Buyer demand is highest for starter supply—and entry-level homes are appreciating faster than others as a result, according to an analysis by Zillow.

“When the housing market crashed, owners of the least valuable homes were especially hard hit and lost more home value than homeowners at the upper end of the market,” says Aaron Terrazas, senior economist at Zillow. “Since then, though, demand for less expensive, entry-level homes has built steadily, causing prices to grow rapidly. As a result, these homeowners have been able to build wealth at a faster pace than owners of more expensive homes.”

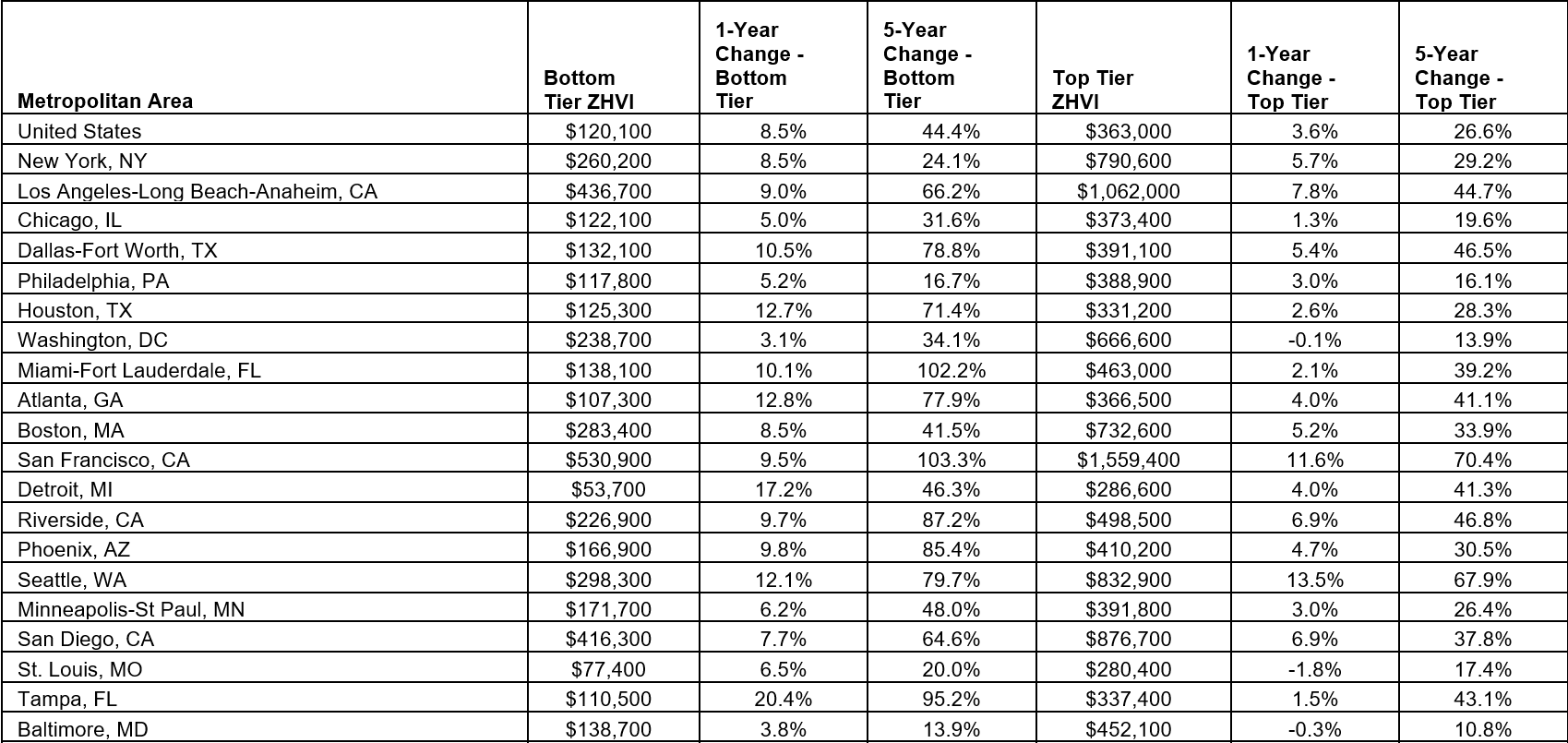

Entry-level homeowners (those in the lowest third in value) have grown their equity by 44.4 percent in the last five years (8.5 percent in the past year), the analysis reveals; at the other end of the spectrum, higher-end homeowners (those in the highest third in value) have grown their equity by 26.6 percent—3.6 percent in the past year.

Appreciation is good for homeowners, but adds to affordability issues, and buyers are competing for the dearth of starter supply.

The areas that have appreciated the most in the starter tier are Las Vegas, Nev. (+104.4 percent in the last five years), San Francisco, Calif. (+103.3 percent), Miami-Ft. Lauderdale, Fla. (+102.2 percent), Sacramento, Calif. (+101 percent) and Tampa, Fla. (+95.2 percent). Entry-level homeowners have gained the most equity in the past year in Tampa, Fla. (+20.4 percent), Las Vegas, Nev. (+19.9 percent), San Antonio, Texas (+18.4 percent), San Jose, Calif. (+18 percent), and Detroit, Mich. (+17.2 percent).

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.