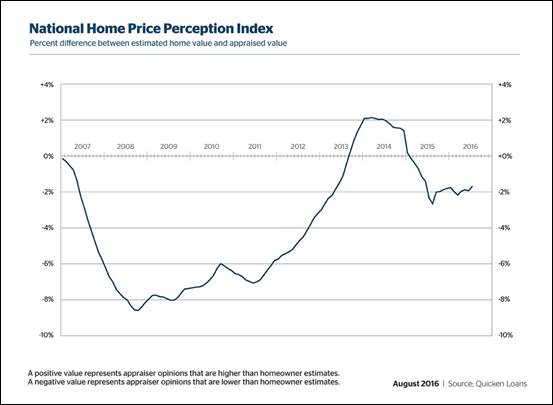

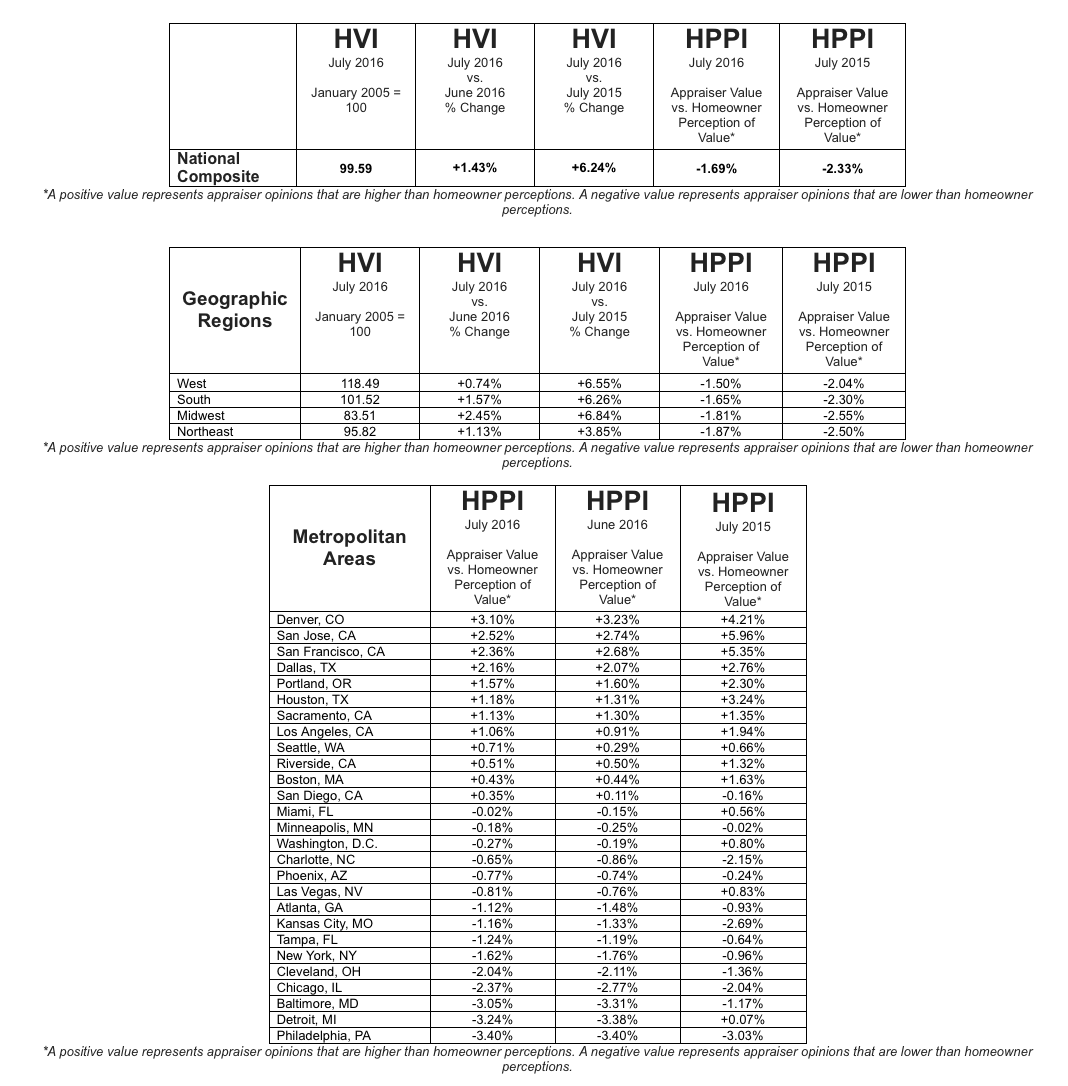

Appraised values were an average of 1.69 percent lower than what homeowners expected in July, according to Quicken Loans’ National Home Price Perception Index (HPPI). The gap between these two measures of home values narrowed since June when appraisals lagged behind expectations by 1.93 percent.

