Back in April 2019, attorneys representing a putative class of recent homesellers filed what would come to be known as the Moehrl lawsuit in Illinois. Around six weeks later, another law firm filed a largely identical lawsuit in Missouri. Quickly drawing interest both inside and outside the industry for its (somewhat) novel claims regarding real estate antitrust, many saw these lawsuits as existential threats to real estate practices, with pundits speculating that the real estate industry could be forced to transform, or shrink significantly.

Fast forward five and a half years. Agents and brokers are grappling with what was once unthinkable to many—most notably, compensation removed from the MLS, though many other decades-old precedents have gone by the wayside as well.

What, specifically, though, was supposed to happen if the plaintiffs got their way? One of the biggest worries for real estate agents was that commission rates would drop significantly (although at least some data has shown that rates fluctuate over time).

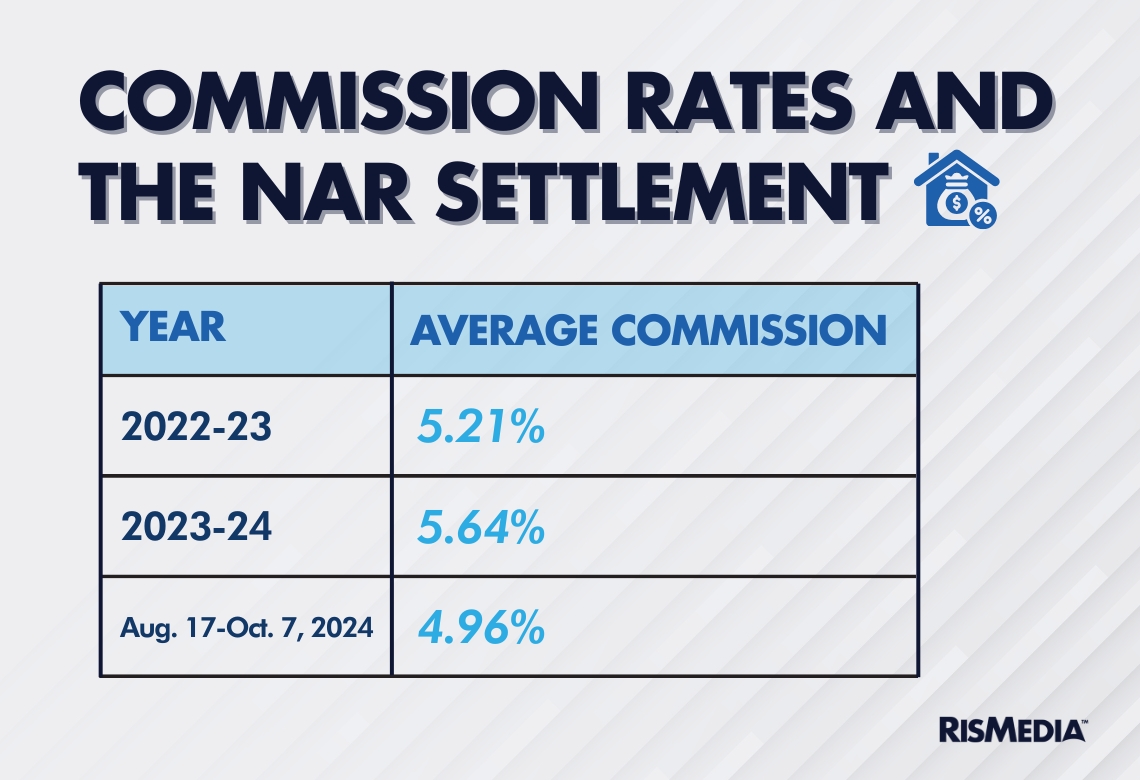

That worry may have been merited, as RISMedia’s survey of more than 1,300 agents and brokers from every part of the country found. Asking agents and brokers to report the average commission rate for buyer and listing agents for transactions over the last month (timed to include only those that took place after the August 17 deadline for policy changes), RISMedia found a drop of 68 basis points (0.68%) compared to the full year before.

