There are a lot of things agents and brokers can’t control when trying to find the best way to bolster their bottom line. A new agent can only hurry up and wait if they want to gain the kind of experience associated with higher commission rates, more transactions and better splits. Likewise, not very many agents and brokers can simply pick up and move to a state or region that’s having greater success in mitigating commission decreases (though perhaps they can still learn lessons from colleagues in those places).

What agents and brokers do have a choice in, though, is what kind of company they affiliate with, or whether they want to operate entirely on their own. That choice does have consequences for your bottom line, and each of those models were affected differently by the recent policy changes.

For instance, buyer agents at national franchises saw their average commission fall from 2.59% before the settlement to 2.39% post-August 17 ($844 on a median-priced home). Independents saw a much bigger drop, from 2.76% to 2.24%, $2,110 less in commission.

Self-employed or hybrid buyer agents saw an almost identical level of average commission reduction compared to independents, from 2.57% to 2.08% ($2,068 lower commission).

This data would appear to indicate that at least during this transitional period, those buy-side agents and brokers affiliated with larger companies that offer more resources and support were better prepared for the changes—though again, there are other potential explanations and more time is needed to see if this trend persists.

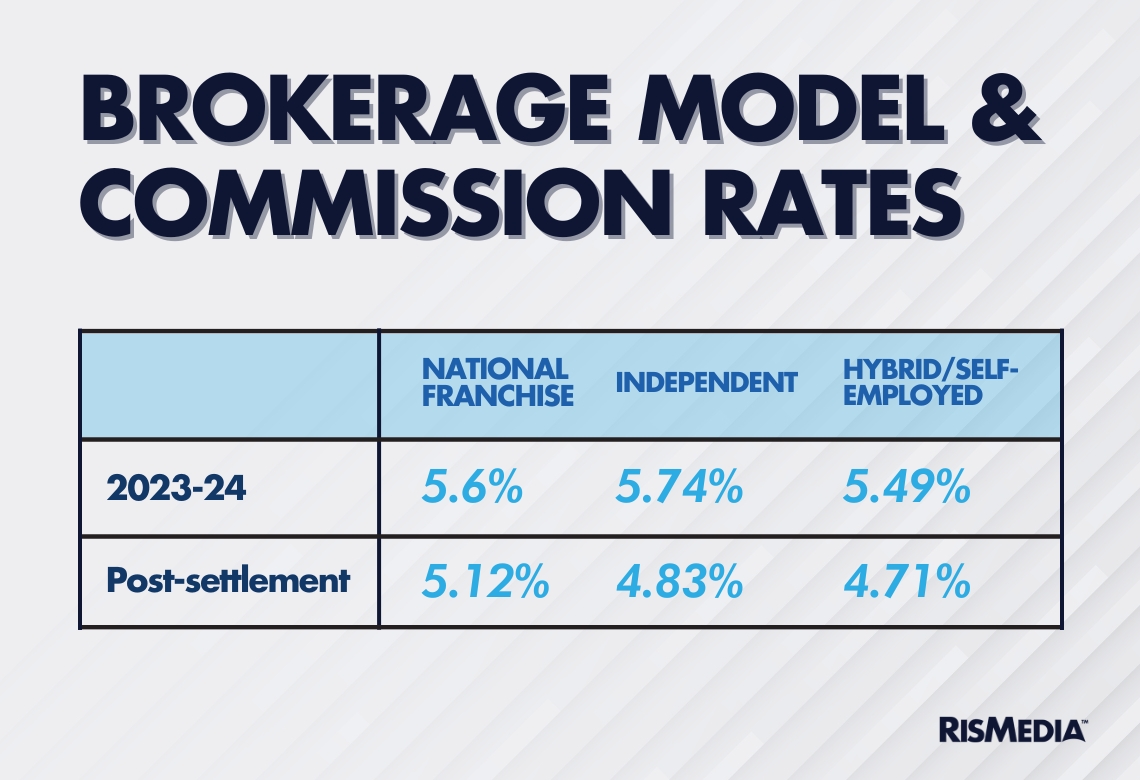

Also notable is that listing-side commissions fell in a similar pattern—national franchises seeing the smallest decrease, and other models falling at almost identical rates.

National franchises, however, experienced a slightly larger sell-side decrease compared to buy-side, from 3.01% to 2.76%. There was also less variation in the sell-side commissions across brokerage models, both pre- and post-settlement, with only a 0.17% range in average listing commissions. This would again support the theory that buy-side commissions are under the most pressure, and are also most likely to vary based on particular agent characteristics.

