When leads and listings are plentiful, interest rates low and inventory high, homes usually sell fast. Real estate agents may not have time to dive deep into tax records, sales and mortgage histories, neighborhood comparables, warranty deeds, interactive GIS maps, area demographics and more as heavily as during a down market.

CRS Data, headquartered in Knoxville, Tennessee, has been providing such precise information through its MLS Tax Suite since 1989. And given the current state of the market, the company’s offerings are more crucial than ever, and often the key factor for prospecting opportunities.

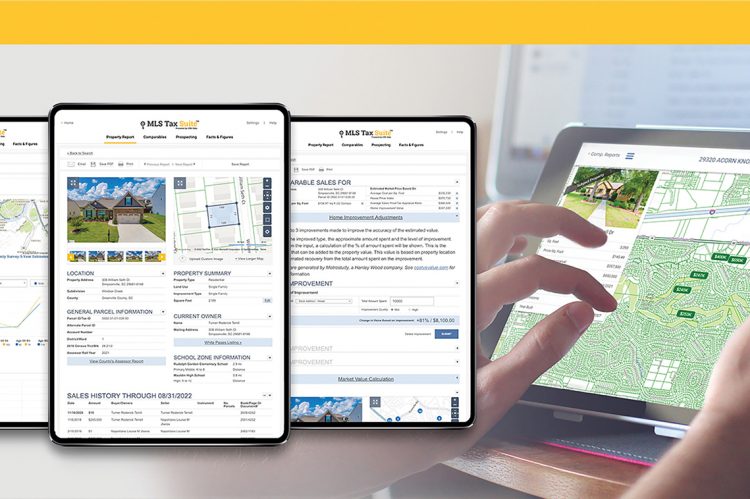

While most MLSs have basic info offerings, CRS Data goes way beyond. With enhanced mapping and search capabilities, MLS Tax Suite adds strategic value to an existing MLS system to better serve clients—and it provides accurate property information that agents can access on the go.

Having been with the company for 20-plus years, Executive Vice President Sara Cooper explains that while the MLSs are their direct customers, agents and brokers are ultimately the end users.

“Our public tax data is the base content that we’re providing, and the most used piece of our product,” says Cooper. “But what the majority of agents and brokers don’t realize is that it can be heavily used for prospecting. We have all of the property records in there for their location, wherever they may be, regardless of whether it’s ever gone through a multiple listing service. If they have a target area they’ve defined to gather their leads, they can use our system to draw a shape on a map and select an outlining area, enter a zipcode or even subdivision name. They can easily create their target list out of our prospecting system,” she adds.

For almost 35 years, CRS Data has worked to put powerful, accurate property data at the fingertips of customers. Committed to discovering, developing and delivering innovative data-driven solutions, what initially began as a better way of accessing property data has become the most powerful and comprehensive tool available for accessing property records and maps.

With new technology, CRS Data and its products have evolved over time, but one thing that remains the same is their commitment and dedication to providing high-quality products and services through innovative and feature-rich tools.

Close to half a million agents belonging to MLS organizations throughout the U.S. and Canada have access to MLS Tax Suite and download more than 40 million property reports each year.

Prospecting with CRS Data

Cooper says the company can be a springboard for agents seeking to find new clients.

“Let’s say somebody’s looking for empty nesters, wanting to help them move from the home they’ve been in for 20 years into a smaller location. They can use filters like the age of the ownership, i.e., how long they’ve been in the home. That’s just one example of many, depending on what that agent is marketing,” she explains.

“Other areas we promote that sometimes aren’t clear to an agent are how seamlessly we will integrate with their MLS system. Anytime they have real estate transactions, they can easily get into our system, whether it’s through a link that takes them directly to our search page or, if they’re reviewing a listing, they can click one button that will take them to the property or the property on the listing itself.

“They can take it over and find comparable properties to help them determine an estimated market value,” adds Cooper. “Using our comparables, we bring up three estimated market values with nothing that’s hidden or proprietary, but using a formula based on the public record data. That’s different from what you get with MLSs. We’ll also show the Zestimate as well, because we know that’s where consumers go, good or bad, but we want to give the agent all the information about the property in one spot so that they don’t have to go to multiple places in order to begin having conversations with clients or prospective clients.”

Cooper acknowledges that now is a tremendous time to align with CRS Data’s MLS Tax Suite due to low housing inventory and the need for agents to try and create their own listings and clients, with data serving as a key factor.

“Leads aren’t coming to you out of the woodwork, and homes you can show your buyers aren’t there,” she acknowledges. “It requires a lot more digging and a lot more information. Yes, you can look through your MLS for the criteria your buyer wants; however, there may be properties that aren’t for sale yet, and what if you find one that meets the criteria? You can approach the owner to see if they want to sell their home, so it’s a way that you can not only find leads for your buyer clients, but also try to find client prospects if and when they’re going to sell.”

Cooper stresses that CRS Data’s technology is state-of-the-art, with safety measures that would repel ransomware or other negative activities.

“We’ve spent a lot of time on things that aren’t seen by the agent or the broker,” she says. “We invest heavily in ensuring the superior quality of the hardware, software and storage infrastructure we use so there’s no down-time.

“But knowing that those things are very possible, we spend a lot of money and time making sure we have multiple backups, so if something does go down, we can get our customers restored as soon as possible. We’re in the very beginning of trying to figure out how we can use AI to increase usability within our product, then also using ‘in-app guides’ throughout the product to guide the users through the different pages. As simple as it seems as a public property records tool, it’s very complex because there’s so many things you can do—not just look up the property, which you can do on county websites, but get a comparable on it or look at demographics or school information.”

Cooper knows CRS Data must stay ahead of the curve. “As technology advances and consumers become more savvy, we are always looking at ways to innovate and enhance MLS Tax Suite.”

For more information, please visit https://www.crsdata.com/mls-tax-suite.