That is very significant, translating to a loss of $2,870 in commission on a median-priced home.* This kind of drop also defies other explanations, as it comes after commissions rose between 2023 and 2024, and is a much larger decrease than what most other sources have measured on a short-term basis, with average commissions generally fluctuating by relatively small amounts over time.

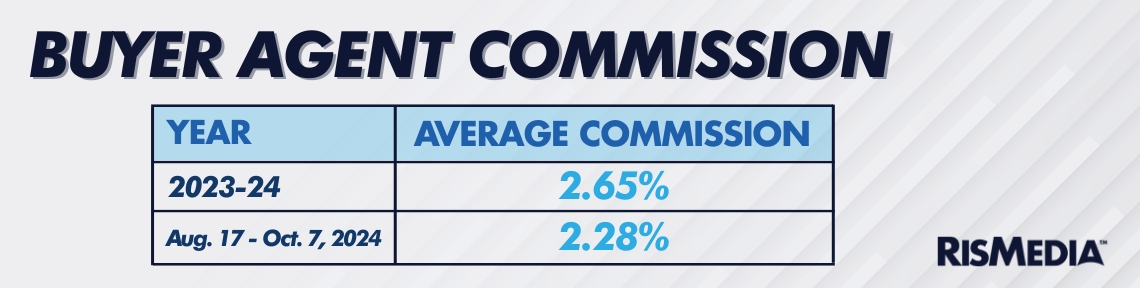

The decrease also appeared to be mostly taken from the buy-side, in line with what would be expected if the drop was catalyzed by policy changes (which were mostly projected to affect buyer agents).

The 0.37% decrease for buyers represents $1,561 out of buyer agents’ pockets per transaction*. There were also other indications in the data that point to buyer agents feeling the squeeze more than listing agents.

