Especially for those newer to the industry, fees can be just as much of a factor in your compensation as splits. As splits decreased from last year, fees have increased—again, affecting all regions and demographics to some degree, but hitting certain agents and brokers particularly hard.

The average total of all annual fees—technology, desk, marketing, etc.—rose by $243 from last year, to $1,115. That translates to a massive 28% jump. Only 16% of those surveyed this year said they pay no fees to their broker compared to 20% who said the same last year.

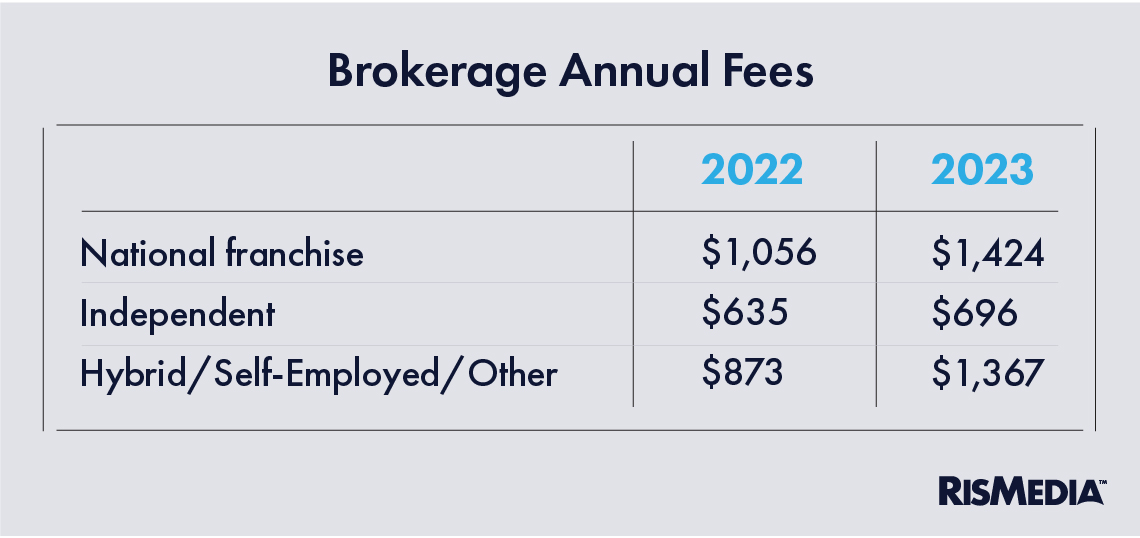

Unsurprisingly, national franchises still charge the highest fees—an average of $1,424, more than double what independents charge ($696 on average). Brokers and agents at national franchises also saw a larger increase from last year compared to independents—up $368, versus a $61 increase at independents.

But alternate models—hybrid, self-employed or other types of businesses—saw the biggest increase from last year, with agents and brokers paying $494 more per year. That is a staggering 57% increase in fees, and people working for those companies are now paying $1,367 on average.

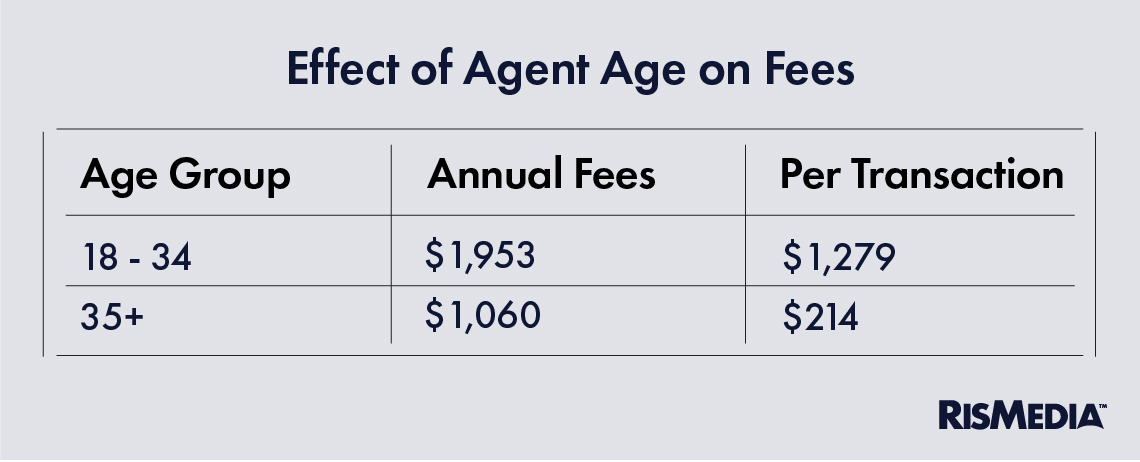

Besides the type of company, age was the second biggest factor determining the amount of fees brokers and agents paid. Those aged 18 to 34 paid almost double what people 55 and older had to dole out in annual fees—$1,953 compared to $1,028.

