With tax preparation season well underway, it is a good time to examine the use of the home-office deduction.

Often cited as a “red flag” for tax audits, the home-office deduction is in fact a legitimate business deduction with particular importance for certain careers and small business owners. Moreover – from the housing economics perspective – IRS data concerning the deduction, along with Census data reporting who works at home, can shed light on an important and growing role for homes: workplaces for business owners and telecommuters.

There’s no doubt that the practice of working at home is on the rise. According to data from the Survey of Income and Program Participation, in 1997, just 7 percent of workers (9.2 million individuals) reported working at home at least one day a week. By 2010, that total had grown to 9.4 percent (13.4 million), an increase of more than 4 million or 35 percent.

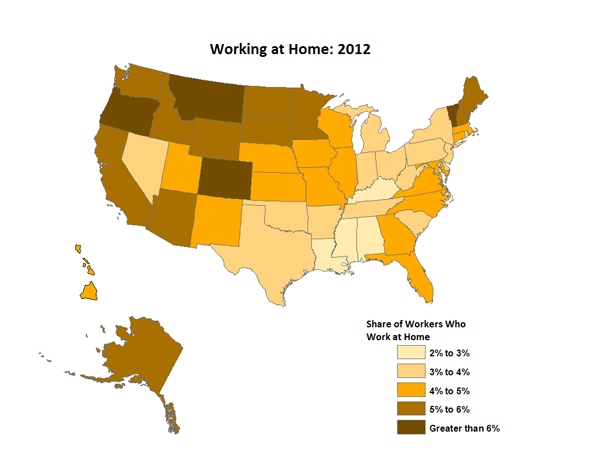

The geographic distribution of those workers who primarily work at home (most days) shows interesting geographic clustering. Using data from the 2012 Census Bureau American Community Survey, the map above maps the share of the workforce (age 16 and over) who report working at home. The highest shares are found in the West, the Northwest, the Upper Midwest and New England. The state of Vermont has the highest share (7.1 percent), followed by Montana (6.5 percent), Colorado (6.5 percent), and Oregon (6.3 percent). Louisiana has the lowest share at 2.3 percent.

The reasons behind this geographic distribution are not immediately clear. Potential explanations include the geographic distribution of jobs that are more likely to include or allow at-home employment, weather, age/education differences in the workforce, and less quantifiable differences in workplace culture across states. Regardless, the growth of working-at-home represents a business opportunity for both remodelers and builders to help accommodate homes for this growing purpose.

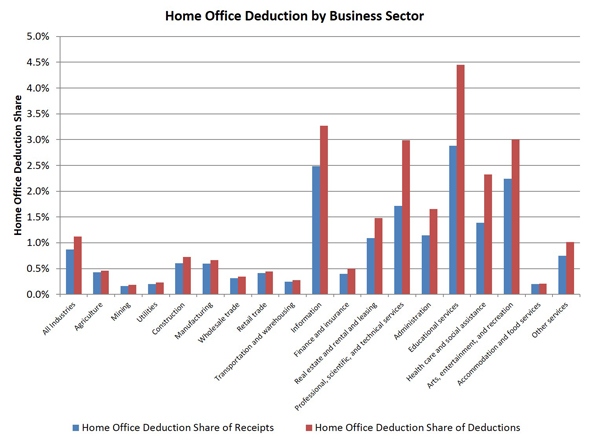

Recent industry-specific IRS data (2010) for the home-office deduction for independent contractors and sole proprietorships (Form 8829) (not telecommuters) provides a sense of who is using space in their home for a dedicated office.

Not surprising, workers in industries that involve more individual independence or technology tend toward greater use of the deduction. For example, educators, the information technology sector, professional services (lawyers, accountants, architects, etc.), and those in the arts and entertainment sectors are all more likely to claim the home-office deduction. The real estate sector is in the middle category, with many REALTORS® reporting home-office expenses. Home-office deductions are less common in the construction sector, although many small construction firms do have home office expenses.

Specific sectors with high levels of home-office deduction use include textile producers, electronics producers, nonstore based retailers, publishers, video/audio producers, broadcasters, internet based workers, certain financial workers, real estate brokers, appliance and video rental services, CPAs, architects, engineers, drafters, building inspectors, designers, science and business consultants, advertisers, marketers, business administrators, educators, doctors, social workers, actors, and religious and professional organization workers.

Overall, according to IRS data for tax year 2011, $9.8 billion in home office expenses (insurance, rent, repairs and utilities) were claimed on IRS Form 8829. The deduction is split into two classes: direct expenses related to the actual officer and indirect expenses that apply to the home as whole and are only partially deductible. Approximately 6 out of every 7 dollars claimed as a deduction originate from this indirect class. An additional $1.3 billion in home office related depreciation deductions was claimed in 2011.

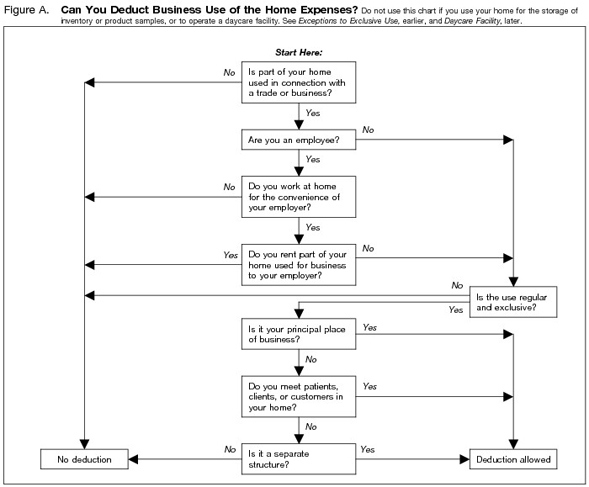

Taxpayers who are likely to claim the deduction, including small business owners (builders and remodelers) and REALTORS®, should be aware of the rules. The IRS has a good summary page on the deduction. More details can be found in IRS Publication 587, which includes the following useful flowchart regarding qualifying.

From a tax law perspective, two relatively recent key changes are worth noting. First, in 2013, the IRS provided a simplified method for claiming the deduction, which can save taxpayers time in filing the required form. Under this approach, taxpayers may claim a $5 per square foot of home office space (up to a maximum of 300 square feet), other expenses such as mortgage interest and real estate taxes are claimed on Schedule A, and no depreciation deduction (or future recapture) is allowed.

Second, for those who have often heard about strict tests connected to the deduction, do keep in mind tax law changes made in 1997 that went into effect in 1999. Under the Taxpayer Relief Act of 1997, a residence can qualify as a principal place of business when it is used to conduct administrative or management activities if there is no other fixed business location. This change clarified a lot of uncertainty regarding the deduction for many classes of workers. However, for all taxpayers (homeowners and renters), the office space must be exclusively used for business purposes.

Telecommuting employees are less likely to be able to claim the deduction (they must itemize for example), and should consult IRS Form 2106 for additional detail.

Finally, the IRS recently published IRS Tax Tip 2015-42 and more explanations on the simplified deduction method. The Tax Tip document provides 6 helpful points on the use of the deduction.

View this original piece on NAHB’s blog, Eye on Housing.