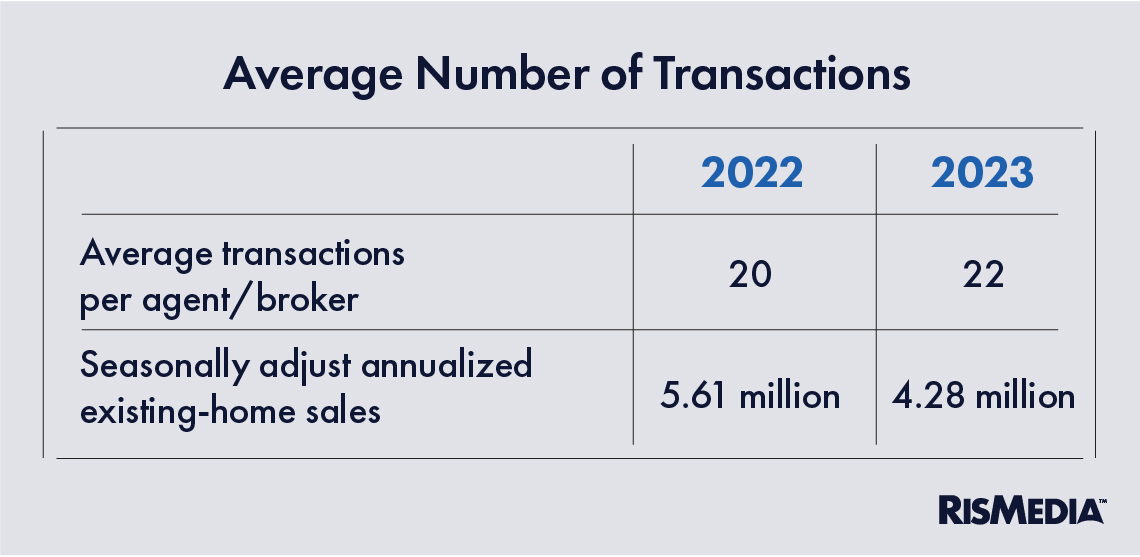

Finding clients and making deals is obviously the foundation of a real estate business, even as many other factors can affect your final income. Somewhat counterintuitively, the average number of transactions agents were involved in this year rose slightly, from 20 to 22, even as overall home sales shrunk.

Likely, that is an effect of the shrinking pool of active real estate agents. NAR has reported losing nearly 70,000 members since late last year, and most observers expect many more to leave the industry.

Who is getting the most transactions this year? Those working for hybrid, alternate models or who are self-employed—by a good amount. These agents and brokers were involved in an average of 30 transactions over the past 12 months. More than one-in-10 (13%) claimed 100 transactions compared to 5% of those at independents and 4% at national franchises.

Experience, like in most things, did have an effect on transactions closed—more on the negative side than the positive. Agents with three or less years in the industry closed only 16 transactions on average, while those with 10 or more years of experience closed slightly more than average—23 over the past 12 months.

Unsurprisingly, inexperienced agents were much more likely to have closed only a small number of transactions—almost three-in-10 (29%) reporting that they were involved in two or fewer transactions. Only 5% of agents and brokers with more than three years of experience reported less than two transactions.

In terms of brokerage model, self-employed or alternate model agents and brokers were slightly less likely to report low transactions—less than 10 over the last 12 months. Under a third (30%) reported this low level of transactions compared to national franchises (37% with less than 10 transactions) and independents (35%).

Another important factor in how many transactions were closed was office time. Those who never went into the office slightly underperformed the average, closing an average of 19 transactions. Those who reported at least some office time were slightly above at 23.

