College students taking specific courses of study have the potential to become homeowners sooner after graduation than others, according to a new report by realtor.com®.

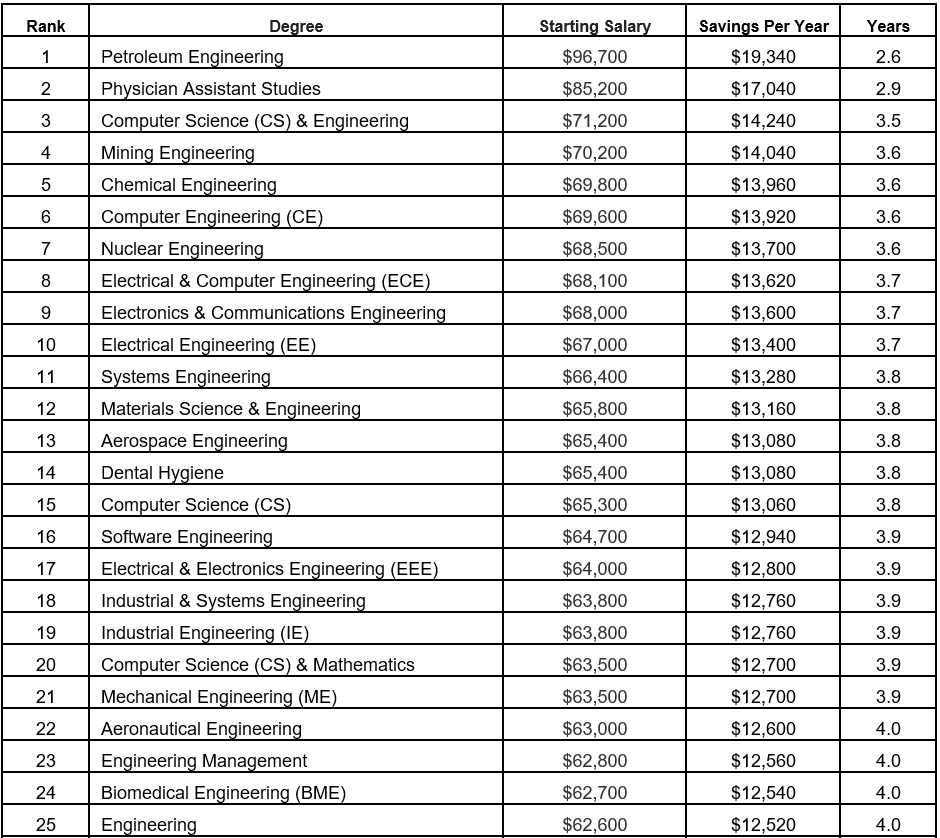

Engineering majors have the most promising prospects, with petroleum engineering majors able to become homeowners in an average 2.6 years—the shortest time of all the degree tracks analyzed by realtor.com. Petroleum engineering majors earn a starting salary of $96,700, according to Payscale.com, which allows for $19,340 savings each year—enough to accumulate a 20 percent down payment on a $250,000 home in roughly two-and-a-half years.

“When it comes to homeownership, degrees in engineering really pay off,” says Joe Kirchner, senior economist at realtor.com. “While this analysis leverages averages and assumptions, it shows just how powerful a high starting salary can be when it comes to early homeownership.”

Other degrees with short timespans to homeownership include: physician assistant studies (2.9 years); computer science (3.5 years); chemical, computer, mining or nuclear engineering (3.6 years); and electrical engineering (EE), electronics and communications engineering or electrical and computer engineering (ECE) (3.7 years).

On the other hand, homeownership is some years away for education majors—according to the report, education majors average seven years saving for a down payment.

“Our analysis also underscores the importance of consistently saving, especially if you aren’t making a high starting salary,” Kirchner says. “While seven years may sound like a long time, putting away 20 percent each month could have education professionals in a home by their late 20s or early 30s.”

For more information, please visit www.realtor.com.

For the latest real estate news and trends, bookmark RISMedia.com.