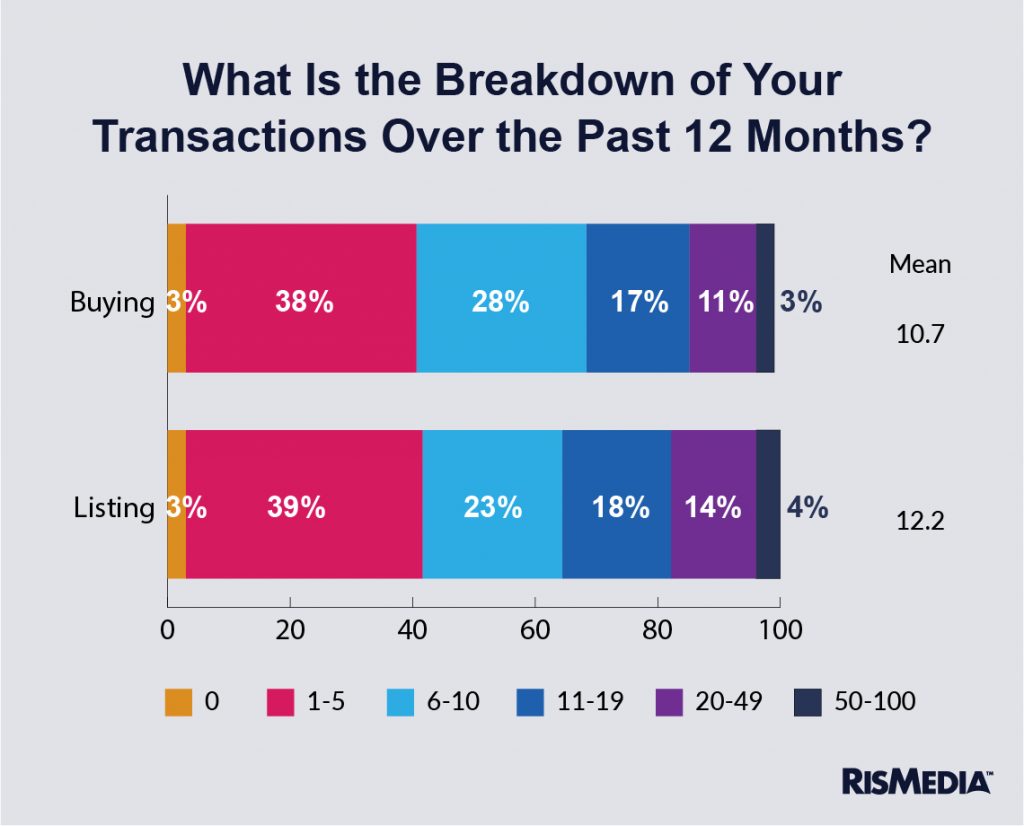

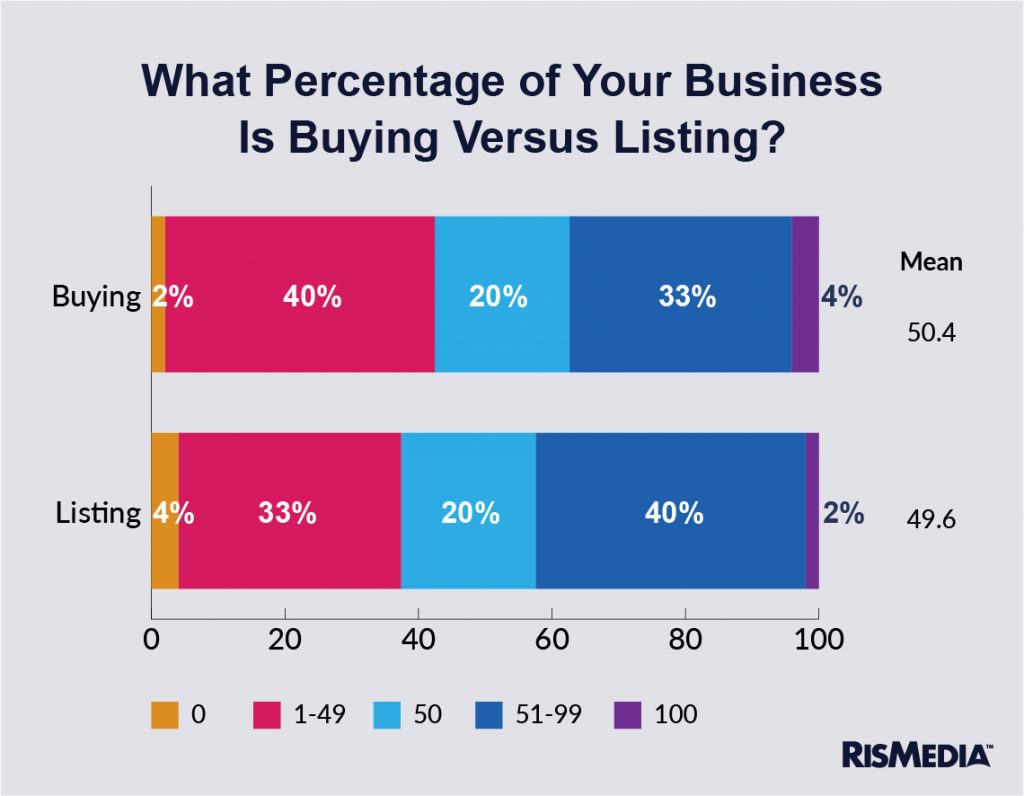

In 2021, agents and commission-earning brokers averaged 10.7 buying transactions and 12.2 listing transactions. Most agents and brokers were involved in more than six transactions, with the average percentage of transactions handled by respondents