As agents and brokers are looking at where they are spending their time and money, where do they agree—or disagree—on what is most worthwhile?

One thing that real estate professionals of all types, backgrounds and levels of experience seem to agree on is that word of mouth is the most important way to grow your business. More than eight in 10 (83%) say word of mouth is the most effective marketing channel, and 96% ranked it in the top three.

All of this is broadly unchanged from 2022.

Another important question is, how have the top-level priorities of brokers changed as markets have shifted? As detailed in the last section, spending would indicate that recruitment is actually a lower priority for brokers, and the qualitative ratings back this up.

Recruitment fell in qualitative ratings of importance by a small but noticeable amount from 2022, down about 5%. The drop was much more significant for national franchise brokers—an almost 10% decrease.

That would indicate that big companies are de-emphasizing marketing efforts meant to bring new agents into the company. Ratings for retention marketing also dropped overall by a little over 5%, and by a more significant 11% for those at national franchises.

Overall, the data appears to show brokers seeing the importance of marketing efforts toward more immediate goals in 2023. Ratings for affiliated services, new construction and obtaining new listings all rose modestly.

This probably reflects an adaptation to the more immediate priorities of a low-inventory, high-rate environment, rather than a major change in how brokers prioritize marketing efforts. New construction in particular saw a historic surge this past year, and competition for listings reached a fever pitch in many markets.

