Back in April 2019, attorneys representing a putative class of recent homesellers filed what would come to be known as the Moehrl lawsuit in Illinois. Around six weeks later, another law firm filed a largely identical lawsuit in Missouri. Quickly drawing interest both inside and outside the industry for its (somewhat) novel claims regarding real estate antitrust, many saw these lawsuits as existential threats to real estate practices, with pundits speculating that the real estate industry could be forced to transform, or shrink significantly.

Fast forward five and a half years. Agents and brokers are grappling with what was once unthinkable to many—most notably, compensation removed from the MLS, though many other decades-old precedents have gone by the wayside as well.

What, specifically, though, was supposed to happen if the plaintiffs got their way? One of the biggest worries for real estate agents was that commission rates would drop significantly (although at least some data has shown that rates fluctuate over time).

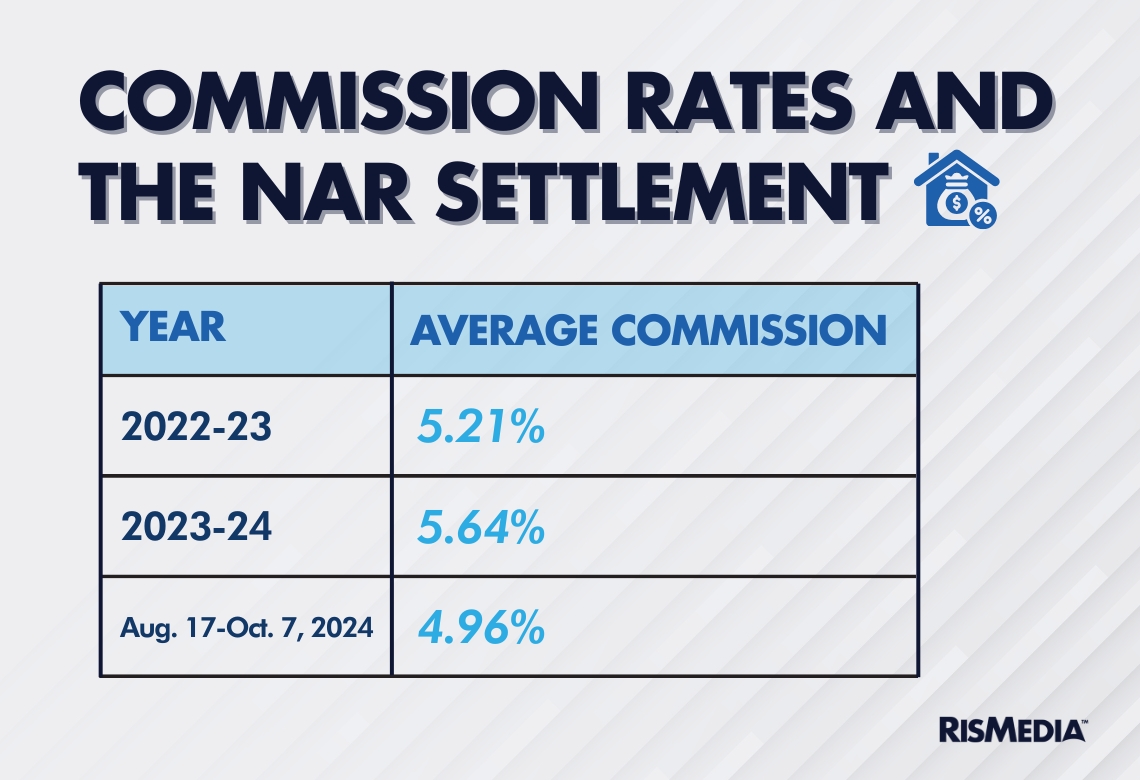

That worry may have been merited, as RISMedia’s survey of more than 1,300 agents and brokers from every part of the country found. Asking agents and brokers to report the average commission rate for buyer and listing agents for transactions over the last month (timed to include only those that took place after the August 17 deadline for policy changes), RISMedia found a drop of 68 basis points (0.68%) compared to the full year before.

