Last year’s market was hard to describe. While many experts celebrated that the industry defied worst-case scenario predictions and emerged from a “housing recession” relatively unscathed, other real estate insiders pointed out the struggles caused by unexpectedly high mortgage rates and an ongoing inventory crisis. Both sides offered compelling evidence for their argument, and there continues to be disagreement among housing economists and industry luminaries on how to characterize the 2023 market—and what to expect from 2024.

But how about marketing? In a field that is notoriously difficult to track and quantify, the numbers can often be revealing. Did agents and brokers significantly change their spending habits, channels or targets in 2023? How did experienced real estate professionals adapt, compared to those new to the industry? What types of companies pulled back, and which ones ramped up?

Overall, companies saw 2023 as a year to tighten their belts. Agents spent about 15% less marketing their personal brand compared to 2022. For brokers, the dip was even more significant: 24% less than the previous year, a decrease of $12,000 on all external marketing costs—although a shift toward internal marketing teams, which is covered in Section 4, could explain at least some of this.

But interestingly, agents actually spent more per listing in 2023 than they did in 2022, likely reflecting a more competitive market. In 2022, agents spent an average of 3.2% of the list price marketing, compared to 3.7% in 2023.

There were other shifts deeper in the demographics as well. Newer agents are investing more on their personal brand compared to 2022, even as nearly every other category of agent cut marketing costs. Agents in their first three years spent $2,760 in 2023 compared to $2,500 in 2022. And they spent even more to market listings: 3.9% in 2023, up from 2.6% in 2022.

Newer agents shouldering a larger share of marketing likely reflects more fundamental shifts in the industry, as overall sales shrink and competition grows. But how about more experienced agents?

Those with more than 15 years of experience made the most significant cut to their personal-brand marketing budget, by about 14%. As a percentage of list price, those agents paid slightly more to market, up to 3.8% of the list price in 2023 compared to 3.5% in 2022.

These more modest, cautious changes likely reflect the stability of more established business people, who did not react as strongly or as broadly to the 2023 market shift as newer folks.

