Stay the course.

That appears to be the choice of brokers all over the country leading into a stratified, potentially shaky spring market, as RISMedia’s gauge of broker sentiment, the Broker Confidence Index (BCI), has remained essentially unchanged since January, with real estate business leaders moving with cautious optimism through March.

After a huge jump to start the year, the shifting real estate landscape has left brokers split—and overall confidence hovering around where it was last August at 6.4, as the Federal Reserve carves an uncertain interest rate path and more volatility roils financial markets.

After a huge jump to start the year, the shifting real estate landscape has left brokers split—and overall confidence hovering around where it was last August at 6.4, as the Federal Reserve carves an uncertain interest rate path and more volatility roils financial markets.

“(There is) uncertainty in the economy,” says John O’Reilly, broker/owner of Better Homes and Gardens Base Camp in Virginia. “We are starting to see the fact that people are feeling the crunch of having more month left at the end of their money, and not more money left at the end of the month.”

Since RISMedia last polled brokers about their confidence in real estate, two major regional banks collapsed, sending shockwaves through global financial markets. The Fed also indicated that it may be staying the course after another 25-basis point rate hike in March, though mortgage rates fell significantly during the month.

This sort of limbo might be preferable to the sharp declines in home sales through the second half of last year, when the BCI bottomed out at 5.3. It might also be the result of brokers holding back on passing too early of a judgment, after seeing how quickly markets move—even as signs point to a rebound.

For many, the worst of the real estate correction does in fact, appear to be over, and barring another catastrophic setback or major policy change, 2023 could end up characterized by a more stable, settled market than any of the last three years.

“In Arizona, inventory is 275% of last year. Pending sales are increasing as buyers return to the market. List price/sales price ratio (is) back to historic percentages,” says Todd C. Menard, CEO of West USA Realty.

“Buyer traffic is picking up,” says Scott Myers, broker/owner of CENTURY 21 Scott Myers REALTORS® in Texas. “More inventory is coming to the market.”

A handful of brokers went as far as to say consumers in their markets were seemingly not rattled by the bank collapse, though economists have warned some potential effects have yet to manifest.

Overall, inventory appears to be a major concern, even as Menard, Myers and other brokers report at least preliminary signs that more homes are coming on the market. National data has appeared to confirm this trend, even though long-term inventory challenges remain difficult to address.

Another notable takeaway from this BCI—significantly fewer brokers are mentioning rates as a concern, even as the average mortgage rate hangs well above 6%—around double what it was last year. Only 13% of responding brokers singled out rates as something affecting their confidence in March, compared to 32% in February. Whether this is a result of consumers becoming used to a new rate environment, or whether a decrease in rates last month by itself made a huge difference, was unclear.

Marketing mavens

Brokers this month were asked not just about their confidence levels ahead of spring, but about how they are preparing—specifically with marketing. A full 23% said they were keeping all marketing expenditures the same, reflecting the overall cautious sentiment this month.