That is very significant, translating to a loss of $2,870 in commission on a median-priced home.* This kind of drop also defies other explanations, as it comes after commissions rose between 2023 and 2024, and is a much larger decrease than what most other sources have measured on a short-term basis, with average commissions generally fluctuating by relatively small amounts over time.

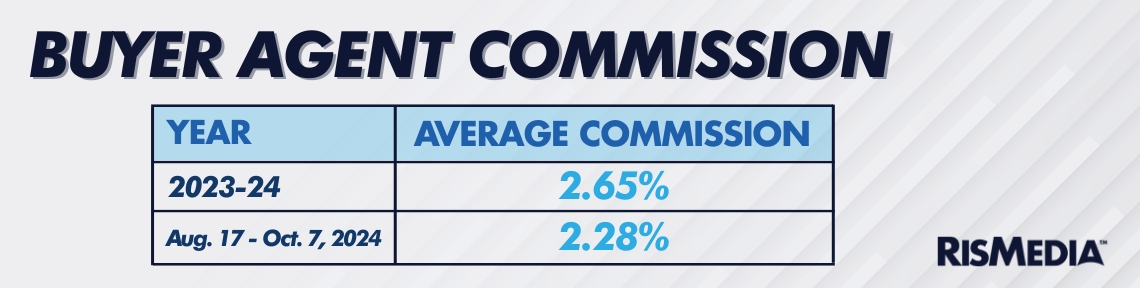

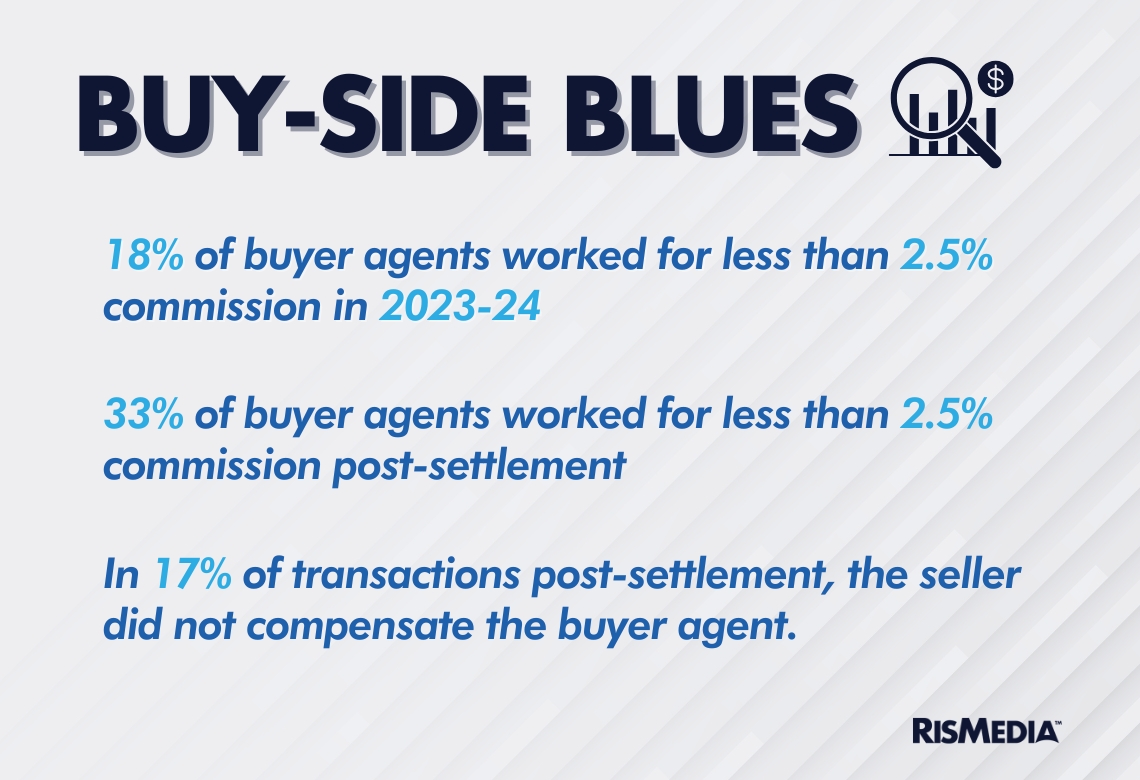

The decrease also appeared to be mostly taken from the buy-side, in line with what would be expected if the drop was catalyzed by policy changes (which were mostly projected to affect buyer agents).