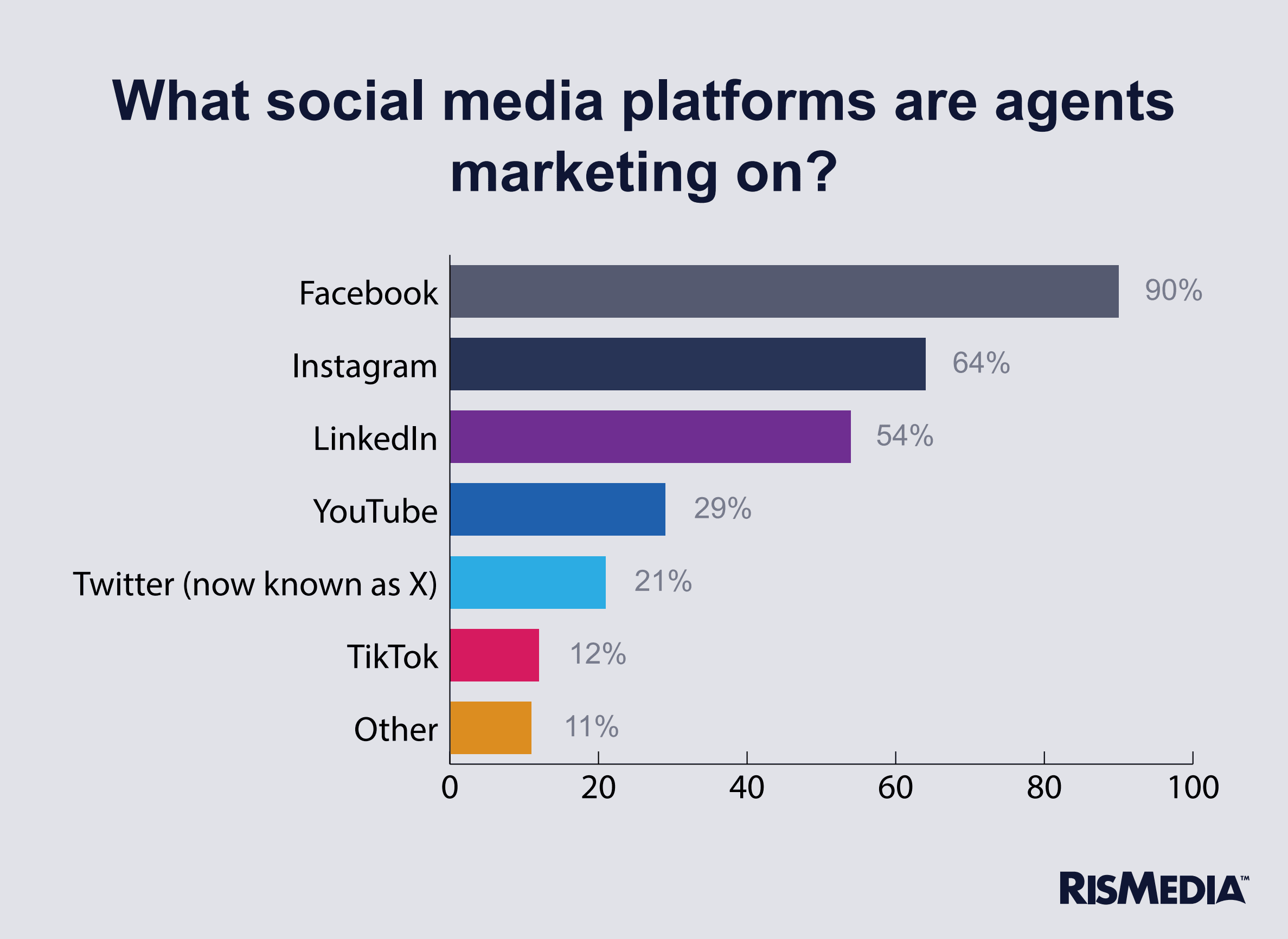

At a more granular level—but also as a trend more likely to persist for the long run—social media has become essential to real estate marketing, with the vast majority of agents and brokers using one or more platforms to advertise their businesses and services. Facebook is by far the most popular, with 90% of agents and 78% of brokers marketing on that platform.

