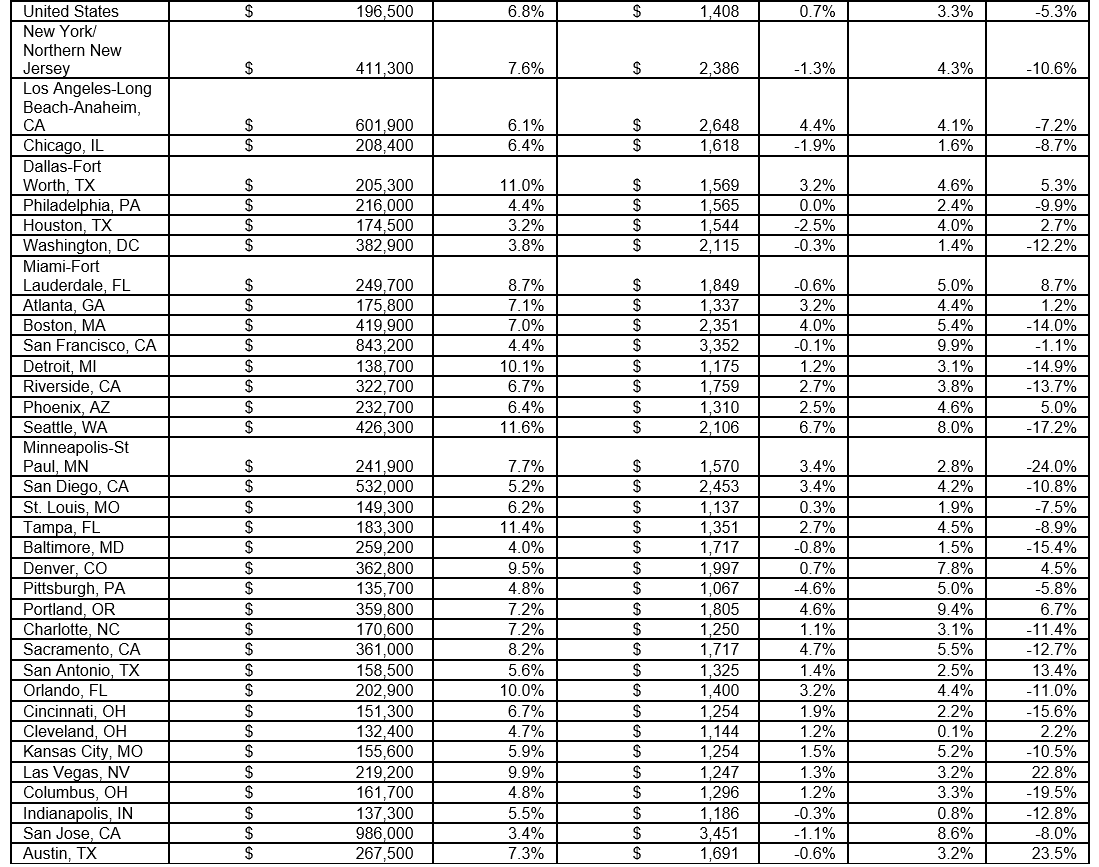

Rent growth is crawling at its slowest pace in five years, with rents up nationwide just 0.7 percent year-over-year, according to the recently released March Zillow® Real Estate Market Reports. Notably, rent growth in the West, which has led appreciation, is stalling. The median rent is now $1,408.

Zillow Chief Economist Dr. Svenja Gudell attributes the brake on appreciation to a more balanced supply/demand scenario.

“The slowdown in rental appreciating is mainly due to new construction finally meeting demand, and even outpacing demand in some areas,” says Gudell.

Despite shorter rent growth, rents are at all-time highs—in fact, the average renter would need his or her income to grow by $168 to keep up with the expected 1 percent rise in rents over the next year.

“Rents are the highest they’ve ever been, weighing heavily on renters’ budgets and making it extremely difficult for those renters hoping to become homeowners to save enough money for a down payment,” Gudell says. “In most markets, a monthly mortgage payment is more affordable than a monthly rent payment, but the most difficult aspect of home-buying for many aspiring homeowners is coming up with enough money for the down payment.”

Home value growth, still, is surpassing bounds, up 6.8 percent year-over-year to a median $196,500, according to the reports.

A breakdown of home values and rents in the top 35 metropolitan areas:

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.