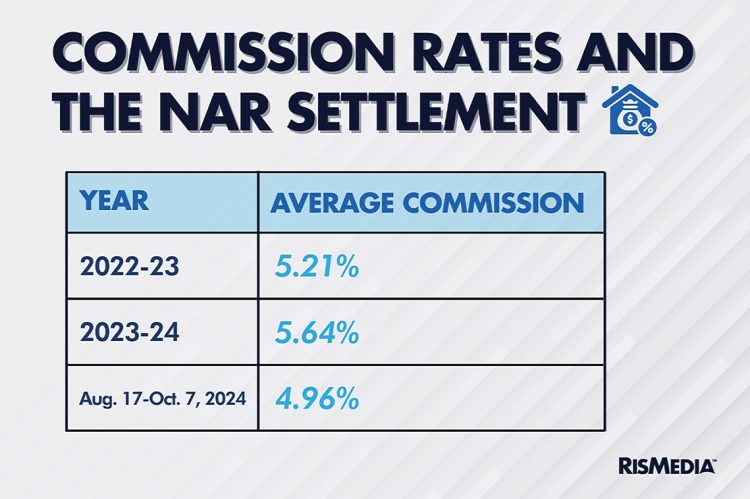

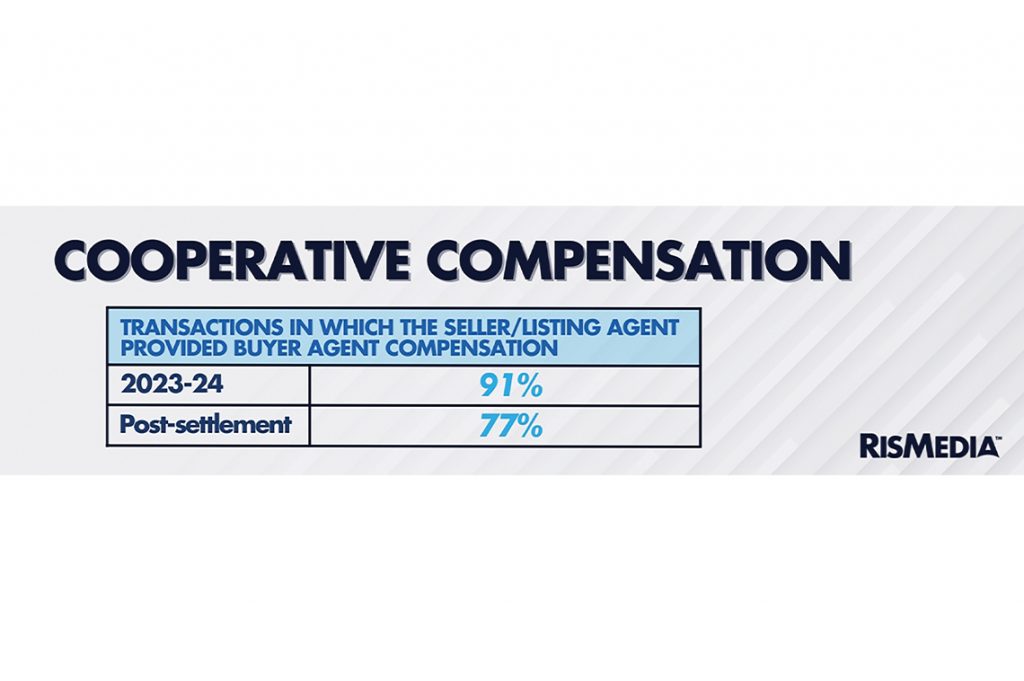

In the days and weeks after the National Association of REALTORS® (NAR) announced that offers of compensation would be removed from the MLS and that all buyer agents would be required to sign agreements with clients, a lot of people both in and outside the industry had more questions than answers.

Will commissions drop? Will buyers stop using agents? How will buyers react to signing contracts up front? Who will enforce it all, and how?

While many brokers and agents scrambled to find answers, some leaders in the industry—including big names like eXp CEO Leo Pareja—took a more measured tone, and urged their colleagues to accept that some answers would only come once the changes were implemented, and real estate professionals had a chance to experiment and gather feedback.

