factors are crucial considerations. There is a massive advantage to having an experienced local partner to guide you all steps of the way.”

Success is also dependent on knowledgeability, stresses Šejvl. “Buying property abroad is not an easy process for the customers,” he explains. The transaction procedures, laws, etc., vary from country to country. It is very important to find buyers the right trustful partner who would guide them throughout the whole buying process safely.”

“Success hinges on thorough local market knowledge, understanding of legal and tax implications and the ability to navigate financial processes smoothly, ensuring client trust and transparency at every step,” adds Zabel.

At the center of global success: Connectivity

While homebuyers have many reasons for purchasing properties around the globe, the connectivity fostered within the LeadingRE network and the deep resources the organization provides to members are the engine that makes it all happen.

“Being a global organization is much more than just having representation around the world,” says Dietz. “It means understanding the nuances of doing business in different places and adapting accordingly with a global mindset. We prioritize helping our members succeed in this space through continual education and awareness and with extensive support through our cross-border referral concierge program. Each referral is carefully managed with an understanding of how real estate is conducted in the local market, a sensitivity to cultural and communications differences, and a hands-on approach that has helped us achieve incredible results.”

“We continually promote referrals through our educational initiatives, member coaching and our annual referral campaign,” agrees Reisinger. “And, we cannot overemphasize the importance of the relationships our members establish when they meet. These connections are very real and can be very lucrative—and that is evidenced by the stories we hear each year following our events: stories of energized business; stories of meaningful relationships; and stories of referrals spanning markets, borders and even hemispheres.”

“We continually promote referrals through our educational initiatives, member coaching and our annual referral campaign,” agrees Reisinger. “And, we cannot overemphasize the importance of the relationships our members establish when they meet. These connections are very real and can be very lucrative—and that is evidenced by the stories we hear each year following our events: stories of energized business; stories of meaningful relationships; and stories of referrals spanning markets, borders and even hemispheres.”

“We can truly say we have connections all over the world,” confirms Barkoff. “Not just a company and a name, but people we know and have full confidence and trust in their expertise and the way our clients will be treated. LeadingRE is an invite-only group so our members must have a similar mindset.”

Branquinho agrees, explaining that being a member of LeadingRE significantly amplifies her firm’s ability to cultivate a global business footprint. “It grants us access to an expansive network comprising top-tier real estate professionals globally, facilitating seamless relocation services, fostering international referral networks, and harnessing collective expertise and resources to expedite successful cross-border transactions,” she says.

“Our affiliation with the LeadingRE network significantly bolsters our ability to navigate global markets, offering invaluable insights and referral opportunities and enhancing our reputation as trusted international real estate advisors,” adds Zabel.

For Dietz and the LeadingRE team, facilitating members’ success is a goal that they live and breathe. “It’s a mission for us 365 days a year/24 hours a day, and that really sets LeadingRE apart.”

For more information, visit https://www.leadingre.com.