For the younger cohort, the increase from last year was over $1,000—more than doubling how much they had to pay per year for tech, marketing and other services. For older agents and brokers, the increase was less extreme but still significant—a jump of $225.

One of the more difficult things to parse out regarding fees is the mix of transaction-based deductions and annual charges. Most agents paid some transaction fees and some annual fees, with all transaction-based fees averaging $283 this year (up from $211 last year). Agents and brokers who were involved in an average number of transactions (which was 22 last year) paid $6,226 in transaction-based fees.

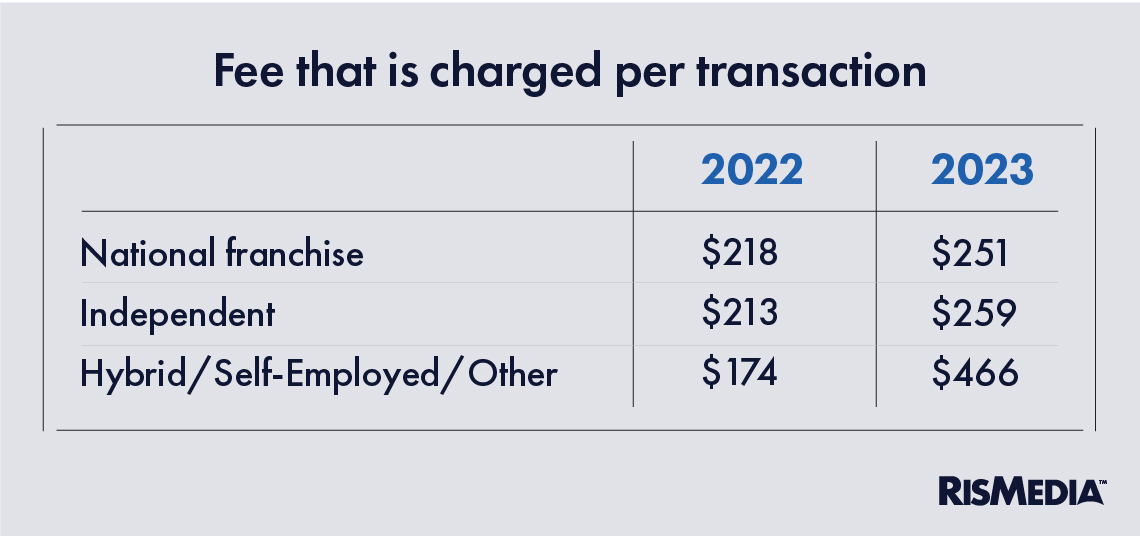

When looking at transaction fees (meaning any fee charged per transaction), national franchises did way better compared to the annual fees, charging less than the overall average at $251. That is still an increase from last year, when the average for national franchises was $218, but a smaller increase than what other models saw.

For those at independent companies, the average fees paid per transaction totaled $259 this year, up from $213 last year. For alternate models and hybrids, the shift was much more significant—going from $174 to $466 per transaction—a 268% increase.