Although those experiments are still in their early stages, RISMedia now has answers to at least some of the most important questions via the results of its landmark 2024 Contract & Commission Study, which laid out the many ways the industry has adapted—or been affected—by the new policies.

Almost as importantly, agents, brokers and MLS executives have had a chance to absorb the changes, and can now speak from experience rather than speculation as to what they are seeing in the real world and why they believe commissions, contracts and compensation trends are shifting.

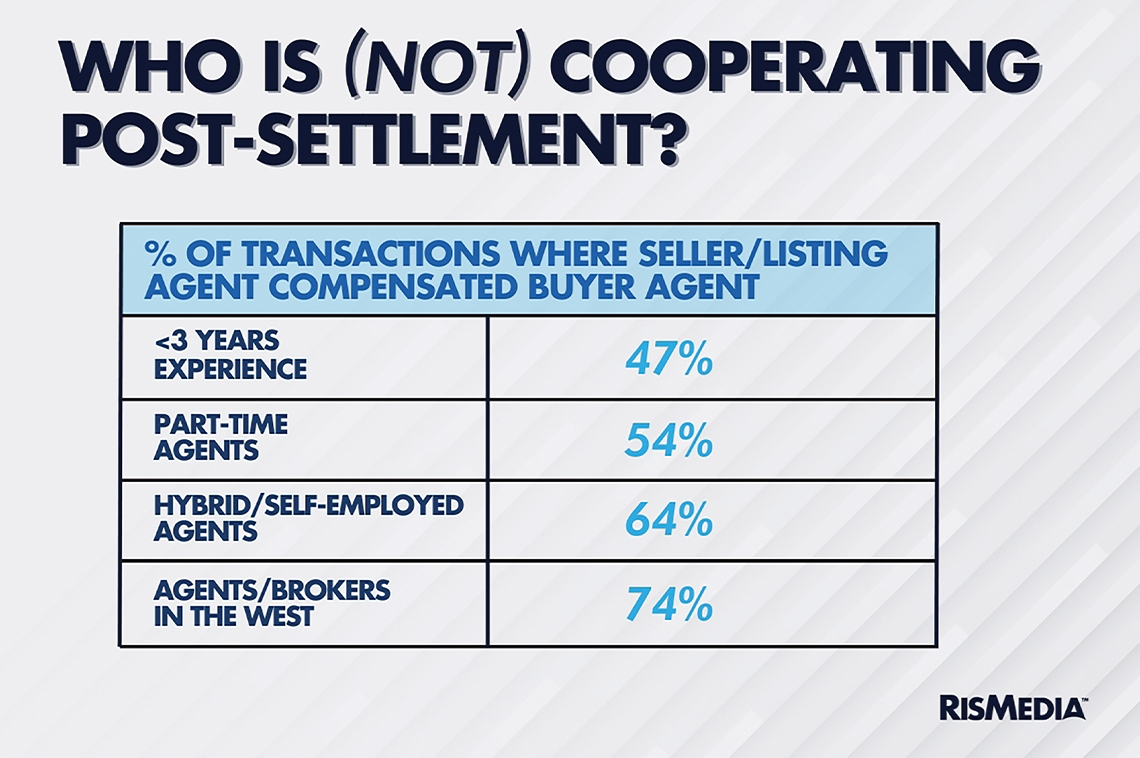

John Gillam is a managing broker for EXIT Realty in Colorado. Speaking to RISMedia last month, he addressed one of the big, though maybe not surprising, revelations to come out of the study—that inexperienced buyer agents are struggling more than those who have spent significant time in the industry.

Specifically, the study found that buyer agents with less than three years of real estate experience under their belt were only able to get sellers to pay their commission 47% of the time after the settlement, compared to 80% for those with 10 or more years in the industry. Those rookie agents also saw a much larger drop in average commission rates compared to their peers.

“You have to have the competence to have the confidence to communicate what it is you do,” said Gillam. “When I am doing that , I am really able to express what my services are in a very different way than other people.”

