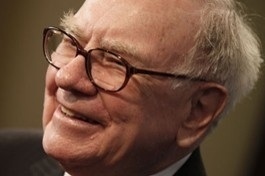

(MCT)—The U.S. housing market disappointed Warren Buffett last year, but he hasn’t given up hope.

(MCT)—The U.S. housing market disappointed Warren Buffett last year, but he hasn’t given up hope.

Buffett said in his annual shareholder letter, posted this weekend, that he was “dead wrong” when he predicted last year that the rebound in U.S. home prices would begin within a year.

This year, though, he’s betting again that the housing market will recover, and for an interesting reason: hormones.

As Buffett explains it, the housing market is currently depressed because young Americans have stayed at home rather than going out and setting up their own households.

“People may postpone hitching up during uncertain times, but eventually hormones take over,” Buffett wrote in the letter to shareholders in his investment company Berkshire Hathaway. “And while ‘doubling-up’ may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.”

That is not the entirety of his argument. He also says that home builders are not creating enough new supply. As a result, the excess inventory that built up after the financial crisis is slowly disappearing, paving the way for new demand.

During an appearance on CNBC on Monday morning, Buffett said he would buy up millions of U.S. homes if it were possible.

Data out Monday seemed to support Buffett’s contention. The National Association of REALTORS® announced that the number of people buying used homes in January rose to a 21-month high.

As usual, the annual letter was an opportunity for Buffett to provide a candid assessment of Berkshire Hathaway’s wins and losses, most of which were in the volatile energy sector. He said his entire $2 billion investment in a Texas utility company may be wiped out unless natural gas prices rise substantially.

“In tennis parlance, this was a major unforced error by your chairman,” he wrote.

Buffett also used the letter to reveal that he has chosen a CEO to succeed him at Berkshire Hathaway—he just refused to provide the identity of that person.

©2012 the Los Angeles Times

Distributed by MCT Information Services