Of all the big changes potentially around the corner, the Clear Cooperation Policy represents the highest profile—and maybe highest stakes—area for real estate markets, practices and fundamentals to shift. After dominating the headlines for much of 2024, in the end, nothing officially changed—although one prominent CEO claimed that MLSs have already stopped enforcing the rule.

But here early in 2025, agents and brokers are being warned to prepare—either for a change or repeal of the policy, or for some further commitment to it—as National Association of REALTORS® (NAR) CEO Nykia Wright recently told RISMedia Founder and CEO John Featherston that she hopes to see the issue “settled” in the next month or so.

But what is Clear Cooperation, and how has it become such a divisive, emotional debate within real estate?

Passed in 2019 and implemented in early 2020, the Clear Cooperation Policy requires brokers to market listings on NAR-affiliated MLSs within one day of marketing them elsewhere (with a notable exception for “office exclusives,” which can be marketed within a given brokerage without going on the MLS).

The policy quickly drew attention on the legal front, with two listing service startups suing NAR, big MLSs and local associations, claiming the Clear Cooperation Policy was designed to suppress competition. The Department of Justice (DOJ) later zeroed in on the policy as part of its broader investigation into NAR—an investigation that remains ongoing. Additionally, Clear Cooperation was used as a prominent, if not primary, point of attack for the plaintiffs in the Burnett case, who trumpeted it as an example of how NAR and big brokerages sought to monopolize markets (with a jury eventually finding defendants liable for $1.8 billion in damages in that case). Specifically,plaintiffs were able to delve into how the policy was conceived and implemented, connecting it to a larger argument that real estate incumbents were violating antitrust laws.

Additionally, Clear Cooperation was used as a prominent, if not primary, point of attack for the plaintiffs in the Burnett case, who trumpeted it as an example of how NAR and big brokerages sought to monopolize markets (with a jury eventually finding defendants liable for $1.8 billion in damages in that case). Specifically,plaintiffs were able to delve into how the policy was conceived and implemented, connecting it to a larger argument that real estate incumbents were violating antitrust laws.

As NAR agreed to change many of the other policies at issue in Burnett (and its many copycats), Clear Cooperation remained untouched. With legal threats still looming, many brokers began calling for NAR to repeal or at least review the policy, arguing that it left the industry vulnerable to more litigation and was not accomplishing its stated goal (although notably, both private lawsuits targeting the policy have now been settled or resolved).

What is that goal? NAR has long touted Clear Cooperation as a way to preserve open markets and ensure accurate, timely, consistent and centralized listing data. Allowing agents to market properties whenever and wherever they wanted could result in fractured markets, the organization has claimed, and would prevent buyers and sellers from accessing all the information they need to transact.

With a decision looming, real estate professionals are preparing for any scenario—as well as debating the foundational principles Clear Cooperation is built on.

The great debate

As part of a panel during RISMedia’s 2025 Real Estate’s Rocking in the New Year virtual event, United Real Estate President Rick Haase asked what might be the most relevant question, independent of Clear Cooperation’s fate:

“People champion the position that they feel is most advantageous to them or their business…who would benefit from eliminating Clear Cooperation?” he asked.

Critics of the policy have argued that it is both agents and their clients—who would theoretically have many more options to market or search for a property—that benefit from ending Clear Cooperation. And at an even higher level, the question related to what is best for consumers has dominated the debate, with both proponents and critics of the policy focusing on what is best for buyers and sellers.

Wendy Civitella, main line regional president for Berkshire Hathaway HomeServices Fox & Roach, REALTORS® and a Rocking in the New Year speaker alongside Haase, said she believed consumers benefit from the policy, but that ending it would be welcome by some in the real estate industry.

“The consumers are the real concern,” she said. “I do think the benefit is going to be the brokerages that try to monopolize and gain marketshare based on…Clear Cooperation going away.”

This “disproportionate” benefit that Civitella warned about bolsters arguments by supporters of the policy, who argue that it puts competing brokerages on an equal playing field (although lawsuits have pointed to the “office exclusives” exception as a loophole that allows big companies especially to hoard listings anyway).

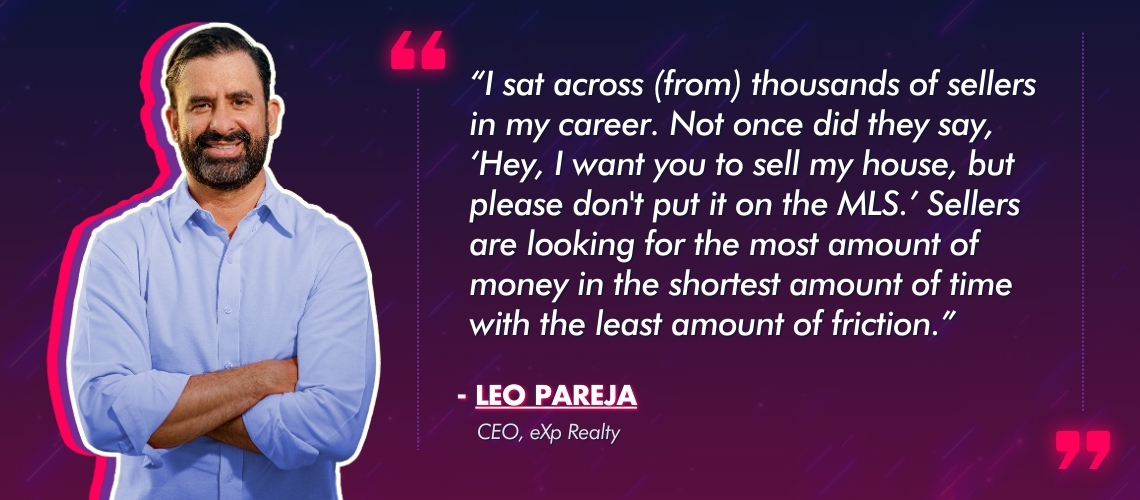

Leo Pareja, CEO of eXp Realty, told Haase that ending Clear Cooperation would “hurt the people who need the most protection,” specifically historically disadvantaged groups trying to buy or sell.

