Defying post-pandemic trends, RISMedia’s Broker Confidence Index (BCI) dipped slightly at the start of the year, with real estate business owners still wrestling with spiking insurance costs, inventory shortages and consumer hesitancy—but most are planning to increase investments in their business.

Falling slightly from 6.2 to 6.1, the relatively minor change skews from recent readings, as the BCI previously saw significant increases between December and January, with brokers largely celebrating a new year as they prepared for the spring market. Housing economists have wondered whether real estate markets would return to regular seasonality after the pandemic, with the timing of slumps and booms offset from historical norms.

Falling slightly from 6.2 to 6.1, the relatively minor change skews from recent readings, as the BCI previously saw significant increases between December and January, with brokers largely celebrating a new year as they prepared for the spring market. Housing economists have wondered whether real estate markets would return to regular seasonality after the pandemic, with the timing of slumps and booms offset from historical norms.

“Typical January market, but the enthusiasm about rate cuts is subsiding and discouraging,” said Chad Ochsner, broker/owner of RE/MAX Alliance in Colorado.

At the same time, though, when asked about their expectations for their company’s sales volume and investments, brokers answered much more optimistically, many pointing to stronger demand and expectations for more inventory.

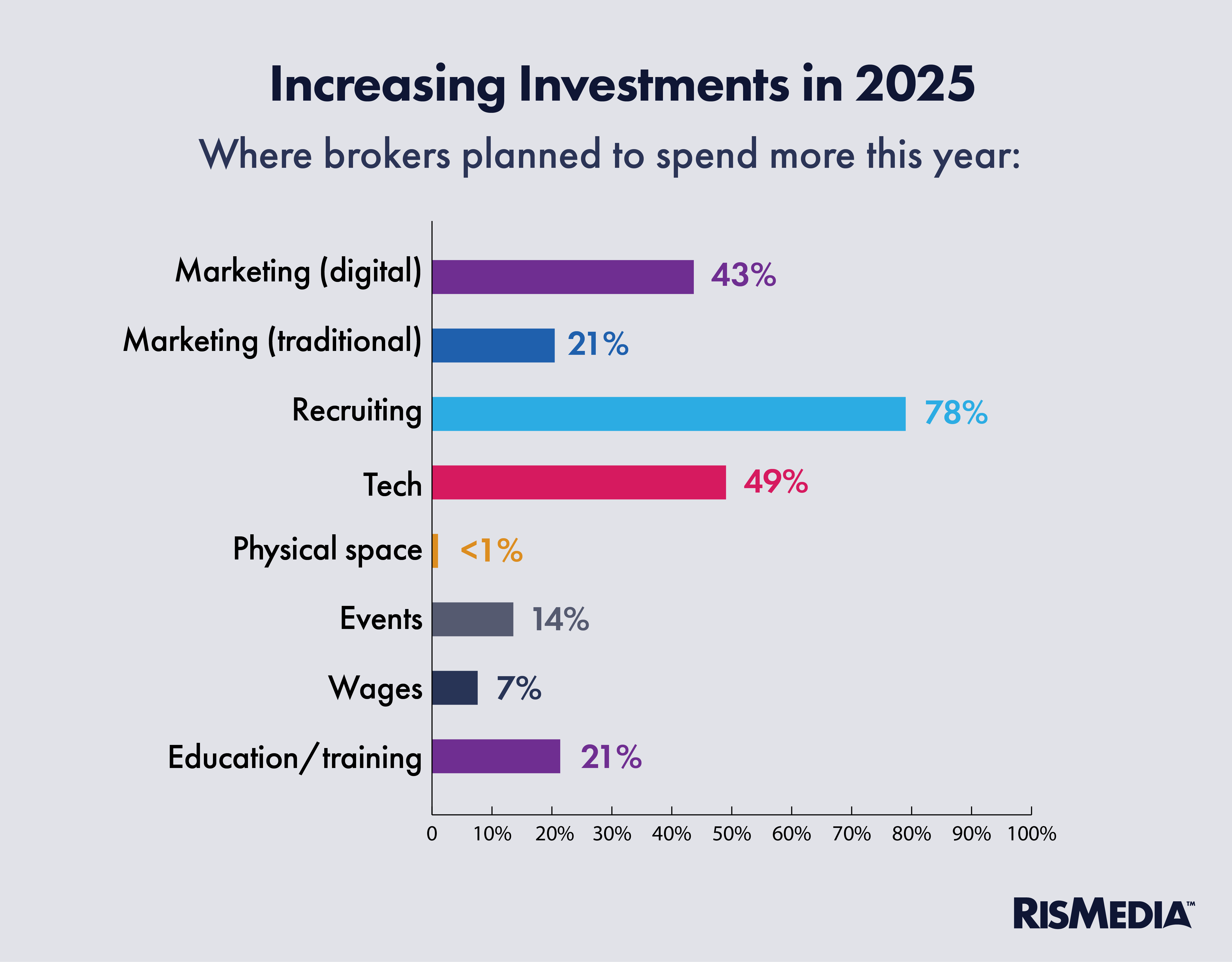

More than half (57%) said they expected to rack up a higher sales volume in 2025 compared to last year, and most said they planned to increase or maintain their investments in marketing, recruiting and technology. A whopping 78% said they would be investing more in recruiting this year.

Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas, cited an “upgrade in sales staff” as part of his reason for optimism, noting that “more housing is available for people to choose from.”

Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas, cited an “upgrade in sales staff” as part of his reason for optimism, noting that “more housing is available for people to choose from.”

All of this aligns with what has mostly been cautious optimism from the real estate industry regarding the new Trump administration’s policies toward housing. Although economists have warned that draconian immigration enforcement actions and tariffs (currently on hold for the most part) could damage both housing markets and the economy, brokers cited the new president as a significant factor in their confidence.

