Housing in major metropolitan areas is moving beyond the means of many, with renters, especially, burdened by rising rents and standstill wages. Affordability has become so strained, according to a recent analysis by Zillow, that even cheap rentals are out of reach for the very segment they’re priced for.

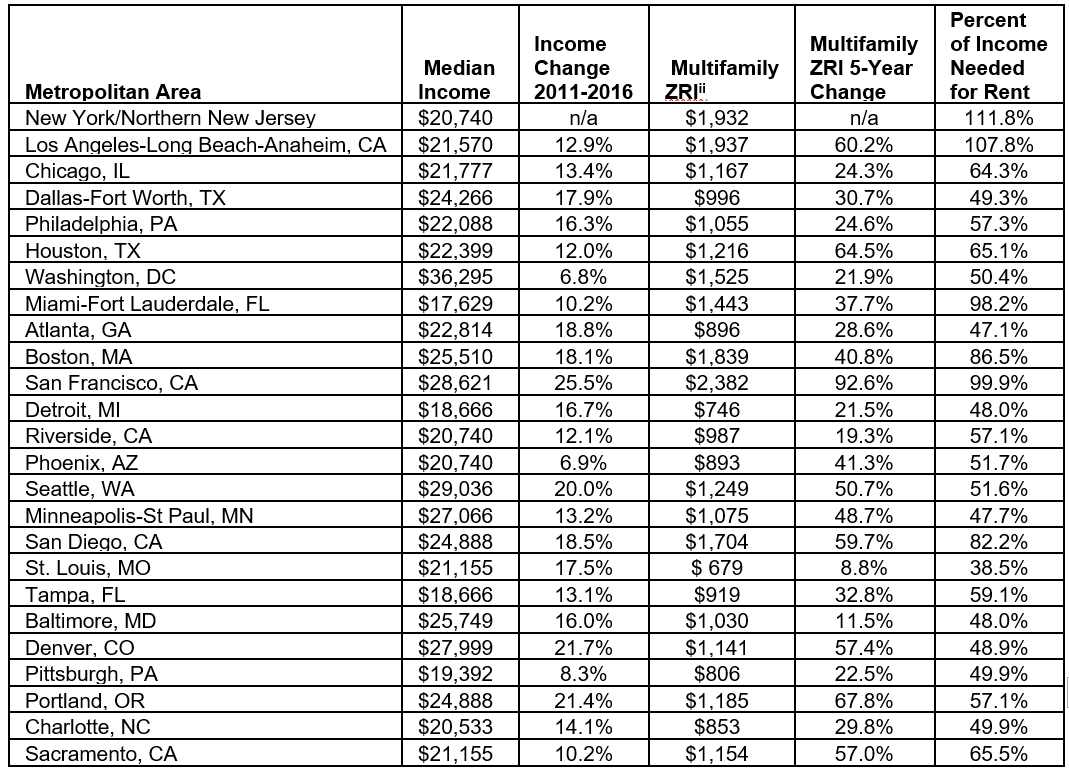

Researchers at Zillow assessed income data from the U.S. Census Bureau against rents, discovering that low-income renters in the 25 largest metropolitan areas are spending much more than what is recommended on rent, even in locations where rentals are priced inexpensively for the market.

The consequence, the research shows, is a lapse in savings that could be disastrous for renters already severely financially strapped. (In a separate analysis, Zillow projected homeless populations in metropolitan areas should rents rise 5 percent in 2017, with stark repercussions.) Roughly 70 percent of renters have not saved three months’ worth of living expenses.

Renters in the lowest income tier in Los Angeles and New York are spending over 100 percent of the areas’ median incomes in the tier on rent, the research shows; renters in San Francisco are spending 99.9 percent, and renters in Miami-Ft. Lauderdale are spending 98.2 percent.

“Any renter can tell you how difficult it is to save up extra cash while spending an increasing portion of their income on rent, but it’s much worse for those who make the least,” says Dr. Svenja Gudell, chief economist at Zillow. “Income inequality is growing in the United States, and this shows how high housing costs contribute to preventing people from moving up the ladder. There are several factors at play here, including wage growth dampened by the recession and increased demand on the rental market. Without a long-term solution to affordable housing, the gap between the haves and have-nots will continue to widen.”

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

For the latest real estate news and trends, bookmark RISMedia.com.