The 0.37% decrease for buyers represents $1,561 out of buyer agents’ pockets per transaction*. There were also other indications in the data that point to buyer agents feeling the squeeze more than listing agents.

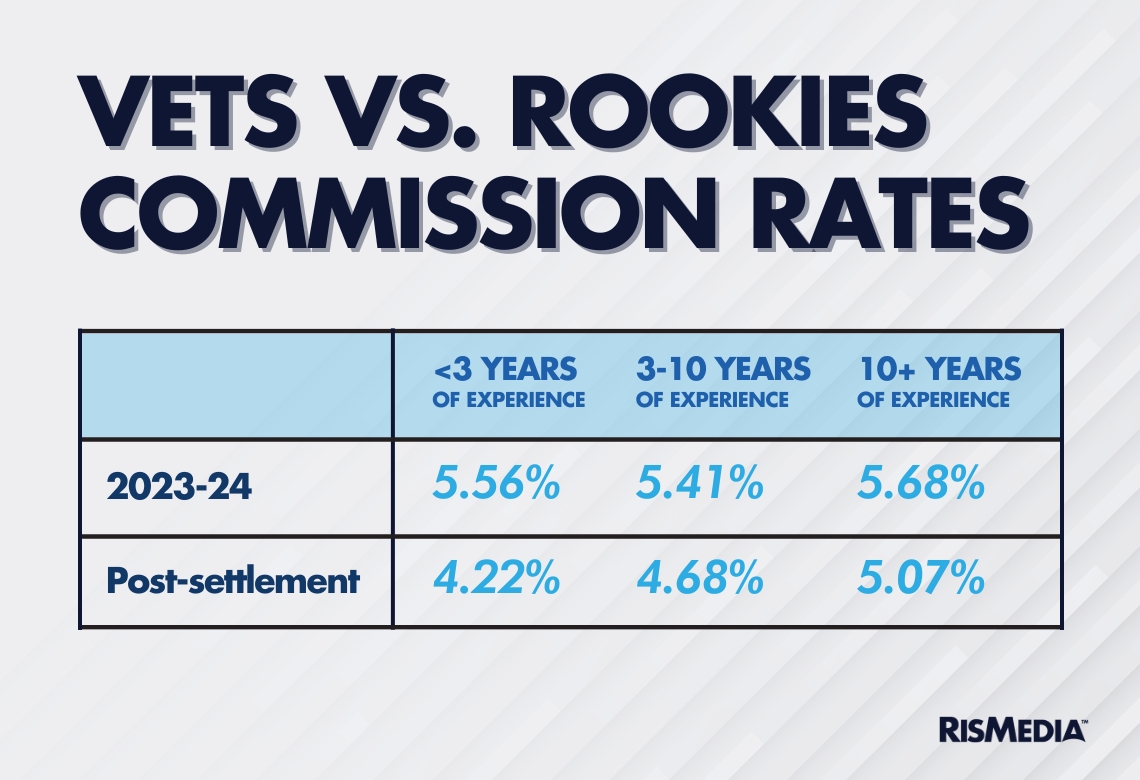

While experience has previously been shown to have an effect on commission rates—despite what some of the lawsuit plaintiffs have alleged—there was an especially large gap in commissions between inexperienced buyer agents (less than three years in the industry) and veterans (those with 10 or more years in real estate).

While inexperienced buyer agents brought in 2.58% on average leading up to the settlement, they only got paid 1.82% post-August 17—more than three-quarters of a percentage point lower. Again, on a median-priced home in 2024*, that is a pay cut of $3,207 per transaction. By comparison, veteran buyer agents only saw a 10-basis point drop post-settlement, from 2.68% to 2.58% (losing $422 on the average transaction).

