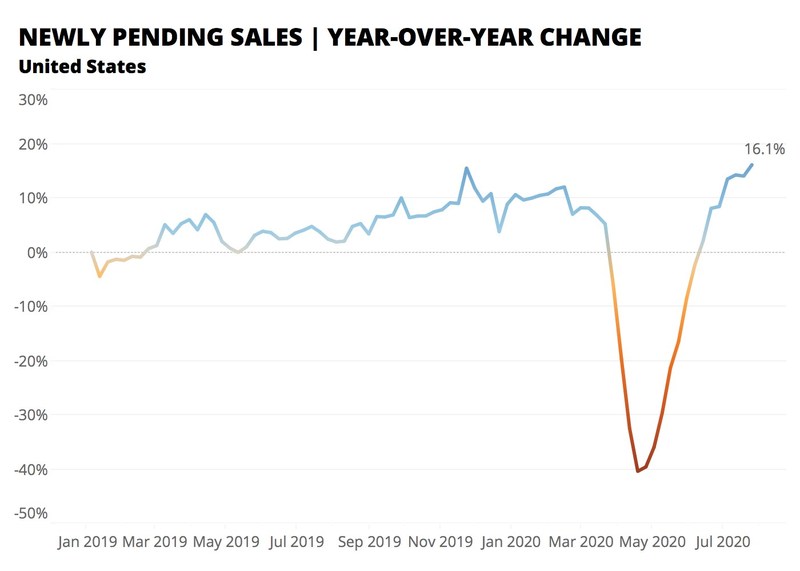

Pending sales are slowing entering the last summer month, likely due to seasonal trends, according to Zillow’s Weekly Market Report. For the week ending July 25, pending sales were up 16.1 percent year-over-year. Month-over-month, newly pending sales are down 1.4 percent. The markets have sped up—days on market is now 14 days, a day faster than reported the previous week and nine days faster than last year.

Here’s a breakdown of other market factors:

Inventory

New For-Sale Listings: -2.2% WoW, -12.2% YoY

Total: -0.9% WoW, -26.3% YoY

List Price

+0.3% WoW ($342,660, on average)

+6% YoY

A recent report from realtor.com® shows that buyer demand drove home prices up 8.5 percent in July, with the national median price now standing at $349,000. Of the 50 largest metros, 48 saw YoY gains in median listing prices in July. Only two of the largest metros, both heavily hit by COVID, saw prices decline in July: Miami-Fort Lauderdale-West Palm Beach, Fla. (-1.5 percent) and Orlando-Kissimmee-Sanford, Fla. (-0.9 percent).

“The coronavirus has impacted every corner of the U.S., but it hasn’t hit every area equally or at the same time. The U.S. housing market performance is closely mirroring COVID’s path, which is providing clues into what we can expect for various housing markets in the months to come,” said realtor.com®’ Chief Economist, Danielle Hale. “After being particularly hard hit in March and April, new coronavirus cases remain stable in the Northeast and we’re seeing buyers return to the market in force. If this same trend follows in the South and Midwest—where outbreaks continue to rise—we could see a flurry of activity well into the fall, especially as schools delay their openings.”