Real estate brokerage leaders are overwhelmingly optimistic about their economic, housing, and business outlooks for 2025, according to the latest Delta Media Real Estate Leadership Survey.

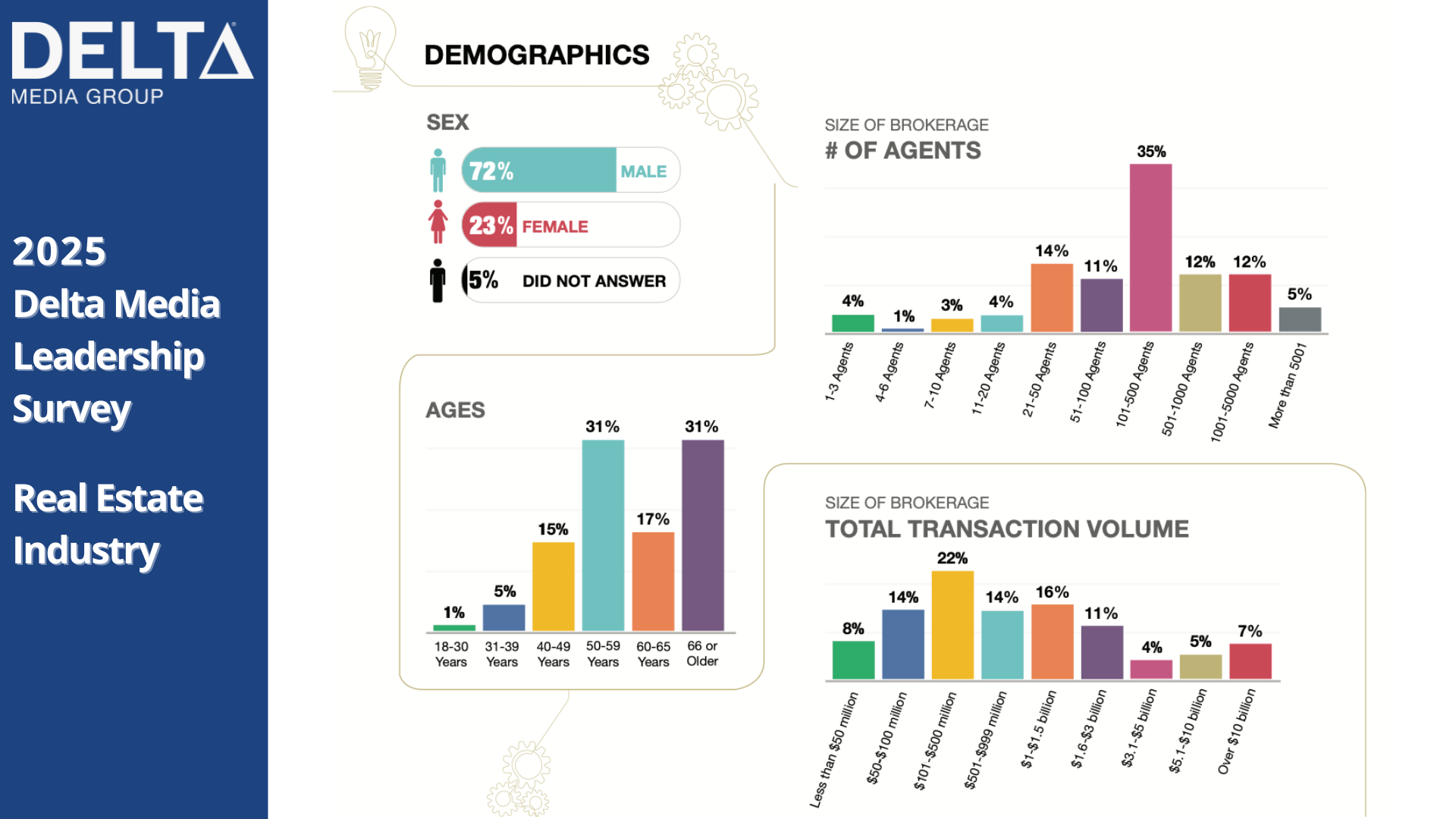

The third annual study surveyed over 100 brokerage executives whose firms collectively generated more than half of all US residential real estate transactions last year.

For the first time since the survey’s inception, Delta Media CEO Michael Minard noted that confidence in profitability, transaction volume and market share has reached record highs, signaling a strong rebound from previous economic uncertainty.

“This year’s survey confirms what we’ve been hearing from top brokerage leaders—they believe their business and the economy will improve this year,” he said.