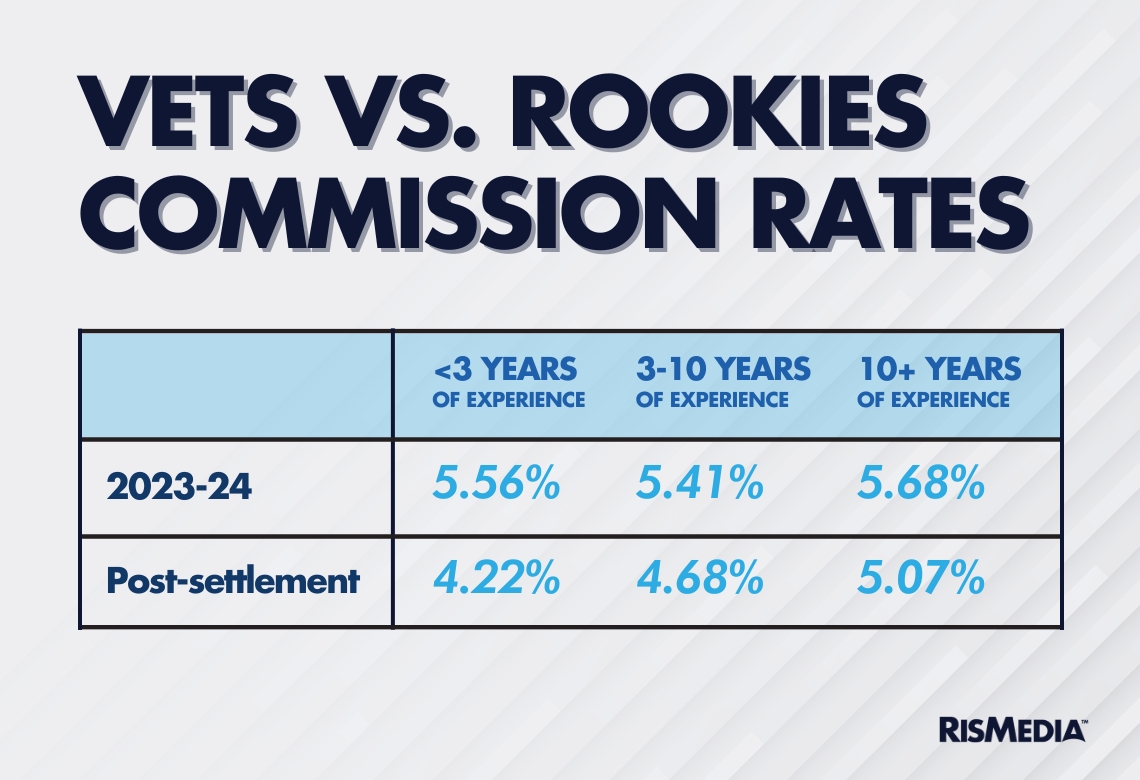

While experience has previously been shown to have an effect on commission rates—despite what some of the lawsuit plaintiffs have alleged—there was an especially large gap in commissions between inexperienced buyer agents (less than three years in the industry) and veterans (those with 10 or more years in real estate).

While inexperienced buyer agents brought in 2.58% on average leading up to the settlement, they only got paid 1.82% post-August 17—more than three-quarters of a percentage point lower. Again, on a median-priced home in 2024*, that is a pay cut of $3,207 per transaction. By comparison, veteran buyer agents only saw a 10-basis point drop post-settlement, from 2.68% to 2.58% (losing $422 on the average transaction).

Inexperienced listing agents were also hit hard, with average commissions down to 2.41% from 2.98% the year before. But notably, experienced listing agents (with 10 or more years experience) took a larger pay cut than buyer agents who had the same tenure. The average commission rates for those veteran listing agents fell from 3.00% to 2.74%.

That result is somewhat incongruous with what was predicted. The fact that experience was not enough to prevent listing agents from lowering their rates significantly, while time in the industry did appear to insulate buyer agents, could be interpreted multiple ways. Possibly, consumers are putting a great emphasis on the value of experience when it comes to the buy side in what is still a seller’s market for most of the country. It is also possible that sellers are negotiating more strenuously with listing agents based on all the recent news of the settlement, and have more leverage due to the current low-inventory environment.

