Accumulating a down payment is a struggle—and even more so for singles, according to a new report.

Singles are facing more than 10 years of saving, assuming they make a 20 percent down payment on a median-priced property, an analysis by Zillow reveals. Conversely, couples can do it in half the time: 4.6 years.

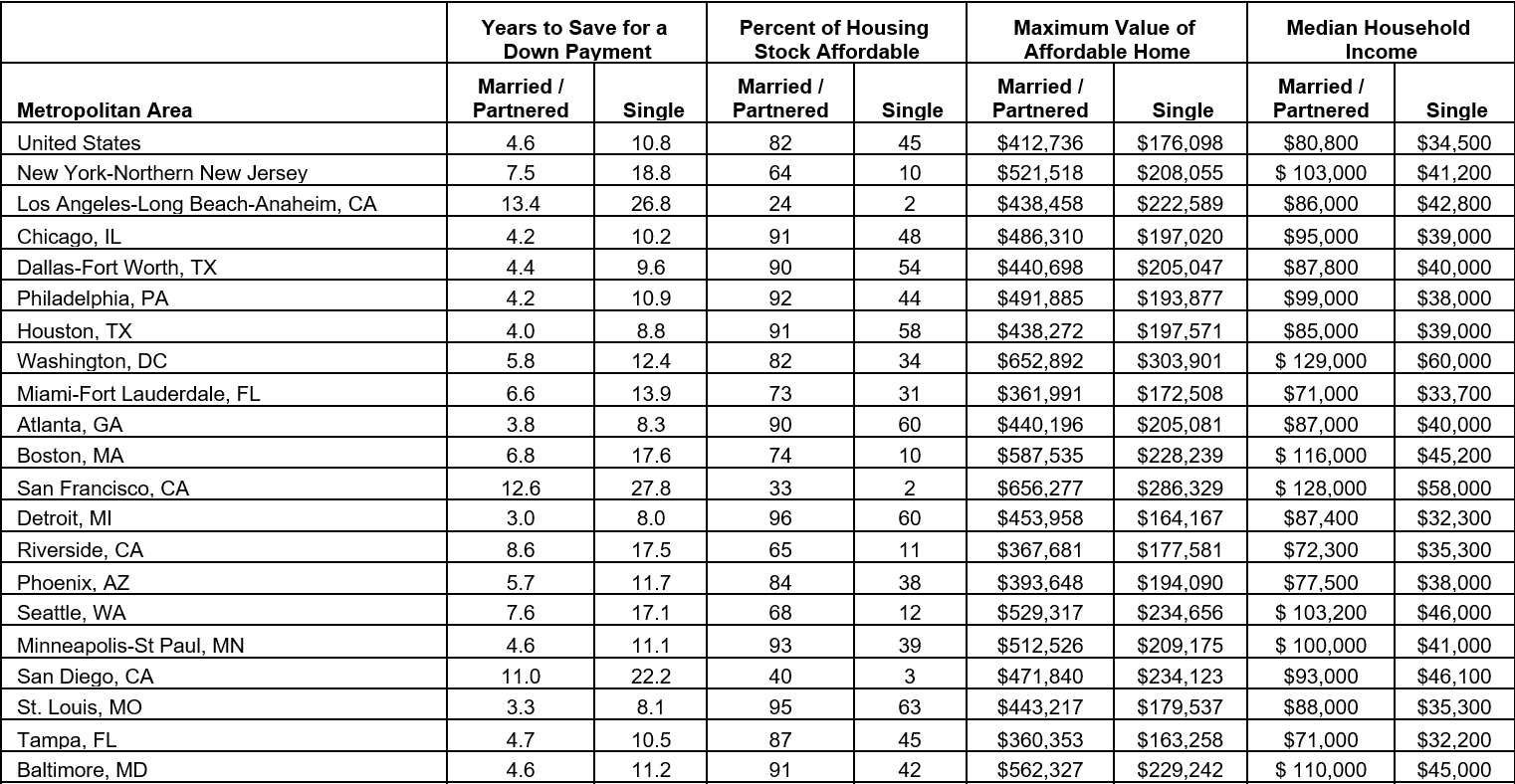

In addition, buyers have limited options when solo: 45 percent of inventory, compared to couples, who can afford 82 percent of supply.

“Nearly two-thirds of Americans agree that buying a home is a central part of living the American Dream, but for unmarried or un-partnered Americans, that dream is increasingly out of reach,” says Aaron Terrazas, senior economist at Zillow. “Single buyers typically have more limited budgets, which means they are likely competing for lower-priced homes that are in high demand. Having two incomes allows buyers to compete in higher-priced tiers where competition is not as stiff.”

The challenge is intensified in markets with rising values, the report shows. Couples face 14 years of saving in San Jose, Calif.—already a haul—but for singles, that span stretches over 30 years. In San Francisco, Calif., couples can amass enough for 20 percent down in 12.6 years, but singles have a longer road, at 27.8 years.

A handful of markets are more realistic for singles: Indianapolis, Ind. (7.5 years of saving); Cleveland, Ohio, and Detroit, Mich. (8 years); and St. Louis, Mo., and Pittsburgh, Pa. (8.1 years).

Across the largest metros:

Analysts assumed buyers are portioning off 10 percent of their income each year to savings. According to 2016 Census data, annual earnings were a median $80,800 for couples and $34,500 for singles.

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.