Many brokers and agents will disagree on the importance or methods for measuring their return on investment for marketing. After all, marketing is a holistic endeavor that might only pay off over the course of years, with interacting and overlapping goals. Not all of those factors can be easily quantified, and many real estate professionals are comfortable without tracking all their priorities or returns.

But the tide might be shifting toward brokers who believe that some level of measurement is essential to any marketing plan. Between 2022 and 2023, the number of brokers who said they were measuring ROI grew significantly with just under half (46%) now reporting that they track ROI.

This jump was largest for self-employed brokers and younger brokers. Younger brokers (those 18 – 54 years old) were almost 70% more likely to track their ROI in 2023 compared to 2022, and the number of self-employed brokers measuring their marketing ROI more than doubled.

Very interesting, though, this shift did not affect agents, who were just as likely to measure—or not measure—ROI for their marketing in 2022 compared to 2023. Just under two-thirds (63%) of agents in 2023 said they measured ROI, and there were almost no disparities across different regions, types of company or age and experience.

It seems relatively obvious that as brokers have tightened their belts, they have been more proactive about finding out if their marketing dollars are being used effectively. Other factors are also likely in play, though, particularly the aforementioned shift toward social media marketing, where tools provided by the companies and the medium itself make measuring ROI easier.

For agents, the explanation is not nearly as obvious. Why wasn’t there a shift in measuring ROI, especially since many agents depend on their brokers for access to tools or training for their marketing efforts?

One datapoint could shed some light. Self-employed agents were the only group to see a change in how often they measured ROI, actually cutting back on measuring ROI between 2022 and 2023. If agents affiliated with larger entities are holding steady in their commitment to measure ROI, and are more likely to, that would indicate that understanding or tracking ROI is more useful to the broker or company than it is to the individual agent—though there are likely other viable explanations.

