There is good news to be celebrated in the new-home sector. All measures, from new-home sales to housing starts to building permits and housing completions, are up year-over-year. Given the dearth of housing inventory in the existing-home sales sector, this is cause for celebration. Current homeowners are unlikely to ditch their golden handcuffs of low-interest-rate mortgages and may have separation anxiety with moving. New-home inventory helps to alleviate this problem.

There’s another segment growing within the new-home market that doesn’t contribute to homeownership: built-for-rent (BFR), also often known as “build to rent.” BFR is just that: new, single-family home construction built with the intent of renting. While there has been growth in new-home sales and construction activity, there has also been growth in multifamily construction. However, for some renters, an apartment may not fulfill their space needs. Like homeowners, many renters have felt the need for more space throughout the pandemic. BFR offers renters the chance to have a yard for a pet, a home office and room for a new baby.

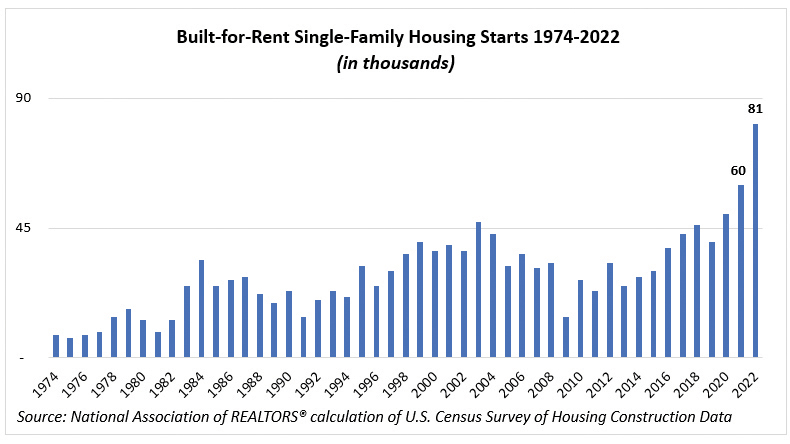

The U.S. Census Bureau’s Survey of Construction Data shows 60,000 BFR housing starts in 2021, jumping to 81,000 units in 2022, a 35% increase.

While the increase in starts is noteworthy, the share of all housing starts is another important number to watch. The share of BFR single-family homes grew from 5% in 2021 to 8% in 2022. Both as a share of all housing starts and in terms of number of units, BFRs are at their highest level since the bureau began collecting data in 1974.

Data by region also showed notable one-year growth in BFR single-family homes. In the Midwest, BFRs went from 5% to 12% of the market. The Northeast saw a rise from 3% to 8%. The increase in the South was more minor, moving from 6% to 8% of the market, followed by the West, which had an increase from 5% to 7%.

Some millennials and first-time buyers have been sidelined from the buying market as a result of rising interest rates and rising prices. As a share of primary-residence buyers, first-time buyers dropped to a data series low of 26% from a historical norm of 40%. BFR homes may be their solution—albeit temporary—as they save for their first-home down payment.

For more information, visit https://www.nar.realtor/.