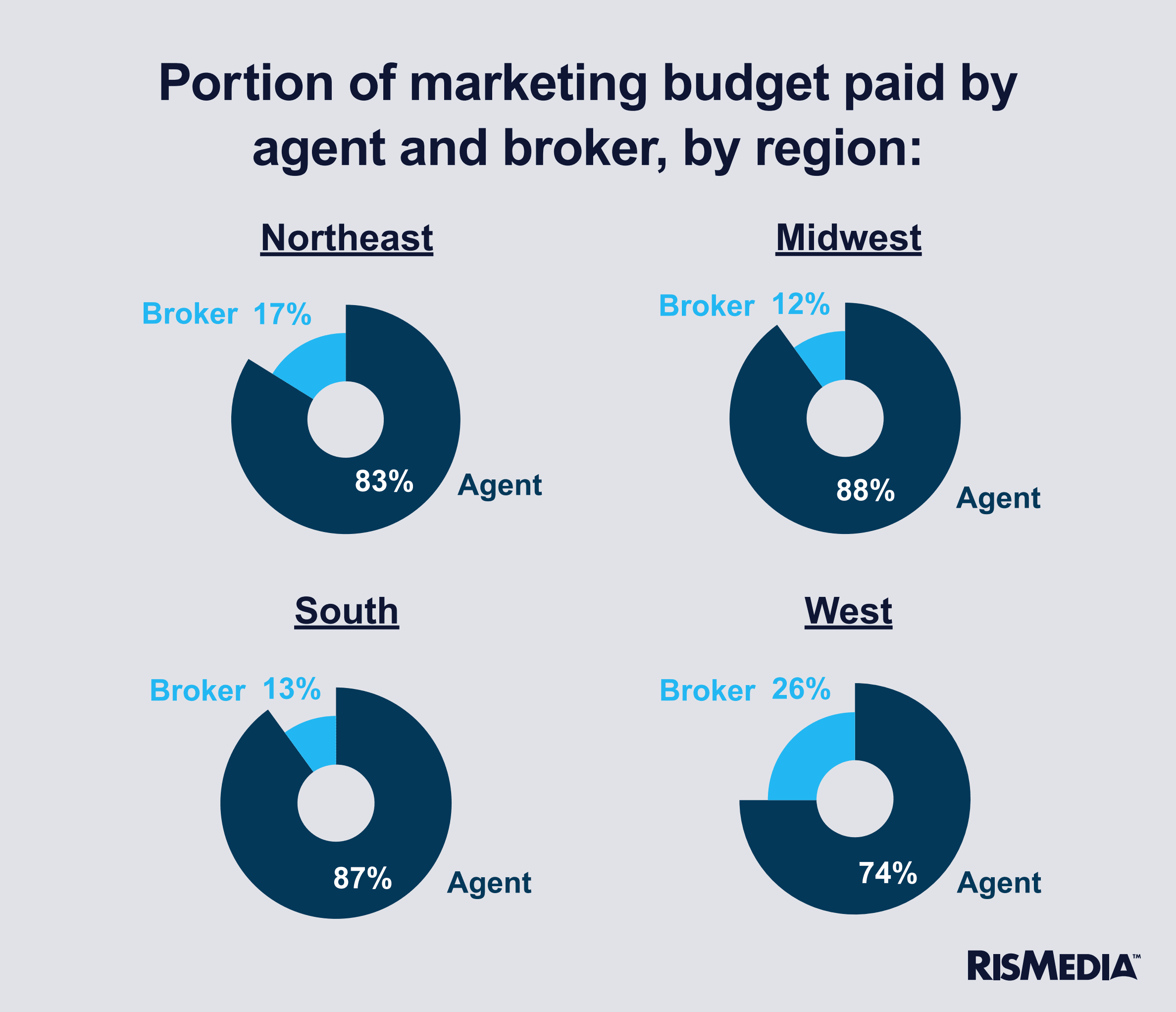

Notably, brokers and agents are still splitting marketing costs the same as they did in 2022, with agents contributing 85% and brokers 15% on average.

But again, that doesn’t apply to newer agents, who despite spending more as a flat amount, actually received more support from their brokers in marketing costs in 2023 compared to the previous year. Agents with less than three years in the industry paid only 68% of their total marketing budget compared to 82% in 2022.

That would strongly suggest that brokers are investing more in their rookie agents, nurturing promising candidates. But oddly, brokers are not putting their marketing dollars toward trying to bring in or hold onto agents, even as they offer inexperienced agents more support.

Recruiting and retention budgets fell sharply by just over half (55%), with brokers spending around $9,700 in 2023 compared to $22,000 in 2022. Again, there is some evidence that a shift toward in-house marketing services could explain some of this. But recruiting and retention seems to be less important for brokers, and this could potentially reflect a major shift in the industry.

