AI in RE

When you consider how massively AI has transformed industries like marketing, ecommerce, healthcare, fintech and others, it’s head-shaking how real estate has been relatively unaffected by this technology so far.

“I think AI is in such an evasive stage that we really haven’t seen what it can do long-term yet,” Carter says. “Real estate is so centered on photos and on descriptions, and a lot of stuff taught in classes on the best way to market properties, you’re going to start seeing AI pop up in the near-term that will help REALTORS® address that. We’re really just scratching the surface at this point on what AI can do.”

One thing consumers have long complained about in the industry is the lack of follow up. And while Carter isn’t advocating for turning this over completely to an AI system, he does feel that it can play a big part in improving it.

“An initial follow up to get them into your pipeline from an AI system that mimics the look and feel of someone personally answering, I think we’ll see a lot more of that popping up in the future,” he says. “Some of the major brands are heading down that road and giving the consumer what they want—which is immediate access.”

Right now, AI is being utilized for things like propensity-to-sell alerts and chatbots, but there is almost certainly a lot more to achieve, and it shouldn’t take long for the technology to make a major impact.

One area it’s leaving its mark on is lead generation models, which have been evolving due to tech advancements. Third parties and even some brokerages are experimenting with inside sales teams mixed with AI to make first and immediate contact with inbound consumer inquiries.

“The timely response and qualifying benefits allow agents to get handed fewer but more valuable leads that are further down the funnel, sometimes with a showing appointment already booked,” Siegler says. “The commission splits or fees are typically higher for this type of lead, but many agents prefer the reduction in noise and time consuming lead qualifying. This is quite a big shift and it’s happening quickly everywhere in the industry, from portals to brokerages.”

Foster notes that she’s seeing data aggregation tools using AI influencing real estate today.

“Savvy brokers can employ tools like home valuation platforms to enhance their client education process and start conversations around listing with homeowners,” she says.

Blockchain and Cryptocurrencies

Blockchain and cryptocurrencies offer some paradigm-changing opportunities to share information across the distributed real estate ecosystem. However, they also come with an enormous amount of risk and uncertainty at this stage.

“It’s important that we continue to learn about the fundamental differences in these technologies that could lend themselves to solving current business problems, while also ensuring that the infrastructure supporting our customers is safe and strong,” DeBord says.

Case in point, RESO’s subject matter experts in distributed ledger technology are exploring the possibilities of MLSs and other information providers sharing roster and property information in a distributed system across the industry to unify datasets.

“Using unique identifiers for licensees, properties and organizations, there’s an opportunity to deduplicate industry information that’s currently siloed with many separate organizations,” DeBord says.

While many feel crypto, NFTs and the blockchain platforms have the highest potential for impact in the industry, they are all likely far off as all still face a lot of headwinds on the path to becoming mainstream.

“Government regulation and tax treatment are especially painful, as is the recent instability thanks to the collapse of the Terra project,” Siegler says. “That being said, we need to position ourselves to have horses in this race, just in case, because the promise of simple transfer of property using crypto, tokenization for fractional ownership, or unlimited real estate in a Metaverse are drool-worthy outcomes for many of us.”

With the companies Fox & Roach deals with, Sajja hasn’t noticed crypto making much of a dent, and that’s because many people still don’t truly understand it.

Carter is optimistic that there will be more of an adoption of blockchain in the years ahead, though not necessarily in the front-end side of things, but more in the movement of the mortgage, title and recording sides.

“Some of the things that blockchain makes possible involve these trusted relationships and the ability to quickly move from the loan application to loan funding in hours or days, instead of weeks,” he says. “It’s going to simplify some of the ways that real estate is transacted in this country.”

The big limiting factor, he shares, is government, and how involved they are with changeover in the United States, and he’s hoping they can get behind this as well.

3D and Aerial Property Tours

In the early months of the pandemic, when a lot of states had restrictions on how many people could attend a showing, things like 3D model tours and remote showings became the absolute norm.

3D tours with floor plans are one of the most concrete and tangible technological benefits affecting the entire spectrum of real estate. With the ability to create these on a phone and immediately upload to the MLS, every stakeholder in the transaction benefits from this new transparency.

Of course, the tech itself isn’t new, but before the pandemic, it was lightly adapted and targeted more toward niche markets and customers.

Two macro factors combined to push 3D rendering tours into the mainstream as expected technology on most listings: the pandemic effect on showings; and a competitive market for buyers where immediate decision-making became a necessity.

“An immersive 3D rendering tour of a home can help a buyer quickly rule a property out, or give them enough confidence in its real-life look and feel to move forward with an offer sight unseen,” Siegler says. “No matter where the potential buyer is, with a 3D rendered tour, they can easily navigate around the home, down the halls, into the kitchen and even out on the terrace to see what the view looks like.”

While the cost was once a concern, the price for the technology required to capture these tours has come tumbling down, and can be done on a smartphone camera with an inexpensive plastic camera mount.

