Thanks to all who participated in RIS Consulting Group’s survey last month. We hope you’ll find your colleagues’ feedback useful and interesting. A response summary of survey questions follows.

Thanks to all who participated in RIS Consulting Group’s survey last month. We hope you’ll find your colleagues’ feedback useful and interesting. A response summary of survey questions follows.

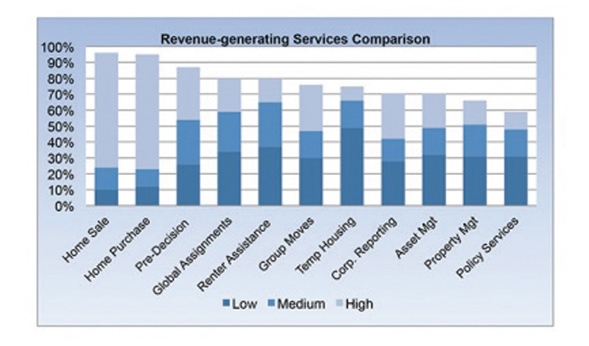

‘Rate the following corporate relocation services by revenue importance to your firm’ (high-medium-low scale).

Based on combined high, medium and low responses home purchase and home sale are the highest revenue-generating activities. Rated third is pre-decision services, confirming its frequent usage in corporate programs. Increases in both global assignments and renter populations support their higher positions, although most indicate medium or lower contribution levels. Group move support, temporary housing and corporate reporting unexpectedly rated above asset management and property management services. The lowest revenue generator is mobility policy services.

‘Identify the primary clients for your top 3 revenue-producing services.’

Primary sources for respondents’ top three revenue-generating services are:

• RMCs – 52%

• Direct corporate relationships – 45%

• Retail customers – 40%

• Government / military – 25%

• Non-profit / institutional – 16%

RMCs are a primary business source for many. At 45 percent, direct corporate client relationships account for slightly more than retail customers. About 15 percent reported that all client sources contribute to their top three revenue-generating businesses.

‘What are major challenges you face today?’

Representative comments from the most often-mentioned item, RMC referral fees, include:

“High fees cause high-quality, successful agents to lose interest in relocation business…because of high fee cost and time necessary for relocation business, other business streams are more profitable… need annual training for those agents willing to work with RMCs and pay referral fees.”

Other challenges include: “Lack of clients… limited inventory… extended home finding time periods…Internet-based referral competition… lack of short term housing…elevating individual brands to RMCs… getting on RMC lists… excessive RMC reporting requirements….limited RMC understanding of cultural differences within markets”

‘How are you adapting to meet these challenges successfully?’

Various improvements include: “Fine tuning administrative efficiencies…adding new software…training for new services…streamlining existing services… goal setting and staff educational requirements.” Many also reported “Developing other sources of business and revenue… requesting fees for previously unpaid services … up-charging when possible… developing a policy of tiered services.“ Some indicated “Rejection of relocation business… being selective about RMCs we work with” while others are “Calling on new relo companies…using less qualified agents that are hungry for business” and “adding staff who are more customer service oriented.”

‘What critical gaps in employers’ mobility policy provisions for transferees do you often see?‘

Although corporate renter populations have increased, many report that rental policy assistance is minimal or completely lacking. Other policy elements frequently noted as inadequate are “cost of living assistance; temporary housing, pre-decision support and home sale assistance.” Insufficiencies in “communication of policy benefits to transferees” and “transferees’ understanding of how the relocation process works” are also mentioned. Comments such as transferees’ “unrealistic expectations” and “budgets formed before needs of families determined” may suggest need for improved policy/program communication and pre-decision support services. Respondents also see need for “less policy rigidity” and better coordination of the “departure, home valuation, agent selection and home finding processes.”

‘What services/products do you anticipate seeing the most growth in for your relocation department?’

Not surprisingly, respondents say renters’ assistance is the foremost growth area for business, followed closely by global inbound services. Third most frequently cited for business-enabling growth are technology and/or software efficiencies. Affinity referral activities and senior services complete the top five growth areas. Less often reported are retail home purchase and home sale; VIP concierge services; REOs; corporate inventory and property management services.

‘What resources or information would interest you if they could enhance your ability to succeed in your relocation–related position?’

Could certain capabilities or information improve internal efficiencies and increase your value to corporate and RMC clients? Over 60 percent of respondents says they would value information about corporate mobility policy trends, compliance issues, RMC updates and other topics. Over half are interested in client-specific services such as reporting referral activities or communicating transferees’ home-finding / settling-in progress to clients. Over 40 percent thought survey capabilities valuable for obtaining feedback for group moves or new services/products or measuring individual or department service standards. Almost 40 percent reported interest in providing corporate relocation policy services (i.e., evaluation, development and writing) to clients.

‘Comment on any other key trends, issues and opportunities that are important to you.’

While “keeping up with changing mobility trends” and “educational requirements,” are mentioned, the major trend reported is “developing new services and products” – particularly previously noted top business-growth areas.

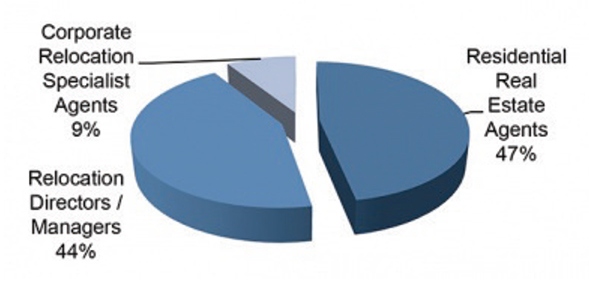

Our survey population comprises a mix of relocation and real estate professionals (see pie chart). About half are specifically involved in corporate relocation. Sixty percent reported their relocation departments are profit centers.

You reported a wide assortment of challenges and issues, but many solutions and opportunities as well. Clearly, there are assorted corporate mobility-related revenue generating activities, although what is prevalent in one region isn’t necessarily in another. Whether a large and mobile corporate or government presence, suburban or metro, different markets determine which relocation businesses are most plentiful. But results also suggest that for many regions, relocation and real estate communities may yet discover opportunities in underserved markets, new or improved services, technologies and products worth exploring.

Peg Guinta, CRP, is Projects Director for RIS Consulting Group. For questions, please email peg@rismedia.com.