At the same time, several brokers cited Trump as also negatively impacting their confidence, showing that significant uncertainty remains around the new administration’s policies. As usual with real estate, local market realities seemed to be the largest driver in sentiment.

“Where we are located (affects my confidence),” said one broker, who requested anonymity. “North and South Carolina—a lot of people are moving to these two states.”

2025 in focus

Despite the overall uncertainty, brokers appeared to see this year as an opportunity to grow rather than pull back. While 28% of brokers said they expected lower sales volume this year, only 18% said they would be cutting investments in any aspect of their business.

Out of those, a little over a third (36%) said they would be cutting investments in physical space.

Across all respondents, 28% of brokers said they would spend “somewhat” less on marketing in 2025, compared to just under half (47%) who said they were spending the same on marketing. Brokers were more likely to plan on cutting print, display and mail marketing compared to digital and social media investments (21% to 7%).

A significant 35% also said they would cut back somewhat on events in 2025, compared to 14% who were planning on spending more.

But plans to increase investments in tech and recruiting would seem to show that brokers are hoping to see their businesses expand this year. Notably, almost exactly half of all respondents said they planned to spend “significantly more” on recruiting, while just under half (49%) said they would spend “somewhat more” on tech.

Recruiting looks to be a particularly important topic this year, with a number of brokers mentioning qualitatively that the agent experience is an important metric to track. One broker who requested anonymity cited “broker competition for agents” as a primary factor in their current level of confidence.

In other areas, brokers largely planned to keep investments steady. A huge majority (85%) of respondents said wages paid to employees (assistants, transaction coordinators and the like) would remain the same, as would investments in education (71%).

As far as what factors were guiding their investment choices (one way or another), a majority of brokers cited rates and demand. Overall, 64% of brokers mentioned rates, demand or both as underlying their decisions, while 36% mentioned inventory.

Why the headline; Confidence Low, but Brokers See 2025 as Growth Opportunity? Are you confused, or is confusion your goal?