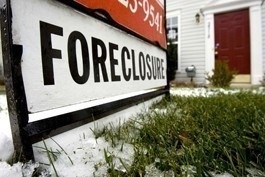

RISMEDIA, October 14, 2010—Thousands of first-time and move-up buyers who hoped to make a foreclosed property their new home now face uncertainty, anxiety and possibly remorse as they worry that closing on their desired property could be in jeopardy. For many, the dream of homeownership could turn into agony if their home purchase is indefinitely delayed by a moratorium on foreclosures declared by some banks, the National Association of Realtors said. The moratoriums are needed, banks say, to review all of the foreclosures in their portfolios to make sure they’re in compliance with the law and that titles are clear.

RISMEDIA, October 14, 2010—Thousands of first-time and move-up buyers who hoped to make a foreclosed property their new home now face uncertainty, anxiety and possibly remorse as they worry that closing on their desired property could be in jeopardy. For many, the dream of homeownership could turn into agony if their home purchase is indefinitely delayed by a moratorium on foreclosures declared by some banks, the National Association of Realtors said. The moratoriums are needed, banks say, to review all of the foreclosures in their portfolios to make sure they’re in compliance with the law and that titles are clear.

NAR warned that a prolonged review process would have a damaging impact on many communities and hinder the nation’s economic recovery.

“As the leading advocate for homeownership issues, we understand that many lenders need a time-out to review their actions to ensure that homeowners are not improperly foreclosed on and that the lenders are following regulations and state laws. After that, the foreclosure process must resume quickly to return stability to families, the housing market and the economy,” said NAR President Vicki Cox Golder.

Over the past few months, NAR has met with officials of top banks to discuss market issues. NAR urged banking leaders to seek resolution quickly through loan modifications and the short sale process rather than through foreclosure. “We stand ready to help lenders develop better short sale procedures,” Golder said.

“There are valid foreclosures that should move ahead quickly, and we shouldn’t lump them in with mortgages that are suspect. That would cause deep problems in an already fragile market and throw many families into uncertainty,” Golder said.

Golder said that she is receiving reports from Realtors that the moratorium is already creating some anxiety among purchasers as transactions are being delayed and that some foreclosure listings are being removed from the market.

Compounding the problem is that the requirements for foreclosure vary by state, and practices to meet these requirements vary by firm. NAR is working with regulators, such as the Federal Housing Finance Agency; and encouraging them to identify and quickly address process problems.

In a letter to the U.S Treasury Department, the U.S. Department of Housing and Urban Development, and the Federal Housing Finance Agency, NAR stated the hope that banks would complete their foreclosure review expeditiously to assure that the rights of borrowers are protected and remove doubt that buyers will receive clear title to their purchase.

“NAR has long urged the lending industry to take every feasible action to keep families in their homes with a loan modification and, if that is not possible, to give them a ‘graceful exit’ through a short sale. These options are far better than a foreclosure, and nothing has driven this point home more clearly than the questions being raised about foreclosures. Lenders should place additional resources into processing loan modifications and short sales,” NAR wrote.

A year ago, NAR instituted a special short sale training program for its Realtor members to work more closely with banks in expediting mortgages at risk by resolving them through short sales and loan modifications. More than 51,000 Realtors have been certified in the program.

For more information, visit www.realtor.org.