Before even talking about ROI, it is vital to understand your own goals with any marketing investment. What are you hoping to track, and how? Not every marketing campaign or channel is going to offer an easily visible or measurable result, but that does not mean it isn’t working. And while some agents are comfortable doing their own, in these cases, does a marketing coach or survey make sense for an agent, or is it worthwhile for brokers to get into the weeds on measurements and metrics?

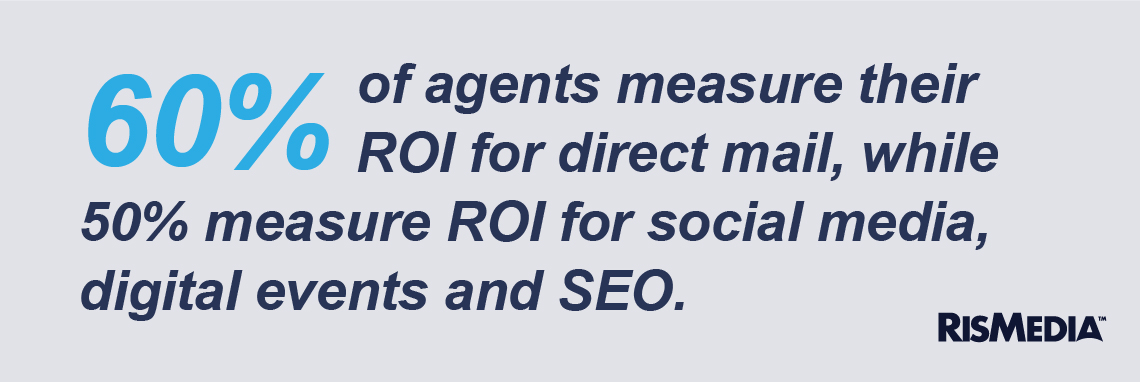

The answer is, it is worth it for some. Just under two-thirds (64%) of agents measure ROI, with 60% saying they measured ROI for direct mail and about half measuring it for social media (50%), digital (49%), events (47%) and SEO (48%). A little under half (45%) of brokers measure ROI of their contributions to agents’ marketing. Men were much more likely to measure ROI than women (50% to 35%) and younger brokers also measured ROI more often than older brokers (52% for ages 18 – 54 and 31% for 65 and older).

A majority of brokers who track ROI use lower-tech tools such as spreadsheets or readily available SEO data. Other brokers cited Google Analytics, kvCORE, Wise Agent and HomeSmart’s RealSmart Agent. One broker cited “regular math,” while another said they use a Facebook template.

Agents were even more loose with the measurements of ROI—although only 21% of agents said they did not measure ROI at all. Referrals were the No. 1 way agents measured their marketing ROI, with 55% of agents saying that was a way to track marketing success. Only 5% of agents used QR codes, while just under half tracked new listings (48%), new leads (49%) and buyer transactions (49%).

As far as tools, Excel was the most common software used to track ROI. Others mention QuickBooks, Wise Agent, Google Sheets, various brokerage-specific software, Top Producer and Facebook Analytics. A handful of agents admitted they had no proper tools for tracking ROI, while many others said they simply used calculators, paper or memory.

Only 23% of agents said they used a professional marketing coach, though agents in the first three years of their careers were significantly more likely to have a coach (40%). Agents in the West were also slightly more likely to use a coach, with 28% in that region saying they did.

Four in 10 agents said the majority of their leads are generated organically. Eleven percent claimed all their leads were organic, while about one in 10 (9%) said that less than a quarter of their leads were organic. More than a third of all agents (35%), however, said they do not know what percentage of their leads were generated organically. Agents in the West and the Midwest, and agents 65 years old and above, were more likely to be unsure of their organic lead generation.

As far as what tools brokers are offering their agents, CRM and branded websites were the most common, with 53% of brokers making these available. Forty-eight percent offered lead generation tools, while 41% provided professional coaching, and 38% had branded social media for agents. One in five brokers said they provide no tools to their agents.

Unsurprisingly, national franchises are incredibly more likely to provide these tools. Close to nine out of 10 (89%) provide CRM compared to 45% of independents and 28% of hybrid/self-employed brokers. More than 80% of national franchises provide branded websites, lead generation and professional coaching. Only about 45% of independents provided branded websites or lead generation.

Age, experience and sex did not affect what tools were offered to a significant degree. Midwestern brokers were more likely to offer tools—in particular CRM, 25% more than the South or West. Brokers in the West were far less likely to provide professional coaching compared to other regions, while Southern brokers were less likely to offer social media.