Affordability challenges are weighing on the housing market, as many homebuyers and sellers contend with either being unable to compete or to find a new home within reach.

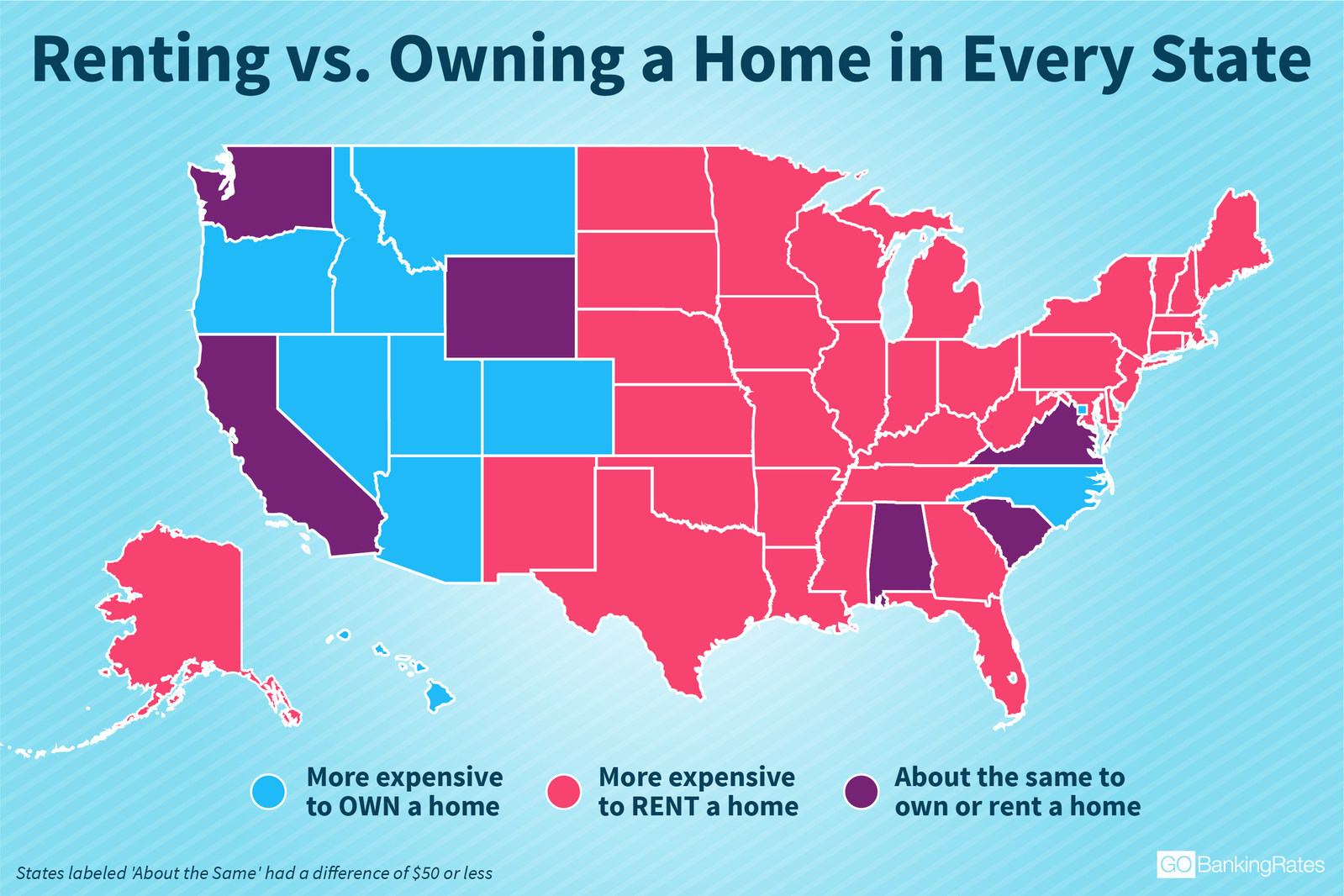

Buying a home, however, is still better than renting one in most states—35, to be exact, according to a recent study by GOBankingRates.

Analysts for GOBankingRates factored in recent median monthly home price and rent data by state, as well as mortgage rates—gathered by Zillow—to determine levels of affordability. The study assumed a 20 percent down payment on a 30-year, fixed-rate mortgage, and took into account homeowners insurance costs and property taxes.

Buying is significantly more affordable than renting in Alaska, Illinois, Maryland, New Jersey and New York, the study shows, with New Jersey residents saving $566 a month by owning—the highest yield of all states.

In six states, the gap between buying and renting is so slim that neither is substantially more affordable than the other: Alabama, California, South Carolina, Virginia, Washington and Wyoming.

The 35 states where buying is more affordable than renting are (in alphabetical order): Alaska; Arkansas; Connecticut; Delaware; Florida; Georgia; Illinois; Indiana; Iowa; Kansas; Kentucky; Louisiana; Maine; Maryland; Massachusetts; Michigan; Minnesota; Mississippi; Missouri; Nebraska; New Hampshire; New Jersey; New Mexico; New York; North Dakota; Ohio; Oklahoma; Pennsylvania; Rhode Island; South Dakota; Tennessee; Texas; Vermont; West Virginia; and Wisconsin.

View owning and renting costs by state.

Source: GOBankingRates

For the latest real estate news and trends, bookmark RISMedia.com.