A survey of single-family builders conducted by NAHB in June 2015 shows that shortages of labor and subcontractors—already quite widespread in mid-2014—have become even more widespread during the past year.

A survey of single-family builders conducted by NAHB in June 2015 shows that shortages of labor and subcontractors—already quite widespread in mid-2014—have become even more widespread during the past year.

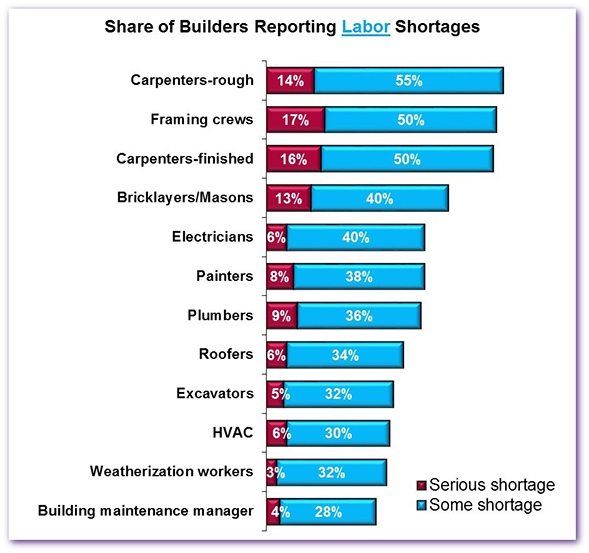

The shortages are most acute for basic skills like carpentry, which are needed during the construction of any home. For example, in the 2015 survey, 69 percent of builders reported a shortage (either serious or some) of construction workers willing and able to do rough carpentry.

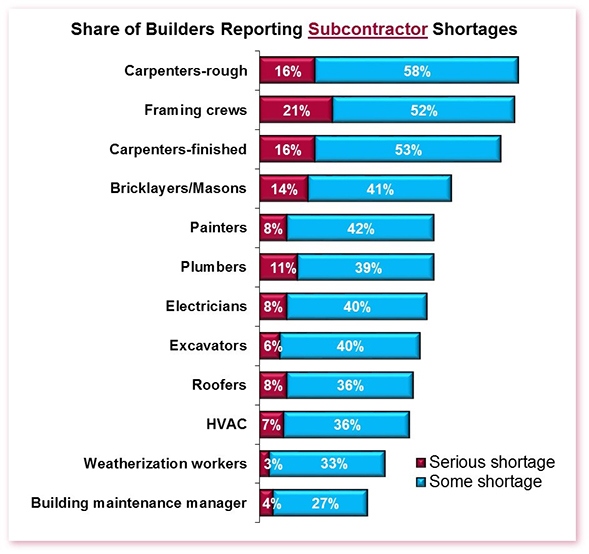

Builders, however, may be even more concerned about the availability of subcontractors than of workers to employ directly. In building a single-family home, three-quarters of the construction work is typically done by subcontractors (documented in a 2012 NAHB survey available here). The rankings of labor and subcontractor shortages in the 2015 survey were similar, but—with the exception of building maintenance managers—the shortages of subcontractors were more widespread. In the rough carpentry category at the top of both charts, 74 percent of builders reported a shortage of subcontractors, compared to 69 percent for labor directly employed.

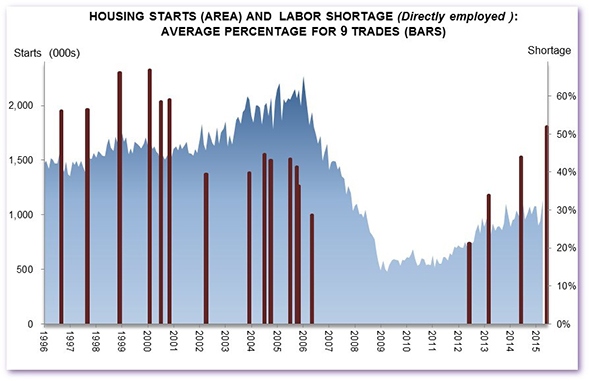

Historically, for every trade covered in the survey, shortages were more widespread in 2015 than in 2014. One way to see this is to look at the labor shortage percentage averaged across all nine trades that NAHB surveys have covered in a consistent way since 1996. This average skyrocketed from a low of 21 percent in 2012 to 46 percent in 2014, before increasing even further to 52 percent in 2015.

The nine consistently covered trades are carpenters-rough, carpenters-finished, electricians, excavators, framing crews, roofers, plumbers, bricklayers/masons and painters. The history for each is available in the full report. The survey’s current list of 12 trades was recommended by Home Builders Institute, NAHB’s workforce development arm.

The incidence of shortages is surprisingly high given the rate of new home construction, which has only partially recovered from its 2008 downturn. In fact, the nine-trade shortage is now substantially higher than it was at the peak of the 2004-2005 boom, when annual starts were averaging around 2 million, compared to current rates of about 1 million. The last time builder-reported labor shortages were as widespread as now was just before 2001—during a prolonged period of strong GDP growth with overall unemployment as low as 4.0 percent.

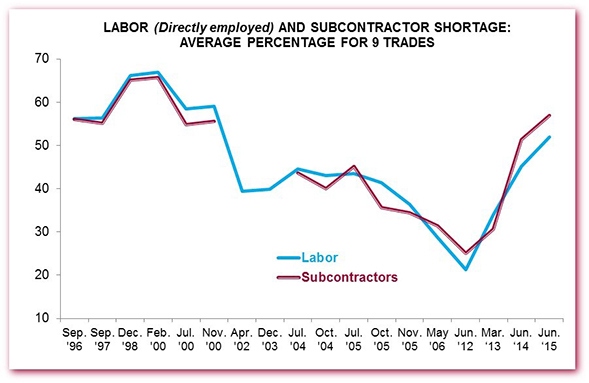

The NAHB survey data can also be used to calculate a nine-trade shortage for subcontractors. In general, the labor and subcontractor averages track each other closely, but since 2013 a gap has opened, with the shortage for subcontractors running 5 to 7 percentage points higher.

Why should such a gap exist? One possibility is that, during the housing downturn, construction workers who were laid off started their own trade contracting businesses. Now, some of the old relationships may be re-forming, with owners of small businesses returning to work for larger companies, slightly improving the availability of workers directly employed by builders while making the availability of subcontracting firms slightly worse. A previous post provided some evidence that this has been occurring.

The most common effects of the shortages have been causing builders to pay higher wages/subcontractor bids (reported by 66 percent of builders) forcing them to raise home prices (61 percent) and making it difficult to complete projects on time (58 percent). Other effects of the shortages are listed in the full report.

While the shortages described in this post are quite widespread, conditions vary across the country. Not all builders in NAHB’s 2015 survey reported shortages. Some even wrote in explicit comments that they were not seeing any shortage of labor in the markets where they currently build.

This post was originally published on NAHB’s blog, Eye on Housing.