While commission rates are somewhat of an indirect product of the brokerage model, there are many other factors that companies exert direct control over—from splits to farming to cooperative compensation. For instance, some large companies have made explicit moves away from listing agents compensating buyer agents—though still with an openness for the seller to pay a buyer agent directly.

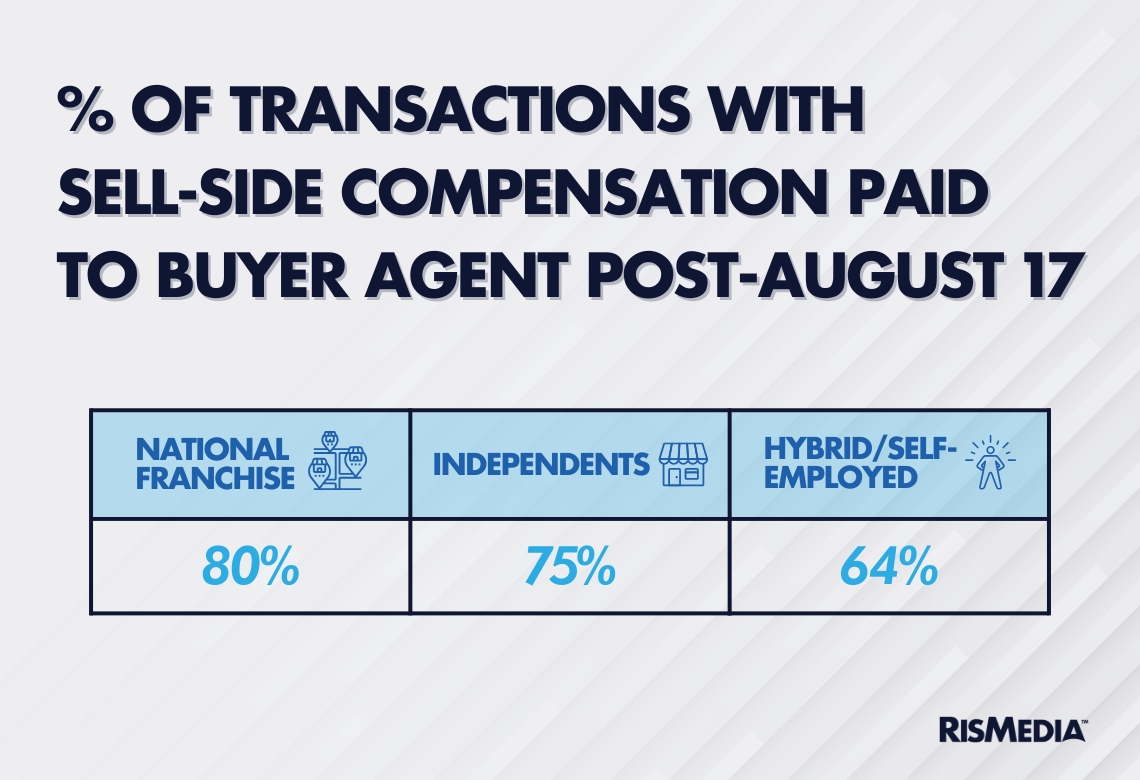

While there was no major difference between independents, national franchises and hybrid/self-employed companies before the settlement changes, agents and brokers affiliated with national franchises were more likely to be involved in transactions that included sell-side compensation paid to buyer agents after August 17.

National franchises were also more likely to report that all of their transactions post-settlement changes included sell-side compensation to buyer agents, at 77%. Conversely, 25% of hybrid/self-employed agents and brokers reported that none of the transactions they were involved in post-settlement included the sell-side compensating buyer agents.

With commission rates under pressure, another very important element that brokerages have control over is splits. One key question following the recent policy changes is whether brokerages would make changes to how commissions are shared, potentially anticipating lower overall rates.

There are some very preliminary signs that agents might be taking home more of their commission. The median split is still 70-30, with 37% of agents using that model (compared to 38% in 2022-23). But the average amount of commission an agent takes home is 74%, compared to 70% in 2022-23, meaning that slightly more agents are working under higher split models.

This change could easily be explained by any number of factors apart from the settlement (notably, the average agent took home 77% of their commission in 2021-22 during the pandemic boom market). It was also notable that there was very little difference between brokerage models, indicating that types of companies are not seeking to differentiate themselves for agents at least around splits.

The 100% commission model grew only slightly in popularity between 2022-23 and 2023-24, with 12% of agents working under that split last year compared to 10% the previous year.