“I sat across (from) thousands of sellers in my career. Not once did they say, ‘Hey, I want you to sell my house, but please don’t put it on the MLS.’ Sellers are looking for the most amount of money in the shortest amount of time with the least amount of friction,” he said.

While that seemingly simple—and universally understood—principle would seem to be something most brokers and agents could support, the fact is, many would like to see Clear Cooperation done away with. Why?

Wayne Bell—licensed broker, lawyer and former California Real Estate Commissioner—said there is one group of agents who have a strong motivation to do away with rules requiring all listings go on the MLS.

“It goes to fiduciary duty. And under case law, real estate agents have a fiduciary duty to their clients,” he told RISMedia. “So the question is, are they being candid, are they being honest…are they saying, ‘Oh, we’re going to get you a better deal through this special little group?’ The reality is—I think if they put (it) on the MLS and they advertise it, they’re going to get a higher price for the homeseller.”

But the “office exclusives” exception in Clear Cooperation appears to undercut this argument in favor of Clear Cooperation, as the policy essentially still allows pocket listings as long as they aren’t advertised on other listing services (something plaintiffs in the aforementioned lawsuits were quick to point out).

Kimberly Harris Campbell, president of the DMV & Southeast Region for Compass—who advocated for “moving past” Clear Cooperation—told Haase and the other Rocking in the New Year panelists that the conversation about whether brokers benefit is missing the point. She also noted that rentals are excluded from Clear Cooperation rules, which she claimed undercuts arguments that the policy is intended to elevate fair housing principles.

“This, at the end of the day, is about homeseller freedom,” she said.

Being able to “pre-market” a property for insights before it goes onto the MLS is something Clear Cooperation prevents, she said, to the detriment of sellers. Experimenting with pricing or other marketing strategies can hurt public stats like days on market, she pointed out, if the listing is required to be on the MLS.

She also repeatedly emphasized that Compass—despite being one of the most prominent critics of Clear Cooperation—is not trying to get listings off the MLS, instead being more thoughtful about how and when by removing a mandatory policy.

“This is not the time for arbitrary rules,” she said. “It’s the time to empower our homesellers.”

If Clear Cooperation were to go away, Harris Campbell said agents should be “empowering” their clients with more options, mostly focused on the aforementioned pre-marketing strategies. That might include gathering interest based on a particular price point before cementing a final listing price, she said. It also helps them avoid accidentally earning the “scarlet letter” of early price drops or more days on market, she added.

Pareja, on the other hand, argued that the eventual result of ending Clear Cooperation was consumers being forced to search through “eight to 10” listing marketplaces where both buyers and sellers miss out on opportunities based on the “sheer complexity” of navigating all those different systems.

How would an agent navigate that kind of world? Bell says it is unlikely they would have to, even with the significant pressure on policies like Clear Cooperation—at least not this year or in the near future.

“I’ve heard people say, ‘I want to create a new MLS where everybody puts (listings) on it, and there will be no controls by NAR, by local associations.’ But I don’t see that happening quickly,” he said. “I do (anticipate) some kind of modifications where they’ll say, ‘You can see certain listings, and we’ll share certain information.’”

The appetite for a bunch of competing listing services might simply not be there, according to Michael Barbaro, president of SmartMLS in Connecticut. Speaking generally about changes to the MLS landscape—including and beyond Clear Cooperation—he said he expected people to try creating new listing services, but didn’t expect these to replace the “open marketplace” of the MLS regardless.

“The idea is if you’re going to change this industry—you have to meet the consumer where they are, and meet the agents where they are, and figure out a way to get them both what they’re looking for without trampling on either one of their interests,” he told RISMedia.

Barbaro said that agents and brokers will be able to tout the “open marketplace” of the MLS regardless of what happens with specific policies, or whether or not consumers are being pushed toward alternative ways to list and market their homes. He adds that some of the portals are already basically capable of converting themselves into a “national MLS.”

And while many buyers and sellers are still heavily relying on the portals for their home search (or in marketing), Barbaro said that even with policies like Clear Cooperation that many see as restrictive, the MLS system offers an alternative, more flexible approach—something that both real estate professionals and consumers can hopefully appreciate.

“The MLS is an open marketplace. It’s a very low bar to entry. Some would argue too low, but that’s okay. That’s what an open marketplace is,” Barbaro said. “(If) I’m the big portal, (I can say), ‘You have to use my home lender. You have to use my insurance company in the future. You have to use my photographer, so I own all the images.’ That’s a closed marketplace that doesn’t benefit anybody except the stockholders of the closed marketplace.”