Given the recent proposed settlement agreements and accompanying media hoopla, it is time for the voice of factuality to be heard.

Now we must even combat misleading presidential pronouncements, such as this from a March 19, 2024, news conference: “…last week the National Association of Realtors agreed for the first time that Americans can negotiate lower commissions when they buy or sell their home. On a typical home purchase, that alone could save folks an average of $10,000 on the sale or purchase. I’m calling on realtors to follow through on lowering their commissions to protect homebuyers.” (Also, see Executive order 14036, Section 5, paragraph h (vi).)

Despite all the false narratives out there, real estate brokerage commissions have always been negotiable and are most definitely NOT the cause of high home prices. Plain and simple, the root cause of all asset bubbles is cheap money, created out of thin air by the controller of the money supply.

Likewise, there is no such thing as a “standard” commission within the industry. While there may be standards within some individual companies, the only universal truth about real estate is that every element of every real estate transaction is 100% negotiable, and it always has been.

Some facts about real estate commissions

Court documents introduced in the recent lawsuits show that the conclusions of evidence for a “standard” commission rate were arrived at solely by reviewing the advertisement of homes for sale in various MLSs. The hired researchers looked at the amount of compensation offered to the buyer agent in those advertisements, and then just multiplied by two. That’s it. The total amount of research performed for introducing this element as evidence.

What this methodology fails to reveal is the final true commission paid by the seller. Twenty-two years of experience has proven to me repeatedly that this amount differs greatly in nearly every single transaction. Furthermore, terms and commissions are fluid all the way to the closing table. Rarely does a sale close with the same terms as initially written. A repair request will arise from the inspection, or some other item of negotiation, and once the principals have reached the limit of their negotiability, the agents involved will frequently modify their commission to make the transaction work.

A critical point: the only place where this is accurately shown is the final settlement statement.

I recently purchased a townhome that was listed for $359,000. When I first found the listing on the MLS (Multiple Listing Service), the offered compensation to a buyer’s agent was 2.5%. Initially, I waived that compensation in the offer, reducing the sales price accordingly, resulting in the seller netting the same amount. After much negotiation over various terms, items to remain, and occupancy dates, the total buyer agent compensation was finalized at $5,250.

The only two places the commission amounts are shown accurately in this entire transaction are in the final counter offer document (which did not change the sales price from the contract) and the final settlement statement. Neither of which are public information.

Today, the property is showing as closed in the MLS…with an offered compensation of 3%.

My point is that using only public information from the MLS to arrive at the broadly accepted “the standard is 6%” was an extremely flawed approach.

In this specific example, that calculation method would indeed arrive at the false belief that a total of 6% compensation was paid on this sale. When in truth, the seller paid 2.5% to the listing agent and $5,250 to the buyer agent—for a total commission of roughly 3.96%.

Granted, this example is not a 100% typical transaction. However, the basic fact that it IS normal for nearly all commissions to be negotiated happens every single day remains. Further, it is a fact that the only way to derive accurate data on the true commission amounts is to consult the final settlement statement of every transaction. All other hypotheses are strictly conjecture.

Commission rates are driving up home prices in America today

The much-ballyhooed connection between real estate commissions and high home prices is another false narrative. Think about it rationally for a moment: home prices in America have risen 25%-40% over the past five years. Even more in some places. Yet commission rates (as a percentage of sales price) have not increased. In fact, they have tended to decline over that same time as the industry has experienced commission compression for many reasons.

The lack of home affordability today lays not at the feet of the Realtor community, but squarely at the feet of government spending. Specifically, the Federal Reserve’s easy money policies since the 2008-2009 subprime mortgage crisis. It has been trending for 20 years before then, but this is when it really ramped up. When to overcome market imbalances (also caused by government policies) the Fed created and injected Trillions and Trillions of dollars into the US economy.

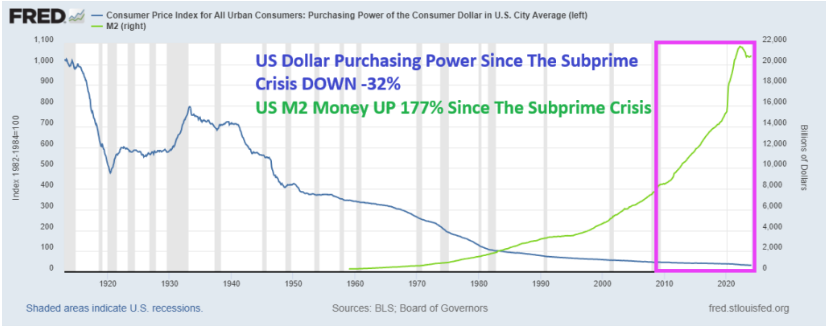

The effect was like an adrenaline injection on the human body. Just like all artificial stimulants, the “body” soon became dependent on continued juice. Our economy became a money addict. The outcome: The U.S. Dollar purchasing power is DOWN -32% and the M2 money supply is UP a staggering +177%. Basic economic principles state that when you have more of something, each is worth less. As the chart below clearly shows, as the M2 money supply shot up, the purchasing power of the dollar continued the downward trajectory. For all the anguished outcry of pain expressed regarding the current Fed’s tightening of rates, it is only that tiny little downward blip at the upper right of the green line. Barely noticeable in the grand scheme.

