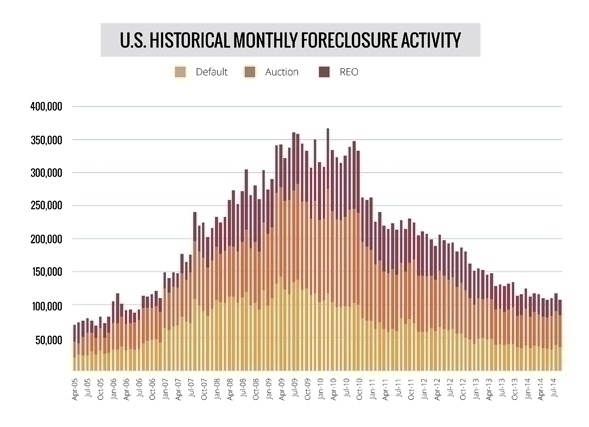

According to RealtyTrac®’s recently released U.S. Foreclosure Market Report™ for September and the third quarter of 2014, foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 317,171 U.S. properties in the third quarter, down 16 percent from a year ago but up 0.42 percent from the previous quarter — marking the first quarterly increase since the third quarter of 2011.

The quarterly increase in overall foreclosure activity was driven by a 2 percent increase in default notices (LIS, NOD) and a 7 percent quarterly increase in scheduled foreclosure auctions (NFS, NTS). Meanwhile bank repossessions (REOs) decreased 12 percent from the previous quarter.

A total of 106,866 U.S. properties had foreclosure filings in September, down 9 percent from the previous month and down 19 percent from a year ago to the lowest level since July 2006 — a 98-month low. September marked the 48th consecutive month where U.S. foreclosure activity decreased on a year-over-year basis.

“September foreclosure activity was back to pre-housing bubble levels nationwide, in large part thanks to a continued slide in bank repossessions,” said Daren Blomquist, vice president at RealtyTrac. “However, a recent rise in scheduled foreclosure auctions in many markets across the country shows lenders are continuing to clean house of lingering delinquent loans. This rise in scheduled auctions foreshadows a corresponding rise in bank repossessions and auction sales to third party buyers in the coming months.”

Default notices (LIS, NOD) were filed on 103,179 U.S. properties in the third quarter, an increase of 2 percent from the previous quarter but still down 11 percent from the third quarter of 2013 — the ninth consecutive quarter where default notices have decreased on a year-over-year basis nationwide.

Default notices in the third quarter increased from a year ago in 10 states, including Indiana (up 59 percent), Oklahoma (up 49 percent), Massachusetts (up 38 percent), New Jersey (up 19 percent), Iowa (up 12 percent) and New York (up 2 percent).

Foreclosure auctions (NFS, NTS) were scheduled on 139,721 U.S. properties in the third quarter, an increase of 7 percent from the previous quarter but a decrease of 1 percent from the third quarter of 2013 — the 15th consecutive quarter where scheduled foreclosure auctions have decreased on a year-over-year basis nationwide.

Scheduled foreclosure auctions in the third quarter increased from a year ago in 22 states, including North Carolina (up 85 percent), Oregon (up 85 percent), New Jersey (up 66 percent), Oklahoma (up 58 percent), New York (up 57 percent), Connecticut (up 51 percent), Colorado (up 48 percent), Alabama (up 24 percent), Texas (up 18 percent), and Ohio (up 17 percent).

Scheduled foreclosure auctions in the third quarter increased from the previous quarter in 32 states, including Michigan (up 34 percent), Maryland (up 30 percent), California (up 25 percent), Texas (up 25 percent) and Arizona (up 25 percent).

Lenders repossessed (REO) 74,271 U.S. properties in the third quarter, a decrease of 12 percent from the previous quarter and down 38 percent from the third quarter of 2013 — the 16th consecutive quarter where REOs have decreased on a year-over-year basis nationwide.

REOs increased from a year ago in the third quarter in seven states, including Maine (up 24 percent), Maryland (up 19 percent), Oregon (up 13 percent), Georgia (up 11 percent) and New Jersey (up 5 percent).

States with the five highest foreclosure rates in the third quarter were Florida, Maryland, New Jersey, Nevada, and Illinois.

Metropolitan statistical areas with the five highest foreclosure rates in the third quarter were Orlando, Atlantic City, N.J., Macon, Ga., Ocala, Fla., and Palm Bay-Melbourne-Titusville, Fla.

U.S. properties foreclosed in the third quarter of 2014 were in the foreclosure process an average of 615 days, up 7 percent from the previous quarter and up 13 percent from the third quarter of 2013 to the longest average time to foreclose since RealtyTrac began tracking in the first quarter of 2007.

States with the longest average time to foreclose in the third quarter were New Jersey (1,064 days), Florida (951 days), Hawaii (937 days), New York (902 days) and Illinois (889 days).

For more information, visit http://www.realtytrac.com/content/foreclosure-market-report/september-and-q3-2014-us-foreclosure-market-report-8163.