Home flips dropped 1.5% in home sales from the first quarter of 2022 to the second, and the gross profit from sales is up 10%, according to a new report released this week by ATTOM.

3 Tips for Staging a Smaller Home

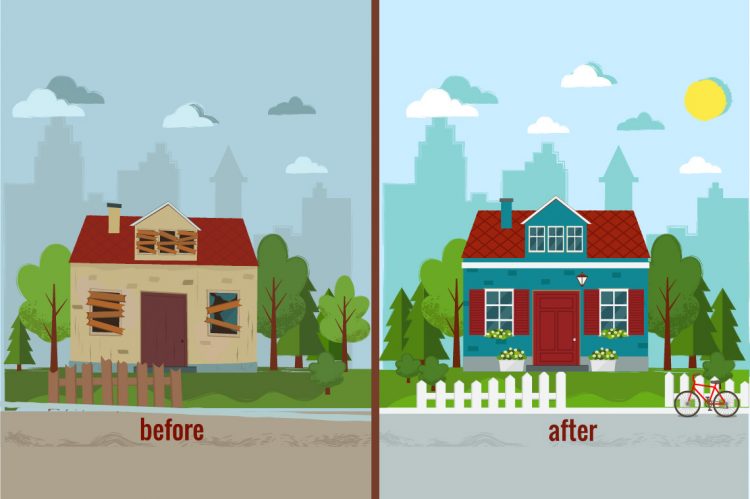

Maximize every square foot of a home and help buyers see the potential of a small space with these staging recommendations. Read more.

https://www.rismedia.com/2025/04/10/3-tips-for-staging-smaller-home/

Business Tip of the Day provided by

Categories

The Most Important Real Estate News & Events

Click below to receive the latest real estate news and events directly to your inbox.

By signing up, you agree to our TOS and Privacy Policy.