Real estate is a very transparent industry. We know how much homes are listed for and sell for, their tax record, their transaction records, what homes are assessed at and what their current estimated values are. Likewise, brokerages are extremely transparent about the number of transactions they close, as well as their sales volume each year.

What is not so transparent, however—and in fact a taboo topic for the most part—is how agents are compensated for selling a home or representing a buyer in a transaction. One may get a general sense of a firm’s typical commission split, but rarely (if ever) do brokerages have a one-size-fits-all contract and commission structure. Tenure, and a host of other factors, contribute to an agent’s worth to a broker—but exactly what that worth is set at isn’t information that’s typically shared from agent to agent, at least not above board.

We surveyed nearly 1,600 real estate professionals who stepped up to answer some of the most important questions agents and commission-earning brokers should be asking about their contracts and commissions. In this study, we round out what the respondents’ profile looks like. We dive into commission splits and unpack how they are distributed by profile and demographics. We also explore fee structures, what agents value most in their careers and more.

The Agent Profile

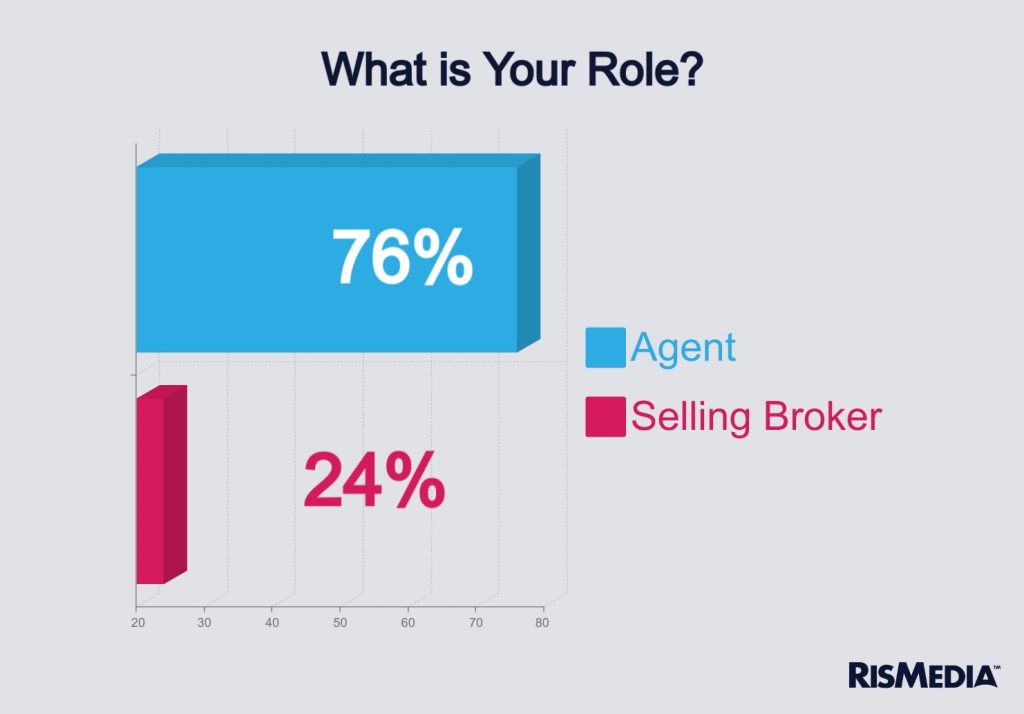

To better understand how agent contracts and commission structures work in residential real estate, the respondent pool was limited to agents and commission-earning brokers. Broker/owners were unable to complete the survey. Most respondents (76%) identified themselves as agents, with the remaining 24% as commission-earning brokers working for a broker/owner.