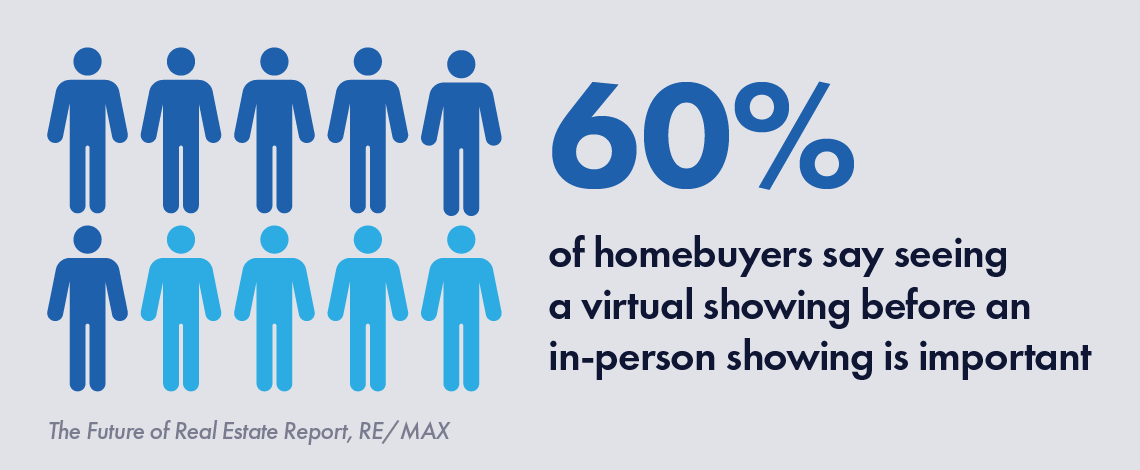

Earlier this year, in partnership with Camp + King, RE/MAX produced The Future of Real Estate Report, an all-encompassing resource that reveals the patterns and future tendencies of real estate consumers and provides context to where the industry is headed.

“The report found that 60% of people say seeing a virtual showing before an in-person showing is important,” Jason Romig, senior vice president of product and engineering for RE/MAX, cites. “This technology has helped the industry on both sides of the transaction as it saves time and resources while helping to prioritize which properties and listings to pursue, which is imperative in a competitive environment like this.”

The advancement of drone technology is also going to play a role in this and will be used by more agents in the years to come.

“A lot more agents are gravitating to drones because people want to see these homes remotely,” Sajja says. “We also launched a service that builds on that—called Listing Concierge—where we do a plethora of marketing that includes photography, 3D visuals and drones, and that’s something that has really taken off this past year.”

Virtual Reality and the Metaverse

While still in its infancy, the Metaverse has already had palpable effects on the real estate industry.

eXp Realty has been operating from its Virbela “virtual campus” since its inception, catering to more than 80,000 real estate agents and 2,000-plus staff members in 22 countries.

“While much of the new Metaverse efforts are a bit less business-oriented, this is a really good example of the proven viability and staying power of this type of tech for real life, day-to-day business,” Siegler says.

One of its biggest impacts, he adds, is the promise of virtual real estate transactions.

“This is exciting because in the physical world, there is only so much real estate that can be sold, but in the Metaverse, there have already been land transfers that people have paid in excess of $2 million for,” he says. “If embraced, and real estate agents have a place in these transactions going forward, we would be marching toward a future where there are potentially exponentially more transactions available for the world’s real estate agents to assist with.”

That could amount to millions or even billions of dollars worth of deals that simply didn’t exist before with properties that could be toured and sold without leaving one’s desk or couch, all with the ease and speed of a quick crypto transfer and blockchain transaction.

Machine Learning Valuations and Property Aggregation Data

Real estate professionals rely on accurate home valuations. Likewise, consumers rely on real estate agents’ expertise and guidance on pricing strategy. This is where Automated Valuation Models, or AVMs, come into play.

“AVMs assist real estate practitioners in their analysis by considering millions of data points simultaneously,” Nejatian explains. “These models are built with a consistent inflow of new and deeper sets of macro- and micro-level data and applying artificial intelligence and machine learning to provide more accurate valuations. Beyond publicly available data, AVMs can analyze user input data, like interior photos of a home, and apply computer vision to accurately determine the condition of the property.”

Therefore, an AVM can offer powerful analysis, and is one of the tools being used for valuations and aggregation data.

RESO Analytics is creating a level of transparency for real estate tech systems through an industry-wide reporting system that is helping MLS software providers compare their products and tune them up for customer needs. DeBord shares that it will allow brokers, MLS operators and data aggregators to look at the entire industry’s landscape and make data-informed decisions as to how they can improve their customers’ products.

There is an incredible amount of data in real estate, and Smith believes that the industry is in its infancy of turning data into appropriate actions that influence change.

“I’m seeing an increased focus on how we can employ data and past findings to build a streamlined end-to-end experience for the client,” he says. “Many companies in the real estate industry are working on this end-to-end solution, and though we aren’t there yet, I’ve seen great strides in the integration of real estate offerings. Eventually, I think we’ll see a world where a client’s experience throughout the transaction is seamless and unified, while on the backend, brokerage companies are integrating partners in mortgage, title and escrow, and insurance into the transaction.”

Data is the oxygen that powers a lot of the successes in this industry, and consumers are now more data-conscious on their end of the transaction as well.

“G73, named for the year RE/MAX began, is the data foundation for RE/MAX and powers remax.com, the RE/MAX Search App, agent websites and more,” Romig says. “There’s so much potential with data—we are able to run metrics on how many times a home flips in a marketplace or how many homes there are in a marketplace, for instance. G73 processes 12,700 new listings and 292,000 images for new listings on average every day.”

Ultimately, data empowers agents and consumers so that they can make educated decisions when there’s often no time to do the research themselves.