Real estate executives expressed overall disapproval of the National Association of REALTORS®’ (NAR) choice to settle commission lawsuits in RISMedia’s most recent Broker Confidence Index (BCI), though opinion at this early stage still seems divided both on the settlement itself, as well as what kind of adaptations are appropriate to deal with upcoming rule changes set to take effect in July.

At the same time, though, the short-term picture for real estate is decidedly sunny right now as the BCI hit its highest level since mid-2022, with most home sale metrics on the upswing as demand continues to defy high mortgage rates.

“A strong first-time buyer base continues—low inventory has left demand extra high,” said Bill Flemming, broker/owner of HomeSmart Connect in Illinois.

While the data so far—from pending home sales to new construction—is far from definitive, brokers on the ground tell RISMedia that the market is looking better than it has in a long time, with hope that even more relief from Fed rate cuts is just around the corner.

Brokers polled by RISMedia also indicated they were confident that the worst legal threats to the industry are over, despite still-ongoing buyer lawsuits (not covered by any settlement agreements proposed so far) and an investigation by the Department of Justice (DOJ).

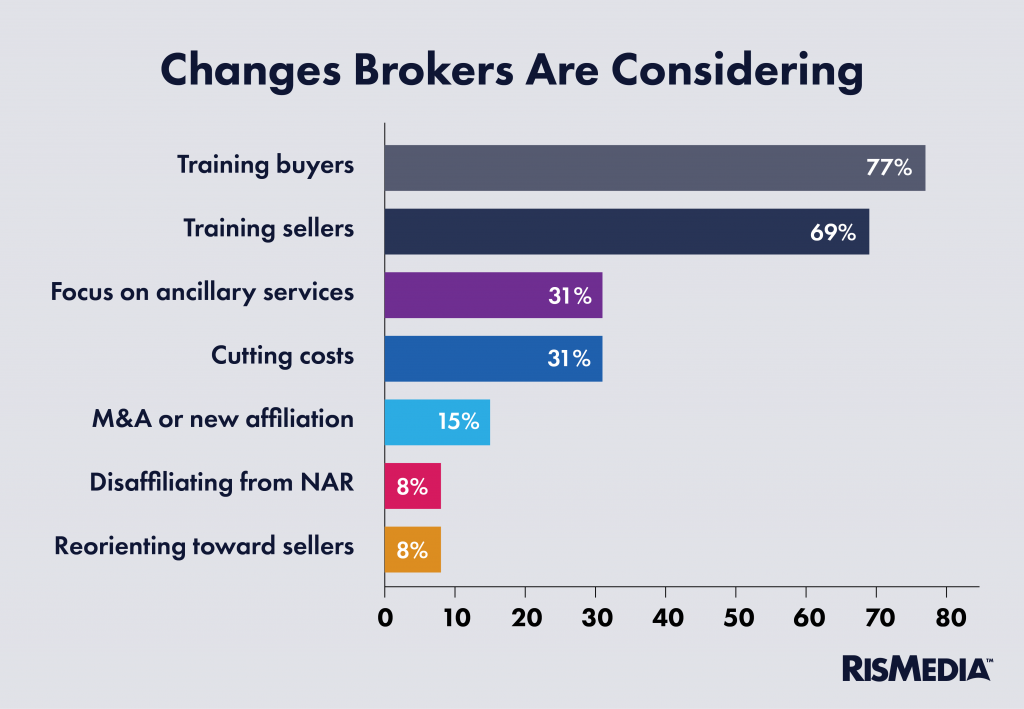

While the consequences of the NAR settlement remain somewhat unclear, brokers are almost universally planning on enacting long-term changes to their businesses, according to the survey—some dramatic, some less so.

More than three-quarters (77%) of brokers said they would be ramping up training on buyer agency and related issues—unsurprising, since the settlement agreement mostly affects how buyer agency functions, making written buyer agency agreements mandatory, setting restrictions on how compensation is determined and removing commission offers from the MLS.

Almost as many brokers said they were also going to train harder on the sell side, with 69% saying they would also push out training for those agents. A much smaller subset of real estate business leaders said they would be increasing their emphasis on ancillary services in response to the settlement, with 31% saying they would be focusing on title, mortgage and other related businesses.

While more training is obvious and uncontroversial, a significant number of brokers are also planning more drastic moves. Almost a third (31%) said they would be cutting costs, and 15% anticipated looking at mergers, acquisitions or new affiliations due to the settlement.

A much smaller subset of executives said they were considering even more fundamental moves—disaffiliating from NAR, or completely reorienting their businesses to focus on the sell side rather than the buy side. Only 8% of respondents were looking to make those changes, though.

This could be seen as comforting or concerning, depending on perspective. Some observers have worried that these changes could significantly reduce buyer agency, while others have argued that the industry will adapt and emerge mostly unscathed.

And while brokers are clearly preparing for the changes ahead, that doesn’t mean they were happy with NAR’s decision making around the settlement—though a relatively large proportion agreed that it was the correct choice under the circumstances.

Looking at the broader landscape, less than 10% of brokers mentioned the potential effects of the lawsuit as a primary factor weighing on their confidence right now, with most still citing rates, demand and inventory as areas where there is cause for optimism.

“With interest rates having settled some, spring market and a prediction of rates declining further, there is optimism in the industry,” said one anonymous broker.

That optimism seems to carry over to future legal issues as well. While the NAR settlement covers a significant portion of ongoing litigation, lawsuits filed by homebuyers are not included. An investigation by the DOJ was also just reinvigorated by an appeals court ruling, with the potential to enact further changes on the industry.

Despite this, just over half (51%) of brokers said they were only “somewhat concerned” about these future threats, positing the worst legal challenges to real estate are in the rearview. At the same time, a quarter of respondents (25%) worried that these suits and investigations are actually a bigger threat than the settled seller suits. Only 22% of brokers said they were mostly or not at all concerned about future litigation and regulatory pressures.

For a more detailed breakdown of brokers’ reactions to the NAR settlement, see the BCI video at the top of the page.