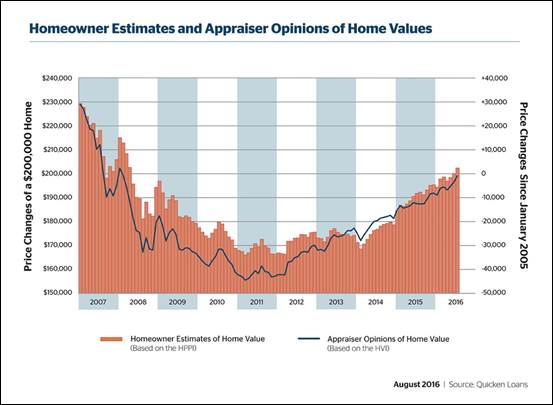

Home values continued to rise in July, according to the Quicken Loans Home Value Index (HVI), the only measure of home value changes based solely on appraisals. The national index reflected a 1.43 percent increase from June, and a year-over-year gain of 6.24 percent.

|

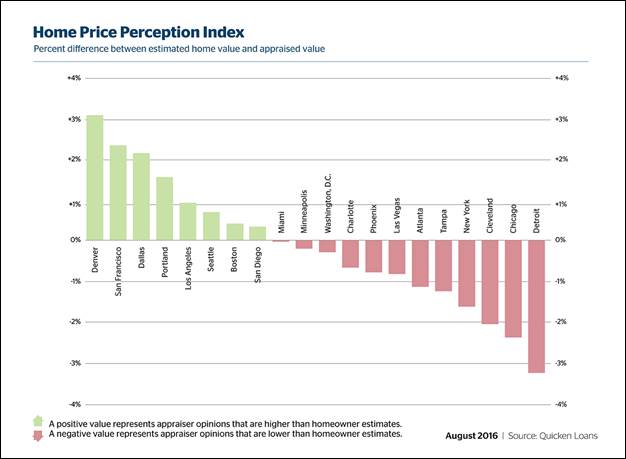

Homeowners and appraisers had differing opinions of home values in July, but the value perceptions didn’t vary as widely as in June. The average appraisal was 1.69 percent lower than homeowners’ estimated value, according to the national HPPI. This is compared to a difference of 1.93 percent in June. Bucking the national trend, homeowner perception has not kept up with rising home values in the west. Appraised values were higher than homeowners estimated in Western cities including Denver, San Jose and San Francisco – by as much as 3.10 percent, 2.52 percent and 2.36 percent respectively.

“One of the most important things for consumers to take away from the HPPI is just how regionalized housing truly is,” says Quicken Loans Chief Economist Bob Walters. “While those on the West coast are being surprised by their high appraisals, homeowners in the Northeast and Midwest are more likely to be shocked by their low values. If homeowners keep an eye on local home sales, they can be better aware of their current home value and not be shocked when they go to sell or refinance.”

|

Appraisals continued their upward march in July rising 1.43 percent since June, as reported by the national HVI. This is a quicker pace than the previous month, when home values rose 0.84 percent. The annual growth continues a trend of especially strong year-over-year appreciation, increasing 6.24 since the same period one year ago. All four regions reflected the robust growth shown nationally with annual increases that ranged from 3.85 percent in the Northeast to 6.84 in the Midwest.

“Home values across the country have been growing at rapid pace, driven by especially enthusiastic buyers this summer,” says Walters. “While the lack of inventory compared to the mass of interested buyers has been the narrative for some time, the effect on the market has intensified as competition for available homes heated up and quickened the pace of rising home values.”

|

|

For more information, visit QuickenLoans.com/Indexes.