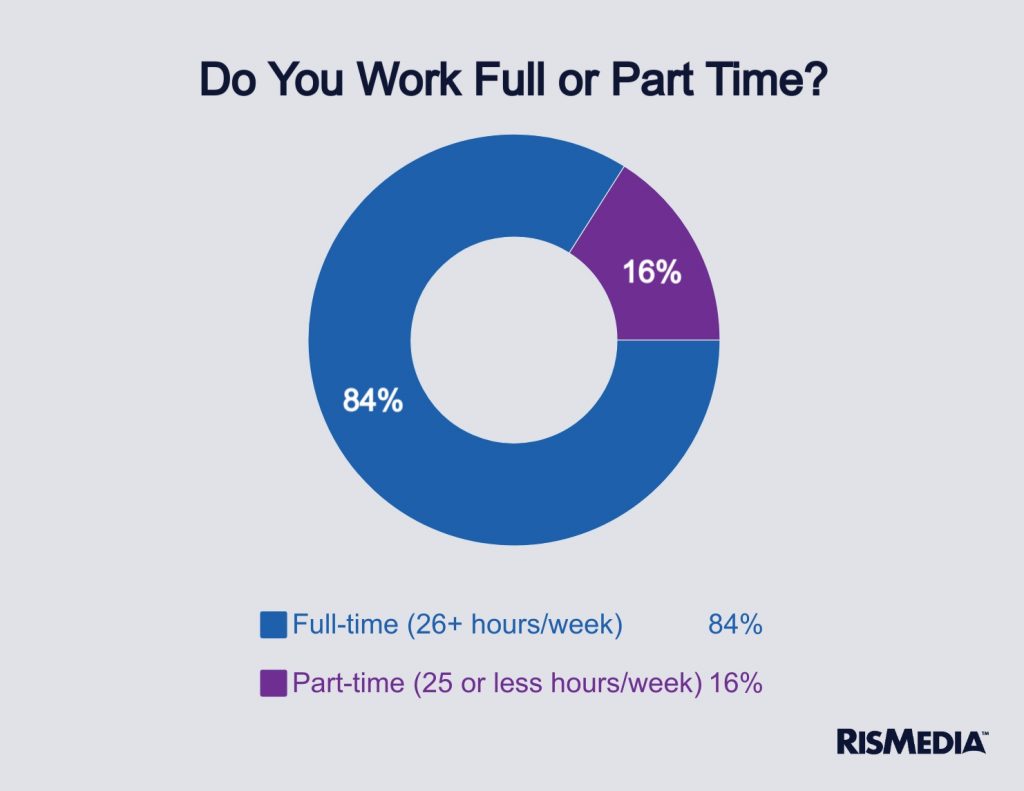

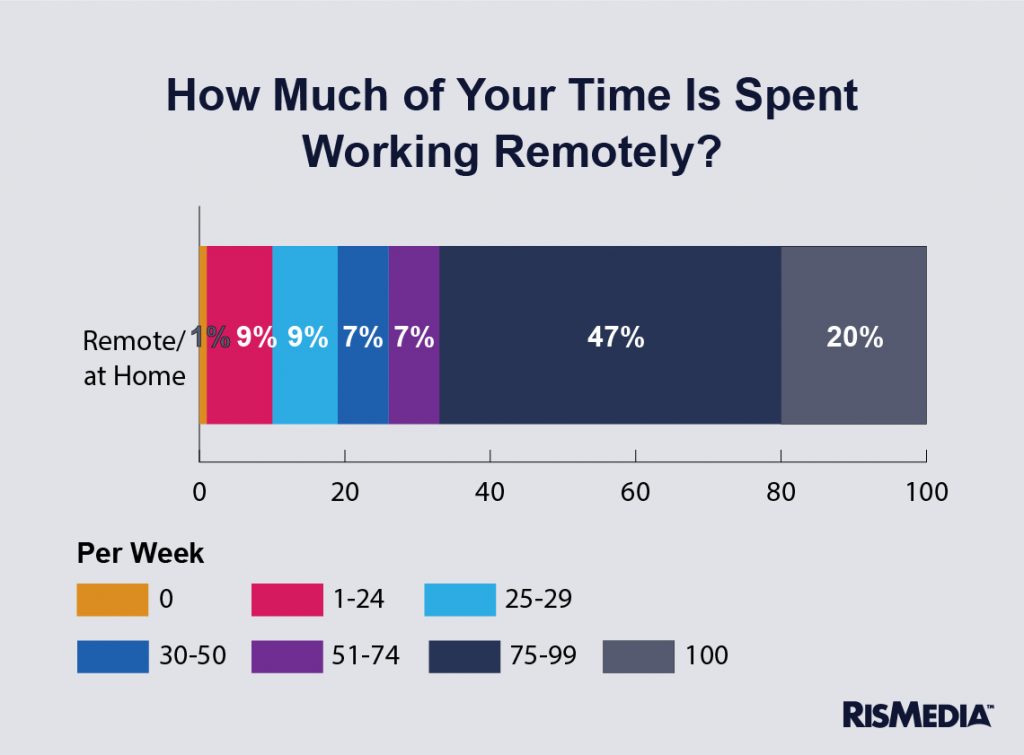

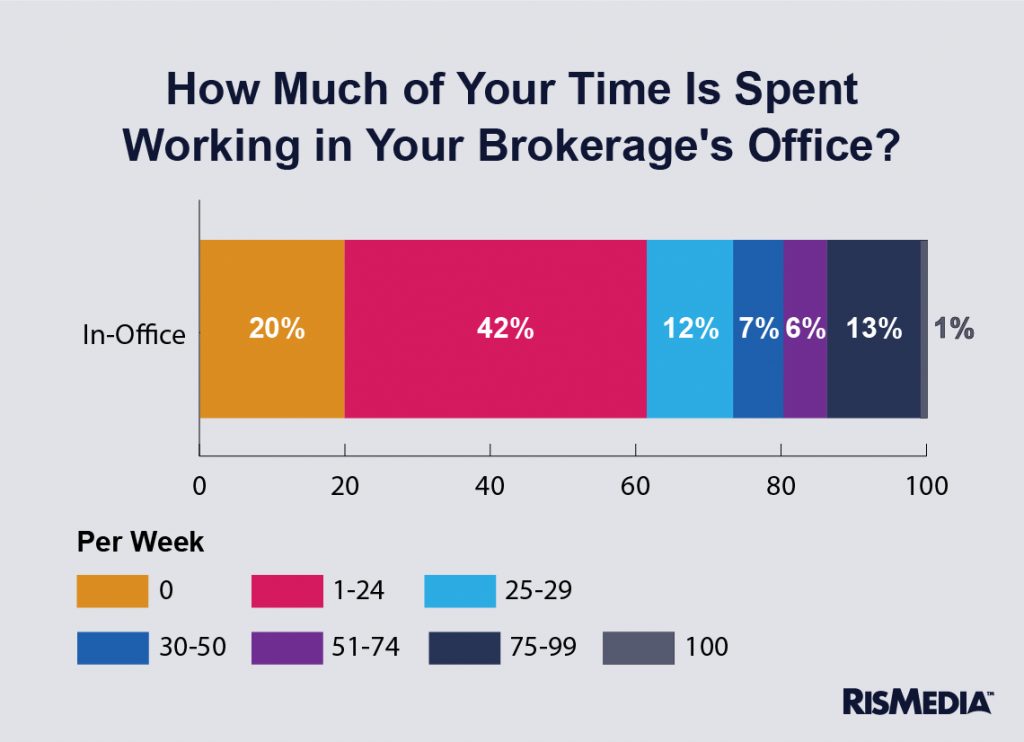

Most (84%) respondents say they work a full-time schedule of 26 hours or more. One in five respondents work fully remote, so despite a proliferating trend of remote work across the country, real estate agents have largely remained as in-office professionals.

Most (84%) respondents say they work a full-time schedule of 26 hours or more. One in five respondents work fully remote, so despite a proliferating trend of remote work across the country, real estate agents have largely remained as in-office professionals.