being 50% buying and 50% listing transactions.

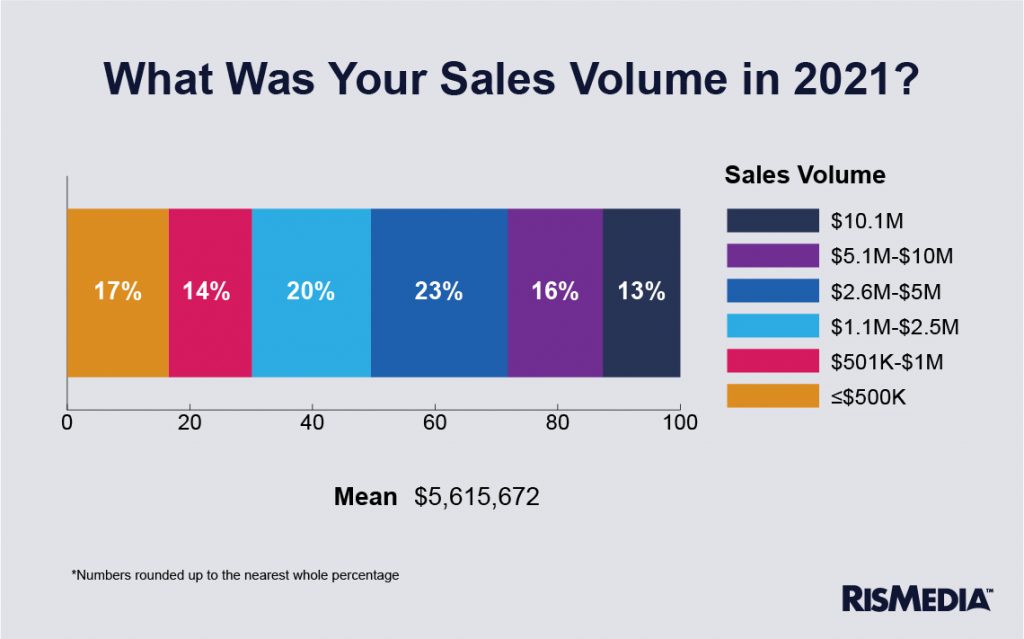

The average individual sales volume among respondents who had listings in the last year was $5.6 million. The numbers skewed higher based on tenure; and for commission-earning brokers and those working individually (self-employed).

