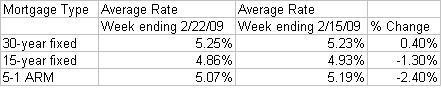

RISMEDIA, February 25, 2009-Although President Obama announced a sweeping Homeowner Affordability and Stability Plan, the weekly average rate borrowers were quoted on Zillow Mortgage Marketplace for thirty-year mortgages remained steady last week at 5.25%, up slightly from 5.23% the week prior, according to the Zillow Mortgage Rate Monitor, compiled by real estate website Zillow.com(R). Meanwhile, rates for 15-year fixed mortgages dropped to 4.86%, down from 4.93% and 5-1 adjustable rate mortgages also dropped, down to 5.07% from 5.19% the week prior.

Rates for 30-year fixed purchase mortgages had fallen on Monday evening, with the average rate on Zillow Mortgage Marketplace at 5.14%. For the most current up-to-the-minute rates, visit www.zillow.com/Mortgage_Rates/.

Thirty-year fixed mortgage rates varied by state. New York mortgage rates and Ohio mortgage rates decreased the most, dropping from 5.31% to 5.11% and from 5.48% to 5.26%, respectively. Florida mortgage rates (5.04%) and Pennsylvania mortgage rates (5.04%) were the lowest in the country while Tennessee mortgage rates (5.34%) were the highest. California mortgage rates were the most requested among all states.

The Zillow Mortgage Rate Monitor is compiled each week using thousands of mortgage rates quoted on Zillow Mortgage Marketplace by mortgage lenders to borrowers who have submitted loan requests. State-level data is gathered for the top 20 states with the highest quote volume on Zillow.

For more information, visit www.Zillow.com.