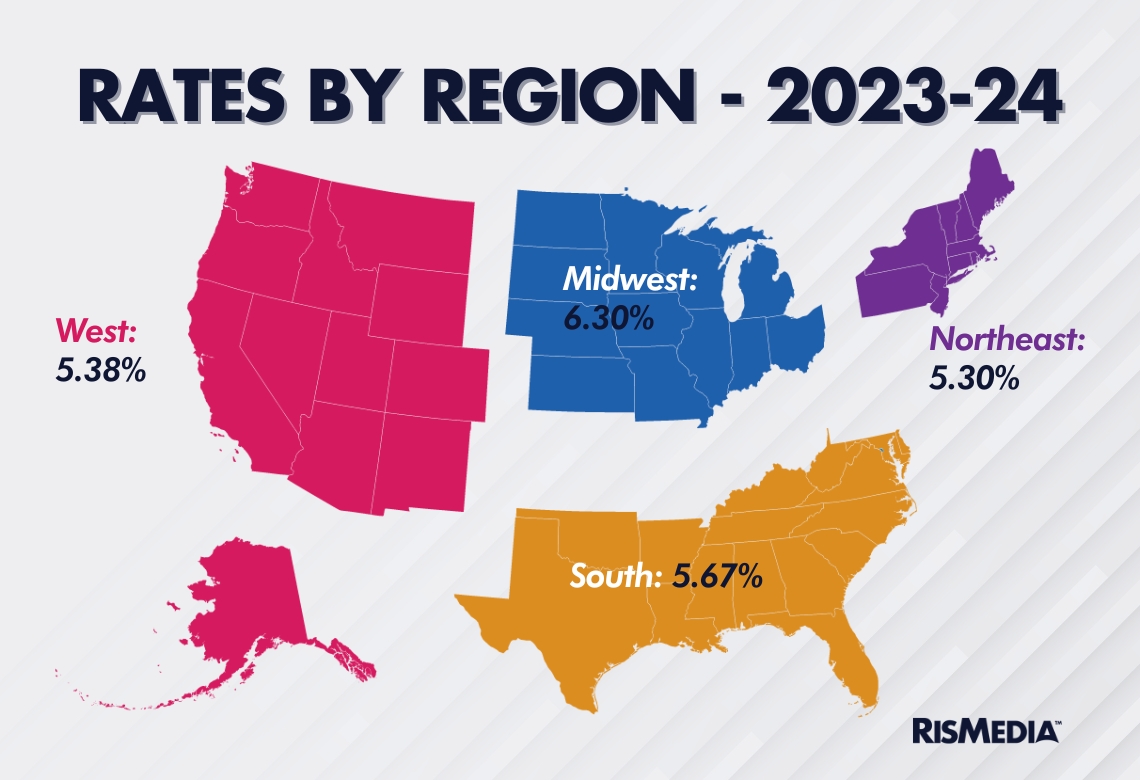

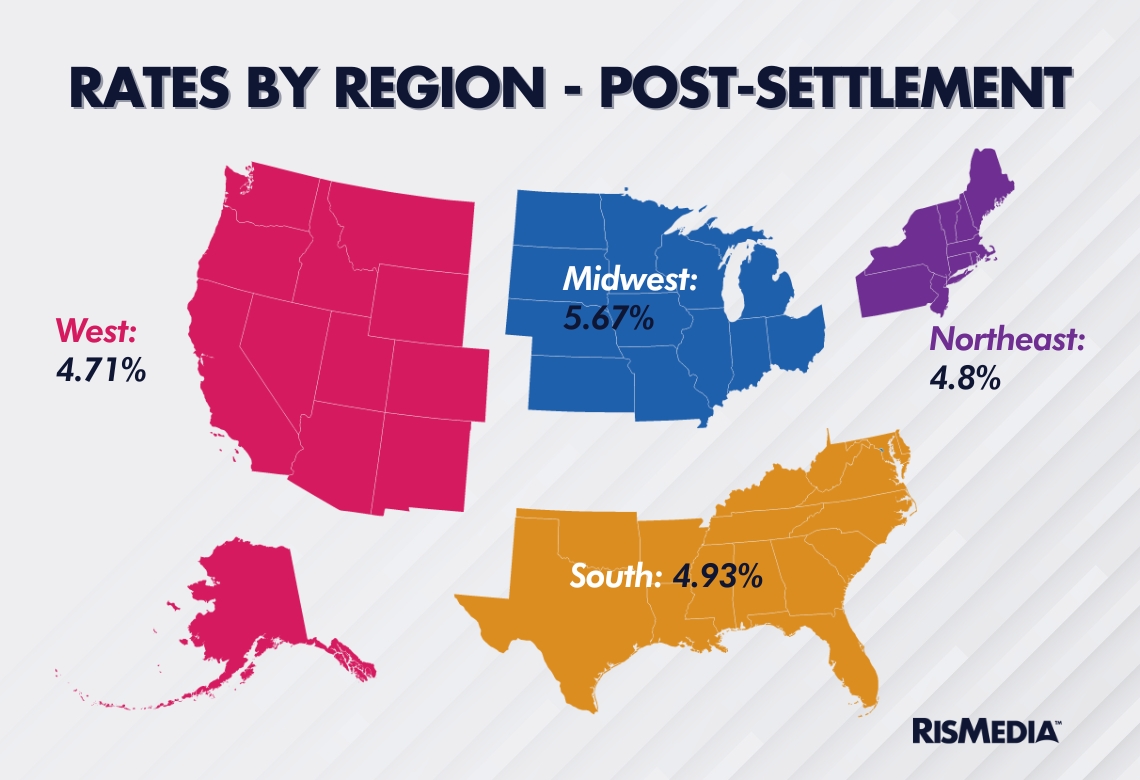

Another notable insight to come out of the report has more to do with region rather than buy versus sell side. In the weeks and months after the settlement, there was speculation that based on local laws and norms, some agents and brokers would be more prepared to negotiate commissions or sign agreements with buyers, and therefore would be less affected by the changes. There are also some significant holdouts to the settlement changes, with MLSs on both coasts not taking part in the agreement.

While the survey did not break down respondents by state, there was a noticeable difference in the drop in buyer commissions in the Northeast.

While buyer agents in the South, Midwest and West took an average hit of 0.39% from their commissions after the settlement, the Northeast saw buyer commissions drop by 0.24%—still significant, but noticeably smaller than the other regions.