The average individual sales volume among respondents who had listings in the last year was $5.6 million. The numbers skewed higher based on tenure; and for commission-earning brokers and those working individually (self-employed).

White agents and brokers generated an average of $2.1 million more than non-Whites—$5.8 million versus $3.7 million, respectively.

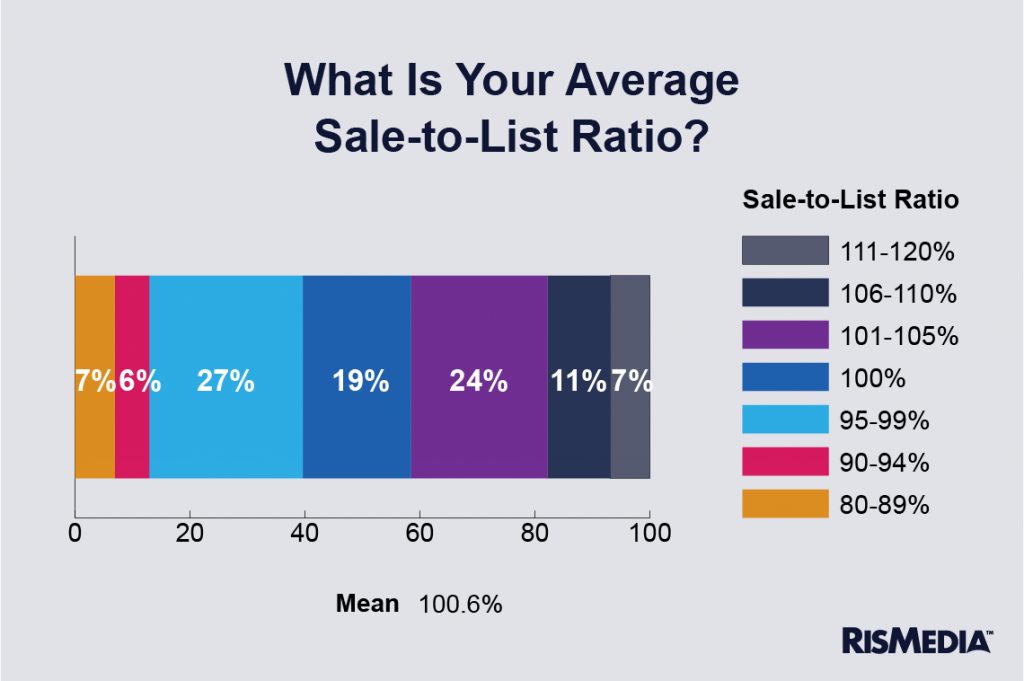

The average sale-to-list ratio was 100.6% and more than two-thirds (70%) were in the 95% – 105% range. The Western region saw the highest average range at 102.4%, while the Northeast was the lowest at 99.6%. The West and South were nearly identical at 100.4% and 100.2%, respectively.

The range was lowest among the less experienced (97.7%) and part-time (98.7%) respondents.

Race and ethnicity showed another divide, with Whites having a sale-to-list ratio of 101.2%, versus non-Whites at 98.3%. Gender, however, showed only marginal differences, with males averaging 100.8% and women 100.4%.

Nearly one in five (19%) report a commission split in a transaction between 3.1% – 4.9% among respondents. Outliers include 7% of respondents who report their gross commission at 0.3% – 2.4%, and 3% of respondents who report gross commissions between 6.1% – 10%.

