RISMEDIA, October 7, 2010—Average mortgage rates dropped to their lowest levels on record this week, according to the LendingTree Weekly Mortgage Rate Pulse, a snapshot of the lowest and average mortgage rates available within the LendingTree network of lenders. On October 5, average home loan rates offered by LendingTree network lenders dropped week-over-week to 4.35 percent (4.56% APR) for 30-year fixed mortgages, 3.81 percent (4.13% APR) for 15-year fixed mortgages and 3.32 percent (3.55% APR) for 5/1 ARMs.

RISMEDIA, October 7, 2010—Average mortgage rates dropped to their lowest levels on record this week, according to the LendingTree Weekly Mortgage Rate Pulse, a snapshot of the lowest and average mortgage rates available within the LendingTree network of lenders. On October 5, average home loan rates offered by LendingTree network lenders dropped week-over-week to 4.35 percent (4.56% APR) for 30-year fixed mortgages, 3.81 percent (4.13% APR) for 15-year fixed mortgages and 3.32 percent (3.55% APR) for 5/1 ARMs.

On the same day, mortgage rates offered by lenders on the LendingTree network were as low as 3.75 percent (3.94% APR) for a 30-year fixed mortgage, 3.25 percent (3.49% APR) for a 15-year fixed mortgage and 2.75 percent (3.37% APR) for a 5/1 adjustable rate mortgage (ARM).

“Mortgage rates remain under pressure given continued weakening of economic conditions placing the Federal Reserve on alert to potentially enter into a second round of quantitative easing,” said Cameron Findlay, Chief Economist of LendingTree.com. “Any government interaction at this juncture will force rates lower.”

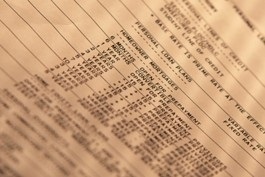

Below is a state-by-state comparison of mortgage data, including a snapshot of the lowest 30-year fixed rates offered by lenders on the LendingTree network, average loan-to-value ratio and percentage of consumers with negative equity.

Additional refinance mortgage rates are available at http://www.lendingtree.com/mortgage-loans/rates/.