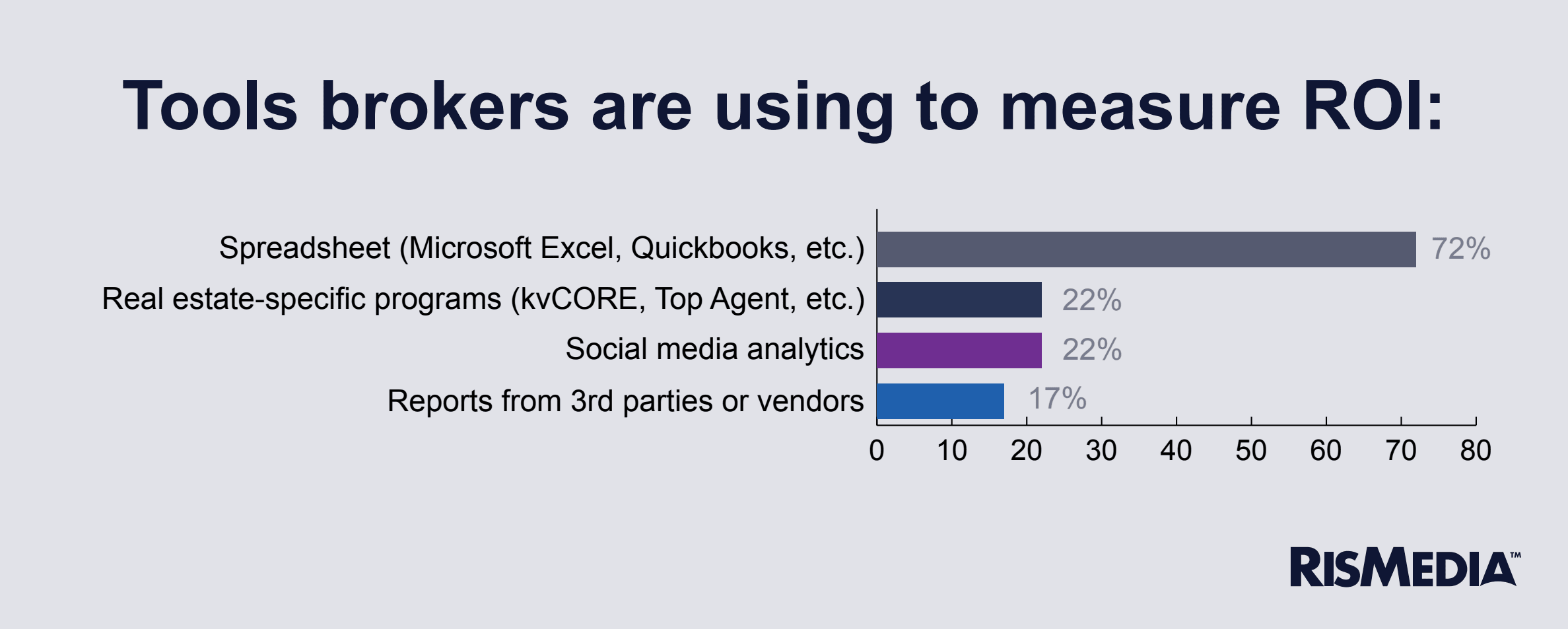

Back to social media, 22% of brokers reported using tools provided by companies like Facebook to track their ROI, the same proportion who reported using real estate-specific software and tools (like kvCORE or Top Agent). Brokers with more than 15 years of experience were also more likely to use social media tools to track their marketing campaigns.

While there is no direct comparison here, it is interesting that brokers across demographics are relying on social media companies to understand their marketing efforts. Even national franchise brokers were just as likely to use these tools (though they were also much more likely to rely on the industry products, 40% compared to 22% for the overall survey).

But brokers are overall very independent and hands-on when it comes to tracking ROI. Almost three-quarters (72%) said they used spreadsheets like Microsoft Excel or Quickbooks. That is roughly the same as 2022, when brokers also reported qualitatively that they preferred relying on their own methods, including tracking marketing ROI with just a pen and paper.

Only 17% of brokers used third-party vendors to track ROI. Self-employed brokers were much more likely to depend on third-party reports, or on real estate-specific products, and also much more likely to track ROI with a spreadsheet.

For agents, measuring ROI also differed across channels. Unsurprisingly, agents were most likely to track their marketing campaigns across social media networks, with more than half tracking their marketing on Facebook, YouTube and TikTok. Agents were least likely to track their ROI when purchasing leads, or for outdoor displays and content marketing. There was minimal variation across age, experience and region for these metrics.

As far as the tools they are using, agents were only slightly more likely to use real estate-specific ROI tools, and much less likely to use any sort of tools overall. Only 28% said they used programs like Top Agent or kvCORE to track ROI, and 44% said they used a spreadsheet.

One-quarter (25%) of agents said they track ROI without any tools, though exactly what this means is unclear. In the 2022 survey, agents also reported qualitatively that they relied on pen and paper or a simple word processor to document marketing ROI.

Also in 2022, over half of brokers reported that they provided their agents with CRM, lead generation or other products specific to real estate. Although not all of these programs necessarily allow agents to track ROI, the fact that so many prefer to use their own methods would imply that there is a disconnect between brokers and agents as far as the specific methods or needs for tracking ROI.

Unlike with brokers, though, there was some difference between types of agents. Surprisingly, the type of company mostly didn’t affect the tools agents used to track their ROI. Those who were self-employed were just as likely to use real estate software as those affiliated with national franchises, despite big companies often pushing or providing those tools for agents.

On the other hand, national franchise agents were much less likely to use third-party vendors to measure ROI, which makes sense, assuming these larger companies are providing in-house reports or tracking tools more often than independents. Self-employed agents were twice as likely to have to use a third party to track ROI compared to national franchise agents.

The biggest variables for agents when looking at the tools used to track ROI were age and experience. Agents with less than three years in the industry were about 30% more likely to use real estate software to track ROI, and 20% more likely to have a spreadsheet tracking their marketing returns. Older agents (65 years and up) were more likely to not use tools at all, although about one-quarter (23%) still used either social media analytics or real estate-specific software.

Another practice that has not changed from year’s past is client surveys. Only 21% of agents said they relied on this type of outreach to help inform their marketing decisions, unchanged from 2022.