Gillam has been working directly to prepare his agents for the policy shifts, and says that there is a growing recognition that the industry needs to change, after many real estate leaders initially pushed back on the idea that the settlement would cause major disruption. Some brokers remain fixated on the old ways, according to Gillam, but apart from data showing that commissions are under pressure or that decades-old habits are ineffective, Gillam has also observed agents—especially newer agents—willing to adapt and change their mindsets.

“The people who are saying, ‘That’s how we’ve always done it’—that’s not true,” he says. “Because they’ve had to change, too. Honestly, for a lot of the newer people , it’s easier for them to embrace the change than it is for a lot of us seasoned people.”

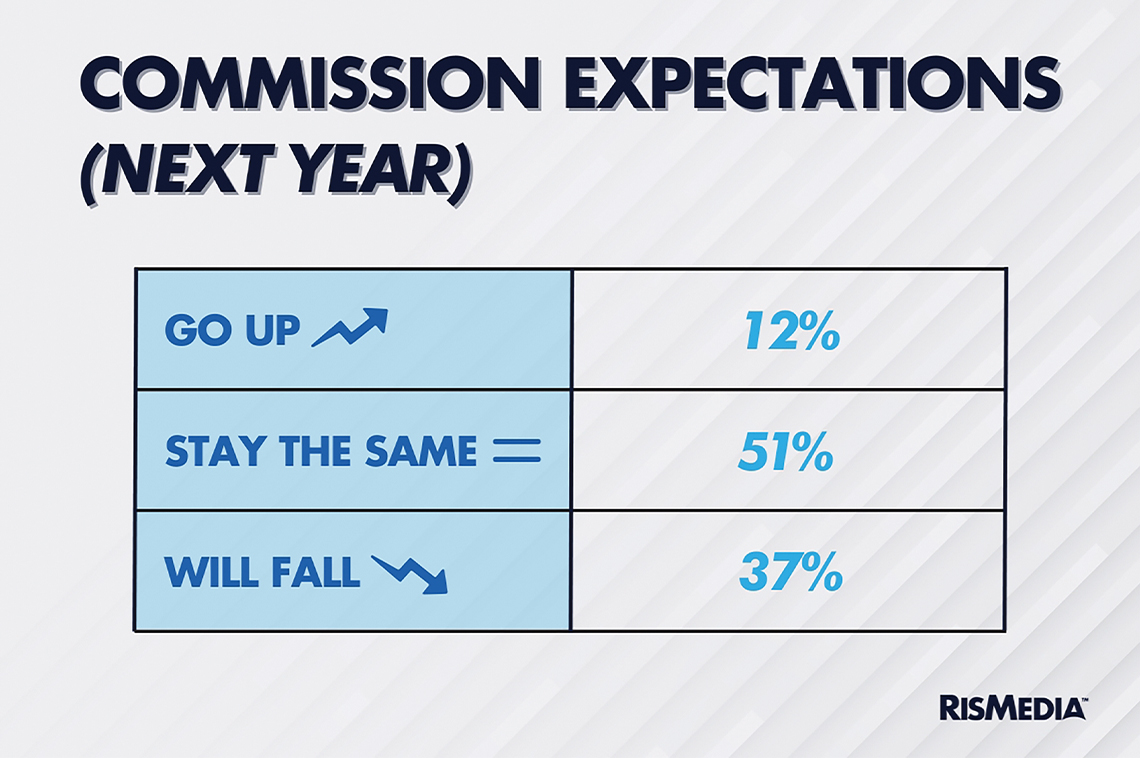

And change is coming. While it is possible some of the data points and trends captured in RISMedia’s Contract & Commission Study will revert or evolve from what was tracked in the first six weeks post-settlement, the qualitative experiences of brokers, agents and executives affirm that business will be done differently as the industry moves forward.

One of the seemingly alarming data points in the study was that agents and brokers did not—at least immediately—fully adopt the buyer agreements into their businesses. In the six weeks after August 17, 43% of agents reported that they had worked with a buyer without signing an agreement or contract.

