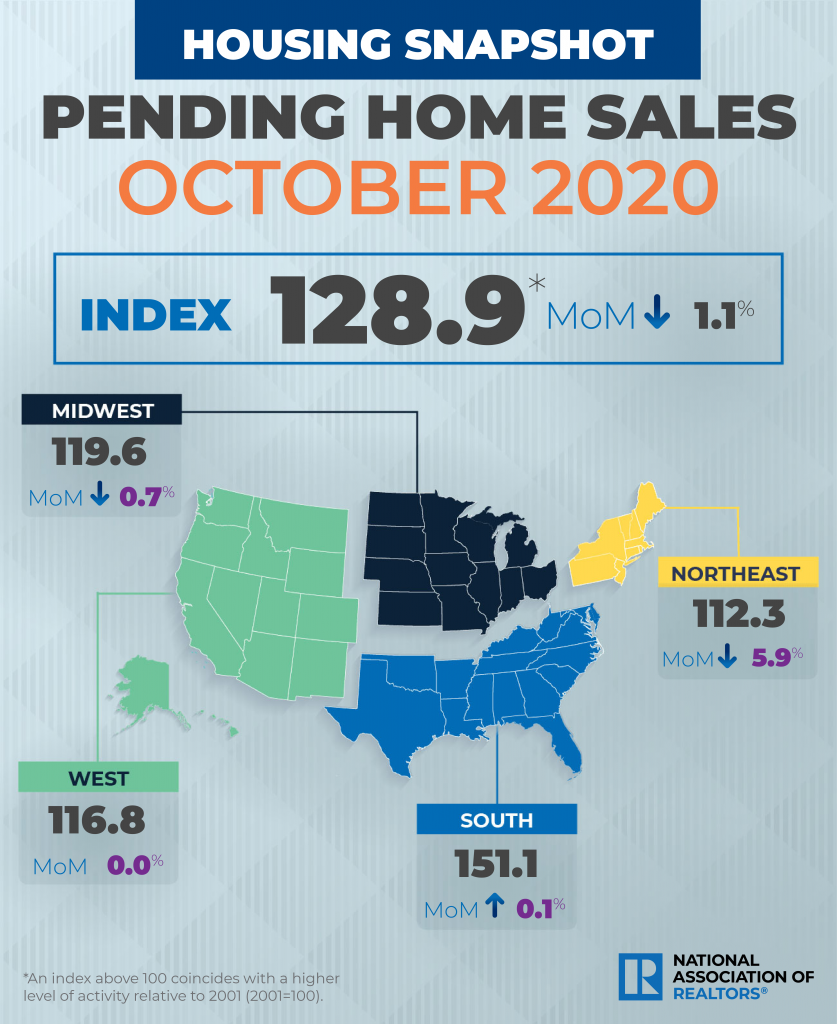

Pending home sales dipped slightly in October, according to the latest report from the National Association of REALTORS® (NAR). The Pending Home Sales Index (PHSI), which is a forward-looking indicator of home sales based on contract signings, declined 1.1 percent to 128.9 in October—the second consecutive month of declines. Since last year, pending home sales have increased 20.2 percent.

Regional Breakdown:

Northeast

-5.9% MoM – Now 112.3 PHSI

+18.5% YoY

Midwest

-0.7% MoM – Now 119.6 PHSI

+19.6% YoY

South

+0/1% MoM – Now 151.1 PHSI

+21.0% YoY

West

No Change – Now 116.8 PHSI

+20.8% YoY

What the Industry Is Saying:

“Pending home transactions saw a small drop off from the prior month but still easily outperformed last year’s numbers for October. The housing market is still hot, but we may be starting to see rising home prices hurting affordability. The combination of these factors—scarce housing and low rates—plus very strong demand has pushed home prices to levels that are making it difficult to save for a down payment, particularly among first-time buyers, who don’t have the luxury of using housing equity from a sale to use as a down payment. Work-from-home flexibility has also increased the demand for both primary and secondary homes.” — Lawrence Yun, Chief Economist, NAR

“Pending home sales decreased in October for the second month in a row, but were still running at a pace 20 percent higher than a year ago. The robust year-over-year improvement in activity is a sign that we continue to see sustained demand for housing late into 2020. REALTORS® cited a combination of high demand and low inventory, which are making conditions more competitive and exerting upward pressure on prices. The faster price growth is leading to affordability challenges for certain segments of buyers, and particularly for first-time homebuyers. October’s contract signings data are consistent with MBA’s data through November thus far, as purchase mortgage applications have shown strong annual gains for over six months, as well as record high loan sizes.” — Joel Kan, AVP of Economic and Industry Forecasting, Mortgage Bankers Association

For more information, please visit www.nar.realtor.