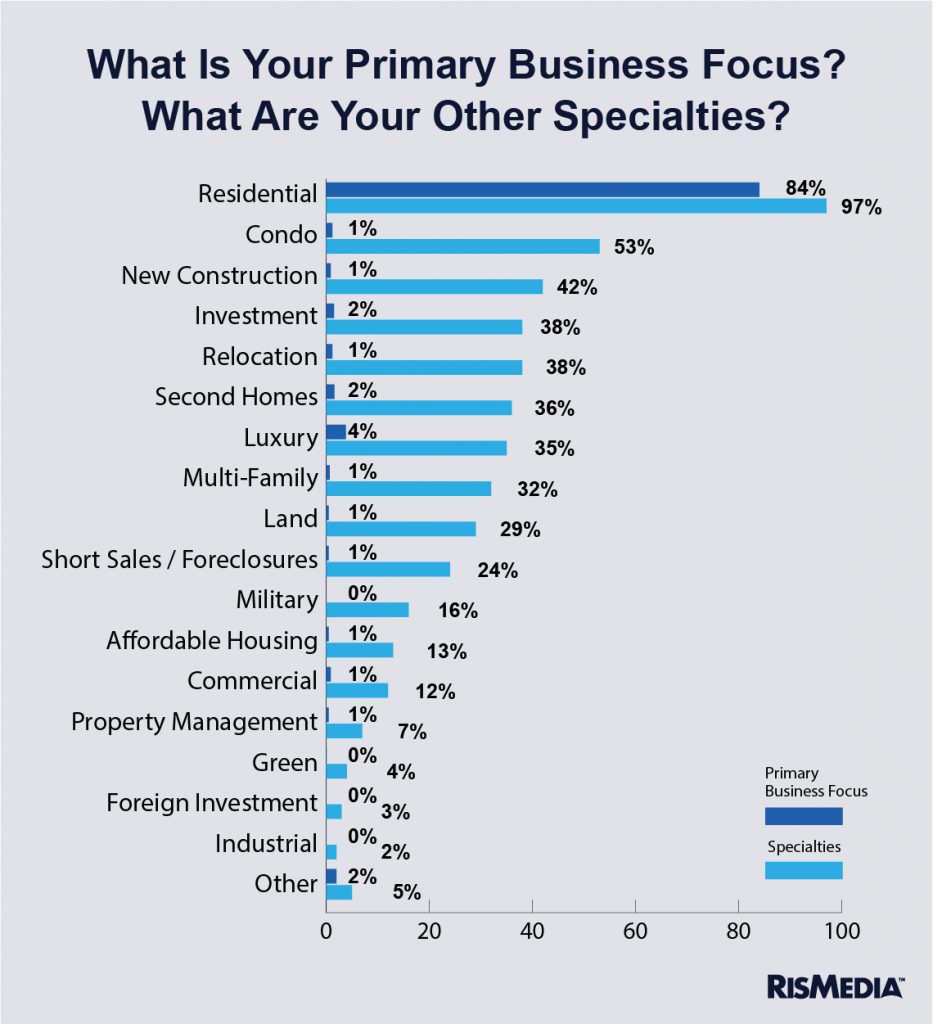

A similarly high number (84%) of respondents indicate that their primary focus is on residential real estate. There was a wide distribution in specialties, with the average agent identifying five areas of focus.

A similarly high number (84%) of respondents indicate that their primary focus is on residential real estate. There was a wide distribution in specialties, with the average agent identifying five areas of focus.