While this was a decrease from 53% in the year leading up to the settlement’s implementation, the large proportion of agents and brokers working without an agreement shows the policy changes may not be creating change as swiftly or as easily as some expected. It is also not clear exactly why the adoption is slower—whether MLSs are easing into enforcement regarding buyer contracts, whether agents and brokers are leaving NAR to avoid the mandate or whether contracts are still not ready in some areas.

Dan Duffy, CEO of United Real Estate, urged the hundreds of real estate professionals at RISMedia’s Power Broker Forum last month, held during NAR NXT in Boston, to not fixate too much on a singular issue like contracts, or whatever the “topic of the day” is.

“The discussion around forms takes away from significant conversations. The lawsuits are transitory; forms are transitory,” he said. “Opportunity is sliding by you.”

It is that mindset shift, beyond the reality of commissions falling, cooperative compensation fading or other data points revealed in the Contract & Commission Study, that real estate leaders say is needed to drive the industry forward. While the study shows that many agents and brokers have already found ways to mitigate the effects of the settlement—as well as identifying certain regions bucking negative trends—the long-term path requires both learning from those success stories, as well as seeing the policy changes in a different way.

Anthony Lamacchia, broker/owner and CEO of Lamacchia Realty, put his positive spin on the new environment—in his trademark candid fashion.

“Fear has made agents better. Two to three years from now, we will be making more money,” he said.

Hope on the horizon

Parsing out where the foundation is, and where there is a floor or ceiling for these changes is going to be vitally important. With only a couple months of observations and data, one thing real estate leaders are trying to understand is the aspects of the industry that will indisputably transcend things like compensation on the MLS or friction with buyers.

Amit Kulkarni, chief marketing officer at Bright MLS, points out the oversaturation of leads, internet traffic and advertising that portals are fighting over. That “noise” is something that many of these companies are chasing without acknowledging that at the end of any convoluted, multi-step and multi-faceted marketing funnel, there is an agent speaking to a buyer or seller.

“There’s so much nuance and personalization to transaction that also is your most expensive transaction. So I think that relationship is what matters,” he says. “That relationship is the core, fundamental thing that is powering real estate. That is what’s at stake right now.”

With indications in the data showing that agents—particularly buyer agents—are adjusting their fees or potentially even shifting to flat fees or “menu of services” models, Kulkarni points out that it is relatively early in the post-settlement era. But he also said he believes that the changes will “trickle through, in different ways, to every part of the industry.”

Does that mean portals and MLSs are also going to be making changes?

At NAR NXT, there were decidedly mixed views on this, with some MLS leaders and executives warning of significant and painful repercussions if the industry doesn’t adapt, while others claimed there was nothing to be worried about.

Speaking at the MLS Policy Committee meeting at NAR NXT, chair Johnny Mowad referenced a previous panel of MLS leaders—who took a darker, more urgent view of the policy changes—and compared them to Christopher Lloyd’s time-traveling Doc Brown character from the 1980s blockbuster “Back to the Future” films, always showing up in a cloud of smoke to warn of imminent catastrophe.

“Don’t worry folks, no DeLorean in this parking lot today, and I’ve got it on good authority that we’re not headed for doomsday. The future of MLS is in good hands,” he said.

While the MLS Committee mostly hewed to the fundamentals and traditional wisdom, there is still a sense—both in the conversations and the data—that institutions like the MLS will need to make their own changes.

Kulkarni emphasizes the idea of value, which he says needs to be part of conversations between agents and clients as they form a relationship, but just as importantly, should be a much bigger focus in the relationships between brokers and agents, as well as between MLSs and their members. Consumers have seen portals working to provide more and more value, and the organizations that serve real estate professionals need to be doing even better, he says.

“I think if you strip away all the legalese, it’s all about value,” he says. “Everybody has to wake up in the industry today and say, ‘Look, we have to show value.’”

