Consolidation is an ongoing trend in business, and real estate is no exception. In fact, the industry is rife with mergers and acquisitions as a means of creating greater efficiencies and expanding a brokerage’s footprint within its own market, as well as new ones.

One of the most acquisitive firms on the market today, United Real Estate has executed a series of substantial M&As in recent years. For example, in April 2022, United Real Estate Group and Platinum Realty merged, creating a 20,000-agent powerhouse nationwide.

Rick Haase, president of United Real Estate, reports that the company’s strategy of attracting regionally dominant, independent brokerages in key markets has proven successful.

“United truly understands the future of real estate brokerages and has built an incredible platform for expansion,” he says. “The commitment to clearly see the changing landscape and consistently drive innovation to become a market leader is a perfect fit with my strategic perspective. We will intensify our execution and innovation as we bring increasing success to our agents and their clients.”

According to Scott Durkin, CEO of Douglas Elliman, acquisition brings many benefits to smaller brokerages and their real estate agents as they evolve from salespeople to real estate advisors.

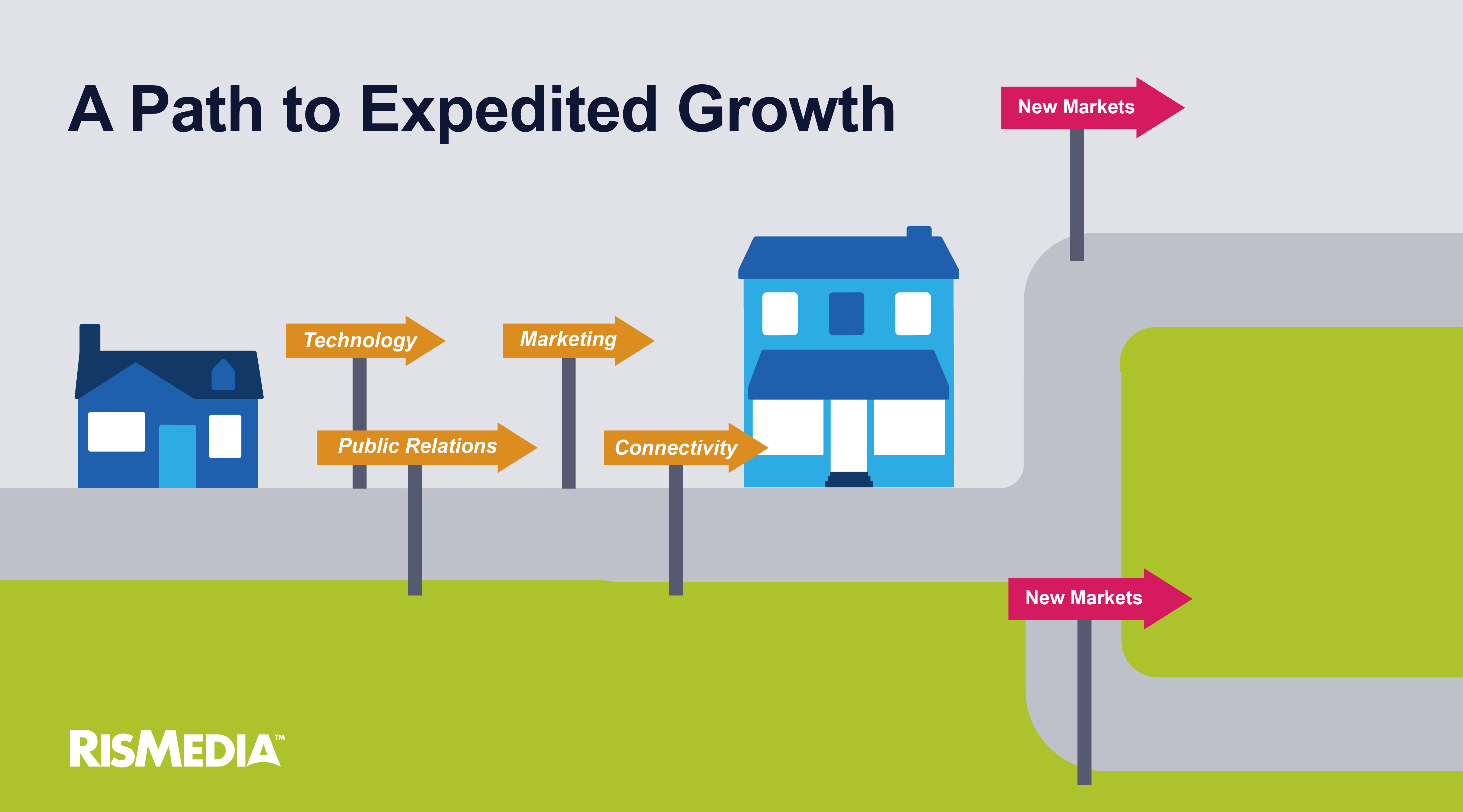

“The truth is, you need a well-established and hardworking engine behind you to be a successful real estate agent today,” he says. “Therefore, smaller brokerages or bigger teams are looking to join a brand that possesses the right technology, the right PR and the right marketing, as well as the right connectivity in global markets in order to best serve their buyers and sellers.”

Candace Adams, president and CEO of Berkshire Hathaway HomeServices New England, New York and Hudson Valley Properties, anticipates that the appetite for consolidation will only increase as the market shifts. “Mergers and acquisitions are continuing, and I anticipate, with the market balancing, an increase in activity,” she explains.

In the current M&A environment, smaller companies are looking to join bigger ones. On the flip side, larger brokerages are looking to expand into new markets, and it is by far easier to do so by acquiring a well-established team or company in that market. But before a broker/owner signs off on a merger or acquisition, there are many critical factors he or she must consider.