Key findings

Delta reported that brokerage leaders expressed record-high confidence in their business performance, market conditions and transaction growth. This year’s survey reveals a significant shift toward optimism across all major economic and business indicators:

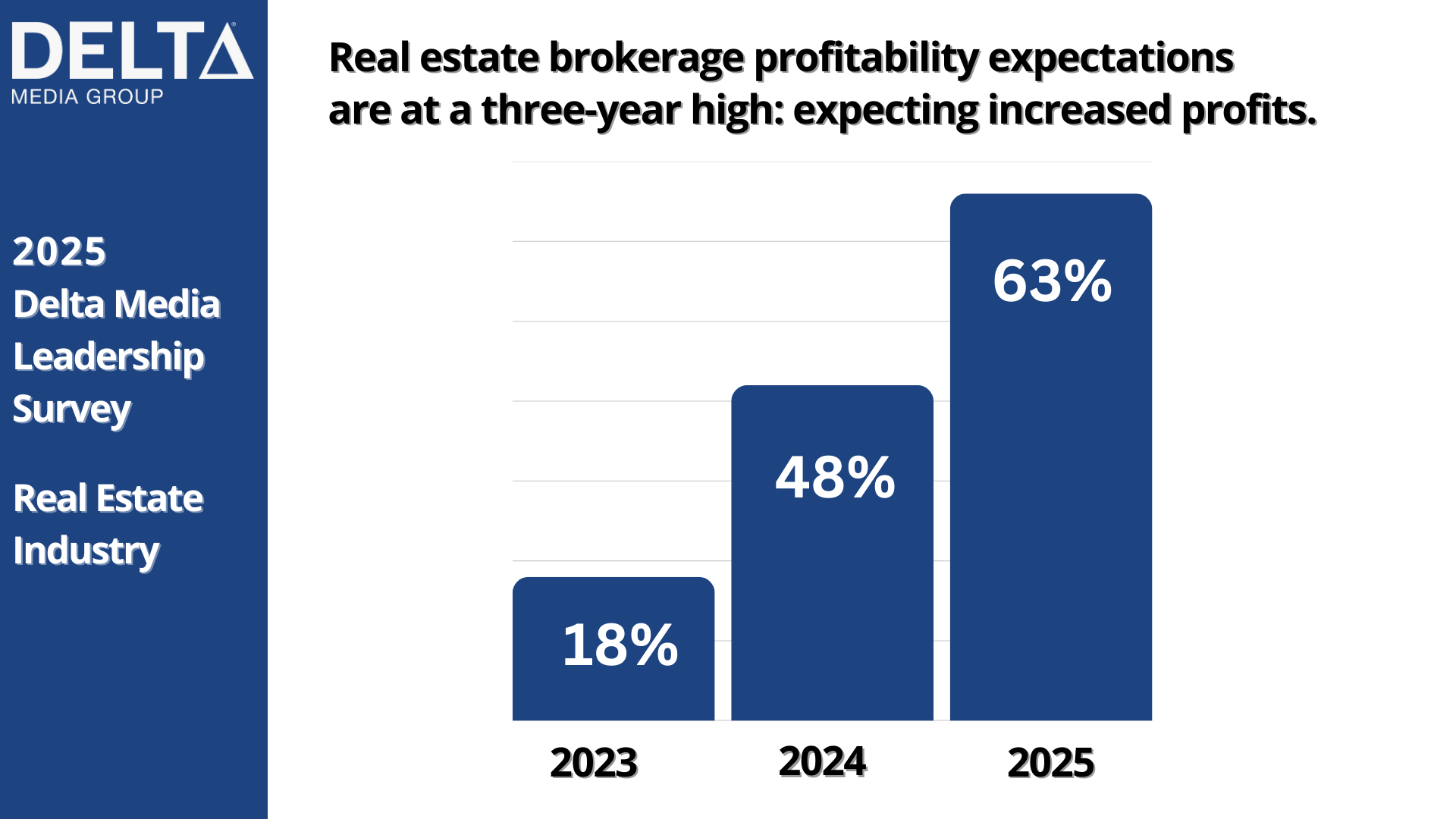

- Profitability expectations are at a three-year high. Nearly two-thirds of brokerage leaders expect higher profitability in 2025, up from 48% in 2024 and just 18% in 2023.

- Market share growth optimism surges. More than two-thirds of brokerage executives believe their market share will increase over the next 12 months, compared to 58% in 2024 and 56% in 2023.

- Transaction volume expectations are the highest on record. More than seven in ten brokerage leaders anticipate an increase in total transaction sides, compared to 60% in 2024 and just 20% in 2023.