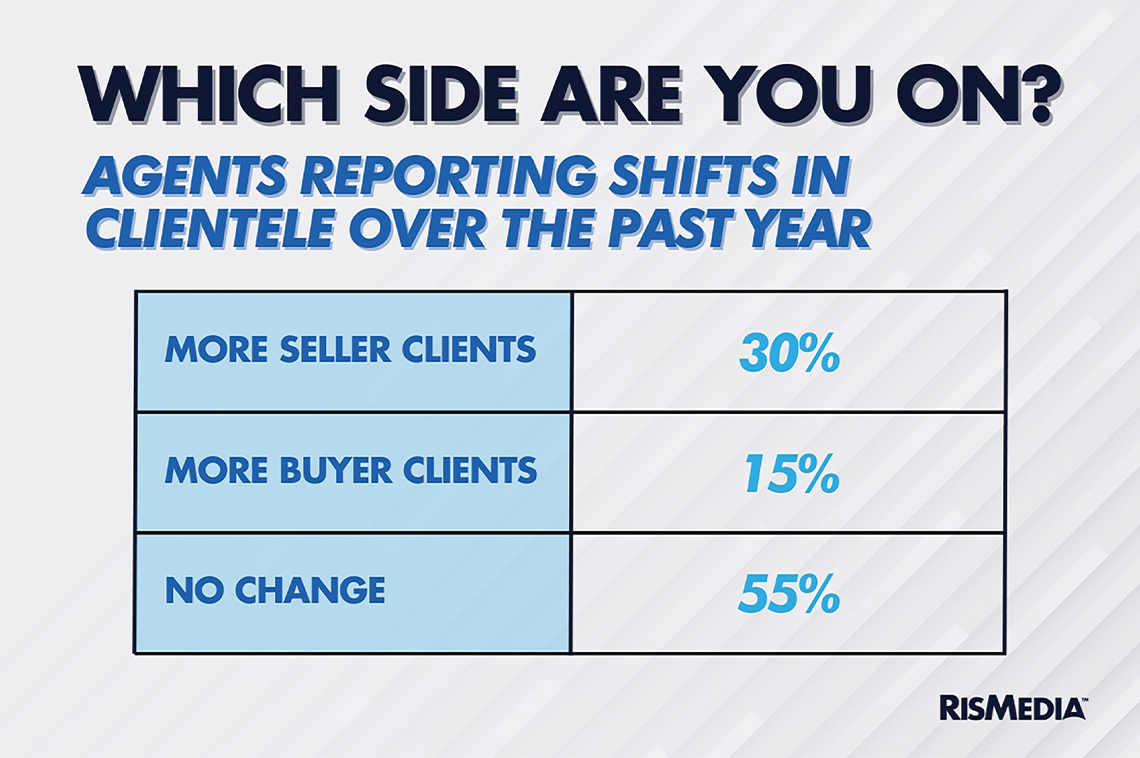

Back to the agent level, one of the other big questions is how practitioners will prioritize buyer or seller clients post-settlement. Some have speculated that individual agents, or possibly whole companies, will prioritize buy-side transactions assuming commissions continue to fall.

The data on this is unclear so far—RISMedia’s Contract & Commission Study found at least some indication that agents are seeing a shift away from buyer clients and services. But Gillam says he believes long term, agents will need to continue to hone their buy-side skills.

“If you have listings, buyers come. I don’t think that’s ever gone away; I don’t think that’s going to go away,” he says. “Find the balance, and take the education.”

But he also acknowledges that there have been issues, both pre- and post-settlement, with dual agency and unrepresented buyers. Some of those issues are garnering more attention as judges, lawyers and consumer advocates scrutinize the new practices.

But Gillam says consumers are still better served by agents and brokers who have the skillset, training and experience to see a transaction from any angle or perspective, and navigate a home sale from the listing side, buy side or both simultaneously. That reality—that the agent best able to serve a consumer’s needs has done it all—will not change, regardless of new preferences, compensation models or structural shifts.

“I’ve seen people that were trained only on one side, and they don’t know where to get the diligence, they don’t know where to find the resources…I should be writing with my buyer sitting with me—how can I do that effectively and educate my buyer on what the seller’s perspectives might be if I don’t have the competence on that side?” Gillam asks. “ markets shift—how can I have that same exact conversation if I don’t understand what a buyer should be expected to do?”

To learn more about RISMedia’s 2024 Contract & Commission Study, and gain exclusive access to the complete results and analysis, visit rismedia.com/reports.