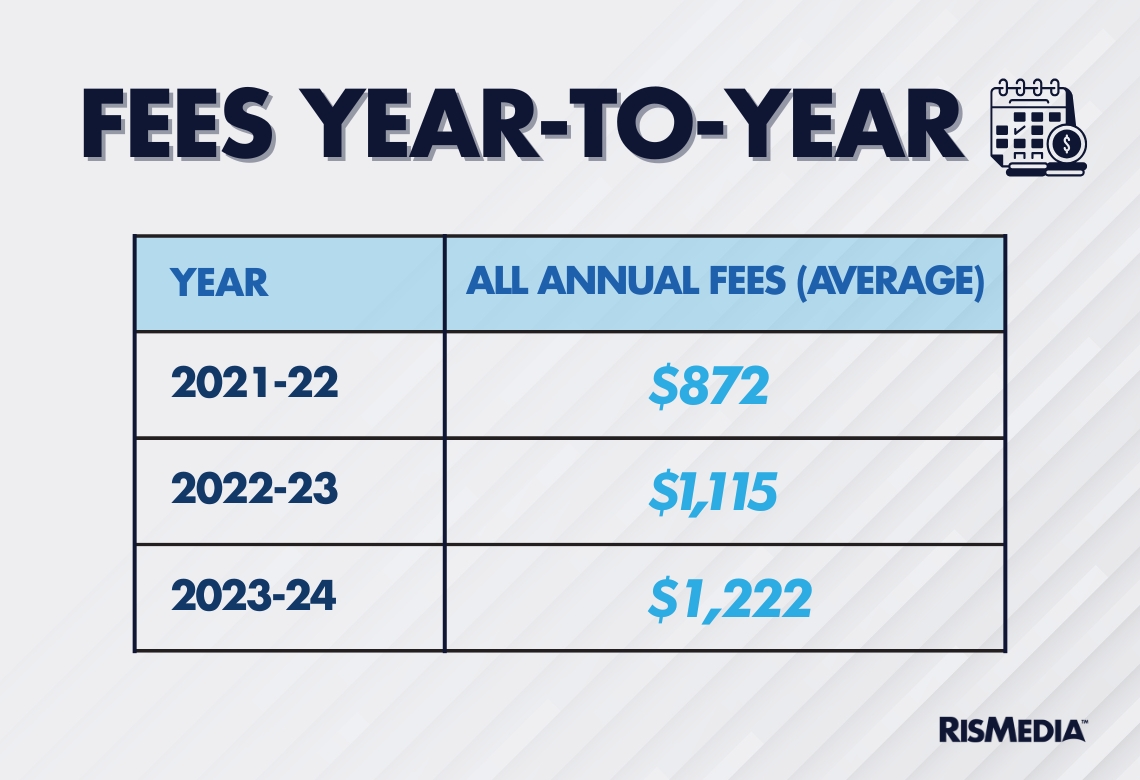

Companies also have the discretion to raise fees, and how all the changes of the last year might affect that is also a topic of urgent debate. Although many companies are likely waiting to make major changes until some of the policy shifts trickle down, fees appear to be up only slightly, after a much larger increase the previous year.

Again, the reason overall fees held essentially flat might have nothing to do with the settlement changes. But there were some notable changes between brokerage models that could indicate that companies are trying different things as far as how they charge agents.

Independents had the largest increase in annual fees both as a percentage and as a flat amount, an average of more than $160, or 23%, although per-transaction fees stayed the same. And hybrid/self-employed agents actually reported paying much lower fees than the previous year, with annual fees down 47% and per-transaction fees lower by 25%.

National franchises charged almost exactly the same overall fees as the previous year, a 1% change in per-transaction fees and 7% increase in annual fees.

The fact that hybrid/self-employed models are finding ways to significantly lower fees could show, however, that there is some innovation or movement in those sorts of companies, or that some alternative brokerages are prioritizing keeping fees down in this new era of real estate.

Another question is whether companies would offer profit-sharing incentives as agents and brokers seek more ways to bolster their incomes in the face of declining commission rates—or would potentially sunset those incentives as their own margins tightened.

Neither of these scenarios seemed to have manifested, at least at this early stage, as respondents reported the same proportion of profit-sharing as last year, with 20% saying they worked for a company that offered this perk.

This survey was conducted by a national market research firm on behalf of RISMedia. Invitations were sent to respondents by RISMedia from a database of more than 130,000 real estate professionals and data was collected from a sample of 1,331 individuals between September 17 and October 7, 2024. Broker/owners and other real estate professionals who do not work on a commission structure were terminated from the survey.