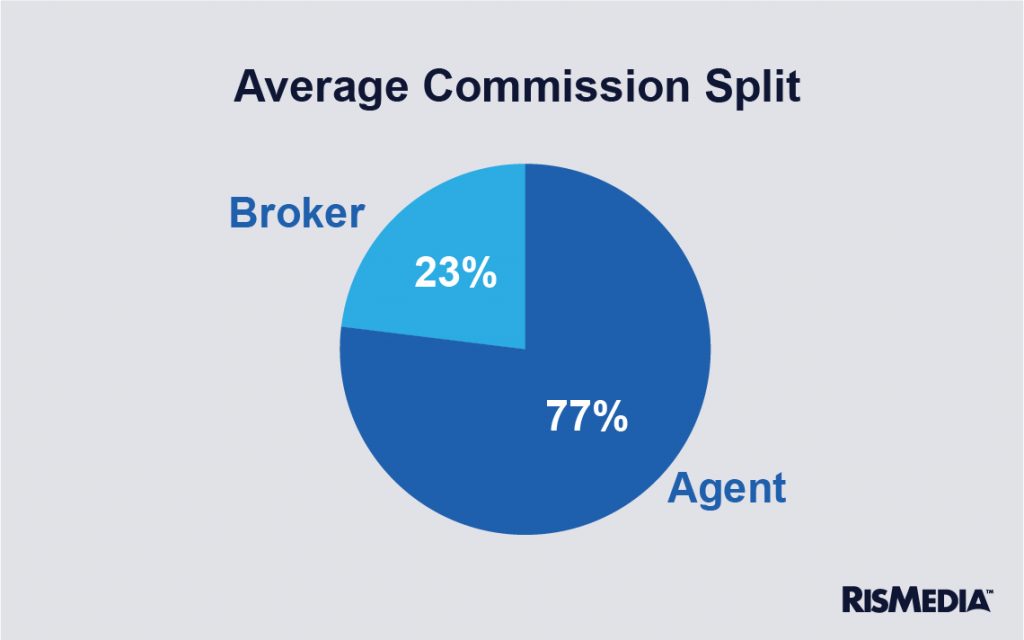

The average commission split is 77% agent, 23% broker. This does, however, vary regionally. In the Northeast, brokers take an average of 28%, while brokers in the West take just 21%. The South and Midwest show a nearly identical split, with brokers taking 21% and 22%, respectively.

Also worth noting is the disparity in commission splits between early career professionals (66% agent, 34% broker) versus industry professionals with more than 15 years of experience (79% agent, 21% broker).