It is not fully clear what could have caused this, although many Northeast states (Connecticut, New Hampshire, Pennsylvania and Vermont) had some requirements for buyer agreements before the settlement. MLS PIN, which claims around 40,000 subscribers in Massachusetts, Rhode Island and New Hampshire, was also not party to the NAR settlement and did not implement the changes required by that agreement—though it previously made other changes based on a separate settlement in another lawsuit.

*based on median home price, NAR data from Sept. 2024.

This survey was conducted by a national market research firm on behalf of RISMedia. Invitations were sent to respondents by RISMedia from a database of more than 130,000 real estate professionals and data was collected from a sample of 1,331 individuals between September 17 and October 7, 2024. Broker/owners and other real estate professionals who do not work on a commission structure were terminated from the survey.

So we are working for peanuts, not a good business to be in.

Buyer agents really need to have good approach when negotiating their commissions and don’t have too much window with the seller.

If you have been in the business long enough, you know that way too many buyers just cannot afford to pay commission (regardless of any “approach”). This only means that their agent’s commission will be negotiated into the transaction, and taken out of the Seller proceeds anyway. The entire affaire is a nasty joke on all of us, Buyers, Sellers and Realtors, played by a small group of shrewd people who profited from another meritless lawsuit and settlement.

Exactly!

You are so

right.

you’re absokutley right !

Absolutely, and now we have less transparency. A listing agent knows what commission they negotiated with the seller. However, when you have an interested buyer, who you’ve explained the changes to, they simply ask “what will the seller contribute in compensation?” You call the listing agent who knows, but won’t disclose. They just say oh, just ask in the offer and we’ll see. A buyer can’t run numbers on we’ll see. I’m mostly a listing agent and make sure I explain everything to my sellers including the consequences that can occur by not cooperating, to date my sellers agree to pay. Let’s face it a buyer is paying that commission by paying for the house.

You are exactly right!!!

Looks like I’m moving to the midwest…

I predicted this in 1981 after one year in the business. Ive said it ever since. What in Gods name took so long for ambulance chasing lawyers to make the largest mountain out of a non existatnt mole hill. 41 years ago I said we would all end up being paid like paralegals to be paperwork pushers and people would buy homes from a McDonalds kiosk, and that the only reason we exist is that lawyers dont like to drive people around looking at homes. Well the internet took care of the taxi part of our jobs, and made most local MLS systems a bit useless. or at least not exclusive any longer. Who has profited from these suits and settlements? Lawyers. End of story. Ambulance chasers.

I say continue to work hard and be good at presenting your services and marketings plan. TK

Let’s use our best negotiation with our clients as an example of how we can be great negotiators for them. If you’re able and willing to approach a strong position with buyers and sellers, that demonstrates to them how you are able to be strong and capable for them as well. Showing our clients how “cooperative” negotiation works, will affect our bottom line in two ways.

Very sad that someone that brings an actual qualified buyer would have to take a pay cut ..Time to start cutting attorney fees.

Good Luck with that!

You are right!!

Exactly, also cut title fees, brokerage fees, admin fees etc. Agents put $ out for photos, appraisals, inspections, and even some minor repairs and cleaning – we take a cut and the “vendors” keep their same rate. Perhaps in the spirit of cooperation, they should follow suit.

I think the settlement slowed the industry altogether in sales one it has was confusing, and people froze up, not wanting to show properties. Especially the inexperienced buyers agent. I am strictly a listing agent and I have found that listings are sitting stagnated without a lot of showings, regardless of price drops.

That’s definite;y true!!

This is an insult to agents who have a 20 yr plus record, over 90 million closed transactions. Taking a paycut with all my years experience is insulting and expertise. I have earned my fees! The tears, the hard work, the professional advise. I am really disappointed with this, such a disgrace to agents who have worked their whole career and now making less money. What next???

You negotiate your own fees.

Ridiculous and frivolous lawsuits that should NEVER have been permitted at all. Killing what was once (and hopefully still will be) a great industry. Sadly, many agents now don’t want to be buyers’ agents anymore!!

Many of us have only dealt with sellers regarding commissions regardless of years in the industry. It’s a whole new ball game now.

