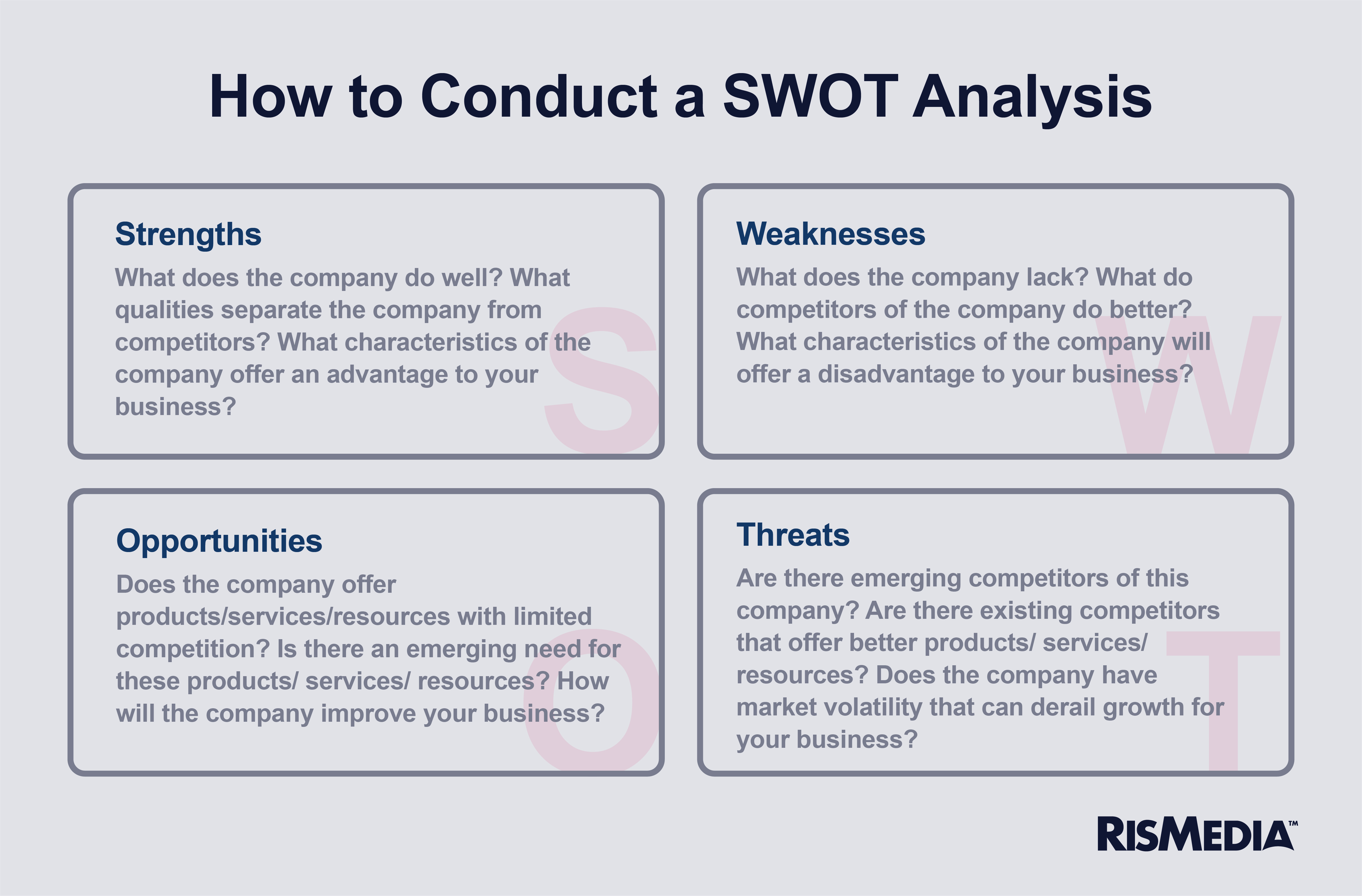

After successfully valuing a company, it’s necessary to examine and analyze the strengths, weaknesses, opportunities and threats (SWOT) of a potential new acquisition and its market to determine if it will truly be a savvy investment.

To conduct a SWOT analysis of a potential new acquisition and its market, McBride recommends pulling information from a range of sources.

“We glean valuable information from the brokerage owners but are sure to bolster that with independent competitor research and conversations with internal company members who are knowledgeable about the market or company we are looking into,” he says. “It is critical to do your due diligence on competitive and target-company trends in the market. You will want to know who in the market is growing, who is declining, who is recruiting and who is losing agents and why.”

McBride has often found that agent attrition is a signal that future revenue will decline and the buyer should reduce their offer accordingly.

Some of the things to look for when opening the books, according to Slusser, are historical trends, productivity per agent, marketshare, competitive rank, company value proposition to the agents and their clients, policies, tools, training and the mix of productive agents.

There are multiple factors Howard Hanna takes into consideration before determining potential new acquisitions.

“We tend to look back at the history of a brokerage firm to see how they have managed through both the good times and the challenging ones,” Hanna says. “Individual markets, and the industry, tend to be cyclical in nature, so we like to see how they have fared in all facets of changing times. If they have done well, we believe it is a direct reflection of the organization’s leadership, and their ability to maintain those leaders is important as an indicator of future potential growth.”

Other factors he considers are how aligned a company’s culture is to Howard Hanna’s and what the growth opportunity in the market is for the next five years.

“We look for well-run, like-minded firms that rank No. 1, 2 or 3 in marketshare so that we can add value to accelerate their growth, because while I don’t think I’m smart enough to fix any single company, what we can certainly do is help make that organization better by adding new marketing programs, tools, technology and initiatives,” Hanna explains.

If a company is entering a new market, it’s vital to evaluate the strength of a potential acquisition in terms of its position in the marketplace.

If a company is entering a new market, it’s vital to evaluate the strength of a potential acquisition in terms of its position in the marketplace.

“As for weaknesses, you want to look at potential competition and retention issues,” Golden says. “When you’re acquiring an office, you’re really acquiring the people and the culture, so it is critical to make sure the people and office fit with your brokerage’s culture so that you don’t have retention issues down the road. In regard to growth, when we look at buying a company, we want to see that there’s an opportunity to integrate our tech, marketing, training and coaching with what’s already there, to help the firm and its agents grow faster.”

When examining a company’s books, the top things to look for are the people in the organization, the volume and what percentage of agents contribute to that volume, says Raveis. If you have a small number of producers making up a majority of that volume, he explains, you need to know how likely those agents are to continue with the company after the merger.

“You have to take into consideration who might leave after the acquisition,” he says. “If you’re going to lose an agent, you need to know what that means. Essentially, you’re paying for five years of their production, so you want to make sure they are going to be there.”

Another thing to look for, he notes, are important synergies. Ask yourself if you’re entering a market that you want to be in and grow in, or whether you’re simply looking to add marketshare.

Once a thorough analysis of a company’s books is complete, Durkin says that it’s critical to spend time with the people you are going to join forces with, making sure there is similar DNA in the way you value people, the way you value time and the way you approach problem-solving.