In traditional housing recoveries, individuals and households provide the bulk of the demand the market needs to rebound. This time, though, a different kind of buyer has been powering the housing recovery: investors looking for valuable rental property.

In traditional housing recoveries, individuals and households provide the bulk of the demand the market needs to rebound. This time, though, a different kind of buyer has been powering the housing recovery: investors looking for valuable rental property.

Along with individual investors, institutional investors have poured into the single-family home market, buying enough foreclosed and unsold homes to reduce inventories, drive up prices and encourage new construction. All-cash home purchases – many of which are made by investors – made up about 32.0% of sales nationally in March 2013, a stark rise from about 20.0% in 2009, according to the National Association of REALTORS®. Why and how are investors getting in the housing game? And how has a larger home-rental market affected other industries?

Investor incentives

Institutional investors have typically focused their capital on commercial properties and multifamily apartment buildings. However, the strategy of converting homes into rental properties benefits investors in several ways. First, other kinds of investments are returning low yields, and investors are searching for higher returns. The Federal Reserve’s policy of keeping interest rates low to spur growth has had the secondary result of lowering yields on bonds and other securities, encouraging investors to look elsewhere for higher returns. Foreclosed homes and other unsold properties can be picked up cheaply in many markets and need only minor renovations, such as new appliances and a new coat of paint. Even if investors choose not to rent the properties, they can count on appreciating prices as the economy moves further into recovery to realize a high return on investment when they sell. While most investors are still individuals like retirees and professionals seeking a side income, institutions have entered the market as well: real estate investment and private equity firms, such as Colony Capital and Blackstone Group, have purchased thousands of homes in the past year.

Additionally, even though the Fed’s policy is keeping mortgage rates suppressed, tight lending standards and persistent unemployment are keeping many prospective homebuyers from taking advantage of low rates. Others are saddled with bad credit from foreclosures that occurred during the bust.

Meanwhile, the all-cash offers from investors usually present more attractive terms and immediate payouts to sellers and allow investors to beat out those individual homebuyers who have been able to secure financing. Furthermore, the influx of investor cash is quickly elevating home prices in many markets like Phoenix , Las Vegas and Atlanta, further squeezing out individual buyers who are now unable to afford homes that were in their price range only a year ago.

Construction, retail and service industries benefit

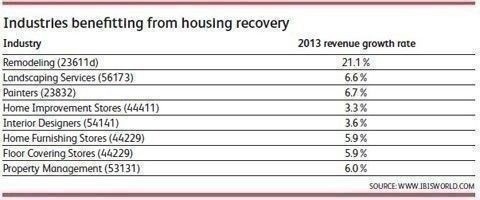

Several industries across different sectors benefit from a rentals-driven housing market recovery. While some industries, such as the specialty contractors, would benefit from a traditional homebuyer-led recovery as well, others in the service and retail sectors benefit specifically because the market is shifting toward single-family home rental.

Construction industries are benefiting from investors’ need to improve the curbside appeal of properties and make them ready for renting to families. The remodeling industry has been one of the first to profit. Remodeling contractors typically derive most of their revenue from wealthier households looking to alter or upgrade their homes; however, with the glut of unoccupied or foreclosed homes that investors are planning to fill with renters, remodelers are finding more opportunities for smaller projects like new appliance installation, kitchen renovations or bathroom upgrades. Similarly, operators in the landscaping services industry are receiving more demand from investors looking to clean up properties left unmaintained for years. Painters are being called on to strip old paint and apply fresh coats to improve properties’ rental or resale value. Residential contracts already make up the largest market for professional painters, and like other contractors that rely on the housing market, they benefit from higher demand for residential renovation and maintenance.

Improved demand for certain retail industries has accompanied higher demand for contractors. The home improvement stores industry provides many of the materials that renovators and landscapers need, including lawn supplies, plumbing and lighting fixtures, kitchen hardware and large appliances. A key part of most renovation plans for single-family homes is the installation of new kitchen appliances, countertops, and washers and dryers. Contractors working on rental home renovations can easily source goods from local home improvement stores rather than working through a wholesaler to buy in bulk, as they might for larger multiunit construction contracts. Likewise, investors looking to attract wealthier renters by offering furnished homes may hire interior designers, who in turn would drive up demand for the home furnishing stores and floor covering stores industries.

Finally, operators in the property management industry are benefiting greatly from an increase in institutional investment. Private equity firms and other large investors typically do not directly manage the day-to-day operations of the houses they buy. Instead, they outsource property upkeep and tenant relations to property managers, who currently derive about 63.8% of their revenue from the residential market. However, this market largely comprises the management of multifamily apartment buildings, rather than single-family homes; as such, these operators will shift slightly toward managing groups of homes, opening up a niche service segment for some property managers.

Investors eventually lose interest

Most of these large-scale investors are not expected to remain in the single-family home market for long. As consumer debt falls, unemployment declines and households improve their credit scores, more buyers will qualify for mortgages and enter the market. More demand will put additional upward pressure on home prices. As home prices rise, investors will no longer be able to count on substantial future price appreciation, and their return on investment will drop; meanwhile, sturdier consumer finances will make buying a home more attractive than renting. As these trends strengthen, many investors will begin selling off rental homes, turning a final profit thanks to higher prices.

Because investors now own a historically significant share of homes on the market, a widespread sell-off of these assets could have wider implications for the overall housing market. If too many of the institutional investors who bought thousands of homes decide to cash in on their housing assets at once, they could flood the market with new inventory, dramatically increasing the supply of homes and risking another collapse in prices. However, consumer buying power is projected to regain enough strength to prevent a drastic drop in prices. With unemployment steadily falling, disposable income growing moderately for the next five years and rising pent-up demand for homeownership among consumers currently forced to rent, a second wave of homes on the market could receive a warm welcome.

For a printable PDF of Investors and the Home-Rental Market, click here.