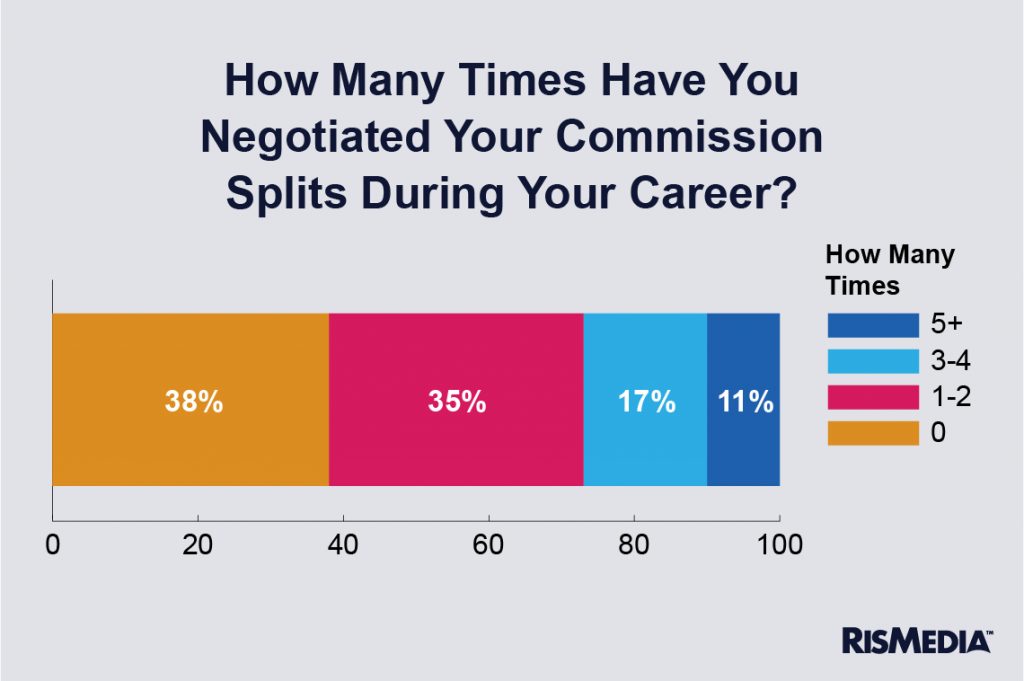

This ties into the findings that show that not many agents and brokers negotiate their commissions. Nearly four in 10 (38%) have never engaged in a commission negotiation, and those who have reported only having done it an average of three times. Unsurprisingly, the majority of those who have negotiated are longer tenured, full-time agents and commission-earning brokers. Men have negotiated slightly more than women, with an average of 3.4 versus 3.1 times in their careers. Ethnicity appears to show little to no difference and falls within the same average range for whites versus non-Whites.

The formula here is clear: tenure plus frequent negotiations can lead to more earning potential for agents and commission-earning brokers. This information is something professionals at all stages in their career should consider. Those newer to the profession should be proactive in negotiating higher commission splits, while the more tenured professionals should ensure that they are maxing out their earning potential so it aligns with their experience and performance record.

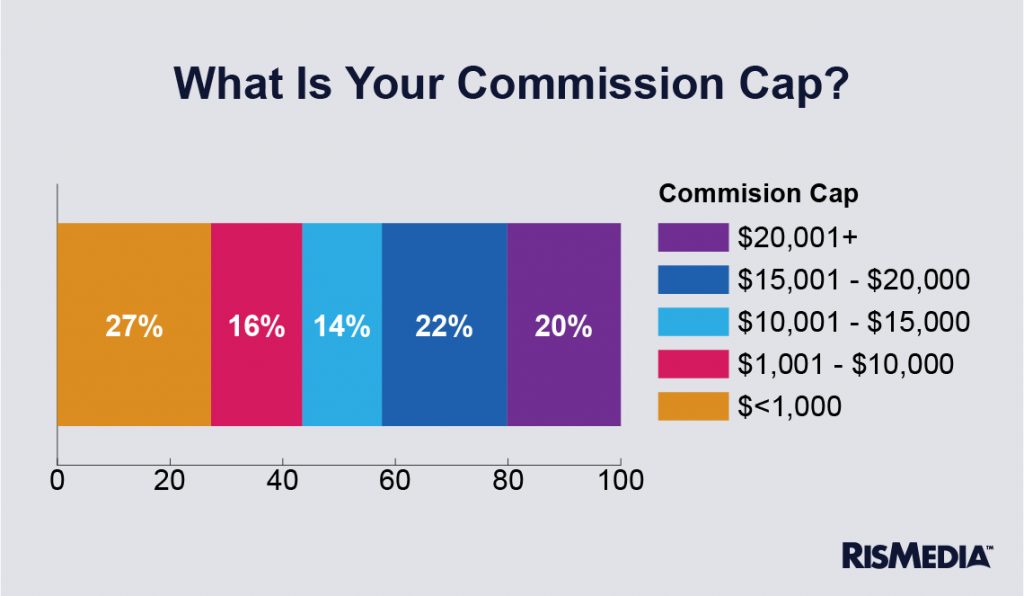

Over three-quarters (77%) of respondents are not subject to a commission cap. However, among those who are, the average cap is $13,631. The least likely agent and commission-earning broker to pay caps are those who work for independent firms.

Only 16% of respondents work for a firm that offers profit sharing. What’s more, those select few who can take advantage of profit sharing are more likely to earn this benefit from a national franchise (22% of those who answered yes) and least likely to earn from an independent firm (10% of those who answered yes). Region, tenure, gender, and race and ethnicity have relatively equal distributions of profit sharing.