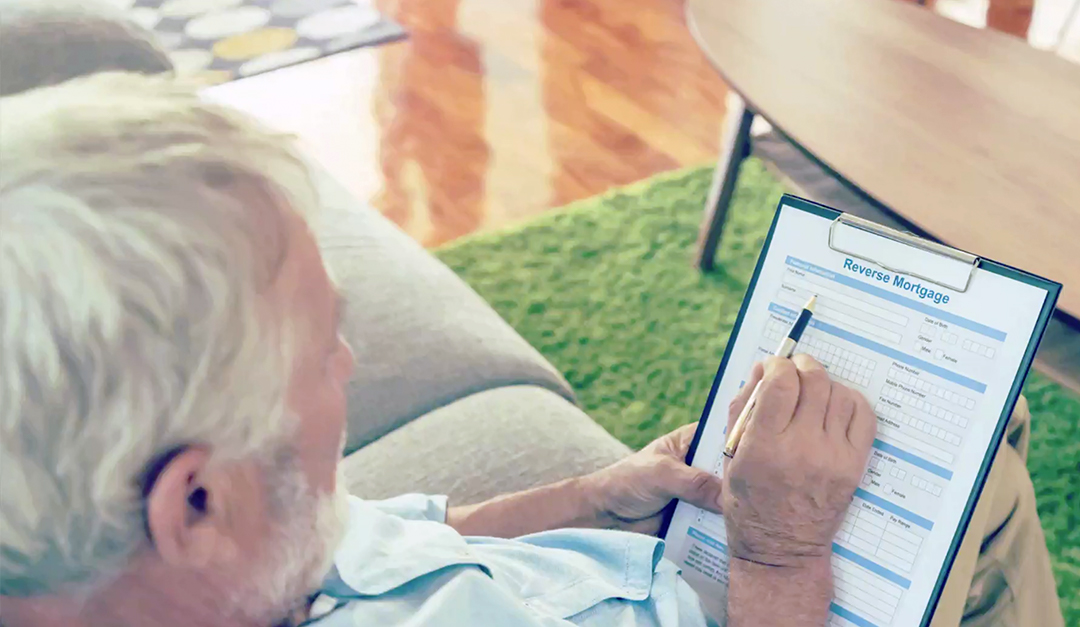

A reverse mortgage can help seniors who have paid off most or all of their mortgage access home equity.

Borrowers must meet age and financial requirements and must pay for property taxes, homeowners insurance and maintenance.

The amount you can borrow will depend on several factors. You can receive the money all at once or over time and use it for many purposes.

A reverse mortgage usually doesn’t have to be repaid until the last borrower dies or moves out.

The loan may be due earlier if you don’t use the house as a primary residence or fall behind on taxes, insurance or maintenance.

Talk to a financial planner to discuss your reverse mortgage options.