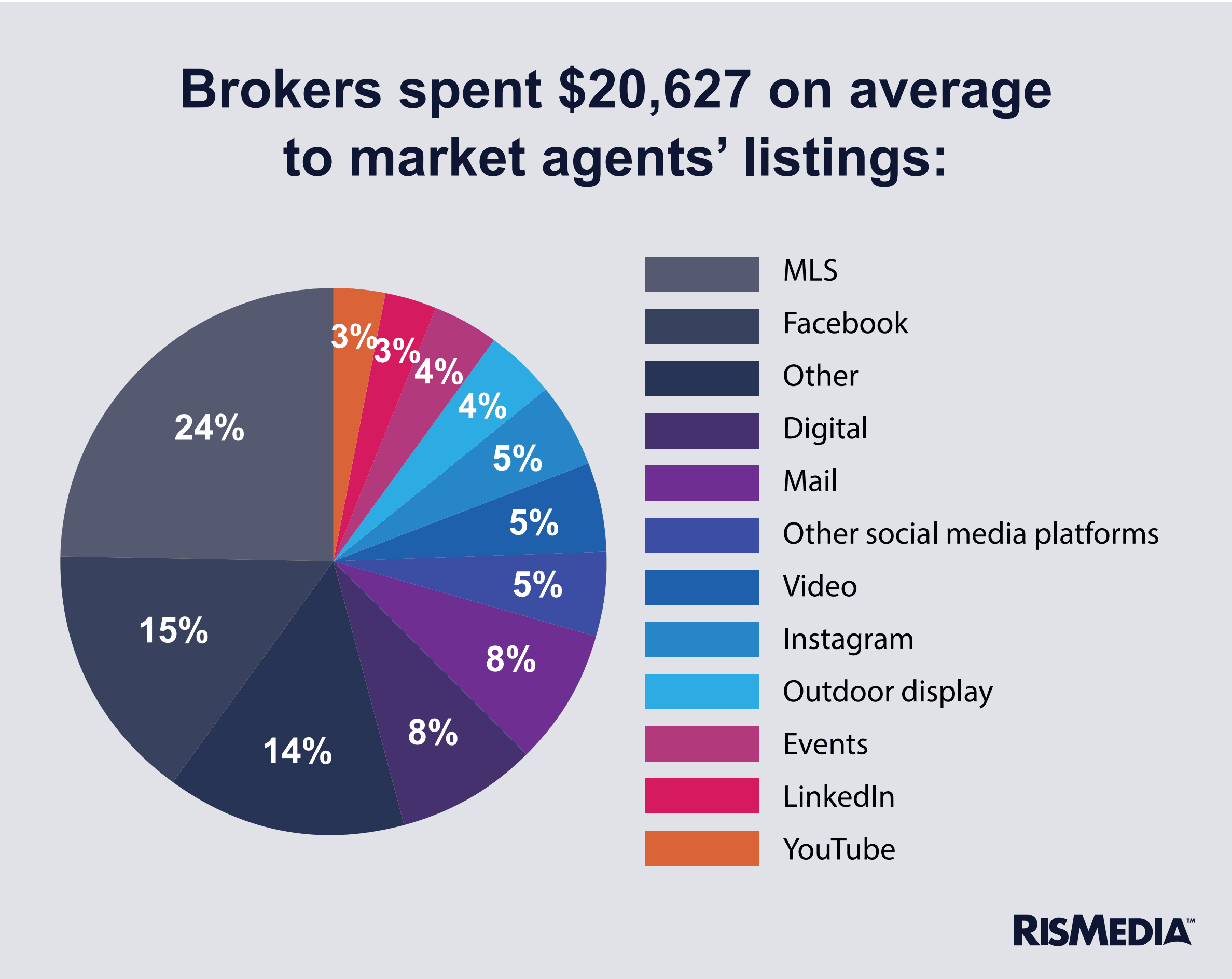

Looking at where agents and brokers are allocating their smaller budgets, there were some other major shifts from the previous year. When marketing listings, agents spent a higher proportion of their budgets on social media in 2023, almost 22% (up from 17% in 2022). Facebook made up a majority of that, with agents spending 14% of their overall budget on that platform, followed by 4% spent on Instagram marketing.

Spending on MLS marketing and digital fell slightly from 2022, with agents spending 20% on MLS and 9% on digital—down 4% and 3%, respectively.

For their personal brands, there was relatively little change among agents. Social media remains the biggest expenditure for agents to promote themselves, accounting for 25% of their marketing spend (and 60% of that going to Facebook). Events gained slightly in popularity, up 2% to 9% of total budgets.

The biggest variable in where agents choose to market appears to be age and experience. Younger agents (aged 18 – 54) were more likely to spend money on events and social media platforms other than Facebook (YouTube, TikTok and Instagram, in particular). More experienced agents (those with 15 or more years in the industry) spent significantly more on print advertising and mail compared to new agents, with more than a fifth (21%) of their budgets going into mailers.

A simplistic interpretation of this would be that older agents are not as savvy with digital marketing, social media or other channels that rely on technology, and that experienced agents are set in their ways and continue to market the same way they did decades ago. But there is some evidence that this isn’t the whole story.

Experienced agents are actually more likely to invest in marketing their personal brands on Facebook compared to those new to the industry. They are also more likely to market themselves with digital advertising, and spend more on content marketing than new agents. Agents 65 and older are also spending the same on SEO and content marketing for their personal brand as younger agents, and spend more on LinkedIn.

That would indicate that these more seasoned agents differentiate how they market their personal brands from other types of advertising compared to younger, less tested agents, who rely broadly on the same channels for most of their efforts. It is hard to say without more qualitative data why this is, but it seems clear that older agents are choosing traditional marketing channels more thoughtfully compared to younger agents.

For listings, experienced agents spent far more on MLS, 23% of their budget compared to 13% for those new to the industry. Overall, younger agents were more likely to spread their listing marketing dollars across a broader spectrum of channels compared to older and more experienced agents. Regionally, agents in the South and West preferred digital ads for listings (spending 10% of their budgets there compared to around 6% for the Northeast and Midwest), and print was less popular in the Midwest, with those agents dropping 4% – 6% less of their budgets there.

Surprisingly, what type of company an agent worked for didn’t seem to make much of a difference in where they spent marketing dollars. Those at national franchises spent more on print to market their personal brand, a little over 14% of their budgets, compared to 10% for self-employed and 12% for independents. National franchise agents were also more likely to spend on mail to market their listings.

Region also made a major difference in where—and how much—agents were spending, with trends and disparities that offered little in the way of surprise. Agents in the West spent more than double what other regions did on marketing personal brands—$11,300 on average. Agents in the West also spent more on video, content marketing and digital compared to other regions.

This seems like an obvious reflection of the type of markets in the West—more expensive, luxury homes and a greater emphasis on lifestyle.

Region also made a difference in who covered marketing costs, with the West and Northeast having brokers cover more of those expenses compared to the Midwest and South.

Interestingly, the Midwest was least likely to rely on social media compared to the other regions, accounting for about 6% less of those agents’ budgets. The Northeast spent more on mail and print, as well as on outdoor displays.

I found the regional breakdowns of marketing dollars and methods really interesting. The info. in the study will help me counsel my agents as they adjust their 2024 plans.