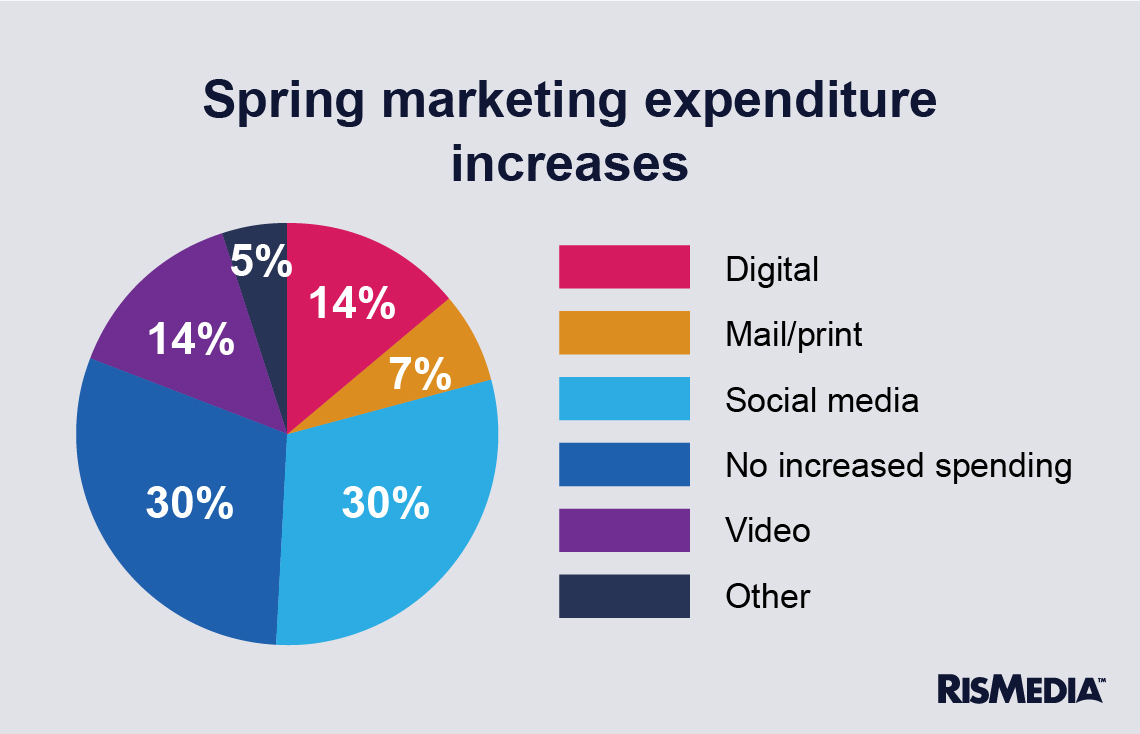

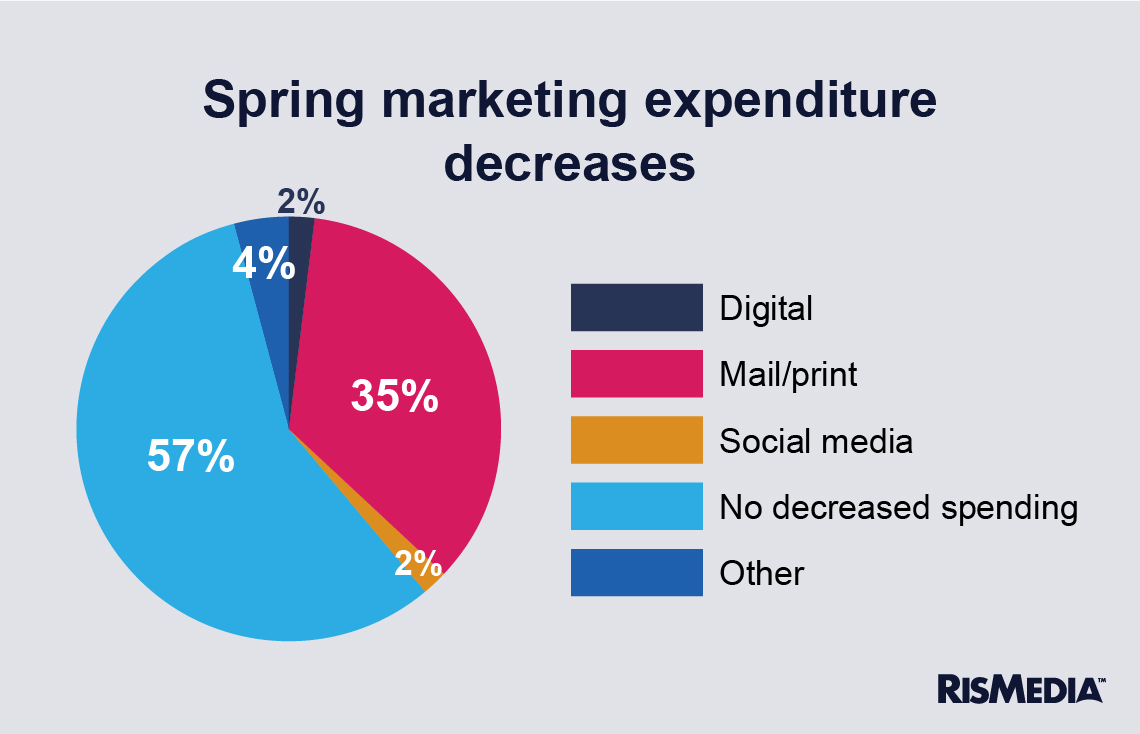

But more brokers said they were planning on increasing their marketing investment through at least one channel—70% in fact, showing that even in “wait and see” mode, real estate business owners are preparing for the possibility of more activity. At the same time, 43% said they were drawing down marketing investments—mostly print and mail marketing.

But more brokers said they were planning on increasing their marketing investment through at least one channel—70% in fact, showing that even in “wait and see” mode, real estate business owners are preparing for the possibility of more activity. At the same time, 43% said they were drawing down marketing investments—mostly print and mail marketing.

Without more information, it would be difficult to characterize exactly how important this data is to the overall approach brokers are taking heading into the busy season. Potentially, many who are keeping expenditures flat have dry powder ready for when the market picks up.

Without more information, it would be difficult to characterize exactly how important this data is to the overall approach brokers are taking heading into the busy season. Potentially, many who are keeping expenditures flat have dry powder ready for when the market picks up.

Preferred channels largely reflect what RISMedia found late last year in a landmark study of real estate marketing practices, with social media broadly leading and print or mail marketing only minimally utilized.