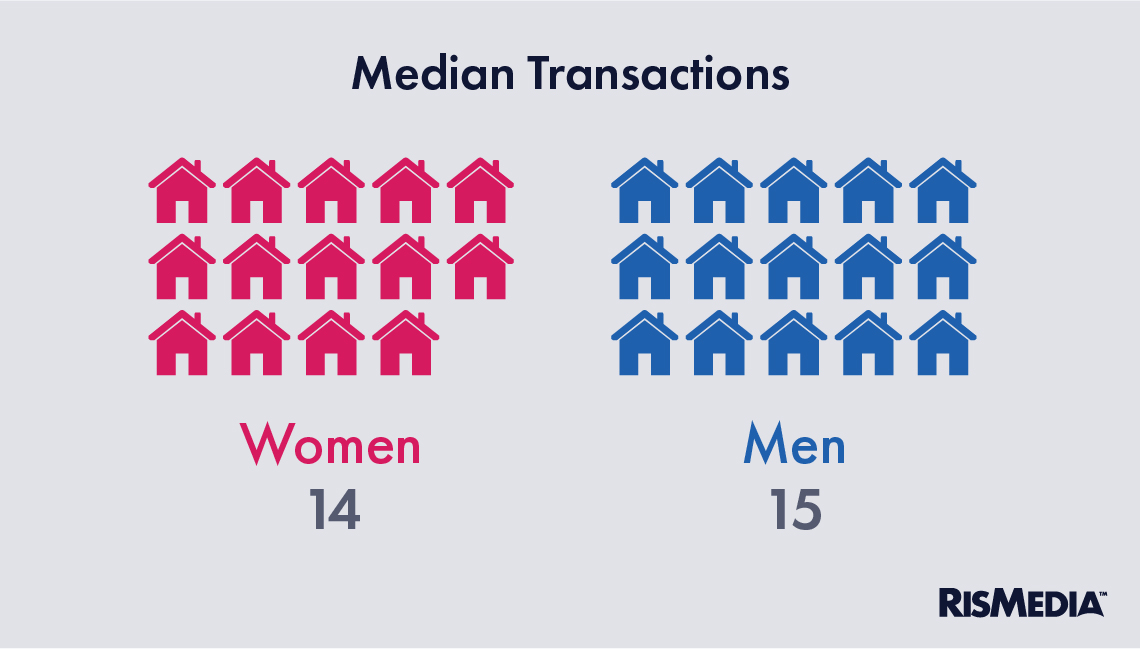

As mentioned in the previous section, men reported more transactions than women by a large amount—27 to 20. One in 10 men (10%) reported 100 or more transactions compared to only 4% of women, which skewed the average somewhat. Twenty-seven percent of men reported having less than 10 transactions last year compared to 33% of women. The median number of transactions was roughly the same—14 for women, 15 for men.

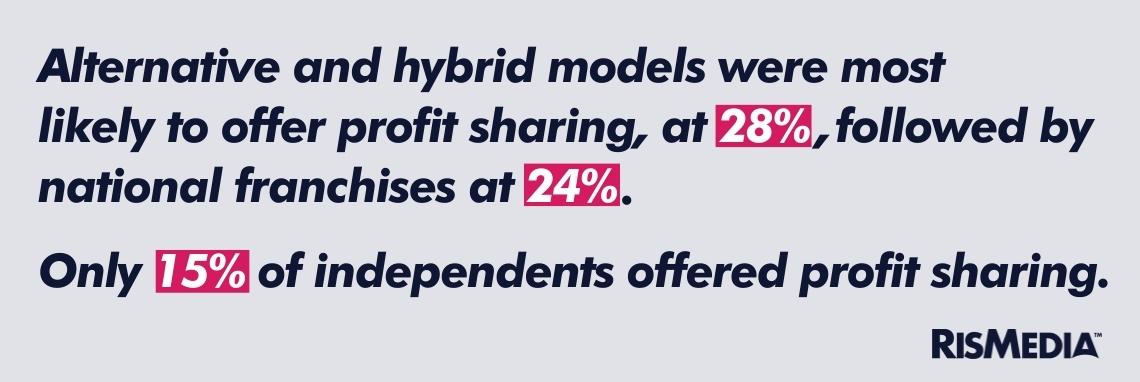

Besides transactions though, there are other ways real estate agents and brokers can boost their compensation. Profit-sharing has been around for a long time in real estate, but has gained increased attention as brokerages like eXp and Keller Williams grew their footprints over the last decade.

Only 21% of agents and brokers overall said they currently worked for a company that offered profit-sharing—but that varied considerably depending on age, brokerage model and experience.

A whopping 71% of agents aged 18 to 34 said they were affiliated with a brokerage that offered profit-sharing—more than triple the overall average, and five times more than those 65 and older. That provides strong evidence that the younger generation of real estate professionals are interested in this type of perk, or are at least joining the kinds of companies who offer and advertise it.

The difference between brokerage models was not quite this dramatic, but still significant. Alternative and hybrid models were most likely to offer profit-sharing, at 28%, followed by national franchises at 24%. Only 15% of independents offered profit-sharing.

Regionally, there were relatively small differences. Almost a quarter (24%) of brokers and agents in the West reported working for a profit-sharing company compared to less than a fifth (18%) in the Northeast. In the South and Midwest, 21% of agents and brokers reported being part of a profit-sharing enterprise.