Economic confidence soars

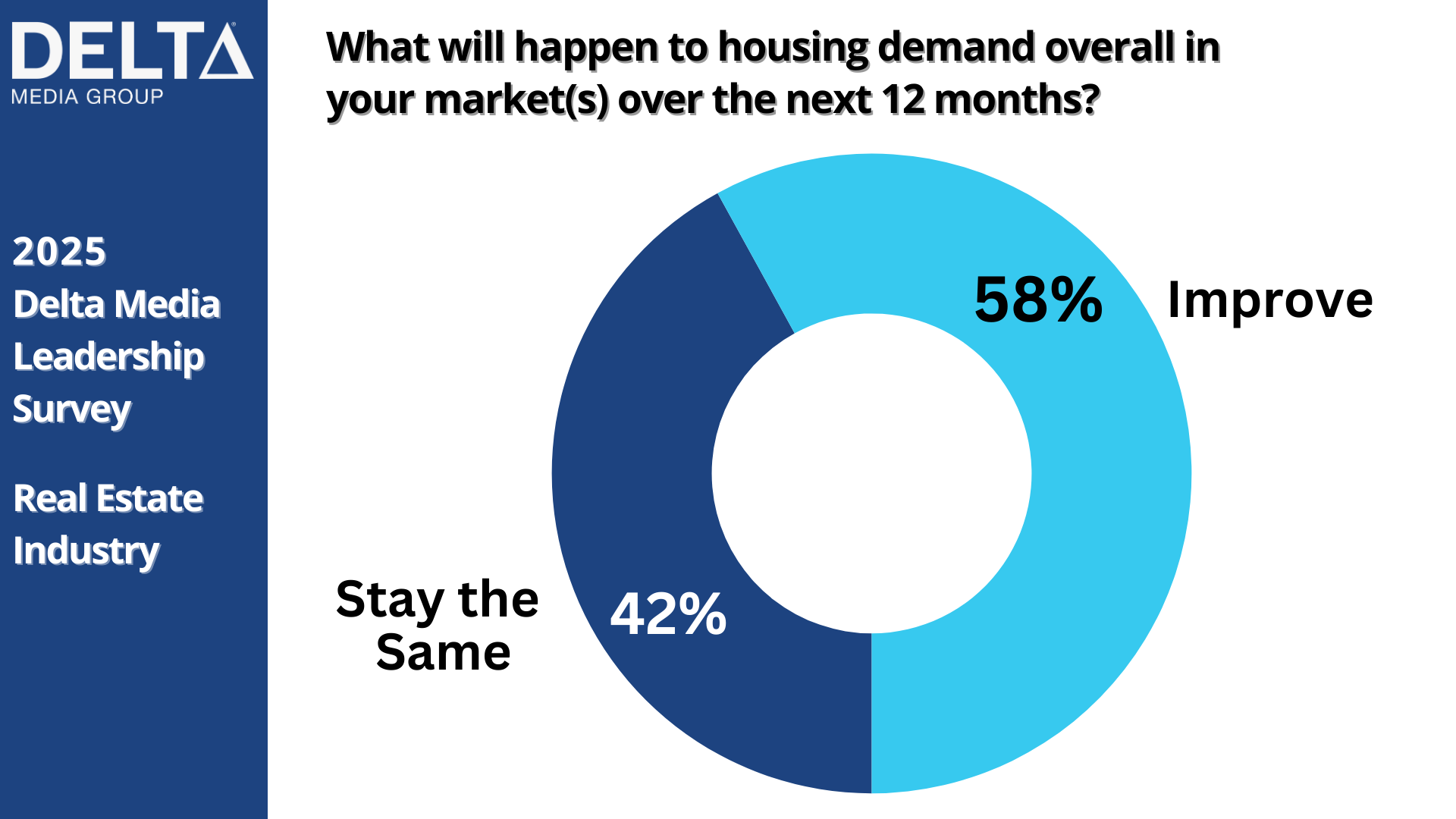

The overall economic outlook among brokerage leaders has dramatically improved, Delta noted, particularly for the U.S. economy. Survey data found that leaders show renewed confidence in broader economic conditions, and the hope of a strong business performance 2025.

- Confidence in the US economy has skyrocketed. In 2023, only 10.6% of brokerage leaders were confident in the US economy—by 2025, that number has surged to 66.3%.

- State and local economies continue to stabilize. Confidence in state economies has steadily improved from 12% in 2023 to 37% in 2025, while local economy optimism has jumped from 9% in 2023 to 42% in both 2024 and 2025.

- Global economic confidence remains the weakest but is improving. More brokerage leaders are optimistic about global market conditions, with 16% expressing confidence, up from just 3% in 2023 and 2024.

“After several years of uncertainty, brokerages are navigating market changes with renewed optimism and strategic focus,” said Minard. “They see opportunities in technology, talent acquisition, and overall market share growth. Despite the challenges 2025 will present, the brokerage leaders we surveyed are bullish on success.”

Top business challenges for 2025

Even with rising optimism, Delta reported that brokerage leaders face crucial challenges, impacting operations, growth and profitability. The top five business challenges this year reported by executives are as follows:

- Recruiting agents remains the No. 1 challenge. Brokerages continue to struggle with attracting top talent in an increasingly competitive hiring environment.

- Reduced profit margins remain a major concern for firms navigating competitive pressures, rising costs, and commission structure changes.

- Agent adoption of brokerage-provided technology is becoming a greater priority as firms invest in AI and automation tools but face challenges driving widespread adoption.

- Managing the impact of AI is now a top-five concern for the first time, replacing commission lawsuits from 2024. Brokerages recognize the potential of AI but also remain cautious about risks and implementation hurdles.

- Cutting the right expenses is a continued focus, with brokerages refining cost structures to balance growth and efficiency.

Shifting confidence by brokerage size and market

Delta noted that the survey also revealed distinct trends based on brokerage size and market location:

- Larger firms are consistently more optimistic about market conditions and transaction growth.

- Mid-market firms (101-500 agents) are more confident in transaction growth than general economic conditions.

- Major-market brokerages (over 1,000 agents, $10B+ transactions) report over 90% optimism about growth.

For the full survey, click here.