Inventory constraints appear to have played a part in pending home sales dwindling in January, according to the latest report from the National Association of REALTORS® (NAR).

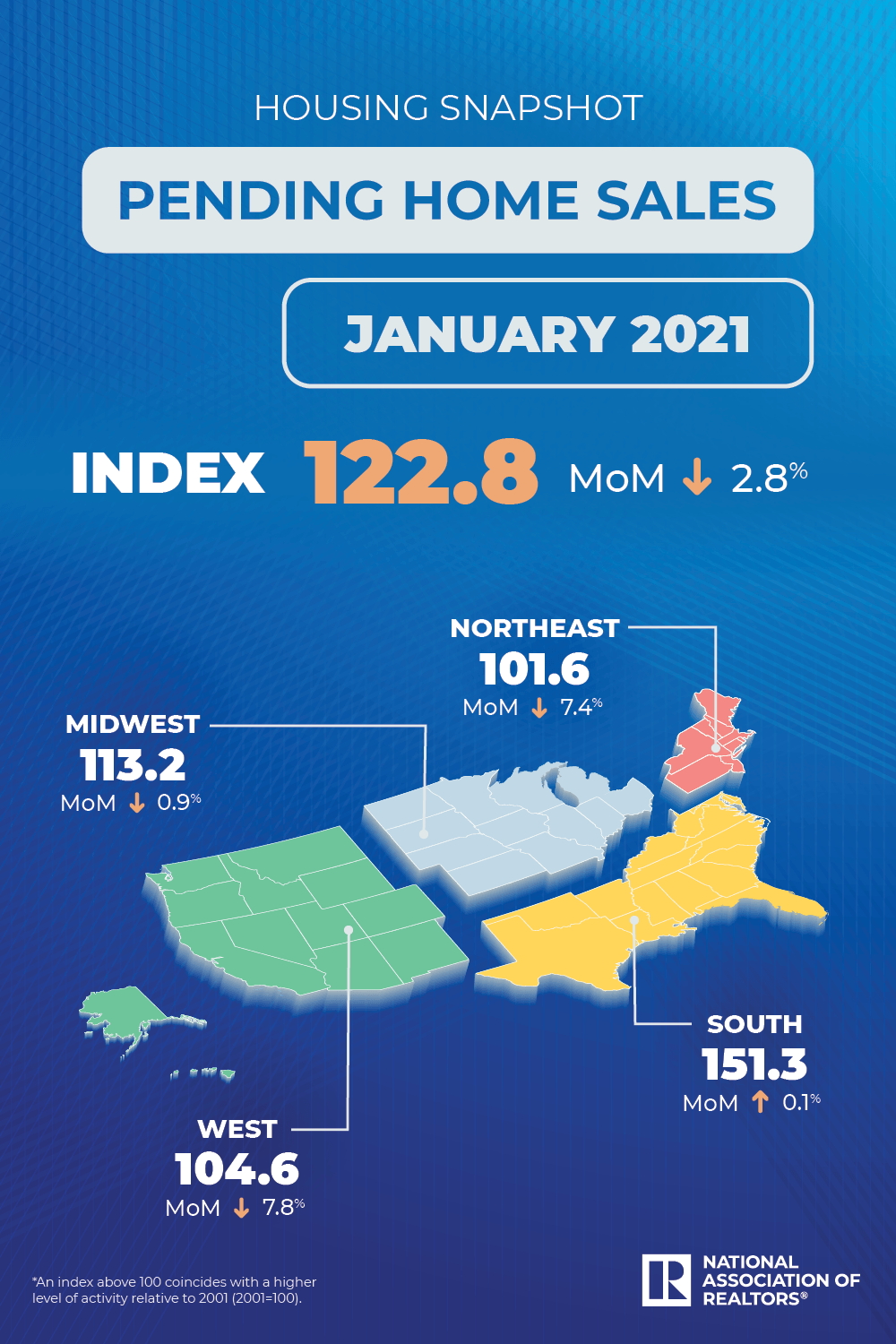

NAR’s Pending Home Sales Index (PHSI), a forward-looking indicator of home sales based on contract signings, showed a decline of 2.8% last month, coming in at 122.8—an all-time high for January. Year-over-year contract signings saw a 13.0% increase with all regions seeing sales gains.

The South was the only region that saw a slight gain from the month prior, while the other three major U.S. regions experienced month-over-month decreases in January.

Regional Breakdown

Northeast

-7.4% MoM — Now 101.6 PHSI

+9.6% YoY

Midwest

– 0.9% MoM — 113.2 PHSI

+ 8.6% YoY

South

+0.1% MoM — 151.3PHSI

+ 17.1% YoY.

West

-7.8% MoM — 104.6 PHSI

+11.5% YoY

What the Industry Is Saying:

“Pending home sales fell in January because there are simply not enough homes to match the demand on the market. That said, there has been an increase in permits and requests to build new homes. There will also be a natural seasonal upswing in inventory in spring and summer after few new listings during the winter months. These trends, along with an anticipated ramp-up in home construction will provide for much-needed supply.” — Lawrence Yun, National Association of REALTORS® Chief Economist

“Indicators for home sales in February and March so far have been strong. We expect to continue to see double-digit year-over-year growth in February, and those numbers will likely jump even higher as we head into the months impacted by the initial reactions to the emergence of COVID-19.

“Mortgage rates are now showing signs of trending upward in response to movements in the 10-year treasury yield. As the long-run economic outlook improves, long-term treasuries will likely return to more normal yields and away from levels that were giving negative real-returns. This will put some upward pressure on mortgage rates, which have been bouncing around historical lows for months now. This will likely weigh on demand some; however, the market is currently so supply-constrained it will likely take some time for the impacts on affordability to have a noticeable impact on market conditions.” — Ruben Gonzalez, Keller Williams Chief Economist

“Despite a slowdown in January, pending home sales remained 13% higher than a year ago, which points to continuing strength in the housing market. The monthly ebbs and flows are a result of the low availability of homes for sale. The housing market is very competitive right now, with buyers seeing limited options and faster home-price growth. Various other data sources have pointed to higher median sales prices and record-high purchase mortgage loan sizes, all of which have started to create affordability challenges in many parts of the country. While home building has picked up to attempt to meet the high demand, increased listings of existing homes will be needed in the coming months to alleviate this shortage of housing inventory.” — Joel Kan, Mortgage Bankers Association AVP of Economic and Industry Forecasting.

Jordan Grice is RISMedia’s associate online editor. Email him your real estate news ideas to jgrice@rismedia.com.