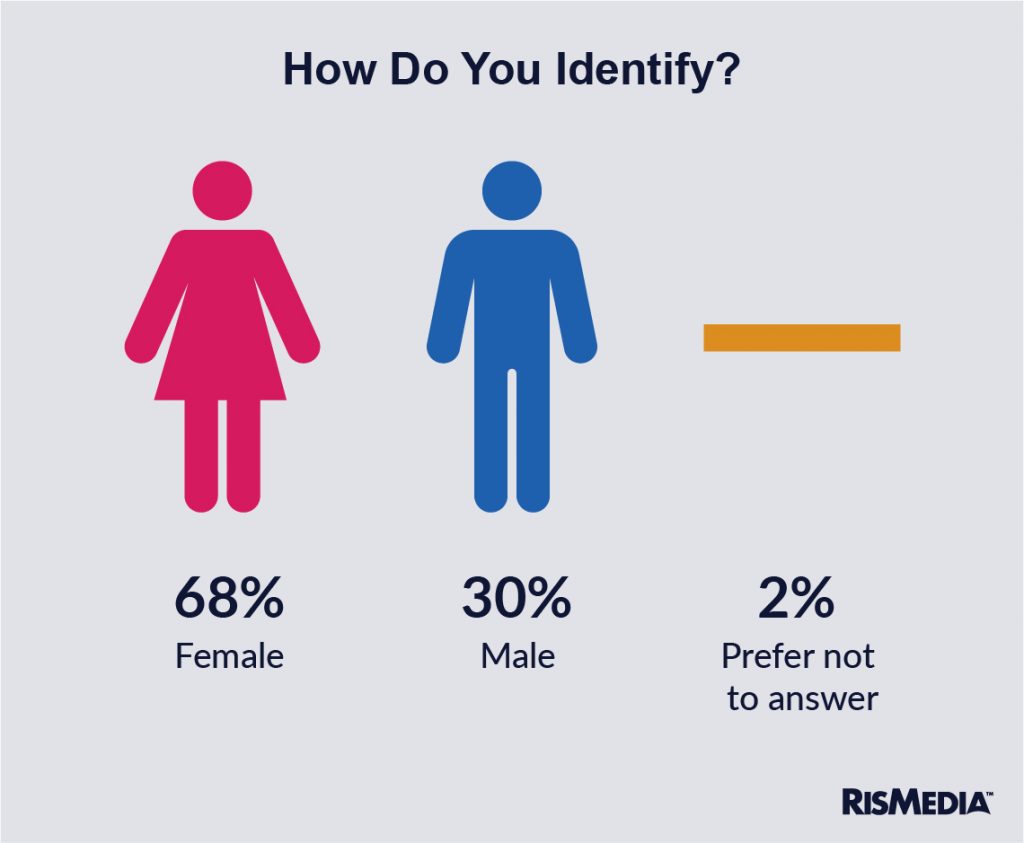

More than two-thirds of respondents (68%) are women, while 30% are men. Another 2% of respondents are nonbinary or prefer not to answer. This aligns closely with the National Association of REALTORS®’ (NAR) membership figures.

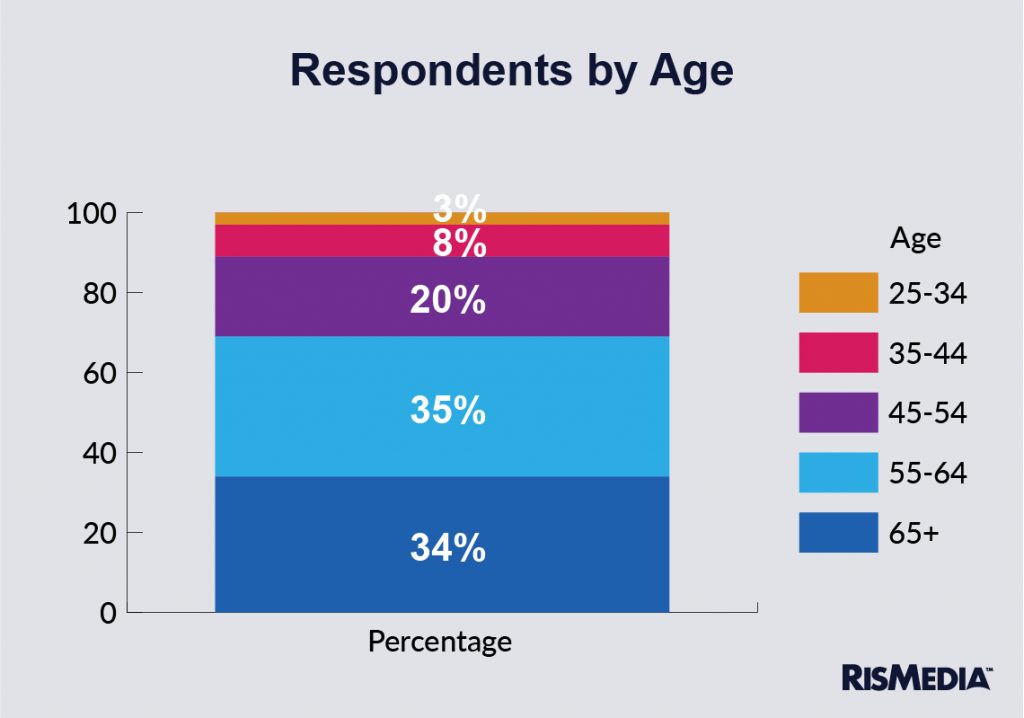

Most agents and commission-earning brokers fall between the ages of 55 – 64 (35%) and 65 and older (34%). This skews slightly older than NAR’s average REALTOR® age of 53. Only 31% are under the age of 55, thus making the average age of the respondents 59.