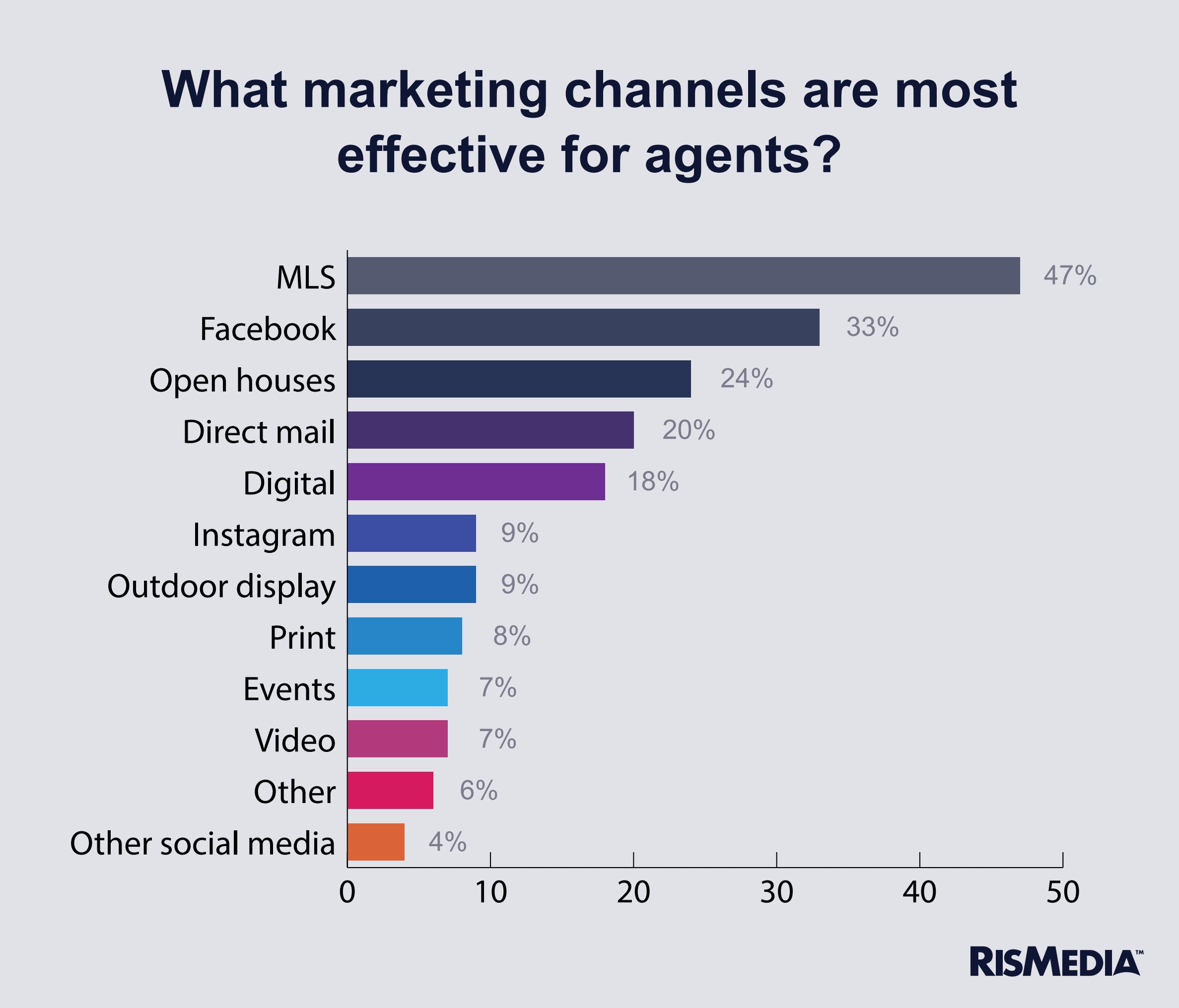

Facebook also ranked in the top three in effectiveness as both an inbound and outbound channel, for brokers and agents. For brokers, Facebook ranked just behind MLS and digital, with 7% calling it the most effective (above word of mouth), and 37% ranking it in the top three.

For agents, 53% called the Meta platform a top three inbound channel, and 46% rated it a top three outbound channel, above digital, mail and events.

Younger brokers were far more likely to have a positive impression of Facebook, as were those who worked with national franchises. In fact, brokers who affiliated with national franchises were 20% more likely to rank Facebook as a top three channel. Interestingly, this didn’t carry over to agents, where type of brokerage had less of an influence on what channels were seen as most effective.

Instagram, also owned by Meta, was the second most popular channel overall with 64% of real estate professionals using it, and is notably much more popular with younger and less experienced agents and brokers. Agents 18 – 54 were 25% more likely to use Instagram than agents and brokers 65 and older, and were also more likely to rate it as effective.

LinkedIn came in third, with 54% of agents and brokers marketing on the Microsoft-owned social media network. Interestingly, older real estate professionals use LinkedIn more, but were only slightly more likely to rate it as effective. For brokers, it was experience that seemed to give a more positive impression of the platform, with 30% of those with 15 years or more in the industry ranking it as a top three channel to market listings on compared to 7% of brokers overall.

With a much greater emphasis on professional connections, LinkedIn seemingly pays off for those who have taken the time to establish themselves in the business community, though it is hard to say how they are using the platform without more information.

As far as other social media platforms, usage is much lower, with YouTube at 29%, Twitter (now known as X) at 21% and TikTok at 12%. Brokers are more likely to be on YouTube compared to agents—44% to 27%—and TikTok has a larger population of younger and inexperienced agents.

Oddly, national franchise affiliates had a lower usage of TikTok and a higher usage of the Meta platforms—Facebook and Instagram—across age and experiences, although these agents and brokers were not more likely to rank those platforms as more effective.

Outside of social media, other outbound channels fell broadly in popularity, as agents and brokers depend more and more on the ubiquitous social networks.

Direct mailers were one of the few channels that did not see their perceived effectiveness drop from 2022 to 2023 (for agents), and event marketing actually rose in its effectiveness rating by a small amount. This would seem to indicate that these basic, tried-and-true marketing strategies are not about to be replaced by social media alternatives.

But digital, print, video, community service and outdoor displays were all rated lower by agents, with community service down 14%, video falling 11%, print lower by 8% and outdoor displays losing 2% from the year prior.

For brokers, the story was similar. Digital fell 14%, video by 7% and outdoor display by 2%. Print, however, was rated higher by brokers in 2023, up by 6%.

It is likely that adoption of social media is accelerating a move away from most traditional marketing channels. But it is also possible that in a year of overall cost-cutting, the degree and speed of this shift may be exaggerated.

Notably, there were no major demographic trends driving these big changes. Besides younger agents using more niche social media channels to a greater extent, it would appear that every region and every type of real estate professional is shifting marketing dollars and emphasis toward social media.

The proportion of leads generated organically, however, stayed the same between 2022 and 2023, meaning agents aren’t necessarily relying on a higher proportion of paid leads from social media—or any other source.

Interestingly, agents are spending the same amount of time marketing their personal brand as they did a year earlier, an average of eight hours a week. Only agents at independent brokerages saw their time commitment to marketing shift by any noticeable amount, with those folks spending about 90 minutes less per week marketing themselves in 2023 compared to 2022.