Inexperienced listing agents were also hit hard, with average commissions down to 2.41% from 2.98% the year before. But notably, experienced listing agents (with 10 or more years experience) took a larger pay cut than buyer agents who had the same tenure. The average commission rates for those veteran listing agents fell from 3.00% to 2.74%.

That result is somewhat incongruous with what was predicted. The fact that experience was not enough to prevent listing agents from lowering their rates significantly, while time in the industry did appear to insulate buyer agents, could be interpreted multiple ways. Possibly, consumers are putting a great emphasis on the value of experience when it comes to the buy side in what is still a seller’s market for most of the country. It is also possible that sellers are negotiating more strenuously with listing agents based on all the recent news of the settlement, and have more leverage due to the current low-inventory environment.

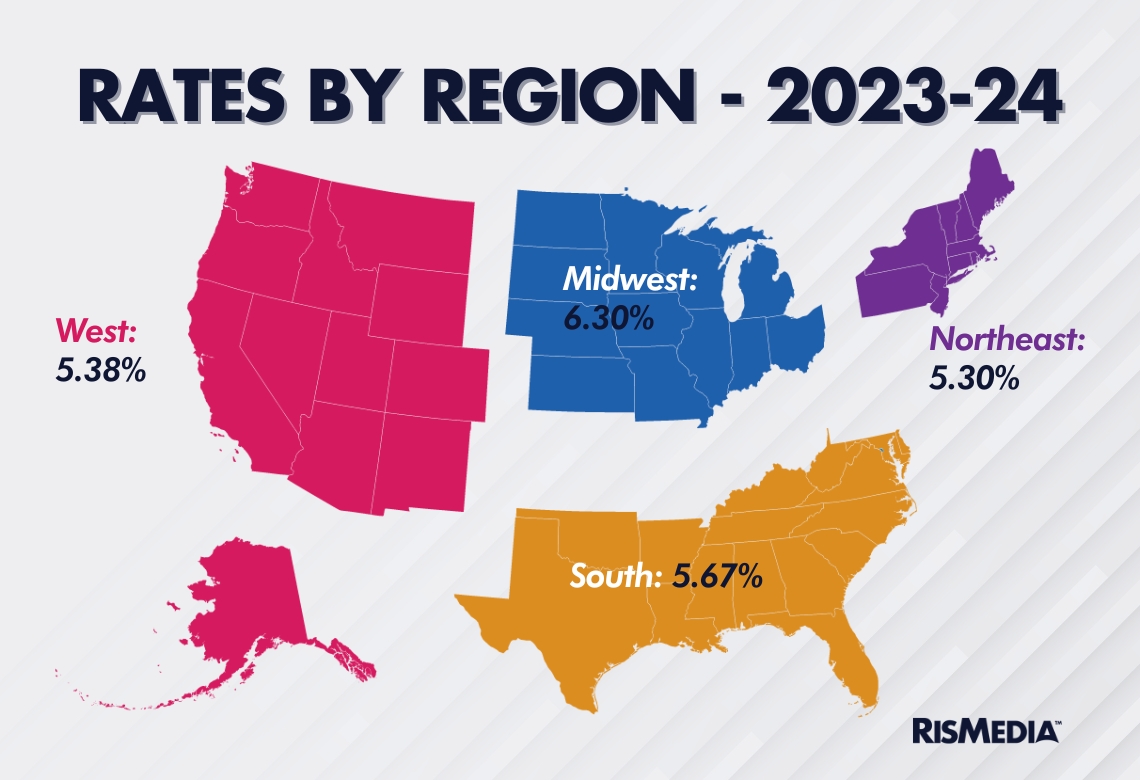

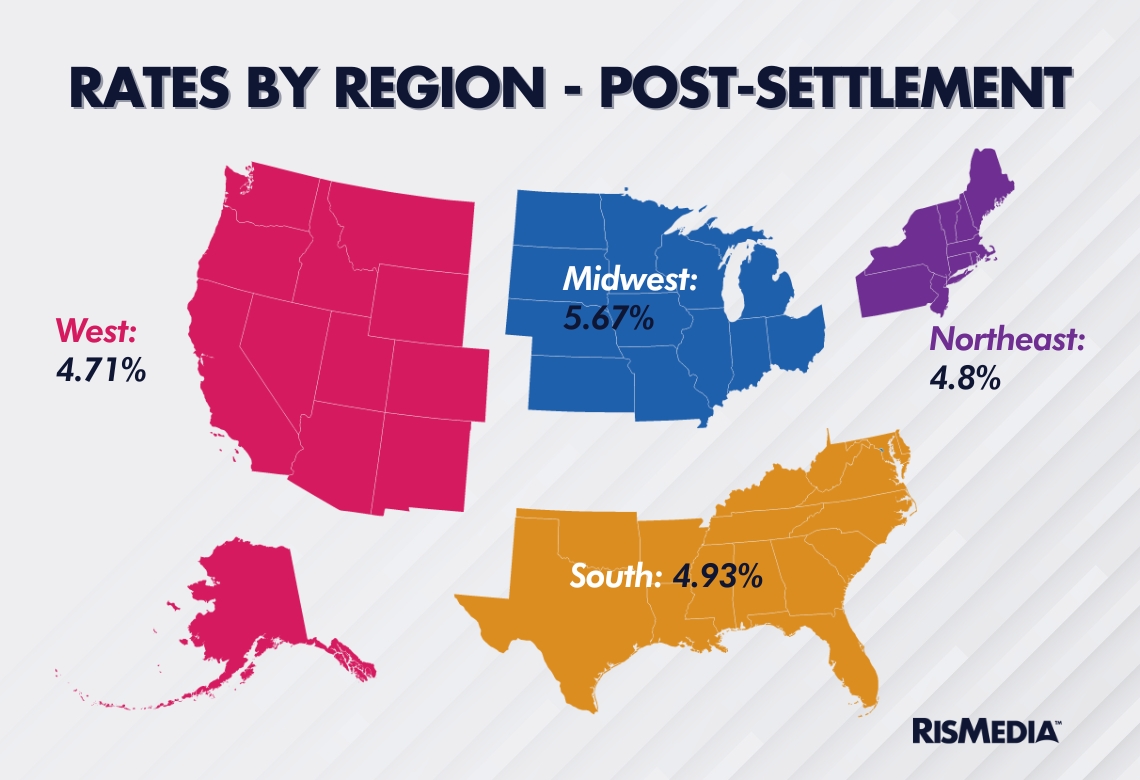

Another notable insight to come out of the report has more to do with region rather than buy versus sell side. In the weeks and months after the settlement, there was speculation that based on local laws and norms, some agents and brokers would be more prepared to negotiate commissions or sign agreements with buyers, and therefore would be less affected by the changes. There are also some significant holdouts to the settlement changes, with MLSs on both coasts not taking part in the agreement.

While the survey did not break down respondents by state, there was a noticeable difference in the drop in buyer commissions in the Northeast.

While buyer agents in the South, Midwest and West took an average hit of 0.39% from their commissions after the settlement, the Northeast saw buyer commissions drop by 0.24%—still significant, but noticeably smaller than the other regions.

It is not fully clear what could have caused this, although many Northeast states (Connecticut, New Hampshire, Pennsylvania and Vermont) had some requirements for buyer agreements before the settlement. MLS PIN, which claims around 40,000 subscribers in Massachusetts, Rhode Island and New Hampshire, was also not party to the NAR settlement and did not implement the changes required by that agreement—though it previously made other changes based on a separate settlement in another lawsuit.

*based on median home price, NAR data from Sept. 2024.

This survey was conducted by a national market research firm on behalf of RISMedia. Invitations were sent to respondents by RISMedia from a database of more than 130,000 real estate professionals and data was collected from a sample of 1,331 individuals between September 17 and October 7, 2024. Broker/owners and other real estate professionals who do not work on a commission structure were terminated from the survey.