A recent interview with a former KC Fed President openly confirms that the Federal Reserve has historically pandered to political and special interest groups, prioritizing immediate relief over long-term financial stability. Bernanke’s zero-interest rate policies (ZIRP) and Quantitative Easing (QE) were short-term fixes that never went away. His successor, Yellen (who is now Secretary of the Treasury), stuck with zero-interest policies, only raising the target rate once. This resulted in a continuance of massive cash infusions into the economy at a time when it was no longer necessary. The “body” had become addicted. To Powell’s credit, he is trying to recover some of the lost purchasing power.

Summary

Massive injections of cash created asset bubbles, destroyed the purchasing power of the dollar, and caused the inflation we are still experiencing. This is an undeniable economic fact. Yet just as every government in the history of the world has done, when confronted with the failure of its policies, they always turn to creating an outside enemy to distract and rally the population. That’s exactly what is happening here. That noise is compounded by some sharp attorneys who figured out how to turn a large, quick buck out of the situation.

Blaming real estate commissions as the culprit for high home prices is not only ludicrous, but it also makes zero sense to anyone who understands even the most basic level of economic theory. Especially given the obvious value of the services rendered in exchange for the money. Hence the need for continued misinformation and the creation of the ‘bogeyman Realtor.”

It’s just sad to see that the industry rolled over so quickly. Past policies and defensibility of business decisions are unique to each business, I suppose.

For more information, visit https://www.unitedrealestate.com/.

” the seller paid 2.5% to the listing agent and $5,250 to the buyer agent—for a total commission of roughly 3.96%. ”

Actually didn’t the seller pay $5250 to the Broker? Then the broker often takes a franchise fee and the broker takes their cut of the 2.5%. The commission that is left is then subject to all taxes including self employment tax, health insurance, business expenses including office, vehicle, marketing.

At the end of the day, what does that agent really make?

I agree, the gov’t is the root of all evil here and more specifically the Democratic party is the worst with all their vote buying scemes. I also lay great blame for the commission debacle at the feet of NAR for the poor defense mounted during the legal process that unfolded over the past year. Where were all these ideas and explanations for commissions during that billion dollar trial? Where are the appeals to set the record straight? Someone is asleep at the wheel.

I will add another reason for insanely rising home prices: Greed. Home owners in my area all want a million dollar home price, even though the reasonable value is much, much less. Too many realtors go along with this to have the sale. We are doing our next generation of home buyers a real (and I’d add moral) disservice.

Sellers and agents don’t set the price of the area, the buyer always does, you have to have a ready and willing buyer in order to purchase. Lowering the price only increases the buyers traffic and offers, raising the price that the buyer is willing to pay, hence the higher price that it closes at.

It’s disingenuous to point the finger toward government policies when Realtors have been informing those policies for over 100 years.

Most real estate commission is divided into four. For example, on average, a 6% commission involving a listing broker and a buyer broker receives 3% on each end of the transaction, then split 50/50 between the Broker and agent realizing 1.5% compensation! Finalizing a transaction and bringing it to the closing table is not always easy

and that is why an experienced agent is worth their weight in gold!

Jo Mauro

Realtor

The writer’s early article about the role of the NAR is worth a read.

As for commission rates in this article- Has the average buyer in America known and been informed routinely by their agent that the $$ being paid to their agent (often out of the total $$ coming from the seller) are negotiable.

As for house prices rising: tying cause and effect to money supply is a piece of the equation (obviously lower rates and plentiful money is a factor), but the availability of land, the cost of supplies, the cost of labor, increase in demand through population increase, etc. are factors. Price jumps in the mid 80s, after the Gulf War and the S and L slump, etc. were somewhat cyclical The fact that despite that there are no “standard”real estate commissions, and each firm sets their own policy, has not kept the average commission charged to change very much over the last 40 years. But, while the commission percentage has stayed the same, obviously, as house prices rise it costs the consumer more in absolute dollars. When the $15,000 commission paid on their 2010 $300,000 sale

Is $30,000 on their $600,000 2024 listing, is it a factor in setting the price.? I expect in most cases it is market setting the price — at least the selling price.

So many businesses to attack as fixed pricing or over-charging. Try to get an attorney to take less than a third in a contingency suit and they take expenses on top of that. Can I negotiate the fee for my hospital stay or the surgeon’s fee? Note that neither the criminal defense attorney nor doctors pay is contingent on success. They are merely practicing. Real estate commissions are paid at settlement when the performance of the job is complete and successful. Why did the plaintiffs sign commission (listing) agreements that they apparently didn’t agree with. Why did Buyers sign Purchase agreements when they felt the price of the home was inflated. Guess no one is responsible for their own decisions anymore. Taxpayers on the hook for students overcharged on their college education–can we sue the universities for price fixing?? Logic has been displaced by feel good progressivism. Bah Humbug!