Why not bring a “class action case” against the Attorneys who tell their potential clients they won’t have to pay any legal fees, when they win the lawsuit!

The folks on the loosing side of a lawsuit won’t pay the winning side’s attorney fees, unless there’s a “prevailing party fee” negotiated before proceeding with a lawsuit!

To be fair, when Attorneys are hired, their client should pay their fee whether they win or loose!

It’s all open and clear who’s paying who and how much!

I don’t see it as an issue. Every agent got a pay increase over the past 3 years due to the rising prices. So, it’s been good for many agents. Regarding the new rules, If the home buyer makes a good offer, most home sellers will pay compensation to the buyers broker. And if not, the buyer must pay. It’s not that complicated. If you are an agent, diversify your business.

Your logic of “every agent got a pay raise due to rising prices” is flawed. Rising prices were caused by Inflation, which made EVERYTHING more expensive, not just housing. And many Buyers do not have the money to pay extra fees for their Buyer’s Agent as, once again, everything (is more expensive. (Title Fees, Insurance Fees, Mortgage Closing Costs).

I agree with you. At first I was very upset and turned off to this business by the change in compensation structure; however I have been seeing that we can actually do better now as agents if we are good at our jobs. We can demand 3% commission from our seller for all our marketing efforts, advise them to give out buyer agent compensation in order to maximize foot traffic and showings. If not, the buyer’s agent can easily negotiate their commission in the contract. There are always new ways around an obstacle if you step outside the box and your comfort zone.

We can’t demand anything, its all driven by supply, demand and negoatiation no matter how good you are or how tenured.

We cant demand anything. Thousands of hungry real estate agents are out there as alternatives. I even see ‘non agancy’ MLS members who will list a home for $250. All the ‘help sell’ types have come out of the woodwork. ANd not to demaen our profession, but a real estate transaction is not brain surgery. How is one better or worse then another—except an agent who doesnt know or obey the laws and rules? We all should pretty much be the same. And come on—NEGOTIATING?? Really? Again a transaction is rarely brain surgery but some may not be standard. I sold a home once and the seller was growing potted special plants to be shipped to another country. The buyer wanted some of them so we started negotiating the number. My part in the negotiating was simply going back and forth with the offers and answers. Big deal. How many of you have saved a weakening transaction with your negotiating skills? Id like to hear about it.

I wish the media would report on the irony of the situation. After the plaintiff’s decided they did not like how it felt to have the commissions coupled together, sued the entire real estate profession. After they have changed how the entire country conducts real estate business, they announced they started a “flat fee” company that will revolutionize the real estate industry. Well welcome to the industry. Real estate has so many different models and the “flat fee” service model is nothing new. Good luck my friends.

Good data points but still too early to start making judgements. Our team has been in practice since 2001 so we’ve seen many changes over the years. Personally, I’m excited about the path forward in representing buyers; our comp is no longer determined by someone else. We are able to set ourselves apart and demonstrate better value. We haven’t experienced, allowed, or accepted any material commission reductions. In fact; I think this whole thing is helping our business standout. I think the reductions and discounts will continue and work themselves out of the system. I’ve done the math and it’s hard to sustain and grow a practice with commission rates that go lower than 2.5% to each side or somewhere between 5-5.5% total. Prices may be increasing but so are all of our expenses so trust we’re not getting any raises by default of increased prices. Having a complete and comprehensive understanding that a buyers agent commission is no longer the sellers responsibility is important and a critical piece of understanding how to position our value to our buyer clients. Those that continue to discount and drive comp lower will continue to drive quality and effectiveness out of their brand, practice, and business. There is always room for high quality and full service professionals.

As a lister, it’s much easier to get 3% than 6%(or 5.5, or 5, 4.5). The pocket listing guys are usually on the lower end of that scale, but never in the Seller’s best interest to limit exposure.

Yes, some shrewd attorneys saw a payday in this industry, a pretty big target. We put ourselves here as we are mostly independent contractors with our own untrained or bad actors. NAR tried to corral us with a code of ethics and clear cooperation as the industry evolved, but it wasnt enough.

So let’s get trained, remember that the client’s best interest is our focus, and stand for our value as Realtors.

