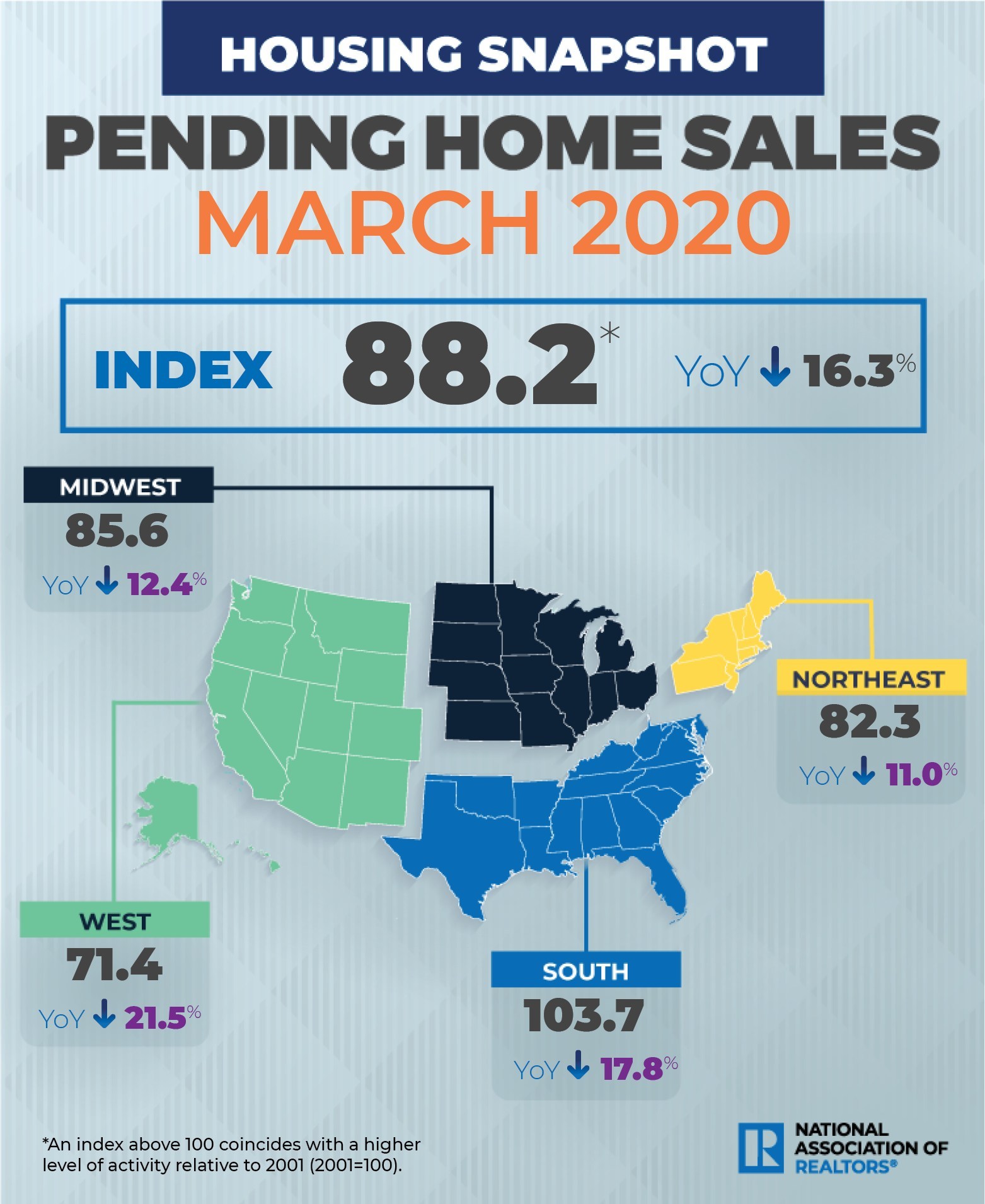

The year started off strong, but the markets have been largely derailed due to the spread of the coronavirus. Pending sales data for March, reported by the National Association of REALTORS® (NAR) this week, showed a significant market slowdown—a 20.8 percent plunge in the Pending Home Sales Index, based on contract signings. This is the lowest level of pending home sales since 2011.

“The housing market is temporarily grappling with the coronavirus-induced shutdown, which pulled down new listings and new contracts,” said Lawrence Yun, NAR’s chief economist.

As states move toward reopening businesses, and coronavirus infection rates start to slow, the markets could see a boost, though a full recovery could take months as real estate plays catch-up.

“As consumers become more accustomed to social distancing protocols, and with the economy slowly and safely reopening, listings and buying activity will resume, especially given the record low mortgage rates,” added Yun. “The usual Spring buying season will be missed, however, so a bounce-back later in the year will be insufficient to make up for the loss of sales in the second quarter,” he said. “Overall, home sales are projected to have declined 14 percent for the year.”

“How infection rates respond in states reopening will be a telling sign as we move forward on how long we can expect a slump in sales to persist,” said Ruben Gonzalez, chief economist at Keller Williams. “If we see no resurgence in infections, we could see sales begin to stabilize in early June; however, if there is a resurgence in infection rates, a substantial backslide across all sectors of the economy is likely.”

Every region experienced a decline in March, with the West experiencing the biggest dip at 26.9 percent. The Midwest decreased by 22 percent, the South by 19.5 percent and the Northeast by 14.5 percent.

Not all segments of the market have been negative impacted by COVID-19, however. According to the latest Census data, the homeownership rate increased to 65.3 percent for the first quarter of 2020—1.1. percentage points higher than Q1 of 2019. However, compared, to Q4 of 2019 (65.1 percent), the rate remained relatively flat. And existing home values have gone up. According to NAR, the median price increased by 8 percent YoY across all house types.

As the coronavirus and its impact on the industry unfold, RISMedia is providing resources and updates. Get the latest.

Liz Dominguez is RISMedia’s senior online editor. Email her your real estate news ideas at ldominguez@rismedia.com.