Pending home sales continued with upward momentum in August. According to the National Association of REALTORS® (NAR), pending home sales for the month marked four consecutive months of growth, with gains across all major regions in both month-over-month and year-over-year transactions.

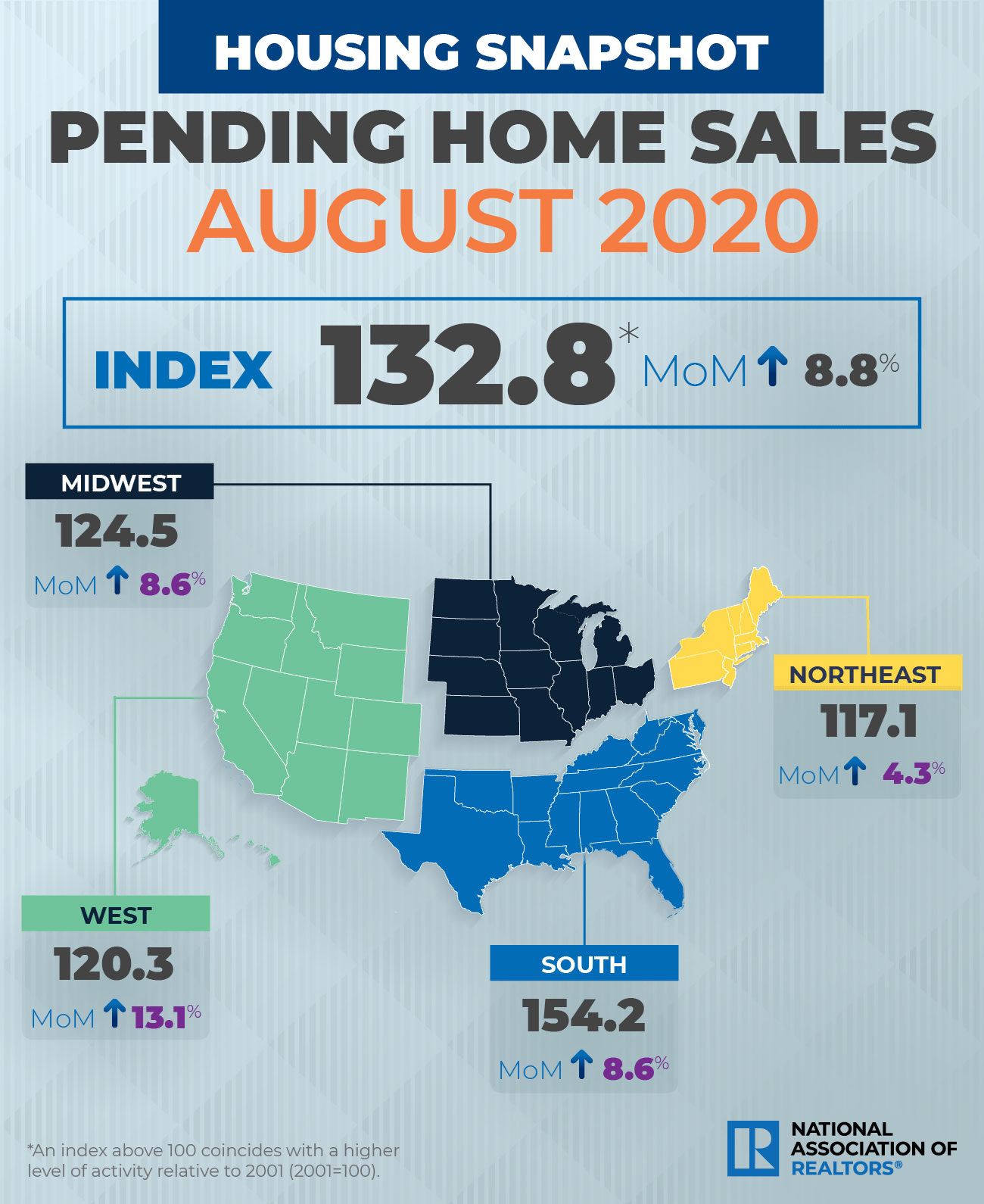

NAR’s Pending Home Sales Index (PHSI) rose 8.8 percent to 132.8 in August, with YoY contract signings increasing 24.2 percent.

Regional Breakdown:

Northeast

+4.3% MoM – Now 117.1 PHSI

+26.0% YoY

Midwest

+8.6% MoM – Now 124.5 PHSI

+25% YoY

South

+8.6% MoM – Now 154.2 PHSI

+23.6% YoY

West

+13.1% MoM – Now 120.3 PHSI

+23.6% YoY

Here’s What the Industry Is Saying:

“Tremendously low mortgage rates—below 3 percent—have again helped pending home sales climb in August. Additionally, the Fed intends to hold short-term fed funds rates near 0 percent for the foreseeable future, which should in the absence of inflationary pressure keep mortgage rates low, and that will undoubtably aid homebuyers continuing to enter the marketplace. While I did very much expect the housing sector to be stable during the pandemic-induced economic shutdowns, I am pleasantly surprised to see the industry bounce back so strongly and so quickly. Home prices are heating up fast. The low mortgage rates are allowing buyers to secure cheaper mortgages, but many may find it harder to make the required down payment.” — Lawrence Yun, Chief Economist, NAR

“We are continuing to see acceleration in home sales as we head into Q4 2020, despite continued elevated unemployment levels. Right now, unemployment continues to be contained primarily to sectors of the economy which are typically made up of younger populations with median incomes below the typical threshold for homeowners, which so far has spared the housing market from the brunt of the economic downturn. Low interest rates continue to spur demand, and it is looking increasingly likely that COVID has altered normal seasonal patterns in homes sales as a result of remote work and education. Inventory remains low and may constrain sales in Q4, as well as accelerate home price growth.” — Ruben Gonzalez, Chief Economist, Keller Williams

For more information, please visit www.nar.realtor.