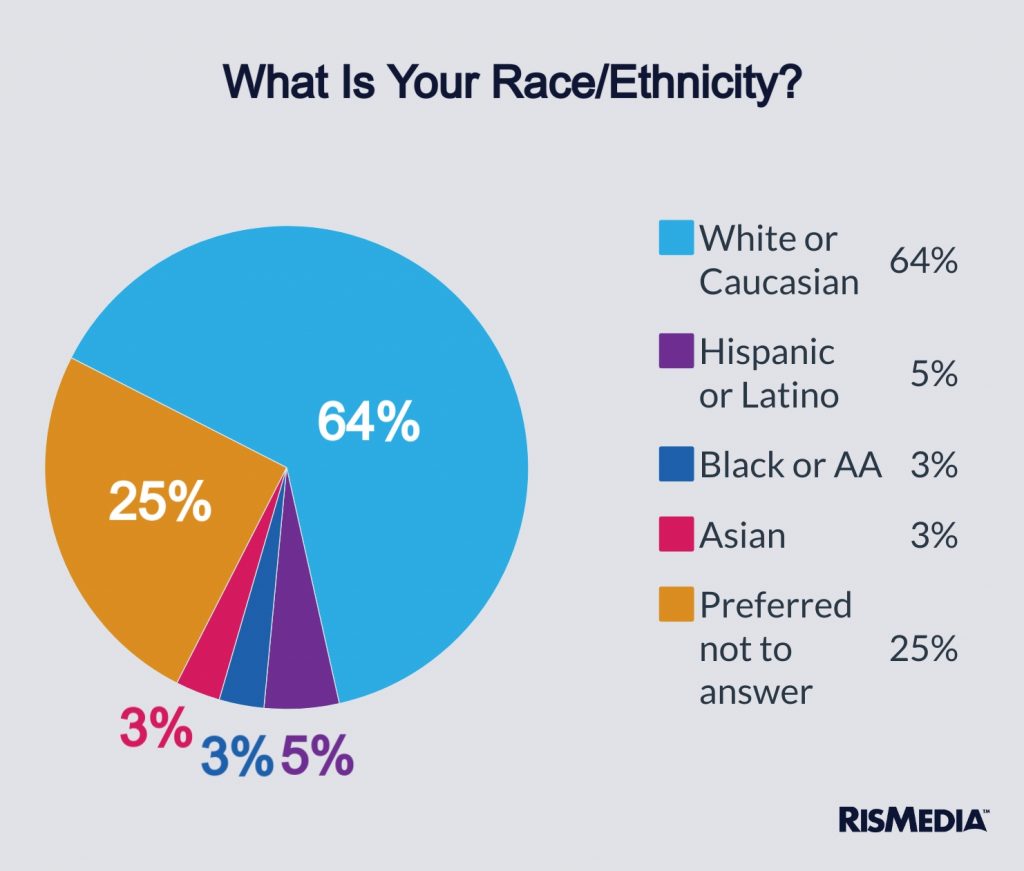

Nearly two-thirds (64%) of respondents are White or Caucasian. However, one-quarter (25%) preferred not to answer or didn’t give consent to answer. Black or African American respondents account for 3% of respondents, while Hispanics are represented by 5% of respondents. Asians and Pacific Islanders accounted for 3% of respondents.

