It is this part of real estate compensation—how much is paid to both buyer’s agent and seller’s agent—that truly determines an agent or broker’s income. Your compensation is primarily a sum of the commission you charge buyers and sellers for your services.

Commissions are also the element most scrutinized by regulators, currently the main focus of a handful of class action lawsuits targeting major brokerages, the National Association of REALTORS® (NAR) and the MLS industry. Acquiring data on what commissions are on average and how (or if) they vary based on region, brokerage or other factors has been difficult for academics or anyone studying the industry.

After adjusting certain data points (some survey respondents reported their portion of the commission, rather than the whole amount split between both agents), RISMedia found that the average commission paid on a house was 5.21%. And while there was a clear concentration toward the industry standards of 5% or 6% (71% of agents and brokers chose one of these two), there was also significant variation across regions and demographics.

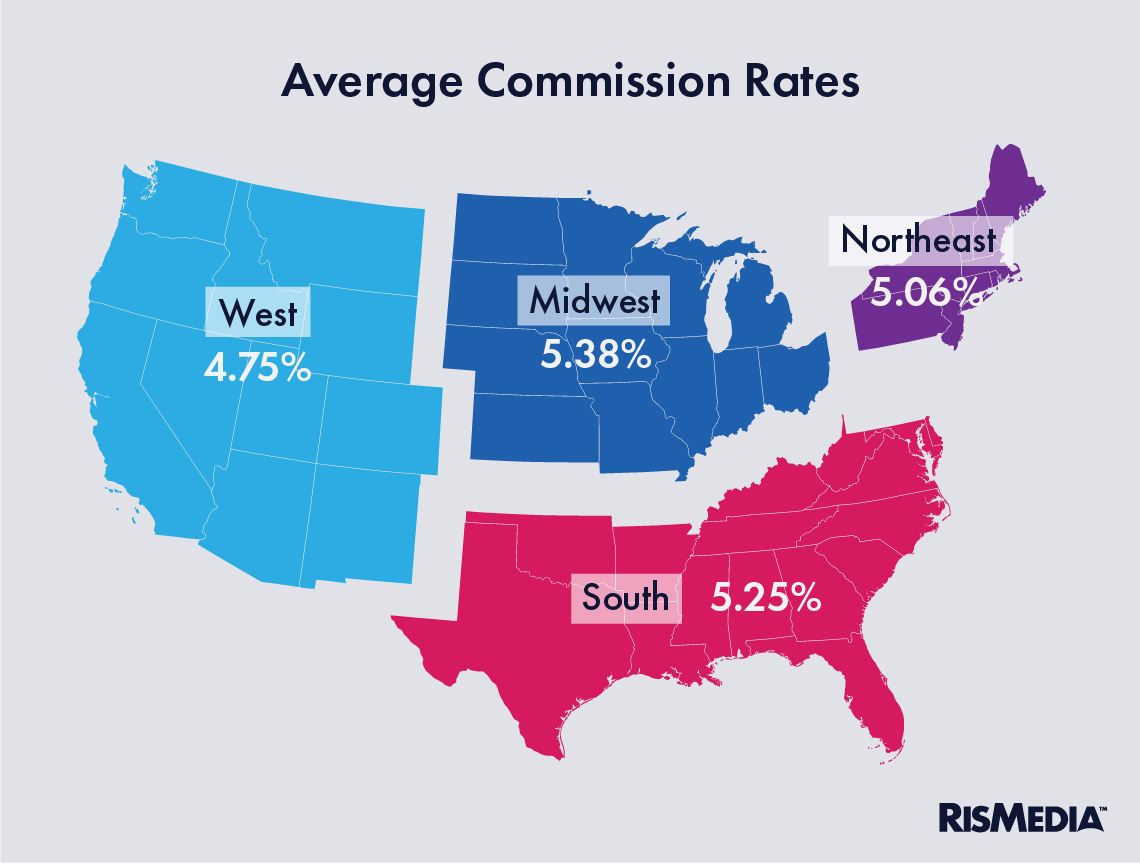

In the West, where home prices are significantly higher, commission rates averaged 4.75%—by far the lowest of any region. For very inexperienced agents, it was even lower—4.51% for those with less than three years in the industry.

The highest commission rates were in the Midwest, at 5.38%, and for agents and brokers with the most tenure, 5.35% (for those with 10 or more years in the industry). The South reported 5.25% and the Northeast 5.06%.

Also very interesting, agents and brokers affiliated with national franchises charged higher commission rates than independents or alternative models. The average commission for brokers and agents working at national franchises was 5.39% compared to 5.05% for independents and 4.63% for other models.