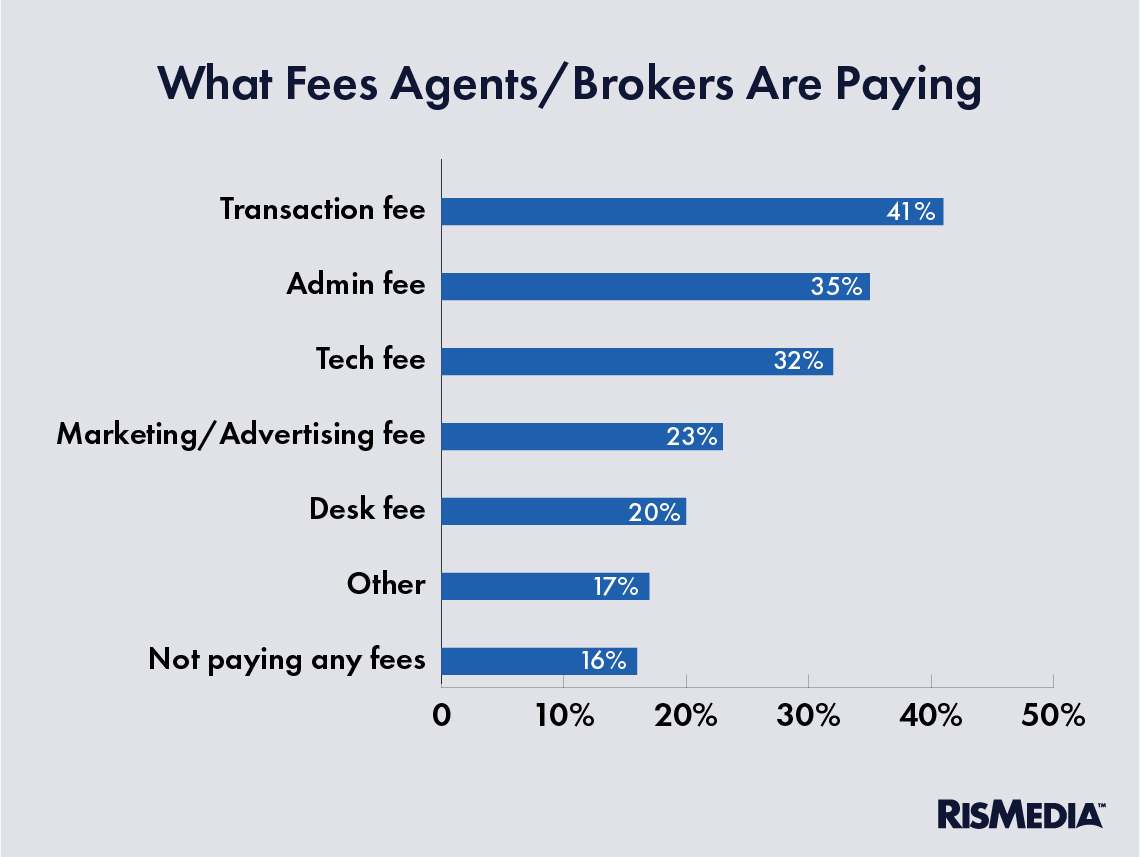

As far as what agents and brokers are being charged for (both per transaction and annually), the transaction fee was most common, with 41% of agents and brokers shelling out money just for the transaction. Only 20% of agents paid a desk fee, both roughly the same proportion as last year.

Those who said they worked fully from home and “never” went into the office paid many of the same fees as those who worked from an office. The exceptions were (of course) desk fees, which remote workers paid 14% of the time, with 22% of in-office workers paying those fees. Less obviously was marketing fees, which only 10% of remote workers paid (compared to 25% of in-office workers).

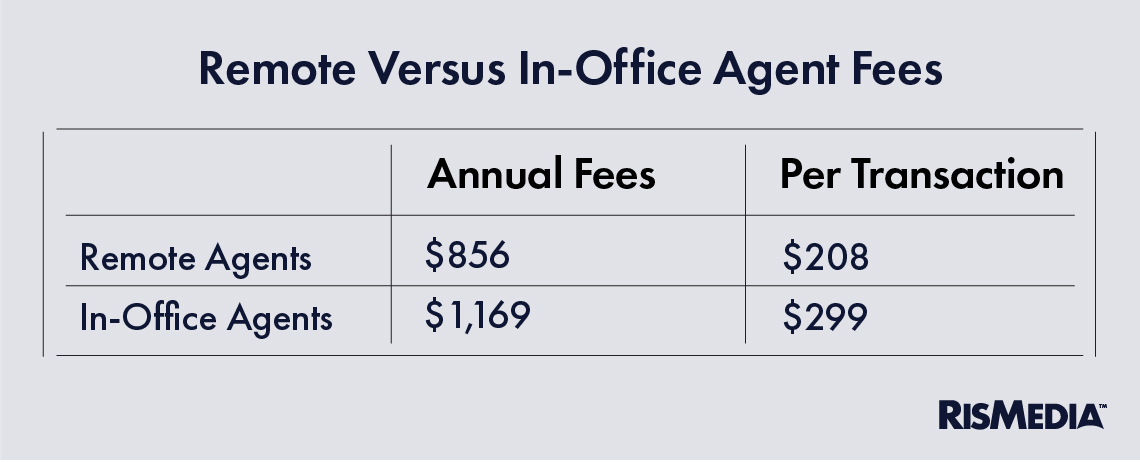

But remote workers pay less overall—by a significant amount. The “never” in office agents and brokers paid an average of $856 in annual fees compared to $1,169 for those who do go into the office. Per transaction, remote agents pay $208 compared to $299 for in-office agents.

Regionally, those working in the Midwest were more likely to pay nearly all types of fees, while the Northeast was less likely to have fees (marketing fees being the exception). Agents and brokers in the West and Midwest were far more likely to pay a technology fee compared to other regions, while the West more often charged administration fees.

But generally, it was hard to find a region or demographic that wasn’t paying at least some fees, even though brokerage model or experience correlated with a decrease in the amount paid. Brokers and agents with more than a decade in the industry were just as likely to pay most fees (marketing/advertising fees being the exception, which 13% fewer veteran agents paid). More experienced agents were also more likely to pay desk fees compared to less experienced ones.

Another fee that isn’t necessarily paid to a broker or company is the referral fee. Those remain almost identical to last year—hovering right around 25% as an overall average. And there was almost no variation across most demographics and regions as far as the standard pay-out for a referral—only very young and/or inexperienced agents paid less (around 20% for 18- to 34-year-olds or those with less than three years of real estate experience).