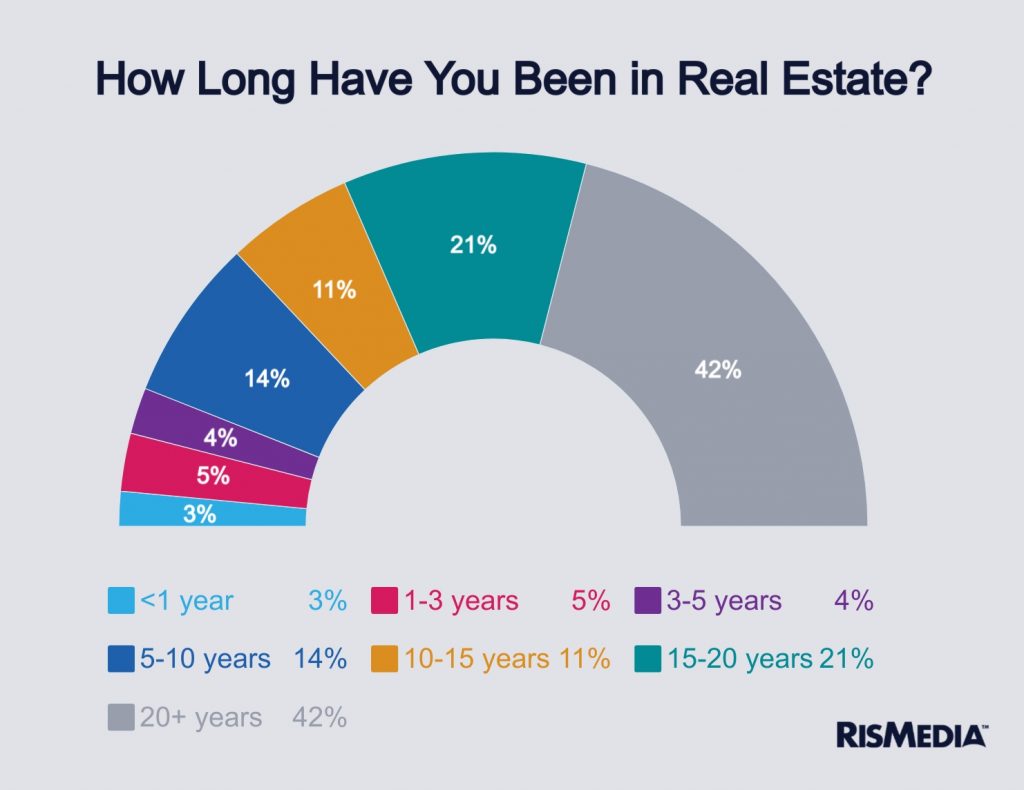

The average respondent has worked in real estate for approximately 17 years. The largest group of respondents (42%) have been in real estate for more than 20 years. Less than 10% have been in the industry for less than three years.

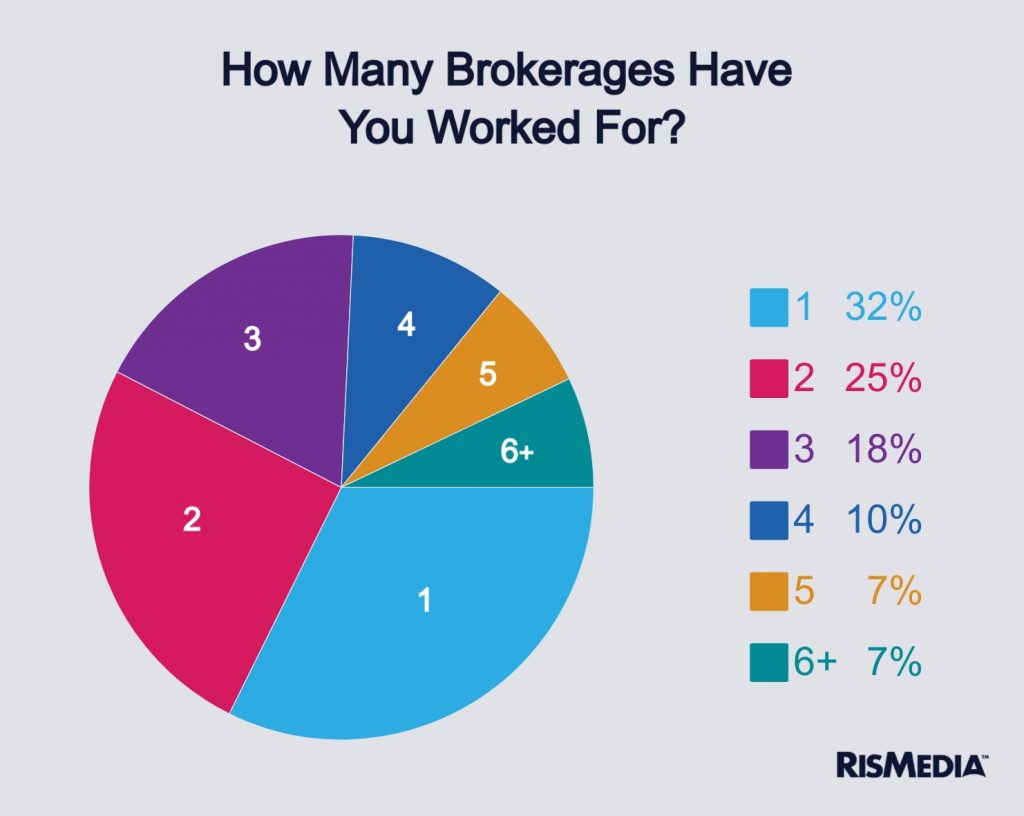

The survey reveals that, despite the common notion that agents frequently move from firm to firm, the total number of respondents have worked for an average of 2.7 brokerages during the span of their careers. This distribution is relatively even across both tenure and region. Agents in the Western region of the U.S. are most likely to change firms, with the average respondent having worked for 3.2 brokerages throughout his or her career.