Somewhat surprisingly, those who never went into an office also reported slightly lower overall commissions, 5.01% compared to 5.11%. While that might seem small, it translates to a roughly $250 difference in commission on a median-priced house today. At the average number of transactions—which was 22 last year—agents who went into the office at least occasionally made $5,500 more in commissions than those who never did (though as mentioned in Section 1, remote agents were more likely to have a better split, potentially offsetting this).

One other variation—women reported significantly higher average commissions than men, 5.33% compared to 4.99%. While women and men also reported nearly identical splits, women were involved in far fewer transactions than men, reporting 20 on average compared to 27 for men.

Much of the scrutiny by regulators and consumers related to commissions has focused on whether they truly vary, in an industry where price fixing had been common and overt for decades. This study would seem to suggest that they do—in the West, agents and brokers charge less because homes are more expensive, and less experienced agents charge less because the value of their service increases with experience.

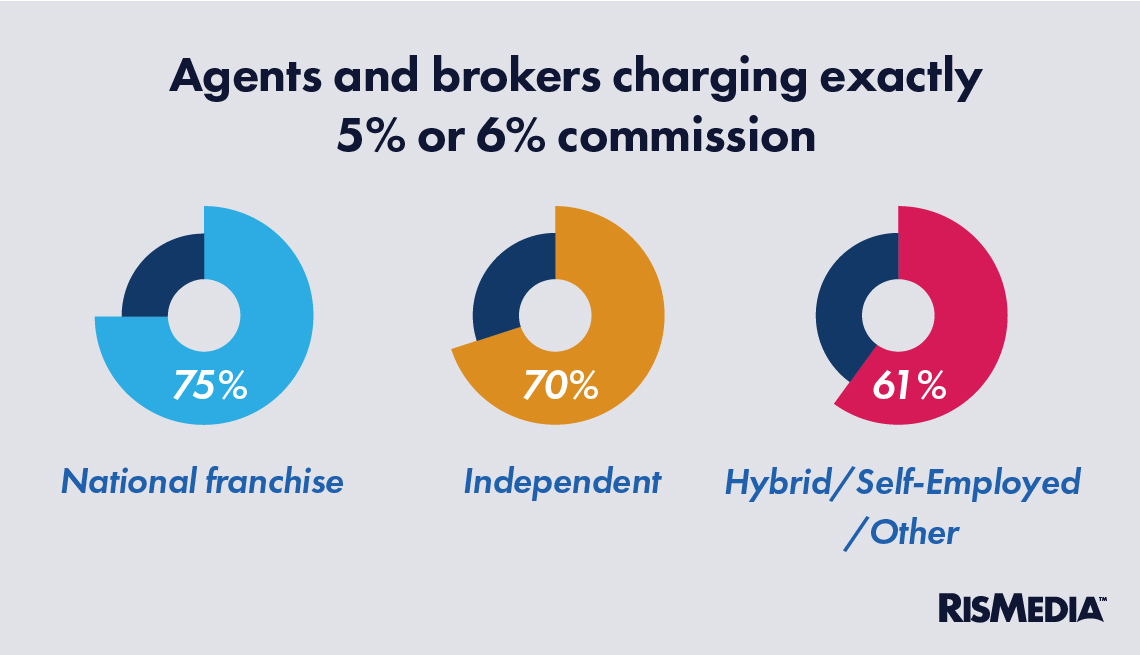

But the concentration of agents and brokers reporting commission at those exact 5% or 6% levels could be interpreted to mean that the industry is still structured to be less flexible or variable with market conditions. Regardless of brokerage affiliation and industry experience, around 70% of agents and brokers reported commissions at one of those two levels (though national franchises were slightly more likely to stick to 5% or 6%, with three-quarters of those agents saying they did, and hybrid/self-employed brokers and agents were less likely, at 61%).

Region, however, did strongly affect the likelihood of an agent reporting exactly 5% or 6% commission. In the West, for instance, only 60% of agents reported those rates, while in the South, almost eight-in-10 (78%) did.

In the Midwest, 72% selected one of these two rates, and in the Northeast, it was 66%.

How or if commissions will change based on ongoing lawsuits remains unclear. Critics have suggested that having buyer commission displayed on the MLS encourages “steering” and discourages agents from offering lower, more competitive rates to consumers. Some of the lawsuits have alleged that the way buyer-seller compensation is structured is inherently anticompetitive.

When and if any changes are implemented in response to these pressures, it will require more iterative data to see how real estate compensation is affected.