And maybe cut out those who prey on our hard work for their own sole benefit through free syndication.

Most of Buyers Not really want to pay commission to their Real Estate Rep. except if the Agent is doing a professional job

There are so many great agents on both the buyer and seller sides of the potential transactions that really have to come to grips with the new rulings and try to work together on each deal. Both agents have expenses to cover in each transaction. Buyer agents need to understand that the seller agents have advertising expenses to cover. Real dollars to recover.

Seller’s agents need to understand that most buyers agents now buy their leads from a third party! Real dollars spent just to find a buyer!

Why can’t we all work together on every deal to just figure out what the total commission can be collected from both seller and buyer and agree to split it equally? That gets the deal done and both agents learn to work together for the common goal! A SALE!

Let’s put the sale/purchase first!

I would like to see your feedback on this IDEA of a common Goal! CLOSING QUICKLY!

Jim

In PA we have had buyer agency since I have been in the business. I never showed a house to a buyer without a contract with them. It didn’t have to be for year . You just met these people. I always have buyer needs analysis meeting with the buyers before I show any homes and they have to be totally preapproved before we start looking . That is not what most agents do . I have ran some big offices and have seen so many contracts with everything dated the day the agent wrote up the contract. Big mistake. In PA that means you were on the sellers side the whole time during showings and all discussions . You get paid for the value you bring to the table. . On the listing side with NAR messing with the MLS, which was a mistake, you tell the sellers how this is all going to work . Agents are going to call me and ask if they are offering a commission . If I tell them no, the chance of that agent showing their property is diminished. So maybe we adjust the price to make it a win win and sell their home. Which is the whole point of hiring me. My advice and knowledge. Compare that to FSBO, what do you do? I tell the FSBO which are not many of to start with , for you today I will handle the whole transaction for both sides and only charge you 4%. They always take that offer after I explain all of the things that need to be done to get to the settlement table. The MLS rule should be reversed. That helps no one. Most of the agents don’t even answer there phones on the first shot. 90% of agents in our business do not have an assistant, which is ridiculous . They spend most of their time in the 80% do the stuff, which has an hourly cost to it . They don’t think like business people. I have really not seen any real impact to my business except for the hassle of reaching listing agents on the phone. People will pay you if you explain the value you bring to the transaction. Everything is still negotiable, the same as it was before NAR screwed up and did this settlement and messed with MLS . DO your job and you will be alright . Remember 2008?, We survived that!

As a listing agent in Austin Texas I now only negotiate my fee for listing. Listing agreement is only for my fee. I then explain the ‘possible fee’ for a buyers agent depending on strength of the offer/terms of the offer. Then it is up to the seller to decide what they want to contribute to the buyers closing costs which can cover whatever fee the buyer and buyer’s agent have agreed to. I am actually happy with the way things are now (been an agent for 20+ years). I am no longer negotiating for the buyers agent which I always thought was counterproductive to what my fiduciary duty was to my client. Buyers agents need to learn to prove their value just like I do as a listing agent. If I don’t prove my value at the listing appointment then the seller goes with someone that does. Should be the same for buyer’s agents.

2008 was a totally different matter. What NAR did was and is a disservice to anyone who currently has Realtor behind their name. They want us to be the “great” negotiators for our commissions, when they didn’t seem to have a clue on how to negotiate for NAR’s own members, the people who actually paid the $400 million. Nothing that NAR has done has benefited me.

True Martha. NAR seems to fall for whatever or whomever brings a question. How about who will watch out for our needs? Doesn’t seem to be them.

This is my take about this. Most of the country is in a seller’s market still due to the pandemic. That can turn in the near future and if it does, sellers will go back to offering full compensation to the buyer’s agents or they will sit on their properties.

What I don’t get is NAR, hey praise that they are on our side and looking after our best interest. So, taking the compensation for Buyer’s agents away from the MLS. is that taking care of us? NO, they are only taking care of their own interest, they don’t want to be suit again. The only antitrust violation from NAR is forcing us to pay their dues so they can collect money to pay their legal bills, offer no benefits and control the monopoly call MLS. Only state agencies are taking care us thru their lobbyists.