Nearly one-third (32%) have worked for the same agency their entire careers. More than three quarters (79%) of new agents who have been on the job for less than three years have remained with one firm. That number drops off to 45% for agents in the business from three to less than 15 years. Perhaps most notable, 19% (nearly one out of five) of respondents with 15-plus years of experience have remained with one firm their entire careers. These corresponding findings cast doubt on the common narratives surrounding high churn rate among real estate agents.

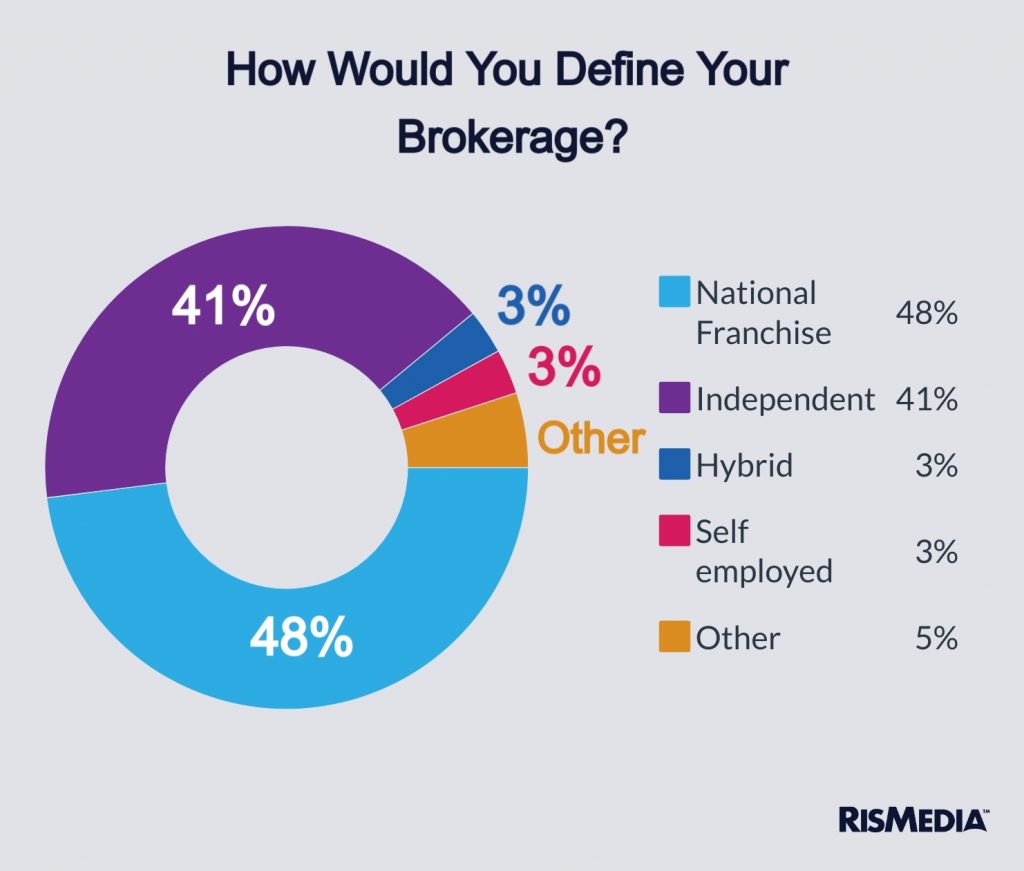

Almost half (48%) of respondents report that they work for a national franchise, while 41% work for an independent brokerage. The remainder identified their brokerages as a hybrid (3%), self-employed (3%) and other (5%).

More than half (53%) of the respondents who have been in the business for less than three years are working for a national franchise. Nearly half (49%) of the long-tenured respondents in the 15-plus range also work for national franchises. Those in the range of three to less than 15 years of tenure are more evenly split, with 45% working at national franchises versus 44.2% at independent firms. In the next section, the pros and cons of working in both these settings are explored.